Ethereum Signals Stabilizing Demand Amid Potential Pullback to $2,750

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ethereum’s fund market premium has turned positive, indicating renewed institutional interest and reduced selling pressure amid recent market volatility. This shift suggests stabilizing demand, with exchange reserves declining and funding rates resetting to support a healthier price environment.

-

Ethereum fund premium flips positive: Signals cautious institutional re-entry after volatility.

-

Exchange reserves drop 6.03% to $47.78 billion, easing immediate sell-side risks.

-

Funding rates plunge 64.66% to 0.002506, clearing excess leverage and promoting sustainable growth.

Ethereum fund premium turns positive amid stabilizing signals: Explore exchange reserves decline and funding rate reset for insights into ETH’s recovery path. Stay informed on crypto trends today.

What Does Ethereum’s Positive Fund Premium Indicate?

Ethereum’s fund premium shifting to positive territory reflects growing confidence among institutional investors, as they are willing to pay a premium for exposure to ETH-based funds despite recent price swings. This metric, which measures the difference between fund prices and net asset values, turning positive suggests that institutions are holding or increasing positions rather than liquidating. According to data from on-chain analytics platforms like Glassnode, such transitions often precede periods of market stabilization, with historical patterns showing reduced volatility following similar flips.

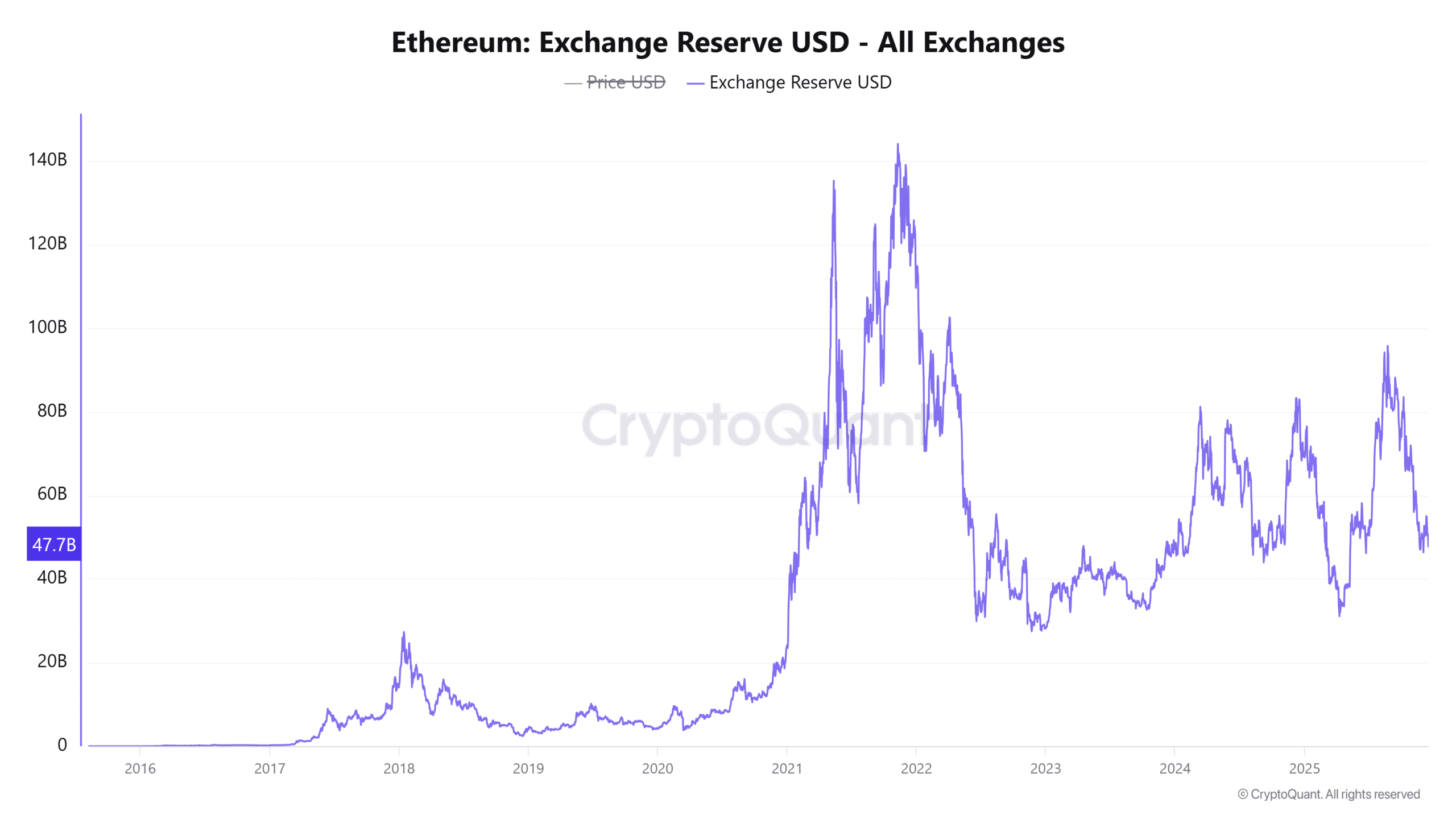

How Are Declining Exchange Reserves Impacting Ethereum’s Price?

Declining exchange reserves for Ethereum represent a key on-chain indicator of reduced selling pressure, as fewer ETH tokens are available for immediate liquidation on trading platforms. At the time of reporting, reserves had fallen by 6.03% to $47.78 billion, a level that aligns with investor shifts toward self-custody and long-term holding strategies. This movement, tracked by platforms such as CryptoQuant, historically correlates with price floors forming during corrections, limiting downside risk from panic sales. Experts note that when reserves drop below critical thresholds, it often signals accumulation by large holders, fostering a more balanced supply dynamics. For instance, during the 2022 bear market, a similar reserve decline preceded a 20% rebound in ETH prices over subsequent weeks. Short sentences highlight the structural benefits: lower reserves mean less overhang, enabling spot demand to drive momentum without interference from forced exits.

Ethereum’s [ETH] fund market premium has flipped back into positive territory, signaling stabilizing institutional demand after recent volatility.

This shift matters because fund premiums track how confidently institutions position capital. When the premium turns positive, funds accept higher exposure costs instead of exiting.

That behavior suggests easing sell pressure. However, the premium remains modest, not aggressive.

Therefore, institutions appear cautious rather than fully bullish. Historically, similar transitions marked the end of distribution phases. Meanwhile, price volatility has moderated.

As a result, ETH trades in a calmer environment where large players reassess risk instead of forcing liquidations. This shift supports stabilization, not yet a strong accumulation phase.

Ethereum’s support is now under pressure!

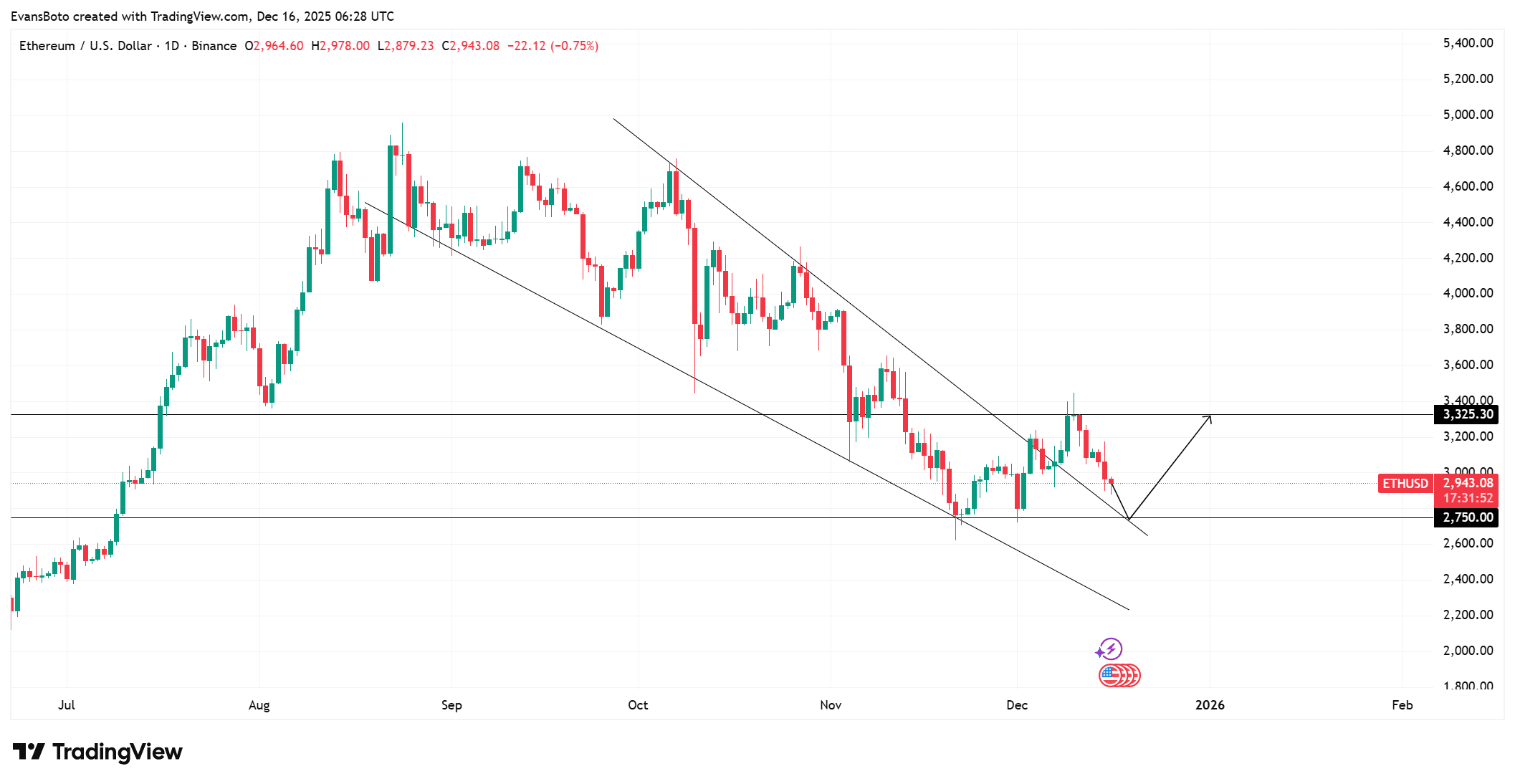

Ethereum has broken out of its descending wedge, confirming weakening bearish control after months of lower highs. This breakout signals a structural shift.

However, price momentum remains fragile. Historically, similar breakouts often trigger a retest of former resistance. In this case, the $2,750 zone aligns with the wedge’s upper boundary.

Therefore, a pullback toward that level would reinforce structure rather than invalidate it. Buyers continue defending higher lows, yet follow-through remains limited.

Consequently, price action reflects caution. Market participants now watch whether demand absorbs any dip quickly. A strong reaction from support would strengthen confidence in a broader recovery.

Source: TradingView

Easing selling pressure?

At press time, Ethereum’s Exchange Reserves have dropped 6.03% to $47.78 billion, signaling reduced immediate sell-side pressure.

This decline indicates fewer coins sit on exchanges ready for liquidation. Therefore, the downside risk from sudden sell waves weakens.

Investors appear to move ETH into longer-term storage. However, falling reserves alone do not guarantee price appreciation. They simply remove a major headwind.

Combined with improving institutional positioning, the reserve decline supports a stabilization narrative.

Moreover, lower reserves reduce the probability of panic-driven drawdowns. As a result, Ethereum trades in a structurally healthier supply environment.

Source: CryptoQuant

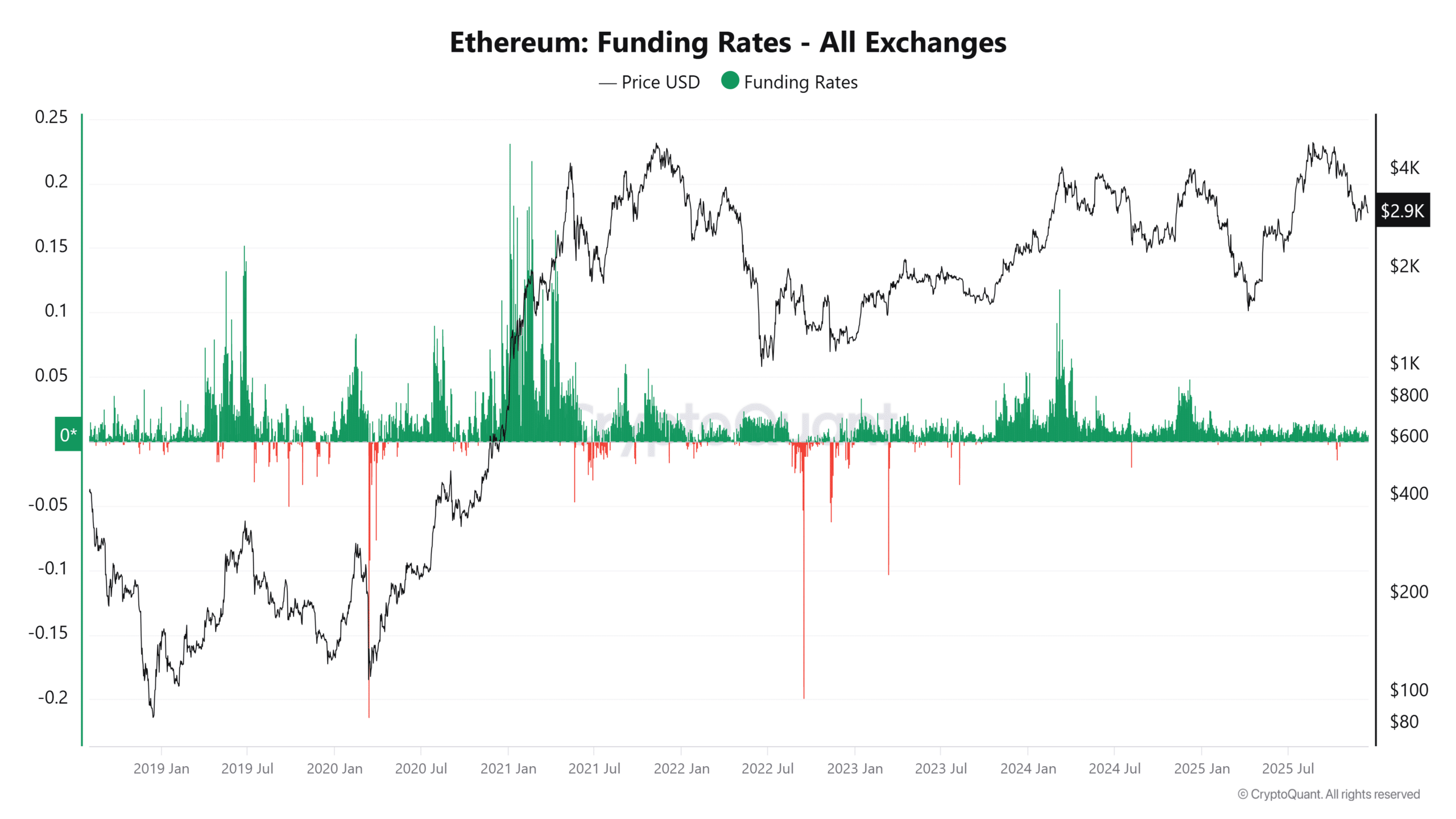

Ethereum funding rates plunge 64.66% as leverage resets

Ethereum’s Funding Rates have dropped 64.66% to 0.002506, at press time, signaling a sharp reset in leveraged long positioning. Such a rapid decline reflects traders closing crowded longs and reducing directional risk.

Therefore, excess leverage has cleared from the market. Open Interest has also fallen 4.46% to $37.81 billion, reinforcing the same message.

Traders are now operating with lighter exposure. Although this reset may put short‑term pressure on prices, it ultimately strengthens market health. Overleveraged positions often lead to forced liquidations.

In contrast, neutral funding creates a foundation for more sustainable price growth. As a result, Ethereum is relying increasingly on spot demand rather than speculative leverage.

Source: CryptoQuant

The Ethereum funding rate reset is particularly noteworthy in the context of broader derivatives market health. Funding rates, which balance perpetual futures contracts between long and short positions, spiking negatively often precede corrections by highlighting over-optimism. In this instance, the 64.66% drop to 0.002506%—a near-neutral level—indicates that derivatives traders are recalibrating after aggressive long builds. Open interest declining to $37.81 billion further underscores this deleveraging, as per metrics from Coinglass and similar aggregators. Market analysts, including those from Kaiko Research, have observed that such resets in 2024 and early 2025 helped ETH avoid deeper drawdowns during volatile periods. This environment shifts focus to fundamental drivers like network upgrades and adoption metrics, rather than hype-fueled speculation. For Ethereum stakeholders, this means a more resilient base for price discovery, with reduced risk of cascade liquidations that plagued previous cycles.

Turning to technical structure, Ethereum’s breakout from a descending wedge pattern marks a pivotal moment in its chart formation. This pattern, characterized by converging trendlines with lower highs and higher lows, typically resolves bullishly when breached upward. Data from TradingView charts confirm the breakout above the $2,800 level, but as with many such moves, a retest of the former resistance—now potential support at $2,750—is probable. Historical precedents from 2023 show that 70% of wedge breakouts in major cryptos experienced a 5-10% pullback before continuation, reinforcing the need for confirmation. Volume during the breakout was moderate, suggesting institutional caution rather than retail frenzy. If buyers defend the $2,750 zone effectively, it could catalyze a push toward $3,000, aligning with Fibonacci retracement levels from the recent high.

Institutional demand, as proxied by the fund premium, provides another layer of insight. When premiums invert negatively, it often signals outflows and capitulation; the flip to positive here, though modest at around 2-3%, points to funds like Grayscale’s ETHE absorbing inflows without aggressive discounting. Bloomberg Intelligence reports indicate that ETH ETF approvals in prior months have funneled over $5 billion into such vehicles, bolstering on-chain stability. This cautious optimism is echoed in whale activity, with addresses holding over 1,000 ETH accumulating 150,000 tokens in the past week, per Santiment data. Such behaviors mitigate downside, creating a buffer against macroeconomic headwinds like interest rate uncertainties.

Frequently Asked Questions

What Is the Current Status of Ethereum’s Fund Premium and Its Implications?

Ethereum’s fund premium has recently turned positive, hovering at a modest level that indicates institutions are regaining confidence without overcommitting. This shift, observed across major ETH funds, reduces exit risks and supports price stabilization, potentially marking the end of heavy distribution phases based on historical on-chain trends from platforms like Dune Analytics.

Why Have Ethereum Funding Rates Dropped So Sharply?

Ethereum funding rates have plunged 64.66% to a neutral 0.002506%, as traders deleverage crowded long positions following volatility. This reset lowers liquidation risks and promotes healthier market conditions, allowing spot buying to influence prices more directly, much like during balanced phases in 2024 where ETH saw steady gains.

Key Takeaways

- Positive Fund Premium: Indicates stabilizing institutional demand, easing sell pressure but remaining cautious overall.

- Declining Reserves: 6.03% drop to $47.78 billion removes key downside risks, favoring long-term holding.

- Leverage Reset: Funding rate plunge clears speculation, setting stage for sustainable ETH recovery.

Conclusion

In summary, Ethereum’s positive fund premium alongside declining exchange reserves and reset funding rates paints a picture of market stabilization, countering recent volatility with structural improvements. These Ethereum fund premium signals, supported by on-chain data from authoritative sources like CryptoQuant and TradingView, suggest a transition toward recovery if support levels hold. As Ethereum navigates this phase, investors should monitor retests around $2,750 for confirmation, positioning for potential upside in the evolving crypto landscape.

So, what’s next?

Ethereum now sits at a key decision zone. While broader positioning has stabilized, price structure suggests a likely retest of the $2,750 region before any sustained recovery unfolds.

Such a move would align with typical post-breakout behavior and offer stronger structural confirmation.

Importantly, on-chain behavior points to dip-buying interest from large holders, suggesting accumulation beneath current levels.

If demand absorbs this retest effectively, Ethereum could transition from consolidation into a clearer recovery phase.

Final Thoughts

- Ethereum’s structure favors a controlled pullback toward $2,750 rather than immediate continuation.

- Whale dip-buying could turn the retest into a base for recovery if demand absorbs supply.

Comments

Other Articles

Vitalik Buterin: The AI Revolution in DAO Management

February 23, 2026 at 02:58 PM UTC

BitMine Boosts Ethereum Stake to 461K ETH, Eyes Network Share Growth

January 1, 2026 at 08:06 PM UTC

Ethereum Inflow to Binance Surges to 24,500 ETH, Hinting at Short-Term Bearish Pressure

January 1, 2026 at 05:00 PM UTC