Ethereum’s Fusaka Upgrade May Enhance Token Value Capture, Bitwise CIO Suggests

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Ethereum’s Fusaka upgrade and emerging tokenomics like Uniswap’s fee burns are enhancing crypto token value capture, potentially driving prices higher by 2026, as noted by Bitwise CIO Matt Hougan. This shift from vague governance to direct holder benefits marks a key evolution in digital assets.

-

Crypto tokens are evolving to better return value to holders through regulatory changes and protocol upgrades.

-

Uniswap’s investor-friendly proposal includes fee mechanisms to burn UNI tokens, boosting liquidity and holder rewards.

-

Ethereum’s Fusaka upgrade, set for December launch, improves staking economics and execution, with 70% of validators expected to benefit from enhanced yields.

Discover how Ethereum’s Fusaka upgrade boosts token value capture in crypto. Explore Uniswap and XRP developments driving 2026 price surges. Stay informed on digital asset evolution today.

What Is Driving Better Token Value Capture in Crypto?

Token value capture in cryptocurrency refers to mechanisms where protocols direct fees, rewards, or economic benefits back to token holders, and it’s improving due to regulatory clarity and upgrades like Ethereum’s Fusaka. Bitwise Chief Investment Officer Matt Hougan highlights this trend as a major factor overlooked amid market volatility. As tokens shift from pure governance roles to revenue-sharing models, holders stand to gain more directly from network activity.

How Will Ethereum’s Fusaka Upgrade Enhance Value for ETH Holders?

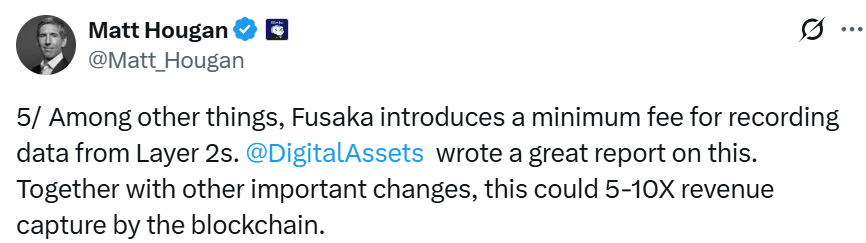

Ethereum’s Fusaka upgrade, scheduled for mainnet activation in December, introduces key improvements to the network’s execution layer and staking mechanics, directly addressing token value capture for ETH. This upgrade optimizes validator rewards and reduces operational costs, potentially increasing staking yields by up to 20% for participants, according to network analyses from Ethereum developers. Hougan emphasizes that Fusaka’s focus on economic efficiency could position ETH to lead the next market rebound, as it aligns protocol growth more closely with holder incentives. Short-term implementations include better blob transaction handling, which lowers fees during high-traffic periods and funnels savings back to stakers. Experts like those from the Ethereum Foundation note that these changes build on prior upgrades, creating a more sustainable model where increased adoption translates to tangible value for token holders. Overall, Fusaka represents a pivotal step in making Ethereum’s economics more holder-centric, fostering long-term confidence in ETH’s utility.

Source: Matt Hougan

Uniswap’s Proposal Signals Shift Toward Investor Benefits

The Uniswap protocol, a leading decentralized exchange, recently saw its native UNI token rally following a proposal from the Uniswap Foundation and Uniswap Labs aimed at enhancing its appeal to investors. This initiative introduces protocol-level mechanisms to redistribute value, moving UNI beyond its traditional governance function. By capturing a portion of trading fees—potentially around 16%—the proposal suggests burning UNI tokens, which could reduce supply and elevate price over time. Hougan, in his analysis shared via social media, describes this as a prime example of evolving token design. He predicts that approval could propel UNI into the top ten cryptocurrencies by market capitalization, given Uniswap’s dominant position in DeFi trading volumes, which exceeded $1 trillion in the past year. Previously, UNI holders benefited little from platform activity, but this change flips that dynamic, aligning token economics with real usage. Community discussions highlight additional features like Protocol Fee Discount Auctions, which would reward liquidity providers and further incentivize participation. If implemented, these steps could stabilize UNI’s value amid broader market fluctuations, demonstrating how targeted upgrades can revive investor interest in established tokens.

Building on this momentum, Hougan points out that the broader crypto ecosystem is witnessing similar transformations. Tokens once criticized for lacking direct economic ties to their protocols are now adapting, thanks to a more supportive regulatory environment. This isn’t isolated to Uniswap; it’s part of a larger narrative where digital assets mature into viable investment vehicles.

Source: Matt Hougan

XRP’s Potential Staking Features and Broader Implications

Ripple’s XRP token is also advancing toward stronger value capture through community-proposed enhancements like staking. Hougan notes a growing emphasis on such features, which would allow holders to earn rewards from network validation and liquidity provision, fundamentally altering XRP’s economic model. Currently, XRP facilitates fast cross-border payments, but integrating staking could yield annual returns of 5-10% for participants, based on preliminary models from Ripple’s ecosystem partners. This move addresses past criticisms of XRP’s utility, tying it more directly to ongoing protocol revenue. As regulatory hurdles ease, particularly in the U.S., these developments could accelerate adoption in institutional finance. Hougan underscores that value capture across digital assets is dynamic and trending upward, countering the perception of static tokenomics. For XRP, this evolution means holders might soon see benefits from Ripple’s expanding partnerships in remittances and DeFi, potentially driving sustained demand.

In the current market environment, where pullbacks often overshadow positive developments, these upgrades stand out. Hougan’s insights, drawn from his role at Bitwise—a firm managing billions in crypto assets—lend credibility to the idea that 2026 could bring significant price appreciation as these mechanisms take hold.

Frequently Asked Questions

What Does Token Value Capture Mean for Crypto Investors?

Token value capture means protocols like Ethereum and Uniswap direct fees or rewards to holders, increasing token utility and potential returns. This shift, accelerated by regulations, could boost prices by 2026, as Hougan predicts, making investments more aligned with network success and reducing reliance on speculation alone.

How Might Ethereum’s Fusaka Upgrade Impact ETH Prices?

Ethereum’s Fusaka upgrade, launching in December, enhances staking yields and execution efficiency, potentially leading ETH to spearhead the crypto rebound. By improving value capture for holders, it positions ETH as a stronger asset in volatile markets, with experts forecasting notable price gains from heightened adoption and economic incentives.

Key Takeaways

- Regulatory Tailwinds: New rules are enabling tokens to unwind risky designs, paving the way for better value distribution to holders starting in 2026.

- Uniswap’s Edge: The fee burn proposal could transform UNI from a governance token to a revenue-sharing asset, targeting top-ten market cap status.

- Stake in the Future: Upgrades like Fusaka for ETH and potential staking for XRP highlight actionable steps for investors to benefit from crypto’s growth.

Conclusion

As token value capture evolves in the crypto space, initiatives like Ethereum’s Fusaka upgrade and Uniswap’s governance reforms signal a maturing ecosystem where holders reap direct rewards from protocol activity. Bitwise’s Matt Hougan’s analysis reveals an upward trajectory for digital assets, with regulatory support amplifying these changes. Looking ahead, investors should monitor these developments closely, as they could fuel substantial growth in 2026 and beyond—position yourself to capitalize on this value-driven shift today.

Comments

Other Articles

Metaplanet CEO Denies Claims: BTC ETF Outflows

February 23, 2026 at 03:37 PM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC