Ethereum Open Interest Decline Hints at Market Reset for ETH

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

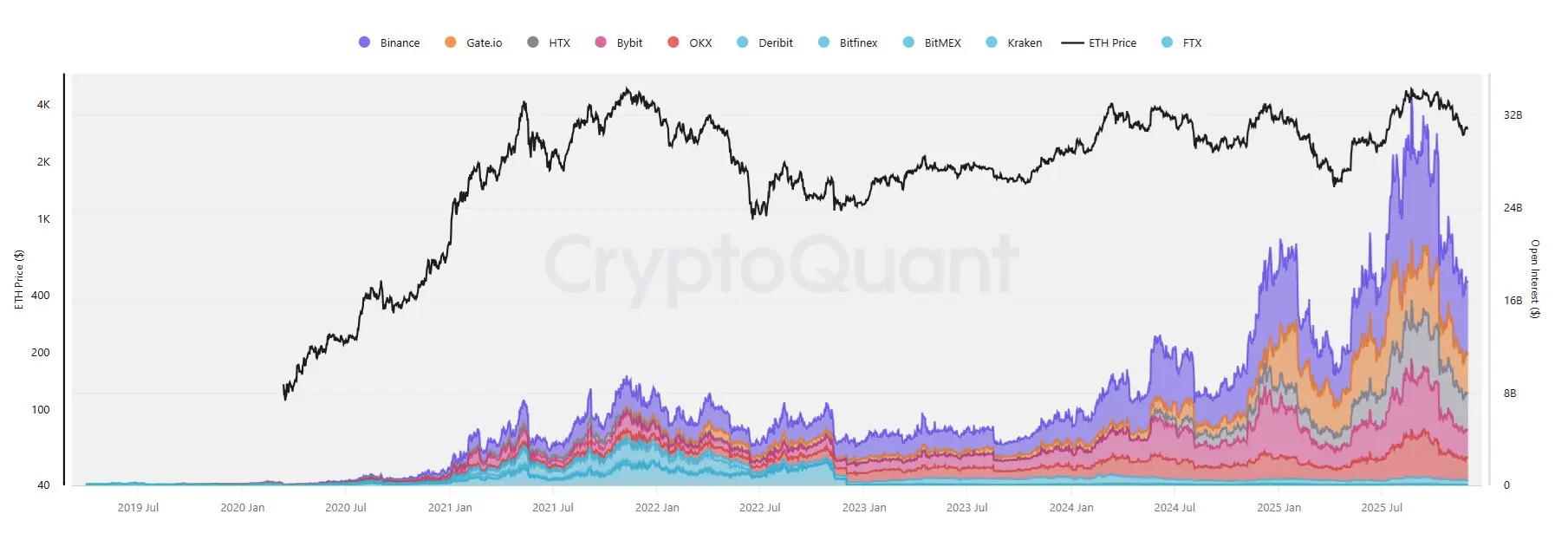

Ethereum’s open interest has declined sharply by 51% on Binance over the past three months, erasing nearly $6.4 billion in positions since the October 11 crash. This deleveraging reflects a market reset amid reduced speculation, with total ETH positions now at $15 billion across exchanges.

-

Binance leads the decline: ETH open interest dropped from $12.6 billion in August to around $6.2 billion today.

-

Other platforms like Gate.io and Bybit also saw reductions, with Gate.io at $3.5 billion and Bybit falling from $6.1 billion to $2.3 billion.

-

ETH price slid 43% from $4,830 to $2,800, contributing to a 22.2% drop in November 2025 and only three green months year-to-date.

Discover the Ethereum open interest decline on Binance and its impact on crypto markets in 2025. Explore key factors, trading shifts, and future implications for ETH investors—stay informed and adjust your strategy today.

What Is the Ethereum Open Interest Decline on Binance?

Ethereum open interest decline refers to the significant reduction in outstanding futures and derivatives contracts for ETH on major exchanges, particularly Binance, where it fell 51% over the past three months. This drop, erasing nearly $6.4 billion in positions since the October 11 crash, signals deleveraging and a shift away from speculative trading. Overall, it indicates a market correction as traders reassess ETH’s value amid price volatility.

How Has Ethereum’s Speculative Trading Evolved Recently?

The Ethereum open interest decline stems from a period of heightened speculation fueled by ETF inflows, Layer 2 ecosystem growth, and recoveries in DeFi, staking, and stablecoins. According to data from CryptoQuant, Binance’s ETH open interest peaked at $12.6 billion in August 2025 before unwinding, reflecting unsustainable bullish momentum. ETH’s failure to break higher price ranges triggered this deleveraging, with spot trading briefly compensating but ultimately failing to stabilize prices. Across exchanges, total ETH positions now stand at $15 billion, with a balanced long-short ratio, as platforms like Hyperliquid saw declines to $1.3 billion. This process highlights Ethereum’s transition from experimental utility token to a potential global finance settlement layer, though current fear levels—evidenced by a 27-point ETH Fear and Greed Index—suggest caution among traders. Supporting statistics show a 43% ETH price drop from $4,830 to $2,800, trading at 0.032 BTC, underscoring the broader market reset.

ETH open interest declined on Binance, erasing 51% in the past three months as Ethereum started unwinding from its most speculative period in its trading history. | Source: CryptoQuant.

ETH open interest declined on Binance, erasing 51% in the past three months as Ethereum started unwinding from its most speculative period in its trading history. | Source: CryptoQuant.Ethereum’s DeFi sector remains resilient, with most loans positioned below liquidation thresholds, yet centralized exchange liquidations have deterred long position builds. Short positions hover around $2,900, reducing short squeeze risks, while subdued derivatives activity has amplified market fear. This decline, part of a longer deleveraging trend since October 10, 2025, marks Ethereum’s entry into a less speculative phase after years of building toward mainstream adoption.

In November 2025, ETH recorded a 22.2% loss, its second-worst monthly performance since February’s 32.2% drop. Year-to-date, only three months showed gains amid short-lived rallies. The open interest evaporation coincides with liquidity losses on other venues: Gate.io at $3.5 billion, Bybit down to $2.3 billion from $6.1 billion earlier. These shifts demonstrate Ethereum’s evolving market structure, where speculative highs have given way to balanced, cautious trading.

Frequently Asked Questions

What Caused the 51% Drop in Ethereum Open Interest on Binance?

The 51% decline in Ethereum open interest on Binance over the past three months resulted from post-crash deleveraging after the October 11, 2025, event, which erased $6.4 billion in positions. Factors include failed price breakouts, unsustainable speculation from ETF interest and DeFi growth, and a shift to spot trading that couldn’t sustain momentum, leading to reduced trader confidence.

Is Ethereum’s DeFi Sector Affected by the Open Interest Decline?

Ethereum’s DeFi space has held up well despite the open interest decline, with loan liquidation prices remaining low and activity in staking, lending, and stablecoin transfers continuing steadily. However, centralized market liquidations have cooled enthusiasm for derivatives, fostering a more conservative environment as ETH navigates its 2025 price challenges.

Key Takeaways

- Deleveraging Trend: Ethereum open interest has fallen 51% on Binance since August 2025, signaling the end of a speculative peak and a market reset.

- Broader Exchange Impact: Total ETH positions across platforms like Bybit and Gate.io dropped to $15 billion, with balanced long-short ratios indicating stabilized but cautious trading.

- Price and Sentiment Insight: ETH’s 43% slide to $2,800 and a 27-point Fear and Greed Index highlight ongoing fear—monitor DeFi health for potential recovery signals.

Conclusion

The Ethereum open interest decline on Binance underscores a pivotal shift in 2025, from speculative fervor driven by ETFs and DeFi expansions to a more measured market evaluation. With positions down to $15 billion overall and ETH trading at subdued levels, this deleveraging process paves the way for sustainable growth. Investors should watch for renewed liquidity inflows and DeFi stability as Ethereum positions itself for future advancements in global finance—consider diversifying strategies to navigate ongoing volatility.