Ethereum May Extend Losses as SharpLink Dumps Holdings Amid ETF Outflows

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ethereum faces intense sell pressure from SharpLink’s $33.54 million ETH dump, $1.022 billion in U.S. Spot ETF outflows over seven days, and a 152,426 ETH rise in exchange reserves, driving a 20% November decline below $2,900.

-

SharpLink leads dumps: The publicly listed firm sold 10,975 ETH via Galaxy Digital OTC, weakening Ethereum’s market structure.

-

U.S. Ethereum Spot ETFs see seven straight days of outflows, totaling $1.022 billion, signaling investor caution.

-

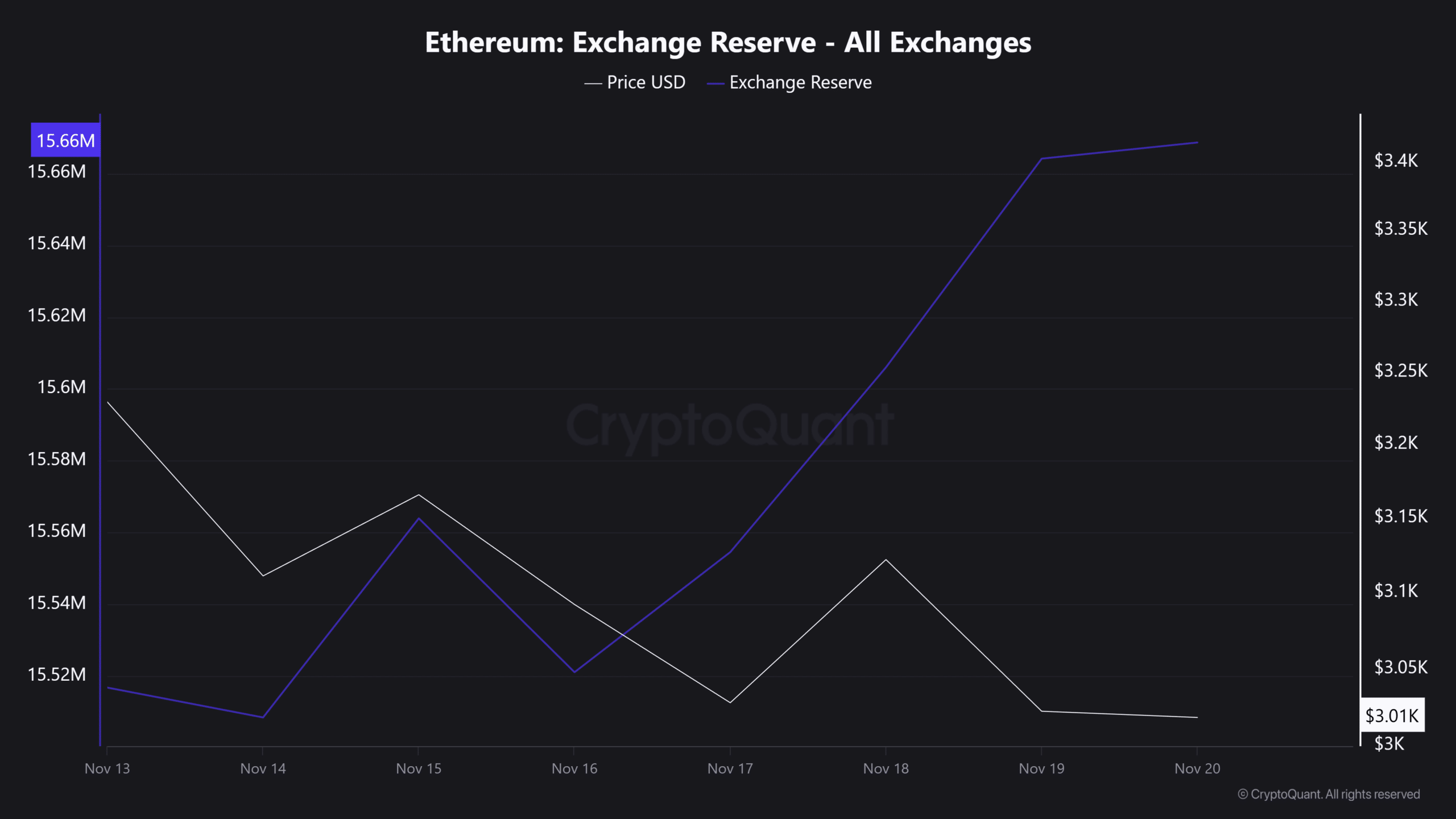

Exchange reserves surged by 152,426 ETH last week per CryptoQuant data, indicating heightened selling by holders amid falling prices.

Ethereum sell pressure intensifies with major dumps and ETF outflows—explore causes, on-chain signals, and price outlook. Stay informed on ETH trends for smarter crypto decisions.

What is causing Ethereum’s current sell pressure?

Ethereum sell pressure stems primarily from institutional sales like SharpLink’s recent offloading of 10,975 ETH worth $33.54 million on the Galaxy Digital OTC desk, as reported by Onchain Lens. This activity coincides with sustained outflows from U.S. Ethereum Spot ETFs, which have lost $1.022 billion over seven consecutive trading sessions according to SoSoValue. Rising exchange reserves further amplify the downward momentum, pushing ETH below $2,900 and erasing over 20% of its value in November alone.

How are U.S. Ethereum Spot ETF outflows impacting the market?

U.S. Ethereum Spot ETFs have experienced significant capital flight, with data from SoSoValue showing outflows for seven straight days reaching a cumulative $1.022 billion. This trend suggests diminishing investor confidence among American participants, potentially reallocating funds amid broader market uncertainties. Experts note that such sustained redemptions often correlate with price depreciation, as they increase available supply without corresponding demand. Short sentences highlight the severity: ETF inflows had previously buoyed ETH, but now reversals dominate. In the context of Ethereum’s ecosystem, these outflows compound existing pressures from on-chain sales, fostering a cautious environment for traders.

Source: SoSoValue

The broader implications extend to Ethereum’s liquidity dynamics. As ETF holders redeem shares, authorized participants sell underlying ETH on the open market, adding to sell-side volume. This mechanism, designed for efficiency, now underscores vulnerability in the second-largest cryptocurrency. Market analysts from platforms like CryptoQuant observe that similar patterns in Bitcoin ETFs preceded temporary bottoms, but Ethereum’s unique staking and layer-2 growth factors may alter recovery timelines. Nonetheless, the $1.022 billion figure represents a stark contrast to earlier inflows, emphasizing the shift in sentiment.

Frequently Asked Questions

Who is responsible for the recent large-scale Ethereum dumps?

SharpLink, the first publicly listed company holding Ethereum as its primary asset, has offloaded 10,975 ETH valued at $33.54 million through the Galaxy Digital OTC exchange, according to Onchain Lens data. This move has contributed to overall market weakness, with no other single entity matching this volume in recent reports.

What do rising Ethereum exchange reserves mean for price?

Rising Ethereum exchange reserves, up by 152,426 ETH in the past week per CryptoQuant, typically signal increased selling intent from investors and long-term holders. This influx boosts available supply on trading platforms, often leading to downward price pressure as it reflects profit-taking or risk aversion in a volatile market.

Key Takeaways

- SharpLink’s ETH dump highlights institutional selling: The firm’s 10,975 ETH sale via OTC has structurally weakened Ethereum’s charts, amplifying broader sell pressure.

- ETF outflows signal waning U.S. investor interest: Seven days of $1.022 billion in redemptions from Spot ETFs point to capital flight, potentially delaying ETH recovery.

- Increased exchange reserves indicate holder distribution: A 152,426 ETH rise suggests ongoing sales, with traders monitoring for a possible drop to $2,750 if support fails.

On-chain metrics paint a bearish picture for Ethereum. Data from CryptoQuant shows exchange reserves across all platforms climbing sharply over the last week, a classic indicator of distribution by whales and retail holders alike. This 152,426 ETH addition directly correlates with ETH’s breach of the $2,900 level, where selling volume overwhelmed buyers. Trading activity has spiked 22% to $38.55 billion, but the uptick accompanies price declines, reinforcing bearish conviction rather than signaling a reversal.

Source: CryptoQuant

Technical indicators further support this outlook. Ethereum’s Average Directional Index (ADX) registers at 43.60, well above the 25 threshold, denoting strong downward momentum. A breakdown from key support levels positions ETH for potential tests at $2,750, provided it remains below $3,000. Analysts emphasize that while trading volume surges indicate engagement, the directional bias leans negative without fresh catalysts like regulatory clarity or network upgrades.

Ethereum’s ecosystem, bolstered by developments in layer-2 scaling and DeFi applications, provides long-term resilience. However, short-term Ethereum sell pressure from ETF dynamics and on-chain sales demands vigilance from investors. U.S. Spot ETF trends, as tracked by SoSoValue, underscore the interplay between traditional finance and crypto markets. As reserves build per CryptoQuant metrics, the market awaits signs of capitulation or accumulation to shift the narrative.

Conclusion

In summary, Ethereum’s ongoing sell pressure arises from SharpLink’s substantial dumps, U.S. Spot ETF outflows exceeding $1 billion, and elevated exchange reserves signaling holder distribution. These factors have driven a sharp 20% decline in November, with technicals pointing to further downside risks below $3,000. Investors should monitor on-chain data closely for reversal cues, positioning strategically as Ethereum’s foundational strengths in smart contracts and scalability could fuel a rebound in the evolving crypto landscape—consider diversifying holdings amid volatility.