Ethereum Leads Stablecoin Supply Growth Amid U.S. Regulatory Reforms

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ethereum leads the stablecoin market with a supply of $174.95 billion, showing a 0.6% week-over-week increase and 63% year-over-year growth. This dominance extends to Layer 2 networks like Arbitrum One and Base, while new U.S. regulations under the GENIUS Act boost overall stablecoin expansion.

-

Ethereum’s stablecoin supply hits $174.95 billion, up 0.6% WoW and 63% YoY.

-

Layer 2 networks such as Arbitrum One and Base show strong growth in stablecoin liquidity.

-

The total stablecoin supply reached an all-time high of $283.2 billion, driven by regulatory clarity from the GENIUS Act.

Ethereum’s stablecoin supply surges to $174.95B amid U.S. regulatory boosts. Discover Layer 2 growth and global trends shaping the market. Stay ahead in crypto—explore now!

What is Ethereum’s Stablecoin Supply and Why Does It Lead the Market?

Ethereum’s stablecoin supply stands at $174.95 billion, maintaining its position as the top blockchain for stablecoins with a 0.6% increase week-over-week and a robust 63% growth year-over-year. This leadership underscores Ethereum’s role as the foundational network for stablecoin issuance and usage, supported by its secure ecosystem and widespread adoption. Factors like institutional interest and regulatory advancements further solidify this dominance.

How Are Layer 2 Networks Impacting Stablecoin Liquidity?

Layer 2 networks are intensifying competition in stablecoin liquidity, with Arbitrum One holding the second spot at $7.84 billion in supply, despite a 1.2% week-over-week dip but a 45% year-over-year rise, according to on-chain data from Growthepie. Base Chain follows with $4.53 billion, marking a 1% weekly gain and 31% annual growth, while Mantle secures fourth place at $668.42 million, up 147% yearly despite a minor 2.1% weekly decline. In contrast, Optimism Mainnet saw a 7.6% weekly drop to $548.79 million, resulting in a 55.2% year-over-year decrease, and Celo’s supply fell 27.9% annually to $184.22 million. These trends highlight varying adoption rates across scaling solutions, with faster networks gaining traction for efficient transactions.

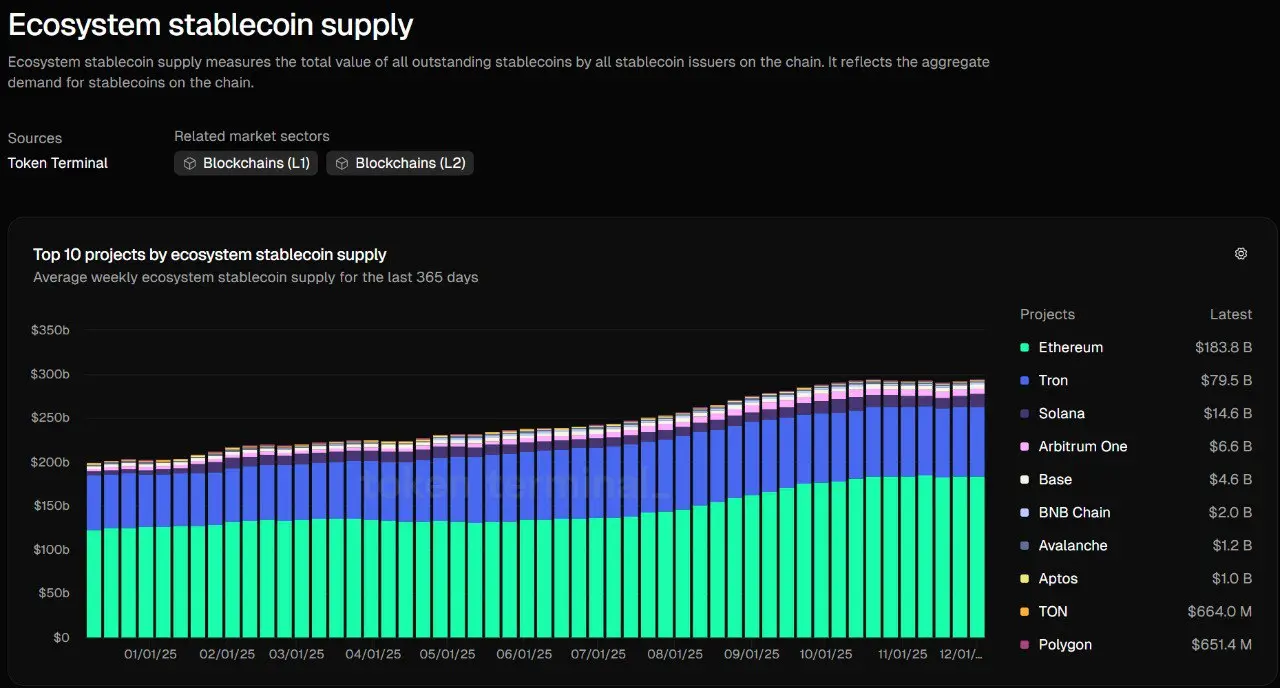

Ethereum continues to outpace other major blockchains in stablecoin metrics. Blockchain analytics from Token Terminal indicate Ethereum’s supply at $184.8 billion, far ahead of Tron’s $78.5 billion and Solana’s $14.4 billion. The overall ecosystem stablecoin supply has climbed to a record $283.2 billion, reflecting heightened demand for stable value in decentralized finance.

Ecosystem stablecoin supply. Source: Token Terminal.

Ecosystem stablecoin supply. Source: Token Terminal.This surge aligns with broader market dynamics, including Tether’s USDT reaching a market cap of $184.79 billion, as reported by CoinMarketCap data. USDT’s steady climb since late November positions it as the premier stablecoin, facilitating seamless trading and remittances across platforms.

Frequently Asked Questions

What Drives the Recent Growth in Ethereum Stablecoin Supply?

The growth in Ethereum’s stablecoin supply stems from regulatory clarity under the GENIUS Act, signed by President Trump, which mandates backing with U.S. Treasuries and dollars. This has encouraged corporate entry, as noted by MNEE CEO Ron Tarter, who called it a “green light” for U.S. firms. Combined with Ethereum’s scalability improvements, it has fueled a 63% year-over-year expansion.

How Will New U.S. Regulations Shape the Global Stablecoin Landscape?

New U.S. regulations like the GENIUS Act aim to reinforce the dollar’s reserve status while promoting crypto innovation, as outlined in a mid-July White House publication. By providing clear rules for issuers, it boosts institutional participation and positions the U.S. as a crypto hub, aligning with Trump’s executive order for leadership in digital assets. This could accelerate global adoption and stability.

Key Takeaways

- Ethereum’s Dominance: With $174.95 billion in stablecoin supply, Ethereum leads due to its mature ecosystem and recent regulatory tailwinds.

- Layer 2 Momentum: Networks like Arbitrum and Base are growing stablecoin liquidity, supporting scalable DeFi applications despite some weekly fluctuations.

- Regulatory Impact: The GENIUS Act and European MiCA framework signal a maturing market, urging issuers to prioritize compliance for broader integration.

Conclusion

Ethereum’s stablecoin supply continues to exemplify blockchain leadership, bolstered by Layer 2 advancements and pivotal regulations like the GENIUS Act. As stablecoin liquidity expands across ecosystems, from Tron’s robust holdings to emerging euro-pegged initiatives under MiCA involving banks such as ING and BNP Paribas, the sector edges toward mainstream financial utility. Investors and institutions should monitor these developments closely, preparing for increased cross-border efficiency and innovation in the evolving crypto landscape.

In Europe, collaborative efforts are underway to develop regulated stablecoins. A consortium of ten major banks, including CaixaBank, DekaBank, Danske Bank, KBC, UniCredit, SEB, Banca Sella, and Raiffeisen Bank International, has formed Qivalis to issue a euro-backed stablecoin. Set for launch in the second half of 2026, it will leverage decentralized blockchains for secure, efficient payments, pending necessary approvals. This initiative complements U.S. reforms, fostering a balanced global stablecoin environment that enhances transaction speed and reduces costs for users worldwide.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026