Ethereum Staking Surges to Record Highs Despite Price Weakness, Signaling Potential Rebound

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ethereum is holding steady despite recent price weakness due to record-high staking activity and strong long-term holder conviction. With over 36 million ETH staked, investors signal confidence in its future, even as the price hovers near $3,000 amid a challenging Q4.

-

Ethereum’s staking reaches all-time high of 36.27 million ETH, showing unwavering holder support.

-

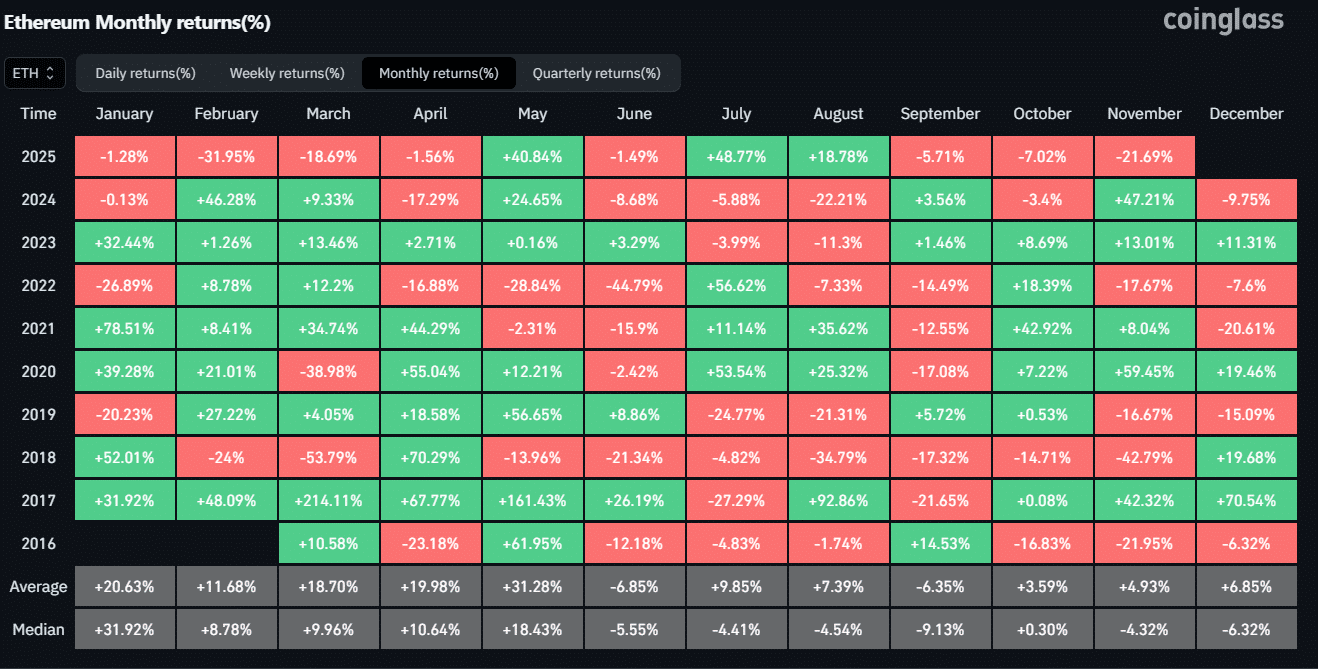

ETH’s 28% Q4 drop against Bitcoin marks its worst quarter since 2019, but historical patterns suggest rebound potential.

-

75% of November losses indicate short-term volatility, with the BTC/ETH ratio stabilizing above 0.03 for possible recovery.

Ethereum staking hits record highs amid price weakness: Explore why long-term holders remain confident and how this could spark a year-end rebound. Discover key metrics and historical insights now.

What is causing Ethereum’s price weakness in Q4 2025?

Ethereum’s price weakness in Q4 2025 stems primarily from broader market pressures and underperformance against Bitcoin, resulting in a 28% decline compared to BTC’s losses under 20%. This marks Ethereum’s most bearish quarter relative to Bitcoin since 2019, with November accounting for 75% of the drop—the sharpest monthly slide since 2018’s -42.79% rally. Despite this, underlying network fundamentals remain robust, hinting at temporary volatility rather than fundamental flaws.

How does Ethereum staking influence price stability?

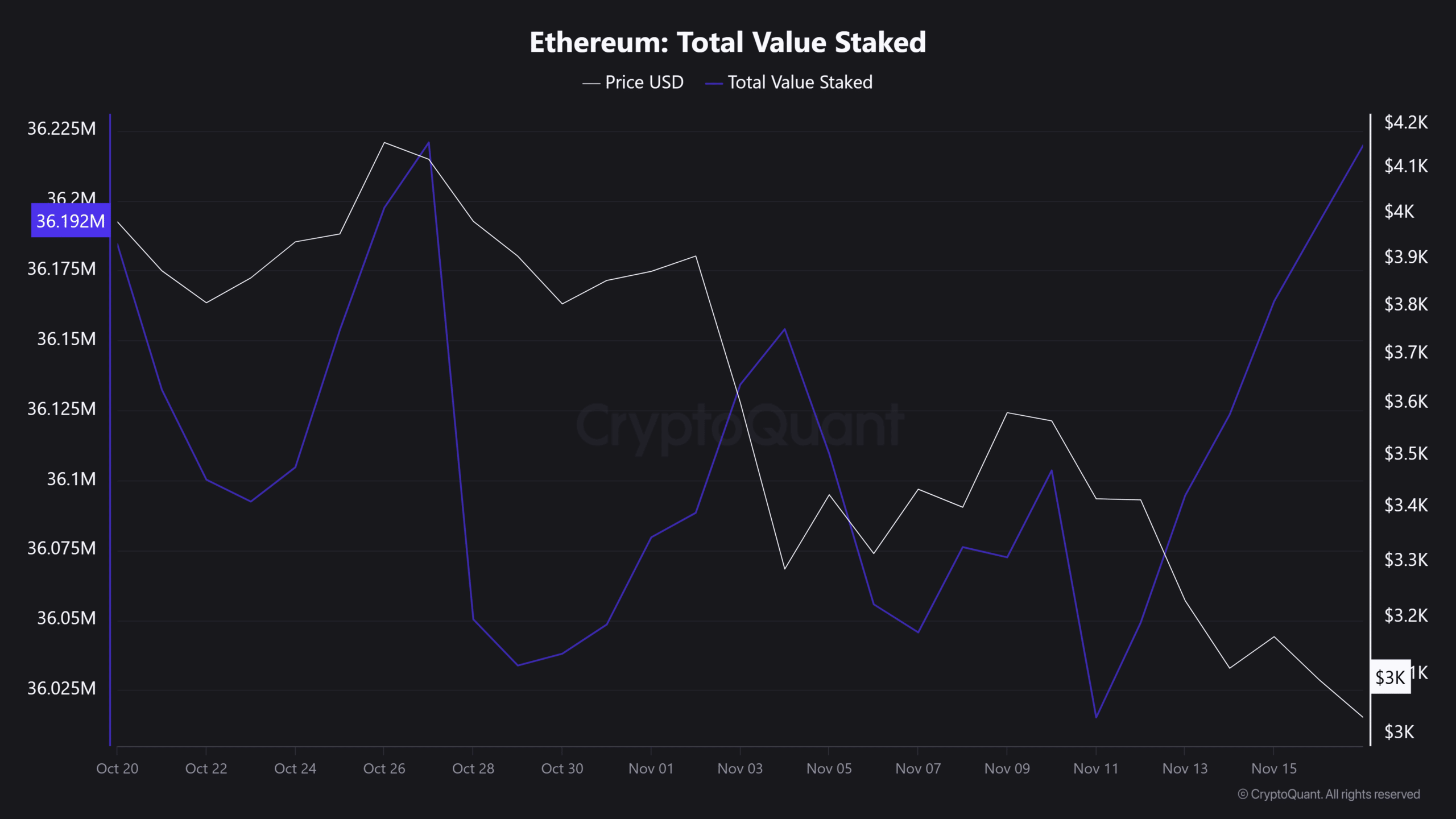

Ethereum staking plays a crucial role in bolstering price stability by locking up supply and rewarding long-term commitment from holders. As of late 2025, the Total Value Staked (TVS) has surged to a record 36.27 million ETH, with approximately 200,000 ETH added to staking pools in the past week alone, according to data from CryptoQuant. This influx demonstrates strong investor conviction, reducing selling pressure and signaling that the current weakness may reflect market-wide risk aversion rather than a lack of faith in Ethereum’s ecosystem.

Staking not only secures the network through proof-of-stake mechanisms but also incentivizes holding, which can mitigate downside risks during volatile periods. Experts note that such high staking levels often precede recoveries, as they indicate accumulation by committed participants. For instance, during similar past downturns, elevated staking has correlated with subsequent price stabilization, providing a buffer against short-term fluctuations.

Furthermore, this staking surge contrasts sharply with the price action, highlighting a divergence where on-chain metrics outperform market sentiment. Data from sources like CryptoQuant underscores that despite the price dipping near $3,000, the network’s security and utility continue to grow, potentially setting the stage for renewed upward momentum.

Frequently Asked Questions

What factors could lead to an Ethereum price rebound by the end of 2025?

An Ethereum price rebound by the end of 2025 could be driven by stabilizing BTC/ETH ratios, reduced leverage in the market, and continued staking growth. Historical precedents, such as the 2018 quarter where ETH rebounded 20% after a steep drop, suggest that shaken-out weak hands often pave the way for recovery. With current metrics showing sideways movement above 0.03 on the ETH/BTC pair, a bounce remains plausible based on these patterns.

Why are long-term Ethereum holders not selling despite the price drop?

Long-term Ethereum holders are refraining from selling due to robust staking rewards and belief in the platform’s long-term value as a leading smart contract network. The recent addition of 200,000 ETH to staking pools reflects this confidence, as holders earn yields that outweigh short-term losses. This behavior aligns with historical trends where conviction during dips has led to significant appreciation post-recovery, making it a strategic hold for many investors.

Key Takeaways

- Ethereum staking at record highs: The TVS of 36.27 million ETH indicates strong holder commitment, countering price pressures and supporting network security.

- Historical rebound potential: Similar to 2018’s 20% December recovery after a quarterly slump, current patterns suggest ETH could bounce against Bitcoin as leverage clears.

- Market divergence signals opportunity: With the BTC/ETH ratio holding steady and weak hands exited, focus on long-term metrics for a possible year-end upturn in Ethereum’s value.

Conclusion

In summary, while Ethereum’s price weakness in Q4 2025 has been pronounced, record Ethereum staking levels and historical echoes point to underlying resilience and potential for rebound. Long-term holders’ conviction, evidenced by surging TVS, underscores the network’s enduring appeal amid volatility. As market conditions evolve, investors should monitor these on-chain indicators closely for opportunities, positioning Ethereum for a stronger performance in the coming months.

Historical echoes

Source: CoinGlass

However, a closer examination reveals a significant divergence in market behavior. In 2018, Ethereum’s substantial quarterly decline of 42% ultimately led to a 20% rebound in December, even as Bitcoin experienced only a modest 6% dip. This historical precedent illustrates that deep quarterly losses for Ethereum do not necessarily foreshadow prolonged downturns, but can instead catalyze renewed interest and price appreciation.

Current Ethereum staking metrics further reinforce this outlook, with long-term holders actively accumulating despite prices lingering near precarious levels around $3,000. This positioning suggests that a year-end rebound is within the realm of possibility, driven by fundamental strengths rather than fleeting market whims.

Delving deeper into the dynamics, Ethereum’s performance relative to Bitcoin has been a focal point for analysts. The ETH/BTC ratio, after enduring three consecutive bearish months and forming lower lows, has now stabilized in November, maintaining levels above 0.03. This sideways consolidation, if sustained, bolsters the case for a potential reversal, aligning with patterns observed in previous cycles.

Ethereum staking hits record highs amid market weakness

Evidence of long-term conviction in Ethereum remains compelling, even as the asset navigates one of its most challenging monthly periods since the first quarter. The Total Value Staked has achieved a new pinnacle at 36.27 million ETH, with roughly 200,000 ETH entering the staking ecosystem over the last week.

This development translates to a clear message: despite evident price pressures, dedicated holders are not capitulating. Technically, the observed weakness appears tied to overarching market sentiment shifts—characterized by risk-off behaviors—rather than any erosion of trust in Ethereum’s core value proposition.

Source: CryptoQuant

This staking milestone represents a pivotal divergence that could fuel an impending rebound. The ETH/BTC ratio’s recent behavior echoes this resilience, holding firm after prior declines. Consequently, with speculative positions liquidated and market excesses purged, the emphasis on sustained holder confidence positions Ethereum for a potential year-end uplift against Bitcoin—reminiscent of the 2018 recovery trajectory.

Broader implications for Ethereum’s ecosystem cannot be overlooked. As staking continues to climb, it enhances the network’s decentralization and security, attracting more developers and users to build on its platform. This organic growth, decoupled from immediate price movements, fortifies Ethereum’s position as the backbone of decentralized finance and Web3 applications.

Analysts from platforms like CryptoQuant emphasize that such metrics often serve as leading indicators for price action. In past instances of market stress, elevated staking has preceded bullish phases by signaling reduced available supply and increased scarcity. For investors eyeing 2025’s remainder, these factors collectively paint a picture of Ethereum not just surviving but potentially thriving post-weakness.

Moreover, the cleanout of leveraged positions has reset the market dynamics, eliminating overextended traders and allowing fundamentals to regain prominence. This scenario mirrors historical cycles where Ethereum has outperformed expectations after periods of relative underperformance, underscoring its adaptability and enduring appeal in the cryptocurrency landscape.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Stablecoins Reach 2025 Peaks Led by USDT, Amid Sustained Activity

December 31, 2025 at 07:01 PM UTC

Ethereum Could Target $8,500 as Bullish Momentum Builds Near $4,811

December 31, 2025 at 02:39 PM UTC