Ethereum Staking Faces Withdrawal Spikes but Shows Signs of Long-Term Growth

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

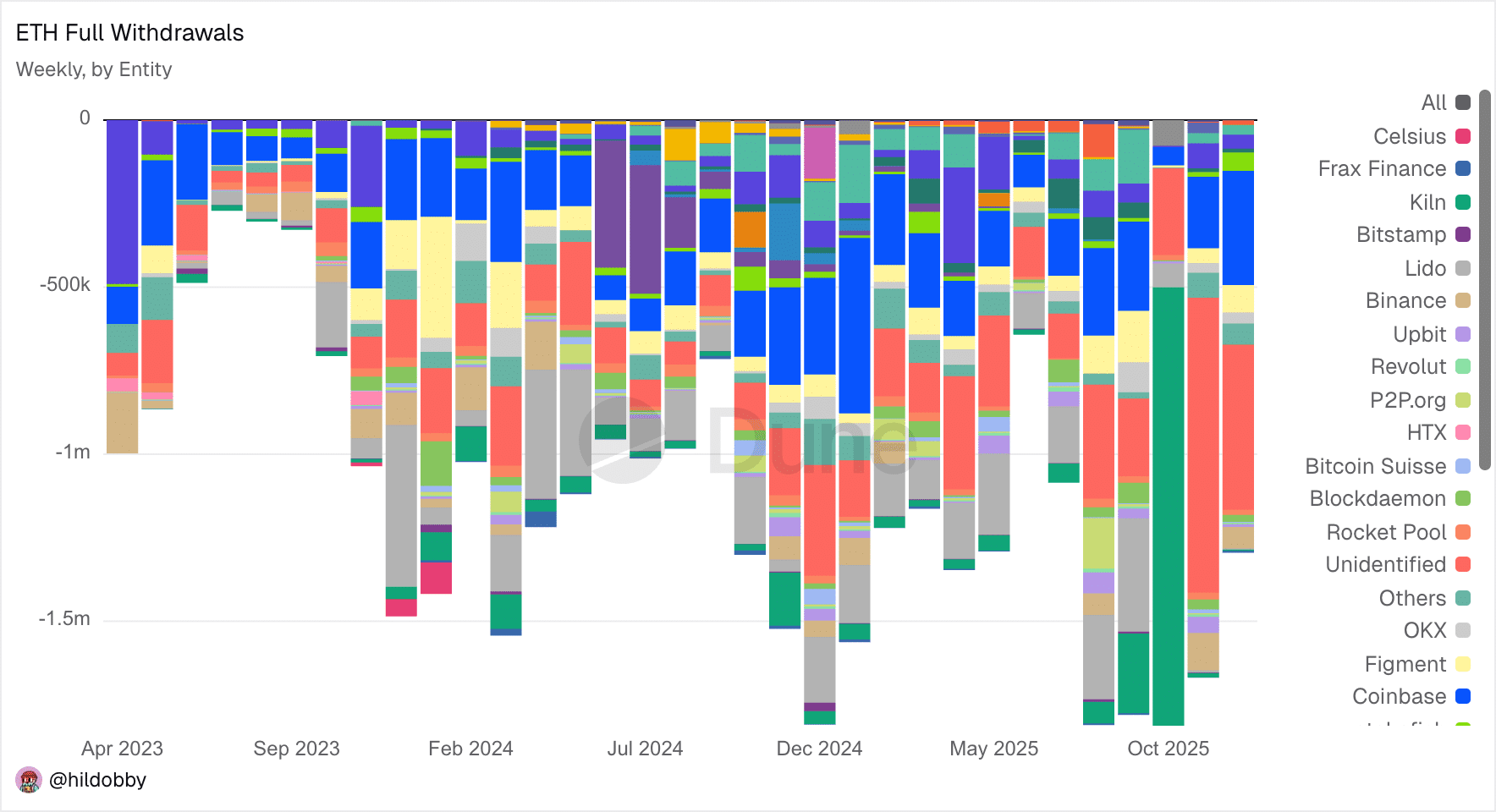

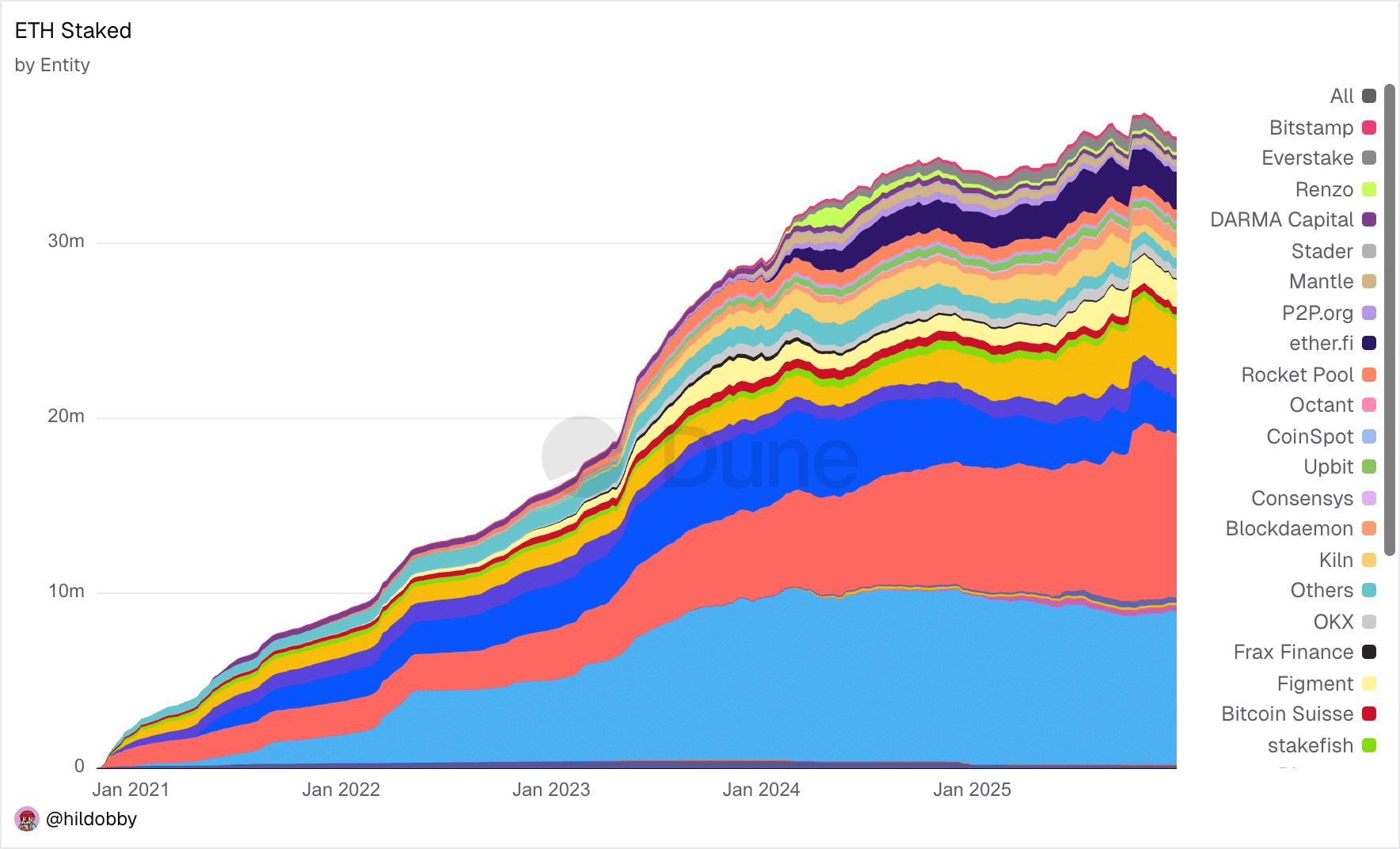

Ethereum staking has seen sharp weekly withdrawal spikes from major providers like Lido and Binance, totaling up to 1.5 million ETH at peaks. Yet, the overall staked supply exceeds 33 million ETH and continues to grow steadily, indicating healthy network participation despite short-term rotations.

-

Withdrawal surges from key entities like Lido, Binance, and Frax Finance have hit 800,000 to 1.5 million ETH weekly.

-

These movements reflect operational rebalancing and migrations, not a broad exit from staking.

-

Total staked ETH remains above 33 million, with newer restaking protocols like ether.fi driving fresh inflows and long-term growth.

Ethereum staking withdrawals spike amid rotations, but total staked ETH hits 33M+ and rises. Discover why this signals network strength. Stay informed on ETH trends now.

What Are the Recent Ethereum Staking Withdrawal Spikes?

Ethereum staking withdrawals have intensified recently, with on-chain data showing large batches of full exits from platforms including Lido, Binance, and Frax Finance. These spikes, peaking at 800,000 to 1.5 million ETH per week, primarily stem from routine operational activities such as validator rebalancing and client migrations. Despite the volume, they do not signal declining confidence but rather ecosystem adjustments.

According to data from Dune Analytics, a leading blockchain analytics platform, these withdrawals have occurred in waves over the past few weeks. Entities like HTX, Rocket Pool, and Coinbase have also contributed to the totals. While the numbers may raise initial concerns about network security, historical patterns indicate these are standard procedures in the staking landscape. Corporate custodians and liquid staking token (LST) providers often cycle validators to optimize infrastructure, ensuring efficiency without reducing overall commitment to the Ethereum network.

The Ethereum proof-of-stake mechanism, introduced with the Merge upgrade in 2022, allows participants to stake ETH to secure the network and earn rewards. Withdrawals, enabled since the Shanghai upgrade in 2023, provide flexibility but can create temporary volatility in staked amounts. In this context, the recent activity underscores the maturity of Ethereum’s validator economy, where participants actively manage positions to align with evolving strategies.

Source: Dune Analytics

Why Is the Total Ethereum Staked Supply Still Increasing?

Even with notable Ethereum staking withdrawals, the total amount of ETH locked in staking has surpassed 33 million ETH, reflecting a robust upward trajectory. This growth is driven by new validators entering the network at a rate that outpaces exits, supported by diverse participants from institutional players to individual stakers. Lido maintains a leading position with 24.26% of the staked ETH, but emerging protocols are gaining traction.

Dune Analytics data highlights the multi-year climb in staked supply, with the current figure underscoring Ethereum’s strengthening security model. Newer services aligned with restaking, such as ether.fi, Renzo, and P2P.org, have seen sharp expansions this year, absorbing inflows into advanced yield structures. These include liquid restaking tokens (LRTs) and modular ecosystems that layer additional rewards on top of base staking yields, attracting sophisticated users seeking compounded returns.

Experts in the field, including analysts from blockchain research firms like ConsenSys, note that such diversification reduces concentration risks and enhances overall network resilience. For instance, restaking protocols allow staked ETH to secure additional services beyond the base layer, potentially increasing annual percentage yields (APYs) from the standard 3-5% to higher figures through secondary mechanisms. This shift not only offsets withdrawals but also positions Ethereum for sustained adoption in decentralized finance (DeFi) and beyond.

The consistent influx of new stakers, including those from institutional custodians, demonstrates enduring demand for Ethereum’s staking rewards. As of late 2025, the network’s active validators number in the hundreds of thousands, with daily rewards incentivizing participation. This dynamic ensures that periodic withdrawals—often tied to profit-taking or portfolio rebalancing—do not disrupt the long-term bullish trend in staked supply.

Source: Dune Analytics

Frequently Asked Questions

What Causes Sudden Ethereum Staking Withdrawals from Major Providers?

Sudden Ethereum staking withdrawals from providers like Lido, Binance, and Frax Finance are typically due to operational rebalancing, validator migrations, or handling customer requests. These activities can result in batches of 800,000 to 1.5 million ETH exiting weekly, but they represent routine maintenance rather than a loss of faith in the network. Data from Dune Analytics confirms this pattern aligns with historical norms in the staking ecosystem.

How Does Restaking Affect Ethereum’s Overall Staking Trends?

Restaking is transforming Ethereum’s staking landscape by enabling staked ETH to generate yields through additional protocols, leading to growth in total staked supply despite withdrawals. Services like ether.fi and Renzo are drawing significant inflows, with the network’s staked ETH now over 33 million. This layered approach boosts security and rewards, making staking more attractive for long-term holders and institutions alike.

Key Takeaways

- Withdrawal Spikes Are Rotational: Recent Ethereum staking withdrawals reflect infrastructure adjustments by providers like Lido and Binance, not a retreat from the network.

- Staked Supply Hits New Highs: Total ETH staked exceeds 33 million, driven by new entrants and restaking protocols, ensuring continued upward momentum.

- Network Security Remains Strong: Increasing validator diversity and participation signal robust demand, positioning Ethereum for future scalability and adoption.

Conclusion

In summary, while Ethereum staking withdrawals have created visible spikes across major entities, the underlying trend of rising total staked ETH above 33 million demonstrates the network’s resilience and appeal. Shifts toward restaking and diversified yield models further bolster participation, mitigating short-term fluctuations. As Ethereum continues to evolve, these dynamics affirm its role as a cornerstone of blockchain security—investors and stakers should monitor ongoing validator growth for sustained opportunities in the space.