Exodus and MoonPay Eye 2026 USD Stablecoin Launch in USDT-Dominated Market

Contents

Exodus has partnered with MoonPay to launch a fully reserved USD-backed stablecoin targeted for everyday payments, set to debut in early 2026. This stablecoin will integrate seamlessly into the Exodus Pay feature, enabling self-custodial transactions without requiring users to possess crypto expertise.

-

The stablecoin is built using M0’s infrastructure for custom issuance and management.

-

It aims to simplify digital dollar movements onchain, bridging traditional finance and crypto for consumers.

-

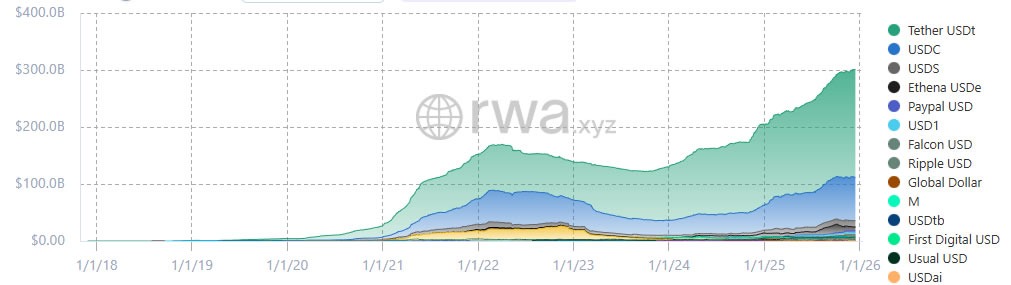

With a market dominated by USDT and USDC holding over $260 billion in combined supply, this new entrant targets niche self-custody needs, per CoinGecko data.

Discover how Exodus and MoonPay’s new USD-backed stablecoin revolutionizes everyday payments with self-custody. Launching in 2026 via Exodus Pay—explore the future of digital dollars today!

What is the Exodus and MoonPay USD-backed stablecoin?

The Exodus and MoonPay USD-backed stablecoin is a fully reserved digital asset designed to facilitate seamless everyday payments without the complexities of traditional cryptocurrency handling. Announced by the Exodus Movement, this stablecoin will be issued and managed by MoonPay using the M0 platform, ensuring full backing by U.S. dollars. It targets a launch in early 2026 and integrates directly into Exodus Pay, allowing users to spend, send, and receive funds while retaining control through self-custody.

How does the stablecoin integrate with Exodus Pay for self-custodial transactions?

The integration with Exodus Pay represents a significant step toward user-friendly crypto adoption, enabling transactions that mirror the simplicity of consumer apps. Users can perform digital dollar payments onchain without intermediaries compromising their asset control, as highlighted by Exodus CEO JP Richardson. Built on M0’s programmable infrastructure, the stablecoin supports interoperability across blockchains, tailoring experiences for specific needs like retail spending or remittances.

This setup addresses key pain points in the stablecoin ecosystem, where accessibility often lags behind demand. According to market analyses, stablecoins have grown to over $310 billion in total capitalization, with platforms like MoonPay’s enterprise solutions accelerating custom developments. Luca Prosperi, co-founder and CEO of M0, emphasized that enterprises seek programmable assets that fit unique product experiences, a principle central to this partnership. By embedding the stablecoin into Exodus’s wallet ecosystem, users benefit from enhanced security and privacy, avoiding the custodial risks associated with centralized exchanges.

Regulatory advancements, such as the GENIUS Act passed in July, have further propelled this innovation by providing a federal framework for fiat-backed stablecoins in the U.S. This legislation has encouraged a surge in stablecoin offerings from banks and crypto firms alike, fostering a more stable and compliant environment. The Exodus-MoonPay collaboration leverages these changes to position the stablecoin as a reliable tool for daily financial activities, from buying groceries to international transfers.

Frequently Asked Questions

What makes the Exodus stablecoin different from existing USD-backed options like USDT or USDC?

The Exodus stablecoin stands out by prioritizing self-custody through direct integration with Exodus Pay, allowing users to maintain full control over their funds without third-party custody. Unlike USDT and USDC, which dominate with 60% and 25% market shares respectively and circulate over $264 billion combined, this new asset focuses on simplifying non-crypto-savvy transactions while using M0 for custom issuance.

When will the Exodus and MoonPay stablecoin be available for users?

The stablecoin is scheduled for launch in early 2026, following development on MoonPay’s infrastructure. This timeline aligns with ongoing regulatory compliance efforts under the GENIUS Act, ensuring a smooth rollout for integration into Exodus’s self-custodial wallet features for everyday payments.

Key Takeaways

- Partnership Innovation: Exodus and MoonPay’s collaboration uses M0 to create a tailor-made USD-backed stablecoin, enhancing accessibility for mainstream users.

- Market Dominance Context: Entering a $310 billion sector led by USDT ($186 billion supply) and USDC ($78 billion), it targets self-custody niches underserved by giants.

- Regulatory Boost: The GENIUS Act’s framework encourages stablecoin growth, positioning this launch as a compliant step toward broader adoption—consider integrating it into your wallet strategy.

USDT and USDC still dominate stablecoin markets. Source: RWA.xyz

Conclusion

The partnership between Exodus and MoonPay to launch a USD-backed stablecoin in early 2026 marks a pivotal advancement in making digital payments more intuitive and secure through self-custody via Exodus Pay. With the stablecoin sector’s rapid expansion—now exceeding $310 billion in market cap, as reported by CoinGecko—and supportive regulations like the GENIUS Act, this development underscores the maturing landscape of fiat-backed digital assets. As stablecoins continue to bridge traditional finance and blockchain, users can anticipate more seamless, everyday applications that prioritize control and simplicity in the evolving crypto ecosystem.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026