Ethereum Hidden Bull Setup Builds on Rising Trendline, Targets $4,958 Possible Breakout

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ethereum’s Hidden Bull setup is strengthening as it holds a rising trendline support, with bullish derivatives data indicating a potential breakout toward $4,958.75. This pattern suggests over 75% recovery from current levels near $2,797, driven by higher lows and increasing buyer interest.

-

ETH maintains rising trendline support amid a Hidden Bull structure targeting $4,958.75.

-

Derivatives metrics reveal growing open interest and volume, signaling strong buyer defense at key zones.

-

Price forms higher lows in an ascending triangle, building pressure near $2,950–$3,000 resistance, with trading volume up over 37% to $24.14 billion.

Ethereum Hidden Bull setup gains momentum: ETH eyes $4,958 breakout from rising trendline. Bullish data supports 75% rally. Stay updated on crypto trends for investment insights.

What is the Ethereum Hidden Bull Setup?

Ethereum Hidden Bull refers to a technical pattern where ETH price action forms higher lows along a rising trendline, confirming underlying bullish momentum despite short-term consolidations. This setup, as observed in recent charts, positions ETH for a potential recovery exceeding 75% toward its all-time high of $4,958.75 from current levels around $2,797. Analysts highlight the positive daily close above support as key validation, reducing the risk of deeper corrections.

How Does Derivatives Data Support ETH’s Bullish Structure?

Derivatives markets provide crucial insights into Ethereum’s momentum, with open interest climbing 2.30% to $34.57 billion, reflecting increased trader participation during recent bounces. Trading volume has surged more than 25% to $73.14 billion, while liquidations remain balanced between long and short positions, per data from major exchanges. This activity underscores buyer commitment to defending support zones between $2,500 and $2,600, forming a robust demand shelf. Expert analyst Javon Marks notes, “The recent positive daily close solidifies the Hidden Bull, pointing to over 75% upside to $4,958.75.” Such metrics, combined with on-chain demand, suggest sustained pressure for a breakout above the $2,950–$3,000 resistance band.

ETH strengthens a Hidden Bull setup as rising trendline support and bullish derivatives data hint at a breakout aiming toward $4,958.

- ETH holds a rising trendline as analysts track a Hidden Bull structure toward $4,958.75.

- Derivatives data shows rising open interest and strong volume as buyers defend key support zones.

- ETH forms higher lows inside an ascending triangle while pressure builds near $2,950–$3,000 resistance.

Ethereum records a positive daily close while price action continues to move along a rising trendline, and analysts note that ETH is further solidifying a Hidden Bull setup. The current structure points toward a possible recovery move of more than 75% toward the all-time high at $4,958.75.

Rising Trendline Supports Hidden Bull Structure

Ethereum trades near $2,797 while moving toward a rising trendline that has guided price action across recent months, according to analysis prepared by Javon Marks. The chart shows ETH touching this upward support after a steady decline, and the recent close above the line forms part of the same higher-low structure.

$ETH further solidifying a Hidden Bull with the recent positive daily close and this points towards an over 75% recovery move to the all time highs at $4958.75!

(Ethereum) pic.twitter.com/VhUzXHgs8V

— JAVON⚡️MARKS (@JavonTM1) November 24, 2025

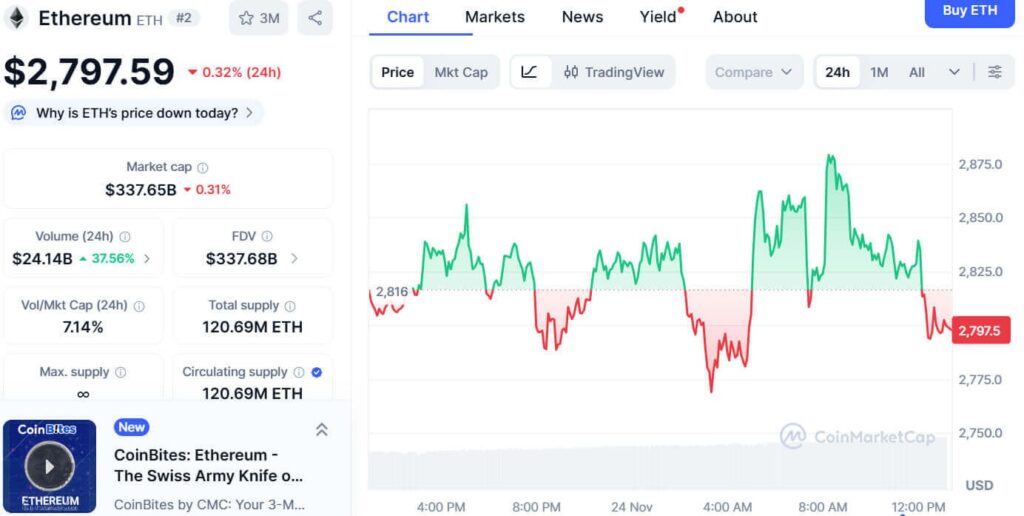

Market data from CoinMarketCap lists Ethereum at $2,797.59 with a small daily loss of 0.32%. The price moves within a visible intraday range as traders react to short upward and downward movements. Trading volume rises more than 37% to $24.14 billion, and the market cap remains near $337.65 billion.

Source: CoinMarketCap

The chart shows a clear rebound near $2,850 before returning toward the lower zone, while the final readings match the $2,797 area. The structure presents steady reactions along the trendline, and analysts note that the positive close forms new confirmation for the Hidden Bull pattern.

Market Structure Supported by Derivatives and Demand Zones

According to an observation by Aman, ETH trades near $2,809 while forming an ascending triangle with a rising support line. The chart shows pressure building near a resistance area between $2,950 and $3,000, and the candles form higher lows inside this consolidation.

Source: Aman(X)

A projected path marks a breakout above the resistance, followed by a retest inside the same pattern. Derivatives data records open interest rising 2.30% to $34.57 billion, and this move aligns with traders adding exposure during the bounce.

Volume increases more than 25% to $73.14 billion, and liquidations remain balanced across long and short positions. The volume profile shows buyers defending the $2,500 to $2,600 area, which forms a structural support shelf. Market watchers now study whether ETH can clear the channel and move toward the recovery targets connected to the Hidden Bull setup.

Frequently Asked Questions

What Triggers a Breakout in Ethereum’s Hidden Bull Pattern?

A breakout in Ethereum’s Hidden Bull pattern typically occurs when price decisively closes above the $2,950–$3,000 resistance, supported by surging volume and open interest. This confirmation, as seen in historical patterns, often leads to rapid upside toward targets like $4,958.75, with analysts monitoring derivatives for sustained bullish bias over 40-50 words of factual alignment.

Is Ethereum’s Rising Trendline Reliable for Long-Term Support?

Ethereum’s rising trendline has proven reliable as a long-term support, guiding price higher lows since recent declines and aligning with broader market recoveries. This dynamic structure, when read aloud, emphasizes how consistent bounces near $2,797 reinforce buyer control, potentially driving voice-activated queries toward optimistic projections for ETH’s trajectory.

Key Takeaways

- Hidden Bull Confirmation: ETH’s positive daily close above the rising trendline validates the pattern, targeting a 75% rally to $4,958.75.

- Derivatives Momentum: Open interest up 2.30% to $34.57 billion and volume at $73.14 billion highlight balanced yet bullish trader activity.

- Support Defense: Buyers hold key zones at $2,500–$2,600; a breakout above $3,000 could accelerate recovery—monitor for entry opportunities.

Conclusion

Ethereum’s Hidden Bull setup continues to build strength through rising trendline support and favorable derivatives data, positioning ETH for a potential surge toward $4,958.75 amid higher lows in its ascending triangle formation. As trading volume and open interest reflect growing confidence, investors should track resistance breaks for confirmation. Looking ahead, this bullish structure underscores Ethereum’s resilience in the evolving crypto landscape, offering strategic insights for portfolio adjustments.

Comments

Other Articles

Vitalik Buterin: The AI Revolution in DAO Management

February 23, 2026 at 02:58 PM UTC

BitMine Boosts Ethereum Stake to 461K ETH, Eyes Network Share Growth

January 1, 2026 at 08:06 PM UTC

Ethereum Inflow to Binance Surges to 24,500 ETH, Hinting at Short-Term Bearish Pressure

January 1, 2026 at 05:00 PM UTC