EU Tokenization Operators Demand Urgent Changes

STX/USDT

$14,062,378.85

$0.2747 / $0.2366

Change: $0.0381 (16.10%)

+0.0056%

Longs pay

Contents

European tokenization operators Securitize, 21X, Boerse Stuttgart Group, Lise, OpenBrick, STX, and Axiology have demanded urgent changes in the EU DLT Pilot Regime. Current asset limits, volume restrictions, and six-year license durations are hindering the scaling of regulated onchain markets. Against the US's progress toward industrial-scale tokenization and instant settlement, the EU's failure to remove these restrictions could risk market share.

EU DLT Pilot Regime Restrictions and Operator Demands

Companies are proposing narrow-scope technical corrections that preserve investor protections:

- Expanding the scope of eligible assets

- Increasing issuance limits

- Removing pilot license durations

These changes can be implemented quickly with a standalone technical update and could enhance Europe's competitiveness in leading crypto markets like BTC detailed analysis.

Tokenization Accelerating in the US: SEC and Exchange Moves

In the US, the SEC stated on December 11, 2025, that tokenized stocks and bonds can be custodied under existing rules and issued a no-action letter to DTCC; this initiates tokenized services for real-world assets (RWA). On January 28, a guide separating tokenized securities into two categories was published. Nasdaq is pursuing approval for tokenized stock listing proposals, while NYSE is developing a platform for 24/7 trading and blockchain-based settlement.

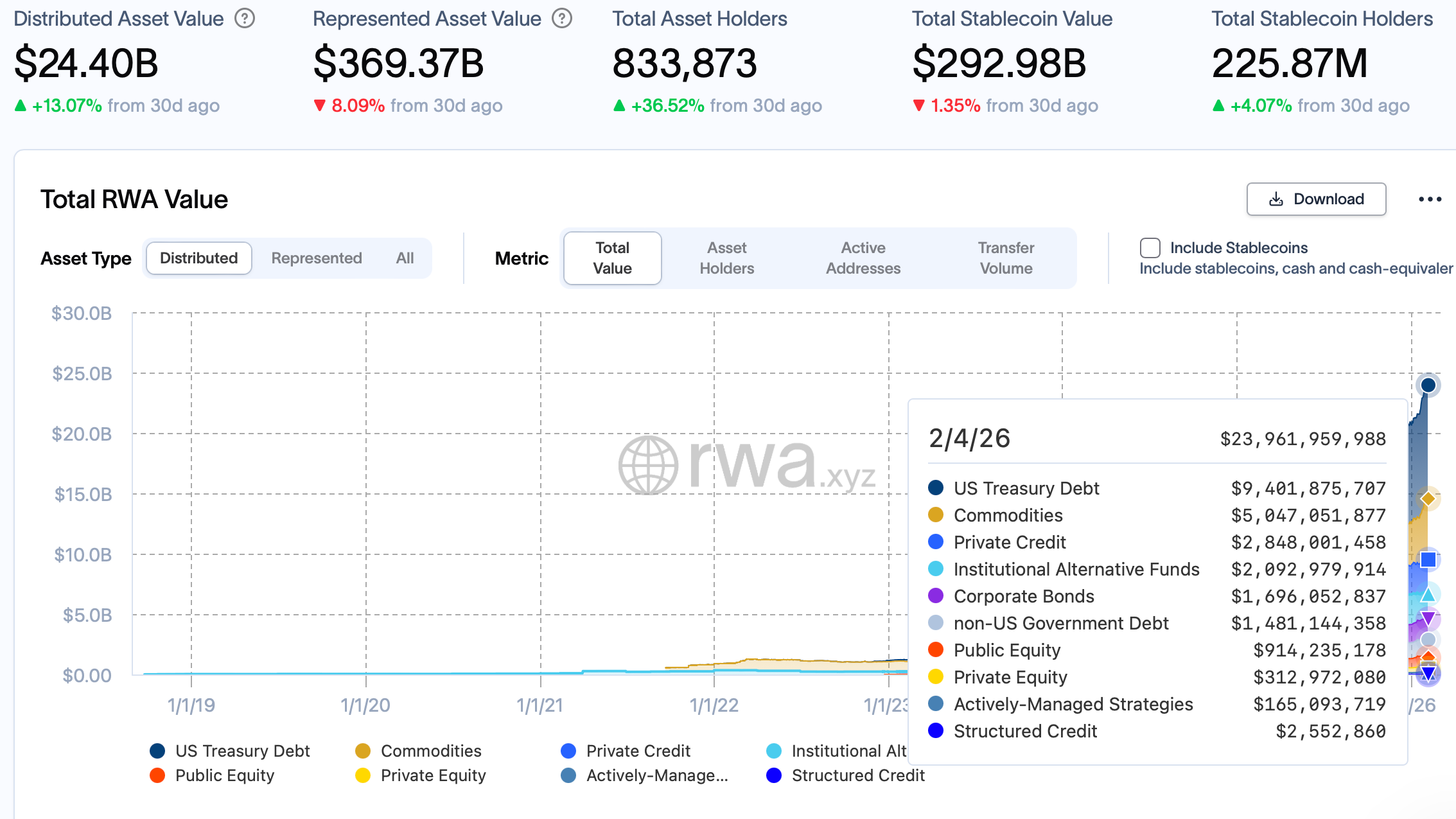

The value of global tokenized real-world assets. Source: RWA.xyz

The Role of RWA Tokenization in the BTC Market

RWA tokenization integrated with instruments like BTC futures strengthens the BTC ecosystem by increasing liquidity. If the EU falls behind, investors may shift to the US. The ETH spot market will also be affected by similar trends.

Frequently Asked Questions About Tokenization and EU DLT

- What is the EU DLT Pilot Regime? A regulatory framework testing blockchain-based financial services, but its restrictions hinder scaling.

- How does RWA tokenization affect BTC? It increases liquidity and volume by integrating real-world assets into the BTC blockchain.

- What are the latest developments in US tokenization? 24/7 trading is accelerating with SEC guides and exchange platforms.

- When will the EU changes come? They can be implemented quickly with technical corrections, but regulatory approval is awaited.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/25/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/24/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/23/2026

DeFi Protocols and Yield Farming Strategies

2/22/2026