ETHZilla Eyes Onchain Auto Credit with Karus Stake Acquisition

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

ETHZilla, a leading crypto treasury company, has acquired a 20% stake in AI-driven automotive-finance startup Karus for $10 million, enabling onchain auto loans through integrated AI underwriting by early 2026. This move tokenizes high-quality auto-loan portfolios for global investors.

-

Strategic Acquisition: ETHZilla gains access to Karus’s AI models trained on 20 million auto-loan outcomes.

-

Deal Structure: Includes $3 million cash and $7 million in ETHZilla stock, plus board seat and governance rights.

-

Market Impact: Targets $1.6 trillion US auto-loan securitization market, projecting $9-12 million EBITDA per $100 million deployed.

Discover how ETHZilla’s stake in Karus revolutionizes onchain auto credit. Explore tokenized loans, AI integration, and investment opportunities in this $10M deal. Stay ahead in crypto finance—read now!

What is ETHZilla’s Acquisition of Karus and Its Impact on Onchain Credit?

ETHZilla’s acquisition of a 20% stake in Karus marks a pivotal expansion into the onchain credit sector for automotive financing. The crypto treasury firm, known for its substantial Ether holdings, invested $10 million—comprising $3 million in cash and $7 million in stock—to integrate Karus’s advanced AI underwriting engine. This partnership aims to launch tokenized auto-loan portfolios by early 2026, democratizing access to traditionally institutional assets.

How Does Karus’s AI Technology Enable Onchain Auto Loans?

Karus’s decisioning engine, powered by machine learning, analyzes over 20 million historical auto-loan outcomes and has assessed more than $5 billion in loans at origination. By embedding this AI into ETHZilla’s blockchain infrastructure, the companies can create segmented, tokenized pools settled onchain, enhancing transparency and efficiency. Expert analysis from financial data providers highlights that such models reduce default risks by up to 25% compared to traditional methods, drawing on datasets from major US lenders.

The integration leverages Karus’s extensive network of car dealers, banks, and credit unions, providing a robust pipeline for loan origination. ETHZilla projects significant returns, estimating $9 to $12 million in adjusted EBITDA for every $100 million in tokenized assets deployed. This structure not only streamlines settlement but also opens these income-generating assets to a broader investor base beyond large institutions.

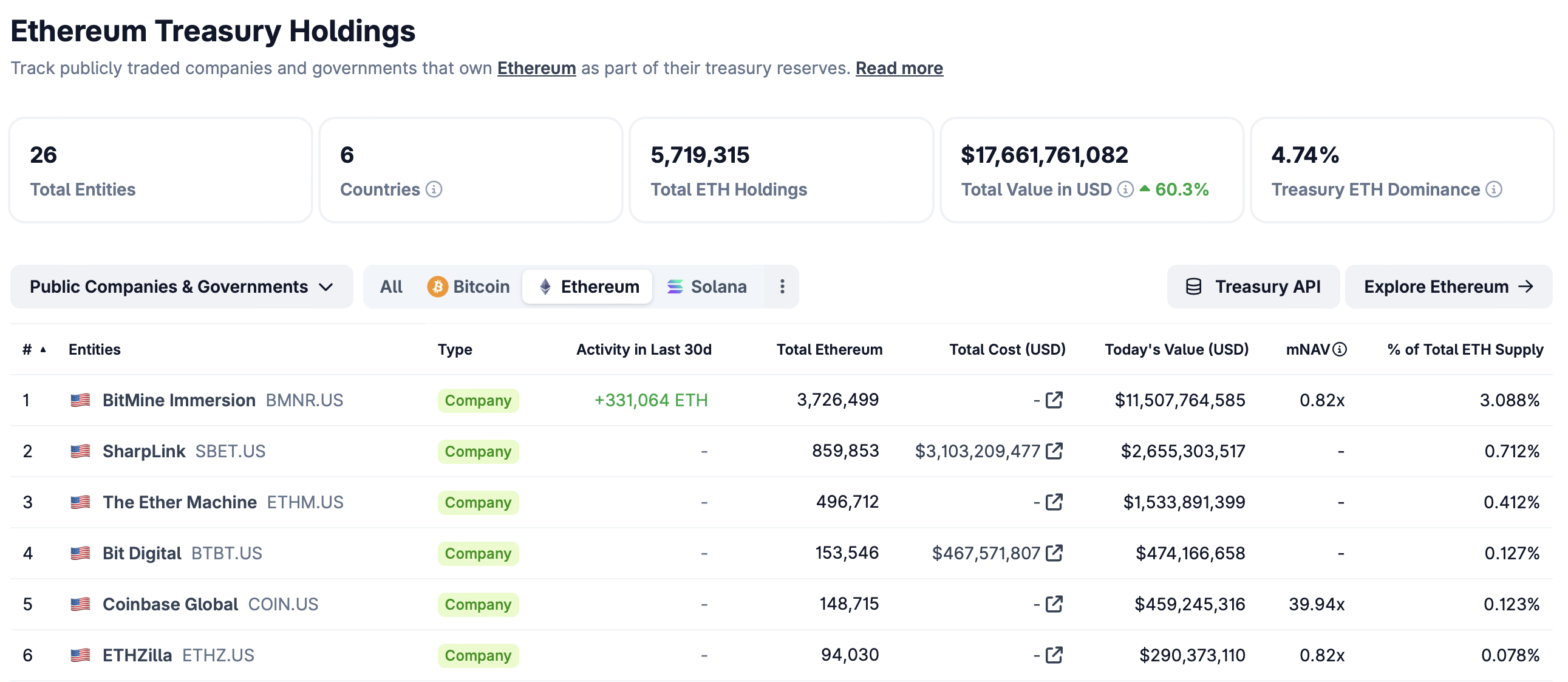

Crypto treasury company ETHZilla has strategically positioned itself in the evolving landscape of blockchain-based finance through this deal. With a balance sheet holding 94,030 Ether—ranking it as the sixth-largest Ether treasury per CoinGecko data—ETHZilla is well-equipped to scale this initiative. The acquisition includes a board seat for ETHZilla, ensuring aligned governance and oversight in product development.

Top Ethereum treasury companies. Source: Coingecko

John Kristoff, head of investor relations at ETHZilla, emphasized the transformative potential: “By bringing auto loans onchain, we are able to open up these high-quality, income-generating assets to a global base of investors for the first time.” This aligns with broader trends in real-world asset (RWA) tokenization, where blockchain technology bridges traditional finance with decentralized markets.

Automotive loans represent a cornerstone of the US asset-backed securities market, totaling approximately $1.6 trillion outstanding as of December 2024, based on SEC filings. ETHZilla’s move taps into this vast sector, previously dominated by complex securitization structures accessible only to institutional players. Karus’s investors, including Stage Global Partners, Tacoma Venture Fund, and Capital Eleven, underscore the startup’s credibility in AI-driven finance.

Tokenized Fixed-Income Products Surge in 2025

The tokenized debt market has seen remarkable growth in 2025, with institutions leveraging blockchain for issuing and trading fixed-income instruments. This surge reflects a maturing ecosystem where onchain solutions offer enhanced liquidity, fractional ownership, and real-time settlement for assets like government bonds and corporate debt.

Tokenized US Treasurys and private credit have emerged as dominant categories. According to data from RWA.xyz, tokenized Treasurys reached $9.21 billion in value, a more than threefold increase from $2.68 billion the previous year. Major players like BlackRock’s BUIDL fund, managing $2.3 billion in such assets, and Franklin Templeton’s US Government Money Fund, with $827 million, are driving this adoption.

Tokenized Treasurys. Source: RWA.xyz

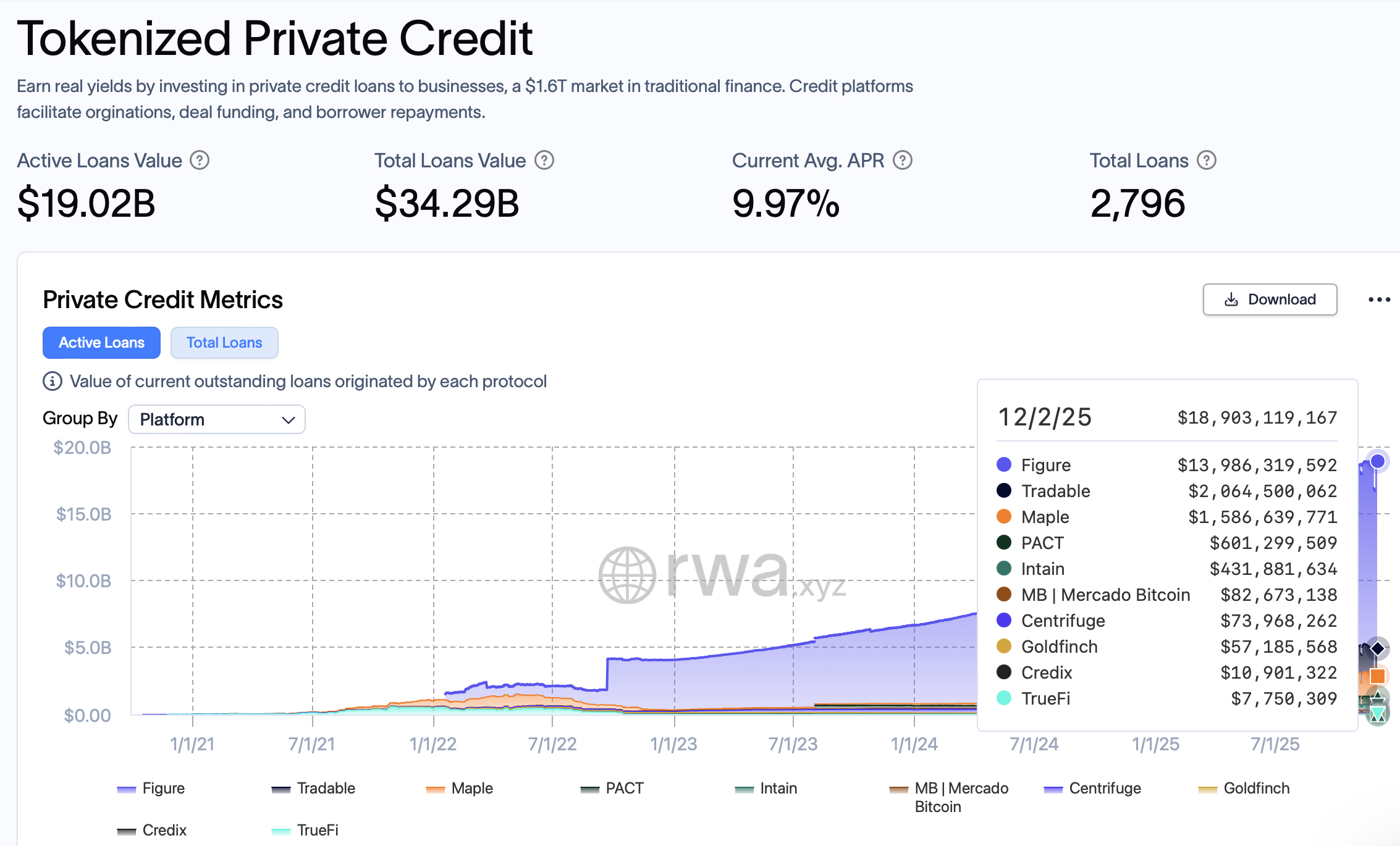

The tokenized private credit segment, valued at $19.02 billion, is led by Figure with $13.98 billion under management. Figure’s recent Nasdaq debut on September 11, following strong IPO demand, signals robust investor confidence in blockchain-enabled lending. These developments parallel ETHZilla’s initiative, illustrating how tokenization is reshaping credit markets by reducing intermediaries and improving accessibility.

Tokenized Private Credit Volume. Source: RWA.xyz

Overall, the integration of AI and blockchain in sectors like automotive finance is poised to unlock trillions in latent value. ETHZilla’s collaboration with Karus exemplifies this trend, combining predictive analytics with decentralized ledgers to create secure, scalable financial products. As regulatory frameworks evolve, such innovations could accelerate mainstream adoption of onchain credit solutions.

Frequently Asked Questions

What Does ETHZilla’s 20% Stake in Karus Mean for Onchain Auto Credit Investors?

ETHZilla’s investment provides immediate access to Karus’s AI underwriting and loan networks, enabling tokenized auto-loan portfolios by 2026. Investors gain exposure to diversified, high-yield assets with projected EBITDA returns of $9-12 million per $100 million deployed, backed by $5 billion in evaluated loans for reduced risk.

How Will Tokenized Auto Loans from ETHZilla and Karus Work in Practice?

Tokenized auto loans will use Karus’s AI to segment and underwrite loans onchain, allowing fractional ownership and instant settlement via blockchain. This process sounds straightforward: borrowers apply through Karus’s network, AI approves based on historical data, and loans convert to tokens tradable globally, enhancing liquidity for all parties involved.

Key Takeaways

- Acquisition Details: ETHZilla’s $10 million investment secures 20% ownership, integrating AI for onchain auto loans starting 2026.

- Market Opportunity: Targets $1.6 trillion auto-loan sector, opening institutional-grade assets to retail and global investors via tokenization.

- Broader Implications: Aligns with 2025’s tokenized debt boom, where Treasurys and private credit have surged to over $28 billion combined.

Conclusion

ETHZilla’s acquisition of a stake in Karus represents a landmark step in blending AI underwriting with onchain auto credit, fostering innovation in tokenized fixed-income products. By leveraging Karus’s robust data models and networks, ETHZilla is set to deliver accessible, high-return opportunities in a market ripe for disruption. As the tokenized debt landscape continues to expand in 2025 and beyond, investors should monitor these developments for emerging portfolio diversification strategies.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026