Ethereum Shows Recovery Signals with Positive Staking Inflows and Institutional Buying

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ethereum staking inflows have turned positive for the first time in six months, signaling a potential recovery. Amid negative ETF flows, on-chain metrics show increased smart contract activity and real-world asset value nearing $19 billion, while institutions like Trend Research accumulate ETH.

-

Ethereum staking inflows reach positive territory after six months of outflows.

-

On-chain data reveals record smart contract deployments and rising RWA tokenization.

-

Institutional holders show 486 long positions versus 1 short in ETHA futures.

Ethereum staking inflows turn positive amid institutional buys and on-chain growth. Explore supply shifts, price support at $2,800, and recovery signals for ETH investors today.

What are Ethereum staking inflows signaling for price recovery?

Ethereum staking inflows have flipped positive for the first time in six months, indicating renewed confidence among holders. This shift coincides with declining exchange balances and a 745,000 ETH staking queue, reducing circulating supply. Despite sideways price action, these fundamentals support a potential floor above $2,800.

Why are institutions increasing Ethereum exposure now?

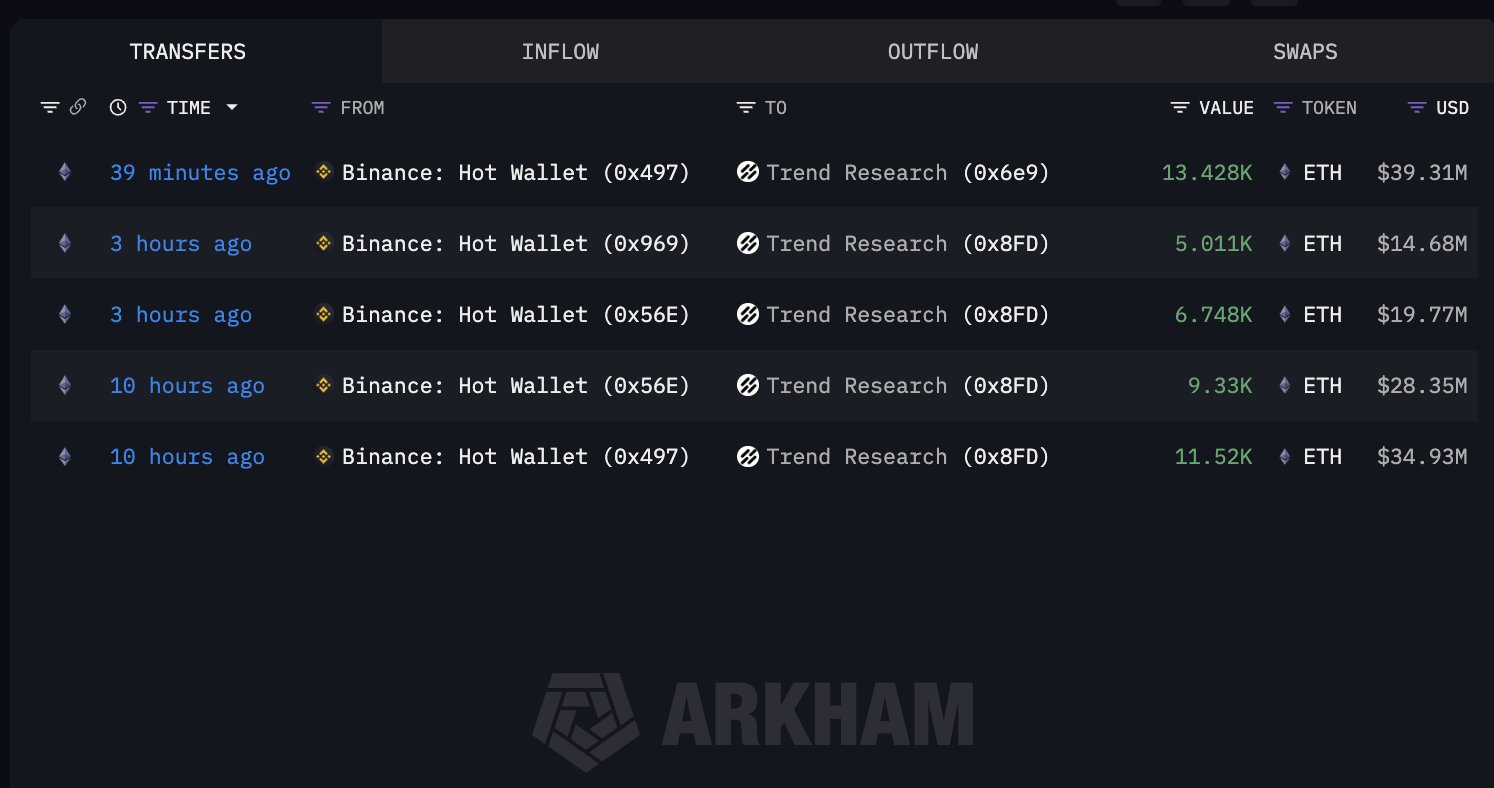

Institutional activity underscores Ethereum’s resilience. Trend Research added 46,000 ETH in a single day, boosting its total holdings to 626,000 ETH. Data from on-chain platforms like Glassnode reveals steady growth in ETHA ownership through late 2025, with holders favoring 486 long positions against just 1 short. This positioning persists even as market sentiment remains cautious. Real-world usage bolsters the case, with smart contract deployments at record highs and tokenized real-world assets (RWA) on Ethereum approaching $19 billion in value. Sell pressure, measured by 90-day Spot Taker CVD, has eased to neutral levels, slowing aggressive outflows.

Supply-demand changes are starting to show

Ethereum has endured a prolonged phase of weak price action and inconsistent ETF inflows, but recent on-chain developments paint a brighter picture. Staking queues have swelled to 745,000 ETH, while exchange balances decline at a rapid pace seen only in previous cycles.

Source: X

These trends align with broader adoption metrics. Platforms tracking RWA tokenization report nearly $19 billion locked on Ethereum, reflecting genuine network utility.

Ethereum stalls, but the floor holds

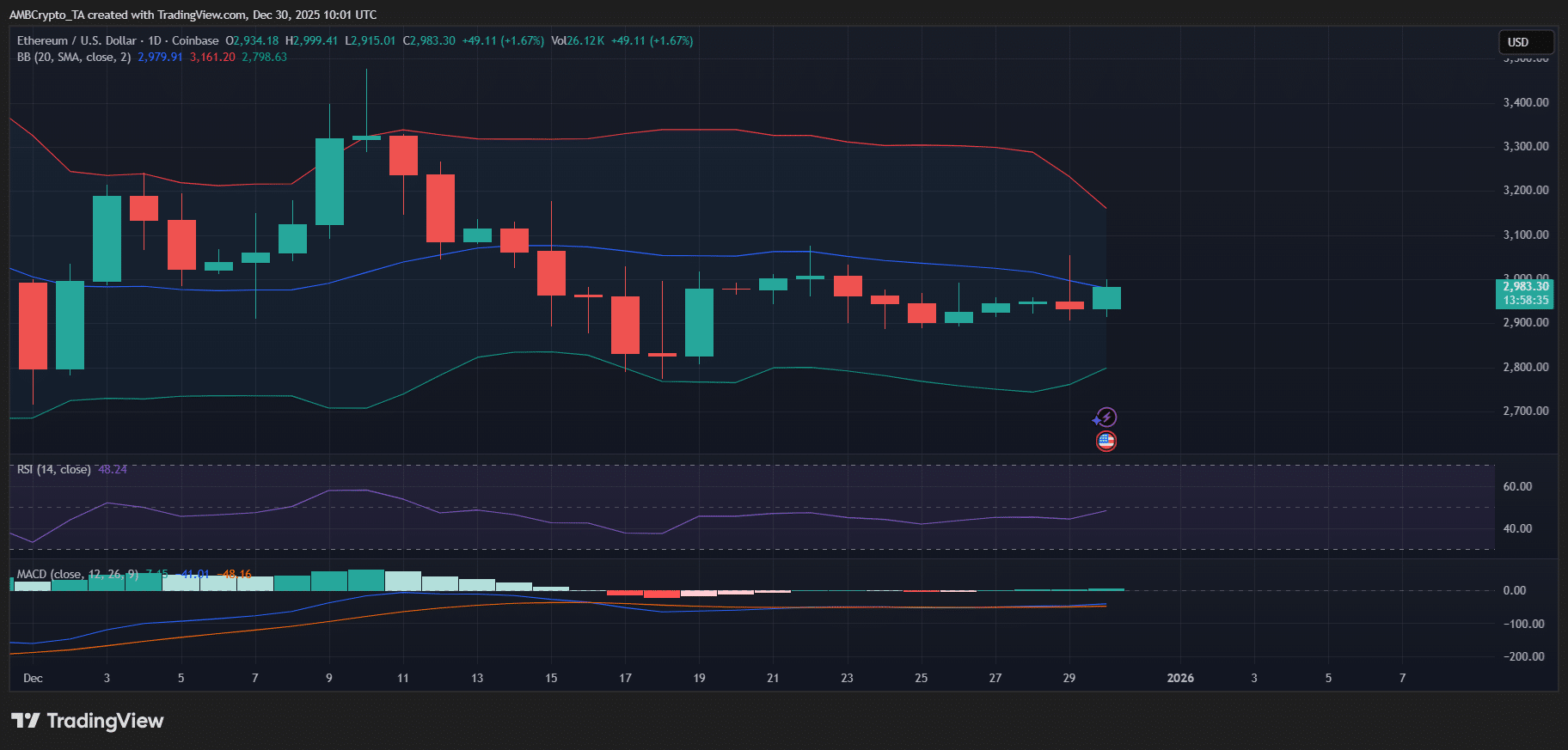

Current price action shows Ethereum trading sideways below the mid-Bollinger Band on daily charts. RSI registers neutral momentum, while MACD flattens, signaling indecision.

Source: TradingView

Critically, downside pressure has been contained above the lower Bollinger Band, preserving support in the $2,800-$2,900 range. Any meaningful breakout will likely mirror Bitcoin’s direction, given Ethereum’s correlation.

Frequently Asked Questions

Are Ethereum staking inflows sustainable after six months of negatives?

Ethereum staking inflows have sustained positive momentum since turning upward, backed by a 745,000 ETH queue and falling exchange reserves. Data from Santiment confirms cycle-typical decline rates, suggesting durability unless ETF outflows accelerate sharply.

What do 486 long versus 1 short ETHA positions indicate?

The overwhelming long bias in ETHA futures among large holders points to institutional conviction. Despite fragile sentiment, this 486-to-1 ratio reflects preparation for upside, as positions grew steadily into late 2025.

Key Takeaways

- Positive staking inflows: First in six months, with 745K ETH queued, tightening supply.

- Institutional strength: 486 long ETHA positions versus 1 short; Trend Research at 626K ETH holdings.

- Price floor intact: Support holds at $2,800-$2,900; watch broader market cues for breakout.

Conclusion

Ethereum staking inflows and institutional accumulation signal foundational recovery amid on-chain growth like record smart contracts and $19 billion in RWAs. With price respecting key support, these metrics position Ethereum for alignment with market uptrends. Monitor staking trends and holder positioning for next moves.