Ethereum Signals Potential Momentum Shift as ETH/BTC Breaks Downtrend with USDC Inflows

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ethereum’s renewed momentum stems from the ETH/BTC pair breaking a prolonged downtrend, supported by surging USDC inflows and new wallet growth. This shift indicates improving market structure, with ETH trading near $3,103 amid ETF inflows and the Fusaka upgrade enhancing Layer-2 capacity.

-

ETH/BTC breakout signals Ethereum’s first structural improvement in months, driven by technical strength and on-chain activity.

-

New wallet registrations hit 190,000 in a day, coinciding with $140 million in BlackRock ETH ETF inflows.

-

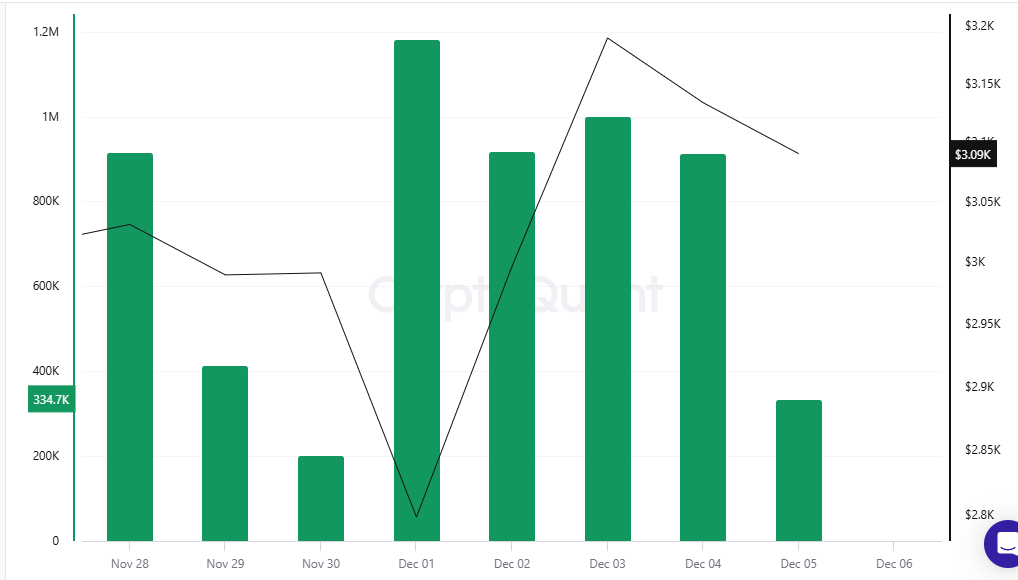

USDC activity surged over 1.2 million units on December 1, aligning with Ethereum’s price recovery above key support levels.

Ethereum momentum builds as ETH/BTC breaks downtrend with USDC inflows and ETF gains. Discover key on-chain trends driving this shift—stay ahead in crypto markets today.

What is Driving Ethereum’s Recent Momentum Against Bitcoin?

Ethereum momentum has gained traction following the ETH/BTC pair’s decisive breakout from a multi-month downtrend, marking a potential reversal in market dynamics. This movement, coupled with sharp increases in USDC liquidity and robust network activity, underscores Ethereum’s strengthening position. As ETH hovers near $3,103, these factors collectively signal renewed investor confidence in Ethereum’s ecosystem.

Ethereum’s performance against Bitcoin has been under pressure since early September, confined within a descending trendline that repeatedly capped upside attempts. However, recent price action delivered a clean break above this resistance, with the ETH/BTC ratio surging nearly 10% in a single candle. This breakout reflects broader market rotation toward Ethereum, supported by technical indicators showing increased buying volume and reduced selling pressure.

Analyst Mr. APE, known as GEM Hunter, highlighted the significance of this move, stating that it represents the first genuine spark for Ethereum after extended consolidation. The ratio’s strength aligns with Ethereum’s USD price gains, including a 2.37% weekly increase, positioning ETH at $3,103.71 while Bitcoin trades at $90,633.92, down 0.96% over the same period.

this is the first real spark from #Ethereum in months 🚨

Just look at the chart, ETH has snapped a key downtrend against #Bitcoin

I’ve been watching this move closely & $ETH finally showed real strength, bouncing almost 10% in ratio aligned to its price

Its not wrong to say… pic.twitter.com/c3IJKUmTnf

— 🦧Mr. APE aka GEM Hunter💎 (@deg_ape) December 5, 2025

Prior to the breakout, ETH/BTC had been trading in a tight range, forming shallow highs and lows characteristic of accumulation phases. The eventual departure from this range occurred with notable velocity, corroborated by Ethereum’s resilience above critical support zones like 0.0348–0.0353. Market observers note that sustaining above these levels could confirm the uptrend’s longevity.

How Has the Fusaka Upgrade Influenced Ethereum’s On-Chain Activity?

The Fusaka upgrade has played a pivotal role in bolstering Ethereum’s appeal by optimizing Layer-2 scalability through advanced blob mechanics and PeerDAS enhancements. Implemented amid low volatility, it has facilitated smoother transaction processing, attracting developers and users to the network. On-chain metrics reflect this impact, with Ethereum registering 190,000 new wallets in just one day—a surge that outpaces recent averages and signals growing adoption.

Complementing these developments, institutional interest has intensified, as evidenced by $140 million in inflows to the BlackRock ETH ETF. Data from Cryptoquant indicates that such capital rotations often precede sustained rallies, providing a factual basis for Ethereum’s momentum. Expert analysis from on-chain platforms like Cryptoquant further supports this, showing a correlation between wallet growth and price stabilization above $3,000.

Short sentences highlight the upgrade’s efficiency: It reduces data availability costs by up to 50%, per Ethereum Foundation reports. This cost-saving measure encourages more decentralized applications (dApps) to migrate, enhancing overall network utility. As a result, transaction volumes have stabilized, contributing to Ethereum’s relative outperformance against Bitcoin and fostering a more robust market structure.

In parallel, the upgrade’s timing has amplified the ETH/BTC breakout’s implications. With Bitcoin facing mild weekly declines, Ethereum’s gains underscore a diversification trend among investors. Supporting statistics from blockchain analytics firms reveal that active addresses rose 15% post-upgrade, aligning with the observed liquidity shifts and reinforcing the narrative of structural improvement.

Frequently Asked Questions

What Caused the Recent ETH/BTC Breakout and Its Impact on Ethereum Price?

The ETH/BTC breakout was triggered by a strong bullish candle surpassing the September downtrend line, fueled by new wallet growth and ETF inflows totaling $140 million. This has propelled Ethereum’s price to $3,103, indicating a potential trend reversal as liquidity rotates from Bitcoin, with on-chain data confirming sustained momentum above key supports.

Why Are USDC Inflows Surging on Ethereum and What Does It Mean for Traders?

USDC inflows on Ethereum spiked to over 1.2 million units on December 1, reflecting heightened stablecoin activity that preceded price recoveries toward $3,180. For traders, this signals building liquidity and reduced volatility, often a precursor to upward moves, as stablecoin rotations provide a buffer against market swings and support Ethereum’s ecosystem stability.

Key Takeaways

- ETH/BTC Breakout Confirmation: The pair’s 10% surge breaks months of downtrend, backed by technical closes above resistance, pointing to Ethereum’s relative strength.

- On-Chain Growth Metrics: 190,000 new wallets and $140 million ETF inflows highlight institutional and retail interest, correlating with price stability near $3,103.

- Liquidity Rotation Insight: USDC surges align with price action, urging traders to monitor support levels for entry points in this evolving momentum.

Conclusion

Ethereum’s momentum, driven by the ETH/BTC breakout and bolstered by the Fusaka upgrade’s scalability improvements, positions the network for potential long-term gains. With USDC inflows and ETF activity providing concrete support, market structure appears to be shifting favorably. Investors should track these on-chain trends closely, as they could herald broader adoption and sustained Ethereum price appreciation in the coming months.

Ethereum shows renewed momentum as ETH/BTC breaks a long downtrend while USDC flows surge, supporting a shift in market structure.

- ETH/BTC breaks a prolonged downtrend as new wallet growth and ETF inflows support a shift in trend.

- USDC inflows rise sharply on December 1, aligning with renewed Ethereum price strength above key support.

- ETH trades near $3,103 as liquidity rotation signals early momentum despite short-term volatility.

Ethereum shows its first real structural improvement in months, with renewed strength against Bitcoin and a notable rise in liquidity metrics. Market flows, technical changes, and new network activity shape the current trend.

Ethereum/BTC Breakout Marks a Shift in Market Rhythm

Ethereum shows renewed activity after months of muted performance against Bitcoin. The pair had moved under a clear downtrend since early September. Each attempt to break above the diagonal resistance produced another rejection, keeping the ratio subdued. The latest candle shifted this pattern with a clean move above the trendline.

Mr. APE, also known as GEM Hunter, noted that ETH delivered a near-10% bounce in the ratio. He stated the move carried more strength than prior attempts. His view suggested that the shift could represent the first spark from Ethereum after months of pressure. The candle broke the trend with a strong close, reflecting a change in momentum.

this is the first real spark from #Ethereum in months 🚨

Just look at the chart, ETH has snapped a key downtrend against #Bitcoin

I’ve been watching this move closely & $ETH finally showed real strength, bouncing almost 10% in ratio aligned to its price

Its not wrong to say… pic.twitter.com/c3IJKUmTnf

— 🦧Mr. APE aka GEM Hunter💎 (@deg_ape) December 5, 2025

The move followed weeks of compression as ETH/BTC traded in a narrow range. This phase created shallow highs and lows often linked with accumulation. The breakout formed as price left the range with pace, matching recent strength in Ethereum’s USD chart. ETH trades at $3,103.71 as of writing, after a 2.37% weekly gain.

Fusaka Upgrade and On-Chain Trends Support the Move

The Fusaka upgrade contributed to renewed interest in Ethereum. It expanded Layer-2 capacity using new blob mechanics and PeerDAS improvements. These changes arrived during a period of low volatility, giving the breakout added weight.

Mr. APE added that the network registered 190,000 new wallets in a single day. He also noted $140 million flowing into the BlackRock ETH ETF. These data points coincided with the strengthening technical framework of the ETH/BTC pair.

As of writing, Bitcoin is trading at $90,633.92, following a decrease of 0.96% last week. The relative performance change indicates an increasing demand towards Ethereum. Market participants are watching how the pair behaves above the 0.0348–0.0353 support band.

USDC Liquidity Signals Reinforce Ethereum’s Momentum

On-chain USDC data from November 28 to December 5 shows shifting liquidity conditions. Activity started strong near 900,000 units before falling sharply on November 29 and 30. This decline aligned with softening price action near $3,050.

Source: Cryptoquant

A sharp rise occurred on December 1 when USDC activity exceeded 1.2 million units. This surge appeared before Ethereum’s price recovery toward $3,180 on December 2 and 3. The increase in liquidity supported the upward move.

USDC volumes remained elevated until December 4 but declined on December 5. The price eased to $3,110 as activity cooled. The pattern suggests that liquidity rotation continues to shape Ethereum’s near-term structure and broader momentum.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Stablecoins Reach 2025 Peaks Led by USDT, Amid Sustained Activity

December 31, 2025 at 07:01 PM UTC

Ethereum Could Target $8,500 as Bullish Momentum Builds Near $4,811

December 31, 2025 at 02:39 PM UTC