ETHZilla’s Zippy Acquisition Eyes Onchain Manufactured-Home Loans as Ether Treasury Stocks Decline

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

ETHZilla has acquired a 15% stake in Zippy for $21.1 million, marking its second deal in a week to tokenize manufactured-home chattel loans onchain amid declining Ether treasury stocks. This move expands real-world asset integration in blockchain finance.

-

ETHZilla’s investment: $5 million cash and $16.1 million in stock for Zippy stake.

-

Integration links Zippy’s AI loan systems with ETHZilla’s tokenization for onchain distribution.

-

Ether treasury stocks down: ETHZilla shares fell 10%, part of a 91% decline since August peak, per market data.

ETHZilla Zippy acquisition brings manufactured-home loans onchain as Ether treasury stocks slide. Discover the impact on real-world assets and blockchain lending. Stay updated on crypto trends today.

What is the ETHZilla Zippy Acquisition?

ETHZilla Zippy acquisition involves the former biotech firm purchasing a 15% stake in the digital housing lender Zippy for a total of $21.1 million. This transaction, announced on a recent Wednesday, includes $5 million in cash and $16.1 million in stock. It represents ETHZilla’s second acquisition within a week, focusing on real-world asset tokenization.

ETHZilla, now a key player in Ether-based strategies, aims to merge Zippy’s loan origination platform with its blockchain infrastructure. Founded in 2021, Zippy specializes in manufactured-home loans in the US, using AI to streamline processes. This partnership will enable the onchain distribution of chattel loans, potentially attracting institutional investors through forward-flow sales.

As part of the deal, ETHZilla secures a board seat at Zippy and a 36-month exclusivity agreement, ensuring all Zippy’s blockchain and tokenization activities route through ETHZilla’s platforms. This builds on ETHZilla’s pivot to real-world assets, positioning it as the sixth-largest Ether treasury holder based on recent market analyses.

Top Ethereum treasury companies. Source: CoinGecko data

Just one week prior, ETHZilla completed its first acquisition by taking a 20% stake in auto-finance startup Karus for $10 million in cash and stock. These moves signal a strategic expansion into tokenized lending markets, despite broader challenges in the Ether sector.

At the time of the announcement, ETHZilla’s stock price had dropped approximately 10%, reflecting ongoing volatility in Ether treasury-related equities, according to financial market trackers.

Source: Yahoo Finance data

How Are Ether Treasury Stocks Performing Amid Market Shifts?

Ether treasury stocks have experienced significant declines since mid-year peaks, with several public companies facing sharp reversals as Ether’s price fell from its all-time high. ETHZilla, for instance, announced its transition to an Ether treasury strategy on July 29, seeing shares rise from $45 to $107 by August 13. However, it has since plummeted about 91%, now trading near $10.

Similar trends affect other firms. SharpLink Gaming initiated its Ethereum treasury approach in May, bolstered by a $425 million private placement involving notable investors and the appointment of Ethereum co-founder Joseph Lubin as chairman. Shares surged over 130% to $79.21 on May 29 but have since fallen to around $11.77.

Source: Yahoo Finance data

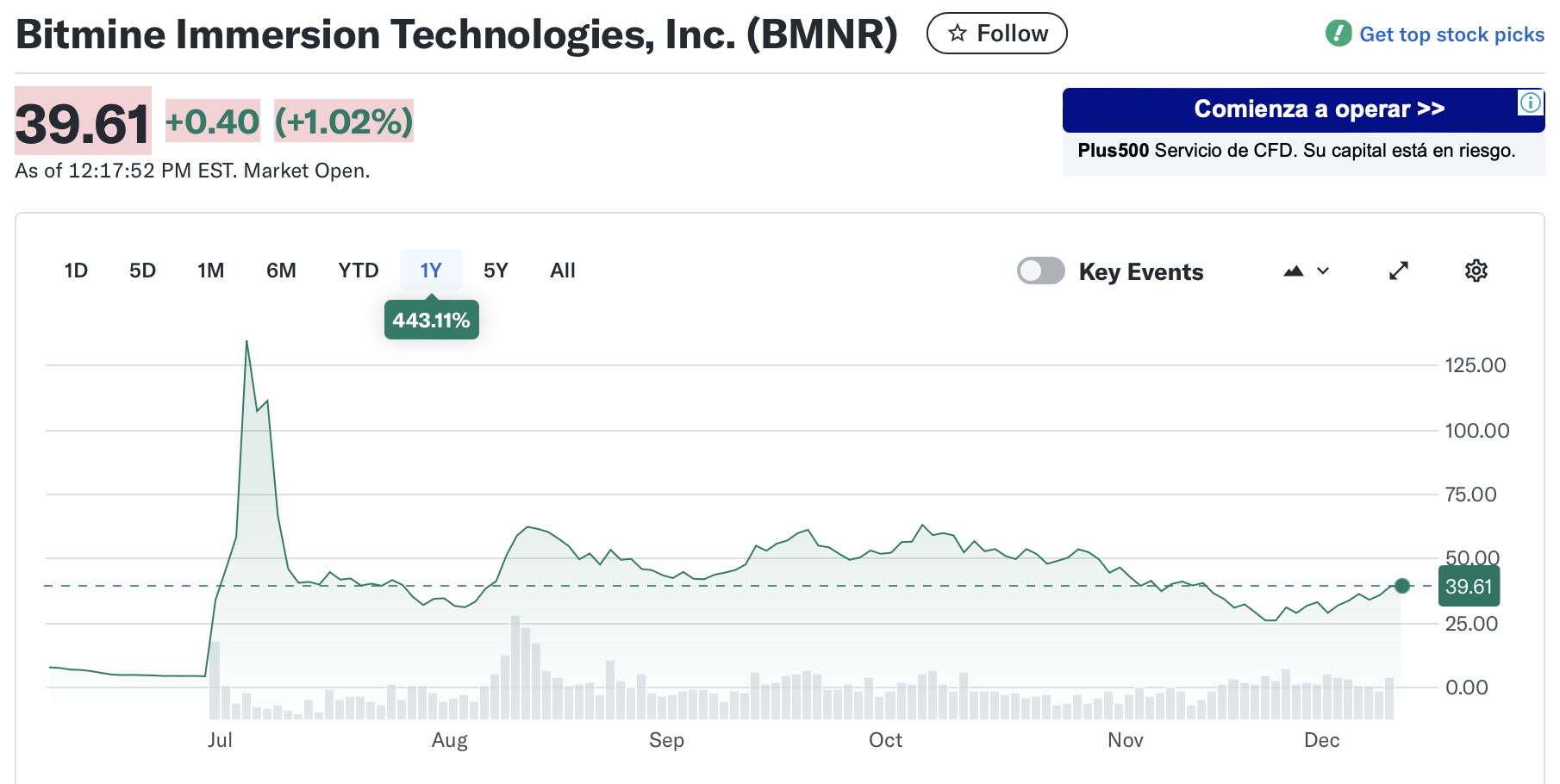

Bitmine Immersion, led by Fundstrat co-founder Tom Lee, reached a high of $135 in July but now trades at about $40. These declines coincide with Ether dropping from $4,946.05 on August 24 to $3,365 currently.

Source: Yahoo Finance data

Experts highlight risks in these strategies. In August, Komodo Platform’s chief technology officer Kadan Stadelmann noted that ETH treasury adoptions carry structural vulnerabilities. A market downturn could trigger liquidations, intensifying selling pressure on Ether. This underscores the volatility in crypto-integrated corporate finance, urging cautious investment approaches.

Frequently Asked Questions

What does the ETHZilla Zippy acquisition mean for real-world asset tokenization?

The ETHZilla Zippy acquisition enables the tokenization of manufactured-home chattel loans, integrating traditional lending with blockchain. Valued at $21.1 million, it provides Zippy with blockchain tools for onchain loan distribution, potentially improving liquidity and access for investors in real-world assets.

Why are Ether treasury stocks declining in 2025?

Ether treasury stocks are declining due to Ether’s price drop from its August peak of over $4,900 to around $3,365, amplifying corporate balance-sheet pressures. Companies like ETHZilla and SharpLink Gaming have seen shares fall 91% and over 85% respectively, as market corrections hit crypto-exposed equities hard.

Key Takeaways

- Strategic Expansion: ETHZilla’s Zippy stake accelerates real-world asset tokenization, linking AI lending with blockchain for manufactured-home loans.

- Market Volatility: Ether treasury firms face 80-90% stock drops since summer highs, tied to Ether’s 30% decline from its peak.

- Risk Awareness: Investors should monitor liquidation risks in ETH strategies, as warned by experts like Kadan Stadelmann.

Conclusion

The ETHZilla Zippy acquisition highlights growing interest in real-world asset tokenization within the Ether ecosystem, despite headwinds from declining treasury stocks. As firms like ETHZilla push boundaries in onchain lending, the sector’s resilience will be tested by ongoing market fluctuations. Forward-thinking investors may find opportunities in tokenized assets, but prudence remains key in navigating Ether’s volatile landscape.

Comments

Other Articles

Vitalik Buterin: The AI Revolution in DAO Management

February 23, 2026 at 02:58 PM UTC

BitMine Boosts Ethereum Stake to 461K ETH, Eyes Network Share Growth

January 1, 2026 at 08:06 PM UTC

Ethereum Inflow to Binance Surges to 24,500 ETH, Hinting at Short-Term Bearish Pressure

January 1, 2026 at 05:00 PM UTC