Ethereum Holds $3K Support Amid ETF Outflows, Reversal Signals Emerge

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ethereum ETF outflows reached $1.42 billion in November 2025, the highest monthly sell-off since launch, driven by institutional risk-off sentiment. However, BitMine Immersion added 54,000 ETH worth $173 million, signaling selective interest amid market volatility.

-

Ethereum spot ETFs saw massive outflows as investors dumped positions amid broader crypto market pressures.

-

Institutional buying remains limited, with only BitMine Immersion actively acquiring ETH during the dip.

-

On-chain indicators suggest a potential reversal at $3,000 support, supported by liquidity resets and options activity.

Ethereum ETF outflows hit $1.42B in Nov 2025 amid institutional caution, but selective buying persists. Discover if $3K holds and what macro data means for ETH recovery. Stay informed on crypto trends.

What is driving Ethereum ETF outflows in 2025?

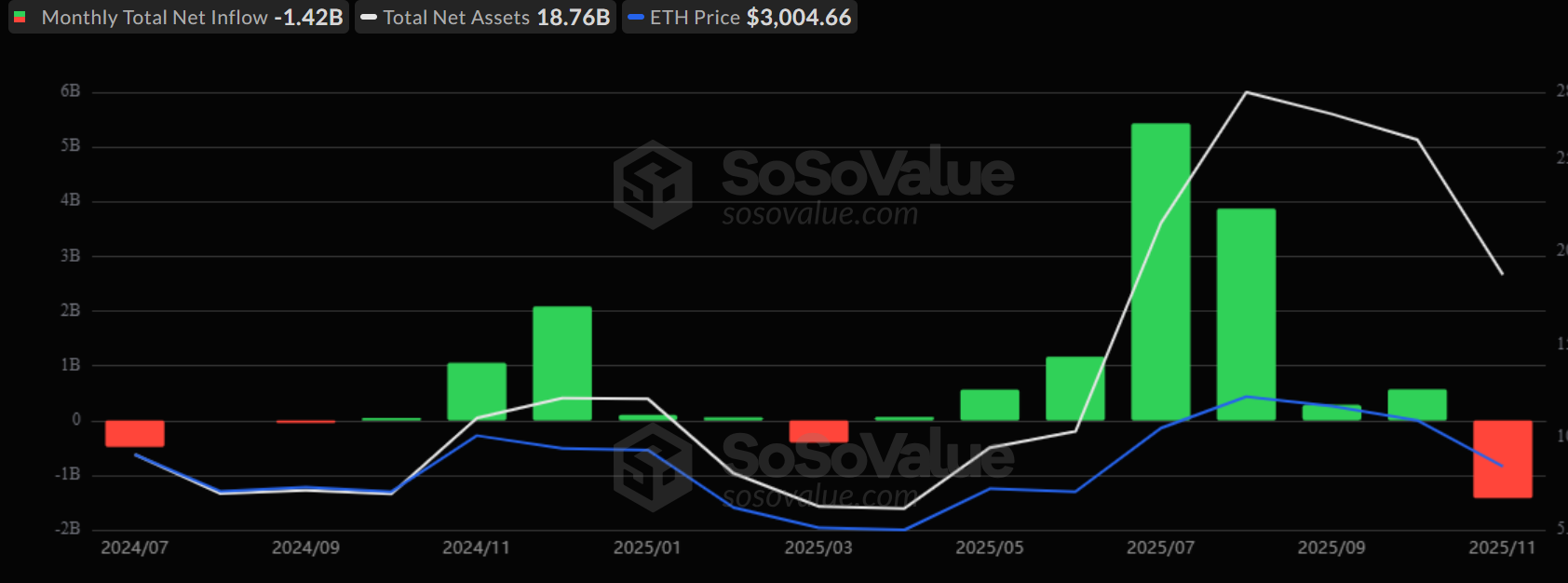

Ethereum ETF outflows in November 2025 have been substantial, totaling $1.42 billion, marking the largest monthly sell-off since the ETFs launched earlier this year. This trend reflects a broader risk-off approach by institutional investors amid heightened market volatility and macroeconomic uncertainties. Despite this, isolated buying from treasury firms like BitMine Immersion highlights pockets of confidence in Ethereum’s long-term potential.

Institutional interest in Ethereum has shown a mixed picture recently. While spot U.S. Ethereum ETFs experienced significant redemptions, one notable player, BitMine Immersion led by Tom Lee, stepped in to buy the dip. The firm acquired an additional 54,000 ETH, valued at approximately $173 million at current prices. This move underscores that not all institutions are fleeing; some are positioning for a rebound.

The ETF complex’s outflows indicate a cautious stance. Investors have withdrawn funds steadily throughout November, contributing to Ethereum’s price pressure near the $3,000 support level. Data from SoSo Value reveals the extent of this sell-off, with net flows turning deeply negative.

Source: SoSo Value

How are leveraged Ethereum positions affecting market sentiment?

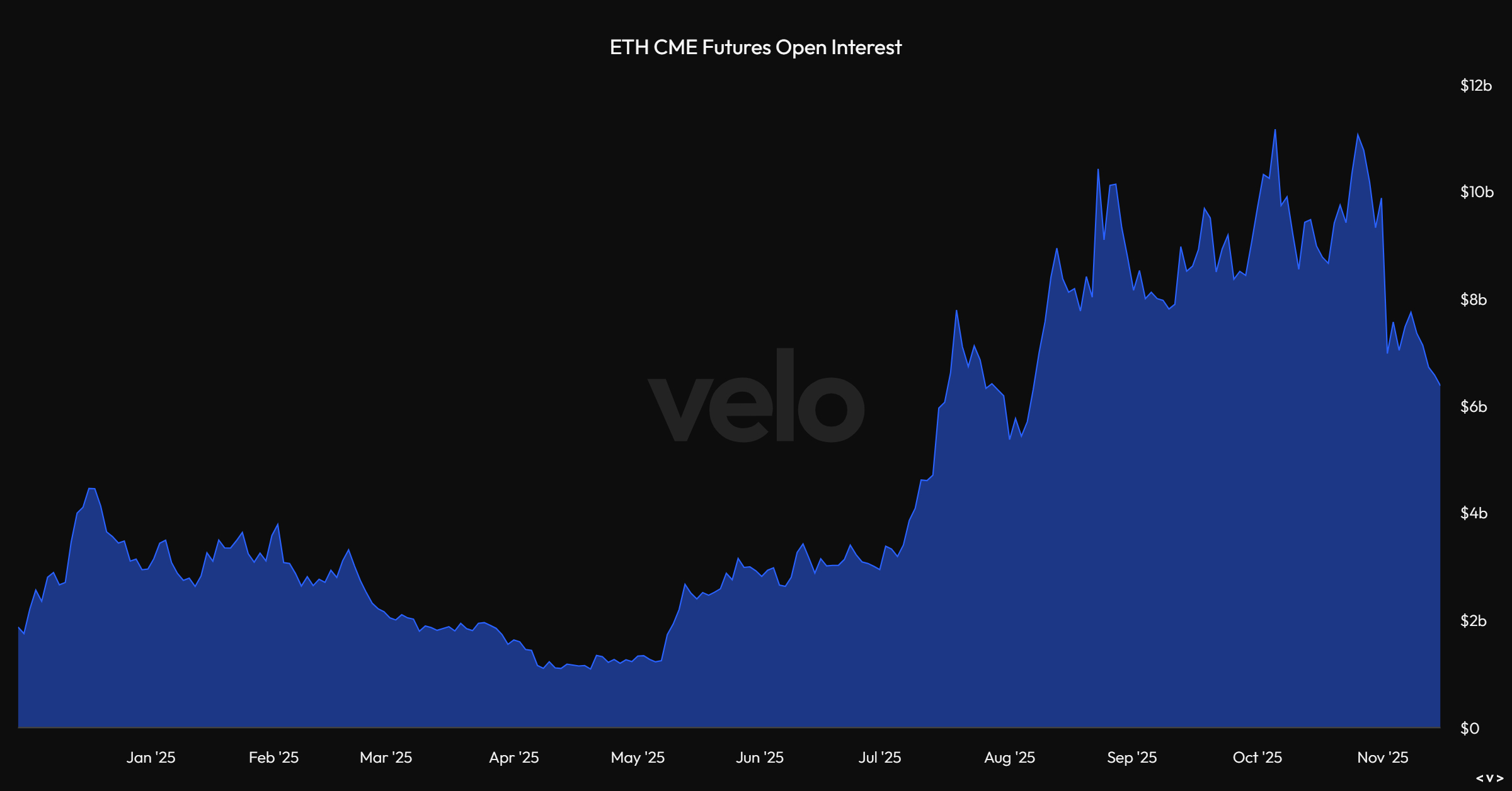

Leveraged bets on Ethereum by institutions have notably cooled, with open interest dropping by nearly $4 billion since the flash crash on October 10, 2025. This decline in open interest, tracked by Velo, points to reduced speculation and a deleveraging process that has stabilized the market somewhat. The ETH basis trade—where investors buy spot ETH via ETFs and short futures on the CME—has also contracted sharply, from 10% to 3% before recovering slightly above 4%.

Source: Velo

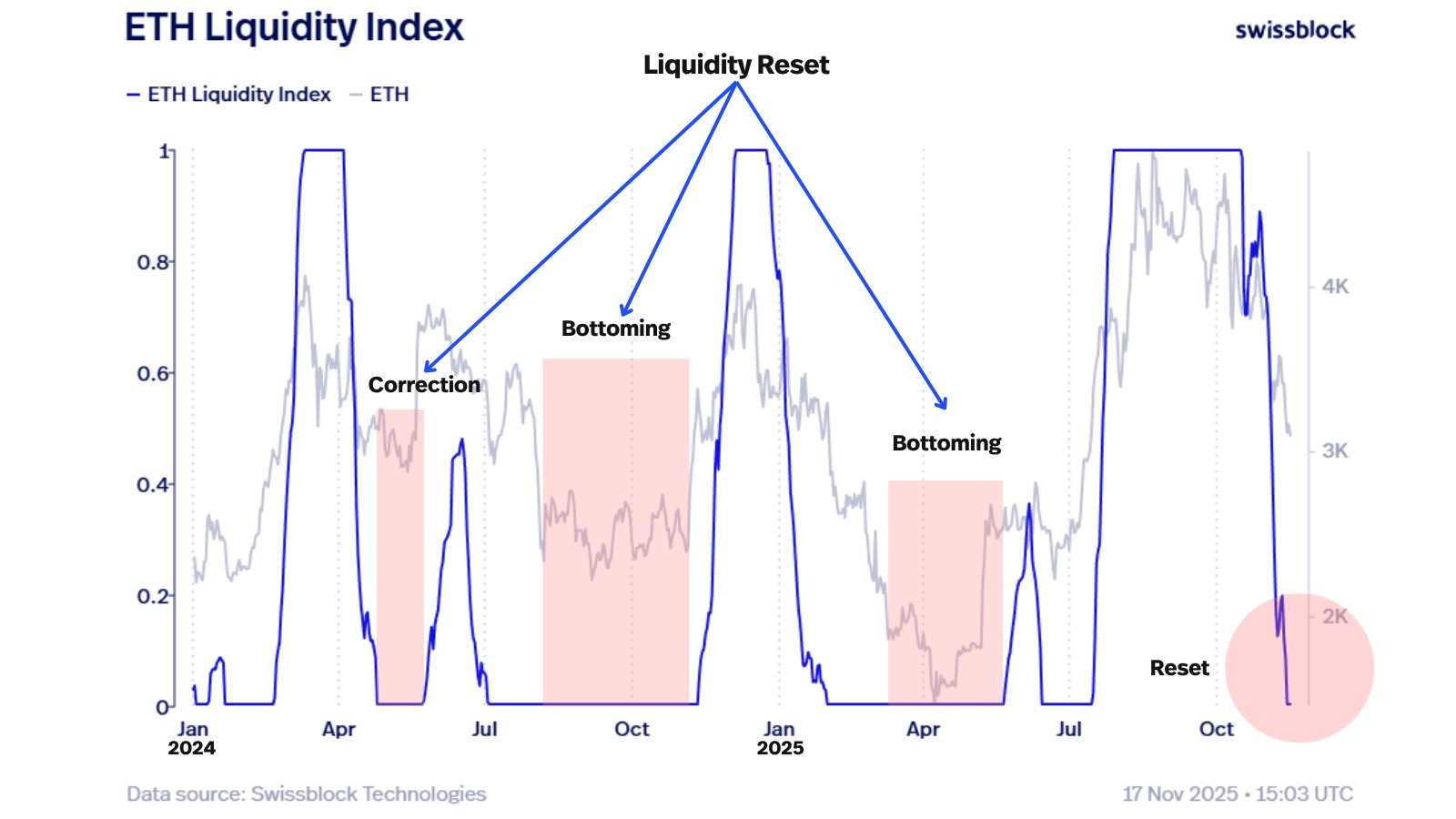

Despite these outflows and reduced leverage, Ethereum has held the $3,000 support level for four consecutive days. Analysts at Swissblock have identified a potential bottom signal through their proprietary Liquidity Index. The firm notes that this index has historically preceded recoveries, as seen in late 2024 and early 2025 when similar signals led to price surges above $4,000.

Swissblock’s analysts stated, “It’s a matter of time: if liquidity is rebuilt in the coming weeks, the next expansion leg opens.” This perspective aligns with on-chain data showing increasing stability and potential for upward momentum.

Source: Altcoin Vector

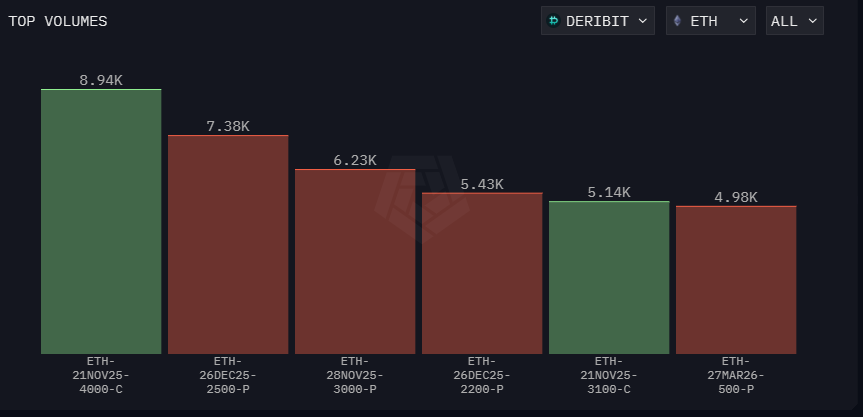

Options market activity further supports a bullish undercurrent. In the last 24 hours, call buying—indicating bullish bets—has focused on strike prices of $4,000 and $3,100 for expirations on November 21 and 28. Data from Arkham shows green bars representing these optimistic positions dominating the flow. Conversely, put options for protection against drops to $3,000 and $2,500 show hedging by cautious traders, suggesting expectations that any further decline might find a floor at $2,500 if $3,000 breaks.

Source: Arkham

Market participants are now eyeing the September Jobs report on November 20 for directional cues. A robust labor market could delay Federal Reserve rate cuts, potentially pressuring risk assets like Ethereum further. In contrast, softer data might enhance rate cut probabilities, fostering a relief rally in cryptocurrencies.

Frequently Asked Questions

Are institutions showing continued interest in Ethereum despite ETF outflows?

Yes, though selective—BitMine Immersion recently purchased 54,000 ETH for $173 million, countering the $1.42 billion in ETF outflows. This indicates targeted accumulation amid broader caution, based on treasury firm disclosures and on-chain tracking.

Will the $3,000 level hold as Ethereum support?

The $3,000 support has held for four days, bolstered by liquidity signals from Swissblock and bullish options activity targeting $3,100. Upcoming macro data on November 20 could confirm stability, with historical patterns suggesting potential recovery if liquidity rebuilds.

Key Takeaways

- Institutional Ethereum interest persists selectively: BitMine Immersion’s $173 million purchase highlights buying amid $1.42 billion ETF outflows.

- Leverage reduction stabilizes ETH: Open interest fell $4 billion post-October crash, shrinking basis trades and supporting $3,000 defense.

- Macro events key to rebound: November 20 Jobs report may influence Fed policy, impacting Ethereum’s path toward $4,000.

Conclusion

Ethereum ETF outflows in 2025 underscore institutional caution, yet selective buying and liquidity signals point to resilience at $3,000 support. With options activity leaning bullish and the November 20 economic data on the horizon, Ethereum’s trajectory hinges on broader market dynamics. Investors should monitor these developments closely for opportunities in the evolving crypto landscape.

Comments

Other Articles

Vitalik Buterin: The AI Revolution in DAO Management

February 23, 2026 at 02:58 PM UTC

BitMine Boosts Ethereum Stake to 461K ETH, Eyes Network Share Growth

January 1, 2026 at 08:06 PM UTC

Ethereum Inflow to Binance Surges to 24,500 ETH, Hinting at Short-Term Bearish Pressure

January 1, 2026 at 05:00 PM UTC