Ethereum Whales Accumulate Amid Bearish Channel: Breakout Potential Ahead

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ethereum whale accumulation has intensified following a 9% price surge from $2,623 on November 21, 2025, signaling renewed investor confidence after a months-long downtrend. Major whales withdrew millions in ETH from exchanges, opening leveraged long positions amid a bearish broader trend.

-

Whale Withdrawals: A dormant whale pulled 10,026 ETH ($29.16 million) from Binance, indicating strong accumulation signals.

-

Multiple entities, including another whale acquiring 2,700 ETH ($8 million) from FalconX, highlight growing interest in Ethereum’s potential rebound.

-

Leveraged Positions: Traders opened long bets worth over $44 million with up to 25x leverage, targeting key support at $2,720 amid liquidation risks near $2,773 and $2,991.

Ethereum whale activity surges post-9% rally from $2,623 low on Nov 21, 2025. Discover accumulation trends, price patterns, and buy signals in this ETH analysis. Stay ahead in crypto markets.

What is driving Ethereum’s recent whale accumulation?

Ethereum whale accumulation is primarily driven by strategic withdrawals and leveraged positioning after ETH rebounded over 9% from its November 21, 2025, low of $2,623, breaking a persistent downtrend that began on October 27, 2025. Large investors, including long-dormant wallets, are moving assets off exchanges to secure holdings, a classic sign of bullish intent in volatile markets. This activity coincides with improving technical indicators, suggesting a potential shift from bearish dominance.

How is Ethereum’s price action evolving amid whale interest?

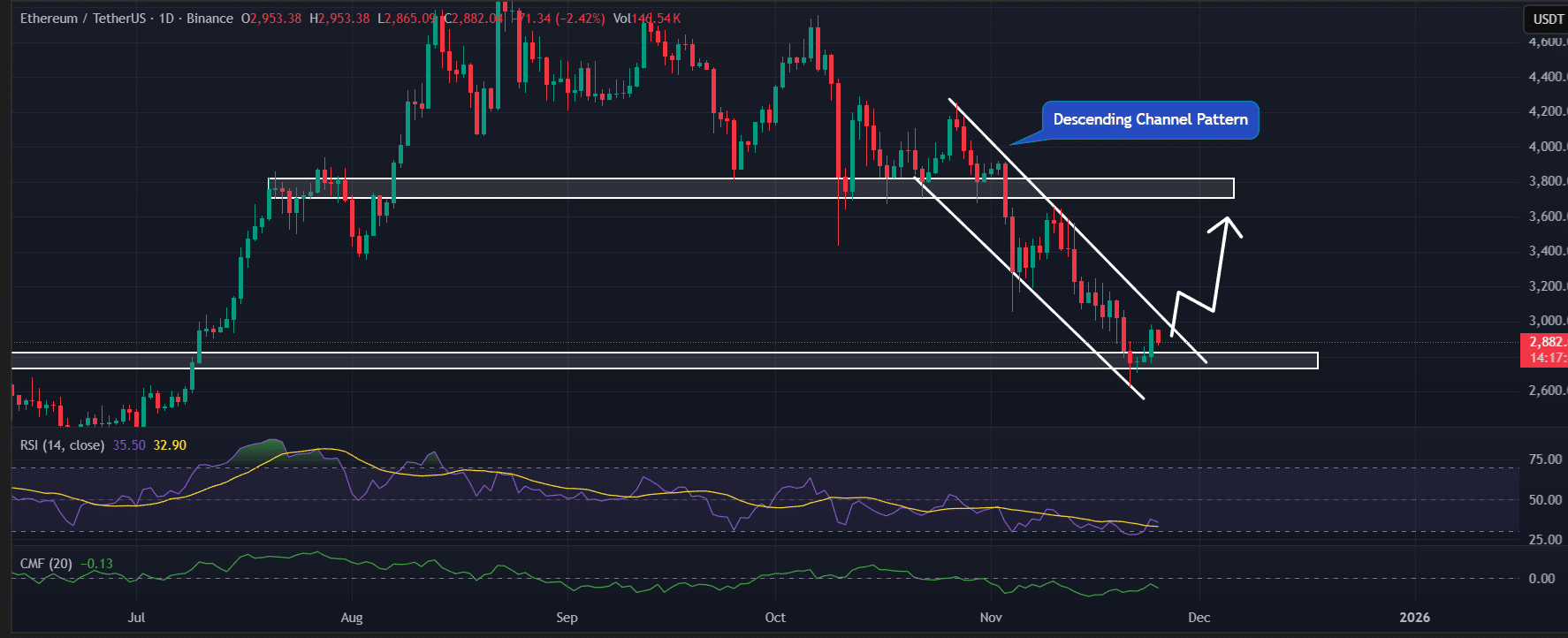

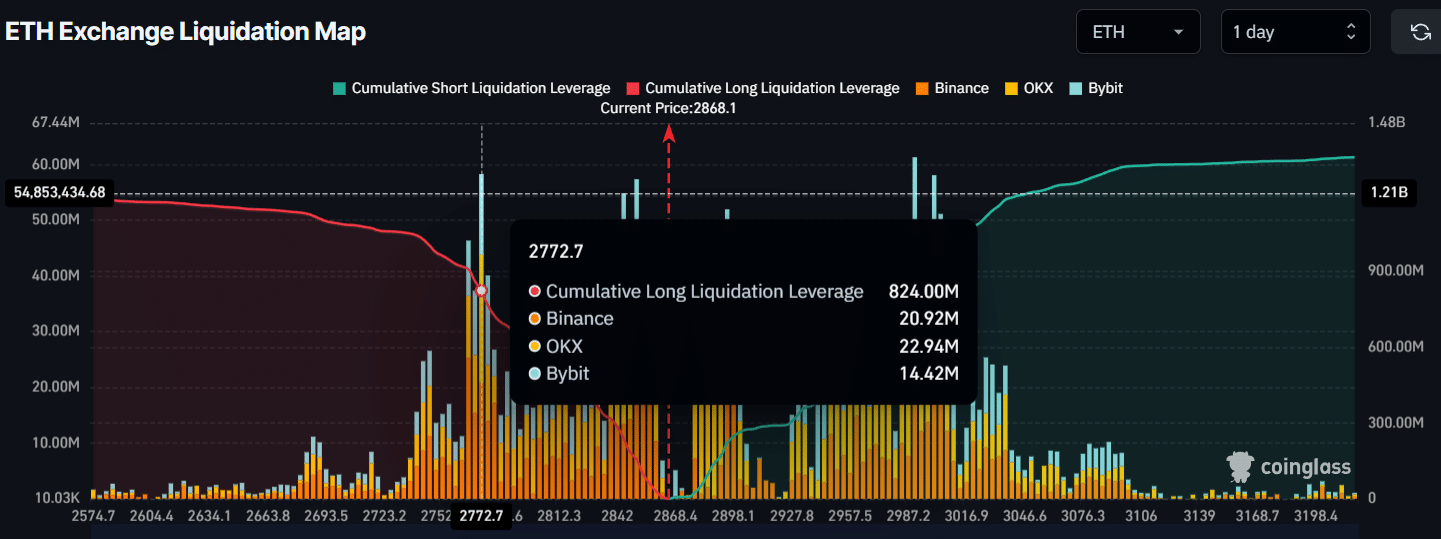

Ethereum’s price has fluctuated within a descending channel since October 27, 2025, with the recent 9% uptick pushing it toward the upper boundary before a 2.75% pullback to $2,872 as of late November 2025. According to data from TradingView, this pattern typically leads to bounces from the lower boundary, but sustained upward movement requires a confirmed breakout above the channel. Blockchain analytics from Onchain Lens reveal that whale transactions, such as a 10,026 ETH withdrawal worth $29.16 million from Binance by wallet 0x446—dormant for a year—underscore accumulation. Another wallet, 0x93d, acquired 2,700 ETH valued at $8 million from FalconX on November 25, 2025. A transaction tracker on X noted a Bitcoin veteran depositing 10 million USDC into Hyperliquid to open a 15,000 ETH long position at $44.3 million with 5x leverage, liquidation at $2,326. Additionally, MachibigBrother deposited 499.68K USDC for a 25x leveraged long on ETH. These moves strengthen the market structure despite ongoing bearish pressures, as per COINOTAG’s daily chart analysis. Historically, such whale engagements have preceded rallies, but failure to hold $2,720 support could extend the downtrend. CoinGlass highlights liquidation clusters at $2,772.7 (shorts) and $2,990.5 (longs), where leveraged positions could amplify volatility. Expert analysts from platforms like Onchain Lens emphasize that these accumulations reflect confidence in Ethereum’s long-term utility in decentralized finance and smart contracts.

Source: TradingView

The Relative Strength Index (RSI) for ETH stands at 35.24, positioned above the moving average, signaling easing selling pressure and a potential buyer momentum shift from oversold levels. In contrast, the Chaikin Money Flow (CMF) at -0.13 points to ongoing capital outflows, with sellers maintaining an edge over buyers in the short term.

Frequently Asked Questions

Is Ethereum whale accumulation a buy signal for ETH in late 2025?

Ethereum whale accumulation, evidenced by multi-million-dollar withdrawals and leveraged longs, often serves as an early indicator of price recovery, particularly after downtrends like the one since October 2025. However, with ETH trading at $2,872 and confined to a descending channel, investors should monitor a breakout above key resistance for confirmation. Data from Onchain Lens supports this as a positive development, but broader market bearishness warrants caution.

When might Ethereum’s bull run resume based on current trends?

Ethereum’s bull run could resume if it breaks out of the descending channel pattern observed since October 27, 2025, potentially targeting $3,000 amid whale-driven momentum. Current technicals show RSI improving at 35.24, but CMF at -0.13 indicates persistent outflows. A hold above $2,720 support is crucial to avoid further declines, as noted in analyses from TradingView and CoinGlass.

Source: CoinGlass

Key Takeaways

- Strong Whale Confidence: Dormant wallets withdrawing over $29 million in ETH from Binance signal accumulation, boosting Ethereum’s market structure after a 9% rally from $2,623.

- Leveraged Bullish Bets: Positions like a $44.3 million 15,000 ETH long with 5x leverage highlight optimism, though liquidation risks at $2,773 could trigger volatility.

- Monitor Channel Breakout: ETH must exceed the descending channel’s upper boundary to initiate a sustainable bull run; failure risks a drop below $2,720 support.

Conclusion

Ethereum whale accumulation and recent price action from the November 21, 2025, low underscore a pivotal moment for ETH investors, with technical indicators like RSI showing signs of reversal amid persistent bearish channels. As whale interest from sources like Onchain Lens and CoinGlass data intensifies, a confirmed breakout could herald stronger gains in the Ethereum ecosystem. Traders should watch support levels closely and consider long-term potential in decentralized applications for informed decisions.

Comments

Other Articles

Vitalik Buterin: The AI Revolution in DAO Management

February 23, 2026 at 02:58 PM UTC

BitMine Boosts Ethereum Stake to 461K ETH, Eyes Network Share Growth

January 1, 2026 at 08:06 PM UTC

Ethereum Inflow to Binance Surges to 24,500 ETH, Hinting at Short-Term Bearish Pressure

January 1, 2026 at 05:00 PM UTC