Ethereum Fusaka Upgrade May Offer Buying Opportunity Amid Market FUD

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

The Ethereum Fusaka upgrade, launching on December 3, 2025, enhances network efficiency amid bearish market conditions, boosting transaction throughput and reducing fees to support Ethereum’s DeFi dominance.

-

Ethereum Fusaka upgrade increases gas limits and introduces PeerDAS for faster block verification.

-

The upgrade arrives during low network activity, potentially replicating the Pectra upgrade’s positive impact on prices and usage.

-

With $65 billion in TVL and strong institutional holdings, Ethereum maintains leadership in blockchain ecosystems despite recent market dips.

Ethereum Fusaka upgrade set for December 3, 2025, promises efficiency gains amid crypto downturn. Explore how it could revitalize ETH’s on-chain metrics and attract more institutional interest. Stay informed on key developments.

What is the Ethereum Fusaka Upgrade?

Ethereum Fusaka upgrade is a significant protocol enhancement scheduled for activation on December 3, 2025, aimed at improving the network’s scalability and performance. It introduces Peer Data Availability Sampling (PeerDAS) to allow nodes to verify blocks more efficiently without full data downloads and raises the gas limit from 45 million to 60 million for higher transaction capacity. This builds on previous upgrades like Pectra, further solidifying Ethereum’s position in decentralized finance.

Fear, uncertainty, and doubt currently shape market sentiment, with substantial losses erasing millions in value and key support levels faltering. As risk appetite diminishes and capitulation risks rise, the anticipated positive momentum for the fourth quarter fades into bearish territory. Overall, December begins with a pronounced downward bias for cryptocurrencies.

Despite this challenging environment, the Ethereum Fusaka upgrade arrives at a pivotal moment, prompting questions about its potential to foster recovery through improved network capabilities.

How Does the Fusaka Upgrade Impact Ethereum’s Performance?

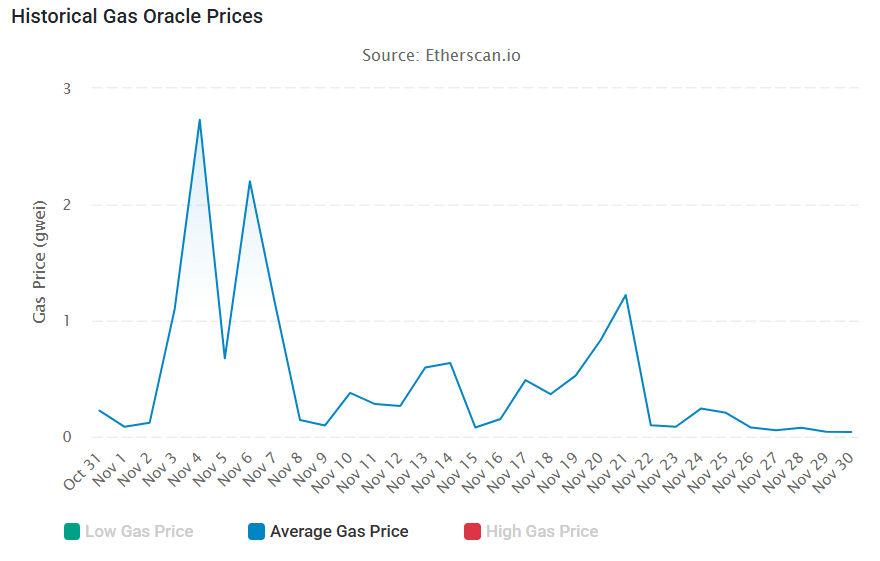

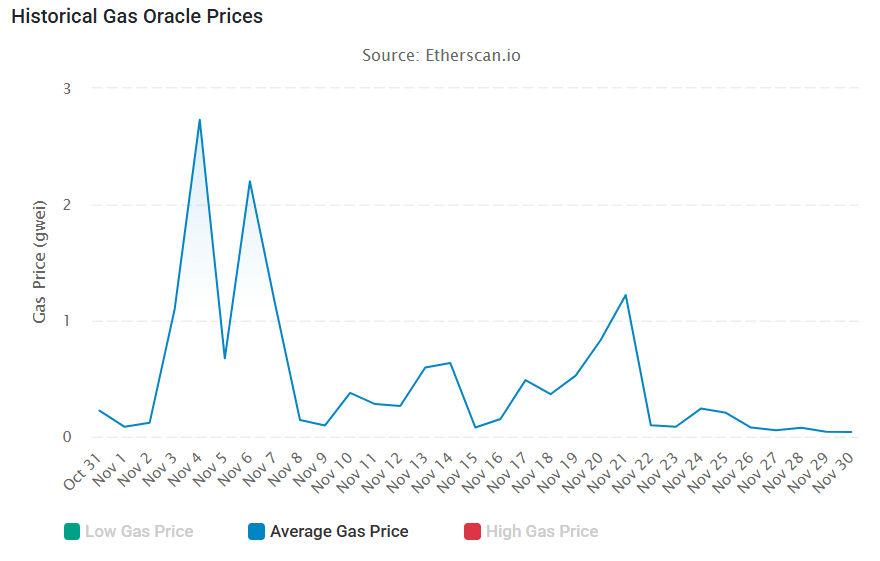

The Fusaka upgrade targets both backend efficiency and user experience, enabling Ethereum to process more transactions with lower costs. PeerDAS optimizes data handling, allowing lighter nodes to contribute to network security, while expanded block capacity supports Layer-2 solutions integral to Ethereum’s ecosystem. According to on-chain data from EtherScan, average gas prices have already fallen to 0.04 Gwei, reflecting reduced congestion even before the upgrade.

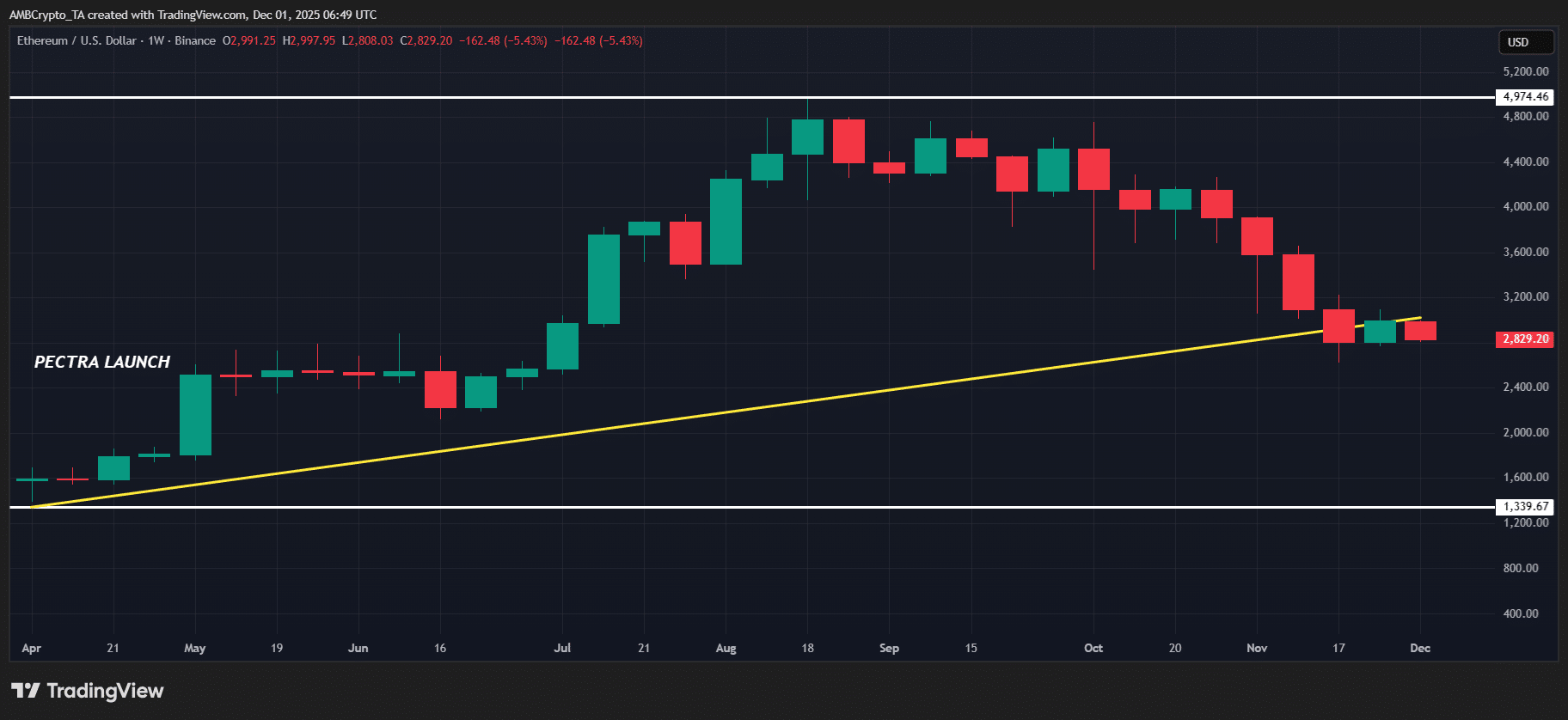

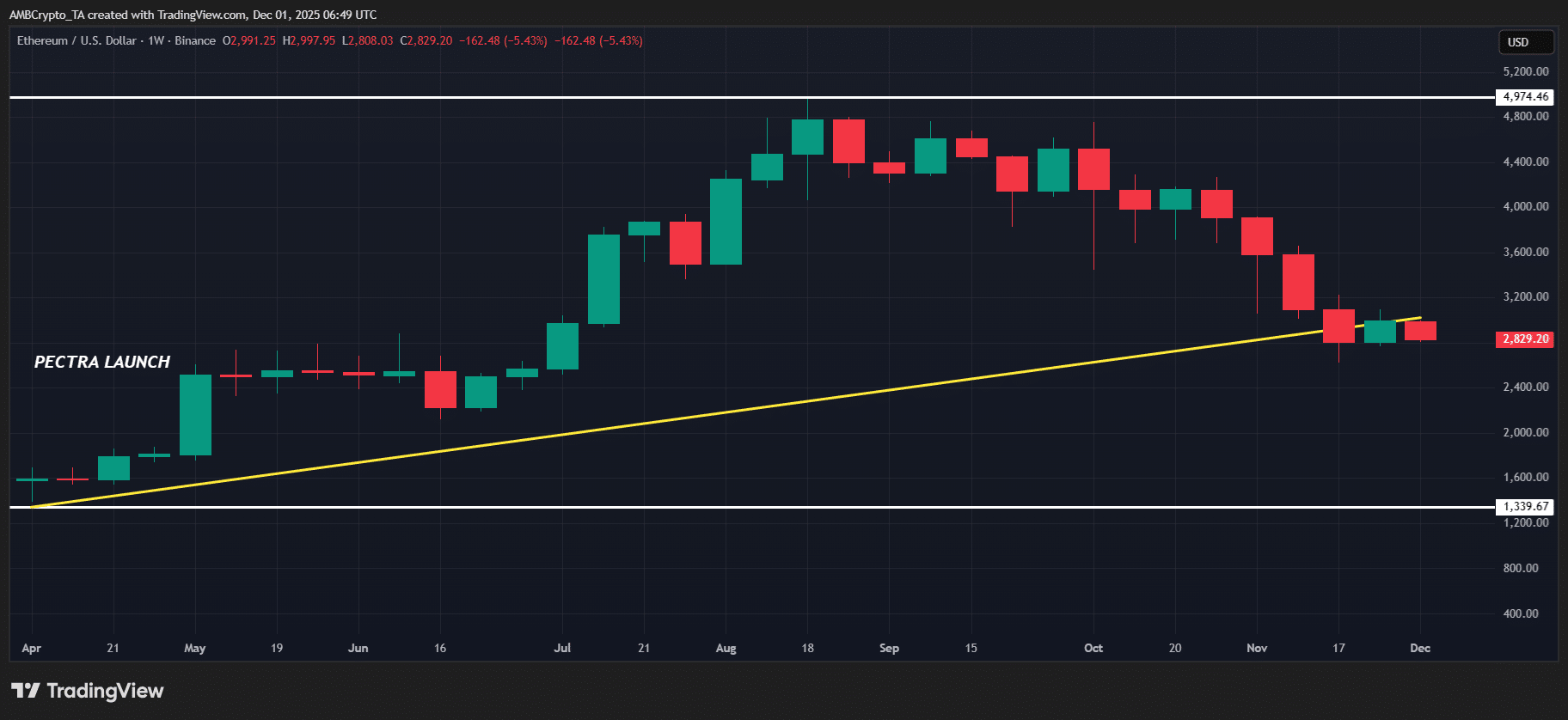

Historically, similar enhancements have driven measurable growth. The Pectra upgrade, activated on May 7, 2025, propelled Ethereum’s price up 40% within three days, surpassing $2,500—a level not seen since early March. Even amid subsequent market pressures, ETH trades 38% above its pre-Pectra value. Daily transactions, measured by a seven-day moving average, rose from 1.25 million to 1.75 million by mid-August, with active addresses increasing by 243,000 over that period, as reported by TradingView analytics.

Source: TradingView (ETH/USDT)

In comparison, Bitcoin trades approximately 10% below its $95,000 range from the same timeframe, underscoring Ethereum’s relative strength. The Fusaka upgrade deploys during lighter network usage, mirroring conditions before Pectra, which could amplify on-chain activity and transaction volumes.

Ethereum’s ecosystem remains robust, boasting $65 billion in total value locked, a $168 billion stablecoin market, $442 billion in bridged TVL, and over 1,670 protocols on a market cap exceeding $340 billion. These figures, drawn from DeFi analytics platforms, highlight Ethereum’s unchallenged lead in decentralized applications.

Frequently Asked Questions

What Are the Key Features of the Ethereum Fusaka Upgrade?

The Ethereum Fusaka upgrade features PeerDAS for efficient data sampling and a gas limit increase to 60 million, enabling higher throughput. It reduces verification burdens on nodes and lowers transaction fees, as evidenced by current gas prices at 0.04 Gwei. This positions Ethereum for sustained growth in scalability.

How Might the Fusaka Upgrade Affect Ethereum’s Price in December 2025?

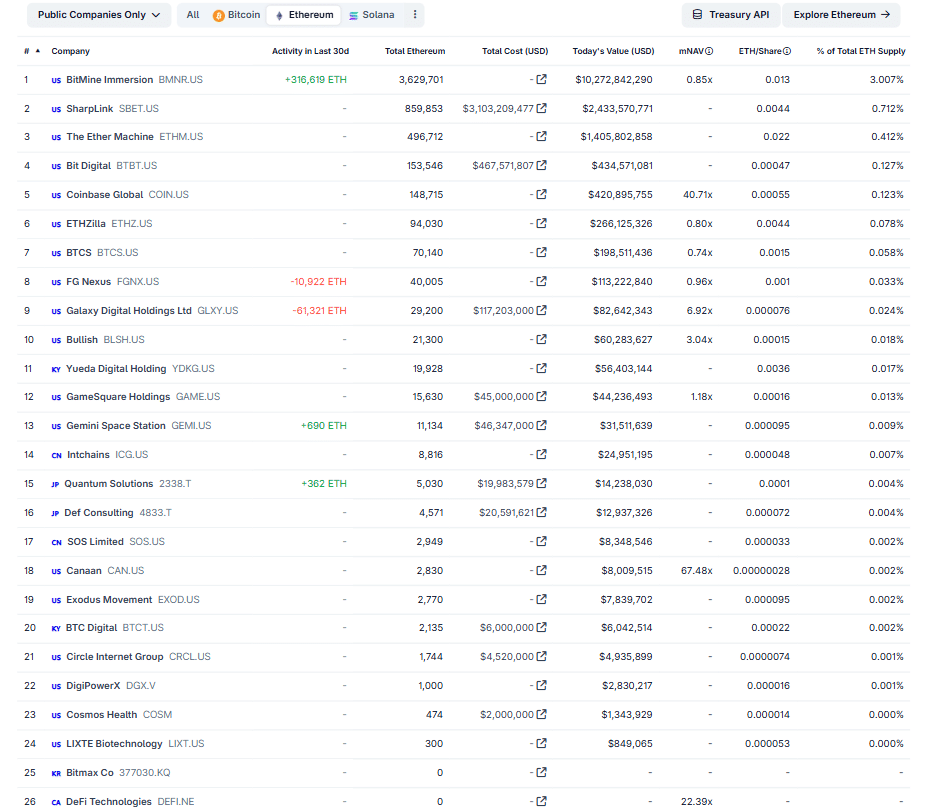

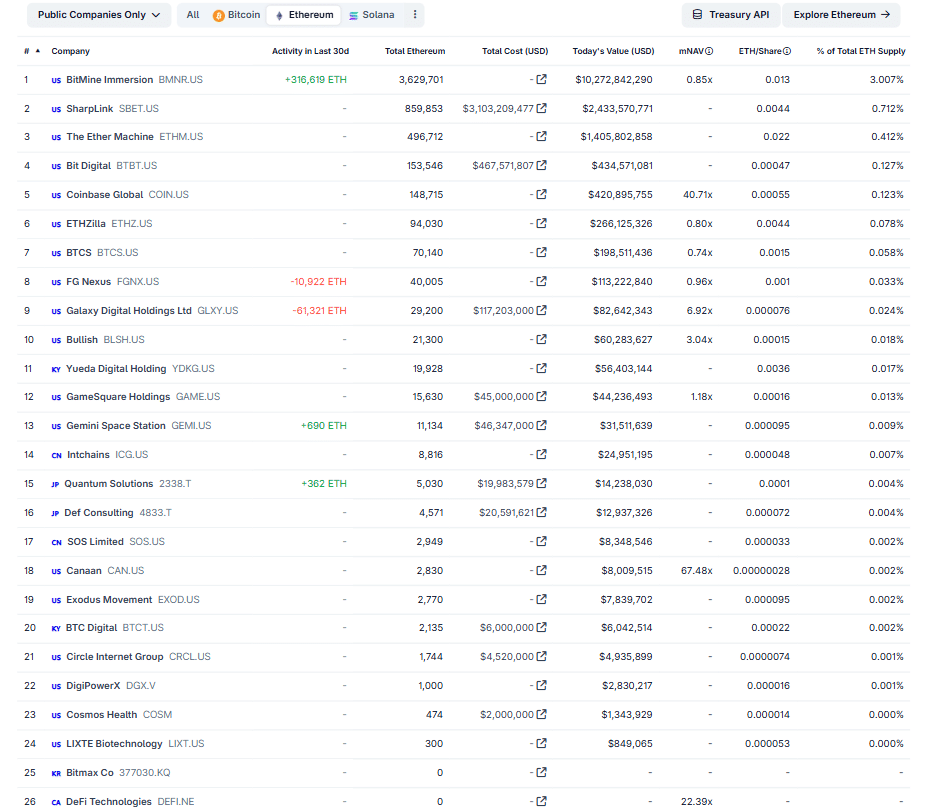

The Ethereum Fusaka upgrade could support price stabilization around $2,800 by enhancing network efficiency during low activity periods. Past upgrades like Pectra led to 40% gains, but outcomes depend on broader market dynamics. Institutional interest, with 26 public companies holding ETH, adds a layer of support for potential upside.

Source: EtherScan

Key Takeaways

- Fusaka Upgrade Enhances Efficiency: It boosts transaction capacity and reduces fees, arriving at a time of low network congestion for optimal impact.

- Institutional Support Strengthens Ethereum: With 26 public firms holding ETH—more than any other Layer-1—and firms like BitMine increasing stakes to 69,000 ETH, fundamentals remain solid.

- Potential for Market Recovery: Drawing from Pectra’s 40% price surge, the upgrade could signal buying opportunities amid bearish sentiment, focusing on long-term ecosystem growth.

Source: CoinGecko

BitMine, for instance, now controls 3% of ETH supply after adding 15,000 ETH to its holdings. Analyst Tom Lee, from Fundstrat Global Advisors, has projected ETH allocations up to 5% in portfolios, with plans for validator operations yielding $500 million in staking revenue by Q1 2026.

Conclusion

The Ethereum Fusaka upgrade represents a critical step in enhancing network scalability and user accessibility, particularly as it coincides with favorable on-chain conditions like low fees and activity levels. Supported by dominant DeFi metrics and growing institutional adoption, including holdings by 26 public companies, Ethereum continues to outpace competitors. As the upgrade activates on December 3, 2025, stakeholders should monitor its effects on transaction volumes and broader market recovery, positioning for sustained growth in the evolving blockchain landscape.