FARTCOIN Breaks Multi-Month Range on Rising Volumes, Liquidity Clusters May Stall Rally

FARTCOIN/USDT

$152,795,006.73

$0.1621 / $0.1468

Change: $0.0153 (10.42%)

+0.0031%

Longs pay

Contents

FARTCOIN’s recent breakout from a multi-month descending channel has driven an 18% price surge in the last 24 hours, pushing its market capitalization toward $300 million amid increased trading volume on centralized exchanges.

-

FARTCOIN broke above key resistance levels, supported by rising open interest and positive funding rates on major platforms.

-

The memecoin’s rally aligns with broader recovery signals in the altcoin market after a period of consolidation.

-

Trading volume exceeded $673 million in futures, with Bybit leading activity, though liquidity clusters at $0.26 and $0.24 may pose resistance.

Discover FARTCOIN’s breakout from multi-month range: 18% surge amid rising CEX volume. Analyze charts, liquidity risks, and expert insights for informed trading decisions.

What is driving FARTCOIN’s breakout from its multi-month range?

FARTCOIN has experienced a notable breakout from a descending channel that confined its price since late July 2025, when many altcoins reached yearly highs. This movement, marked by an 18% increase over the past 24 hours, reflects renewed buyer interest as the token surpassed immediate resistance levels. The rally has elevated its market cap to nearly $300 million, signaling potential momentum in the memecoin sector despite ongoing market weakness.

How has exchange activity influenced FARTCOIN’s recent performance?

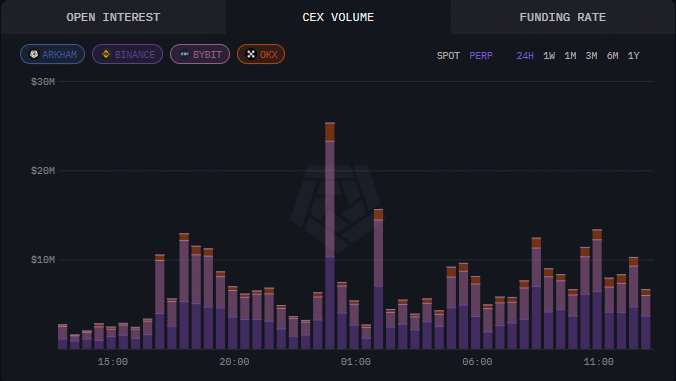

Trading volume on centralized exchanges has surged significantly, with futures turnover reaching $673 million in the latest session, according to data from Arkham. Bybit topped the list for activity, followed closely by Binance and OKX, indicating heightened trader engagement that coincided with the price breakout. Open interest climbed to $224 million, while funding rates shifted positive across most platforms, as reported by CoinGlass, suggesting a bullish tilt from derivatives traders. Short positions faced liquidations over the 12-hour period, which alleviated downward pressure and allowed the price to maintain gains above the multi-month channel. This uptick in exchange metrics underscores the role of institutional and retail participation in sustaining the initial breakout, though sustained volume will be crucial for further appreciation. Expert analysis from TradingView charts highlights how this volume spike often precedes extended rallies in volatile assets like memecoins.

Source: TradingView

Despite these positive indicators, FARTCOIN remains below its 50-day and 200-day moving averages, positioning it in a broader bearish context. The relative strength index (RSI) has moved above the neutral 50 level, confirming buyer dominance in the short term. However, comparisons to recovering altcoins like Starknet (STRK) reveal that FARTCOIN’s buyer conviction is not yet as robust, limiting its ability to challenge the $0.30 resistance decisively.

Frequently Asked Questions

What factors triggered FARTCOIN’s breakout above the multi-month channel?

A decisive close above the descending channel boundary, combined with elevated centralized exchange volume, rising open interest to $224 million, and positive funding rates, propelled FARTCOIN’s 18% surge. These elements, drawn from CoinGlass and Arkham data, indicate strong market participation that eased prior consolidation pressures since late July 2025.

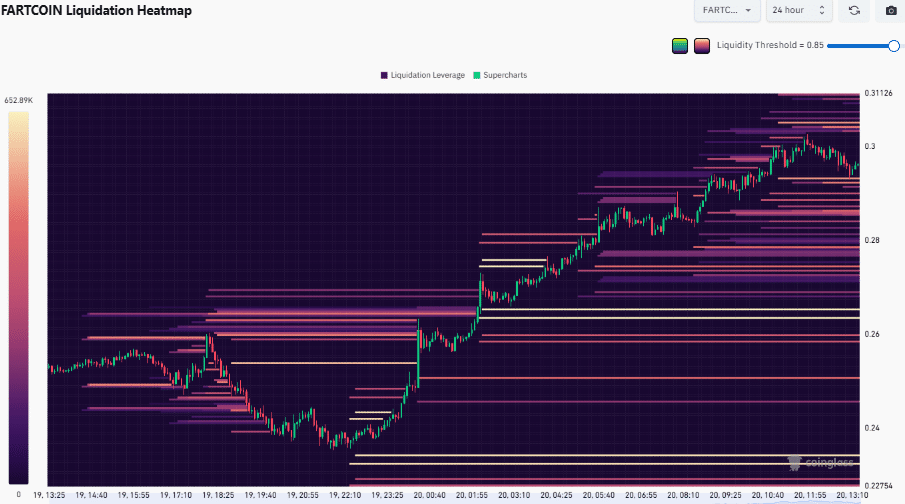

Could liquidity clusters impact FARTCOIN’s upward momentum?

Yes, significant liquidity pools at $0.26 and $0.24, totaling over $2 million in positions, may draw price action downward as markets often gravitate toward dense order clusters. Per CoinGlass analysis, these levels could act as reversal points if buying pressure wanes, potentially stalling the rally unless volume sustains the breakout.

Prominent Solana trader Unipcs, known as the ‘Bonk Guy’ for his memecoin insights, anticipates further gains for FARTCOIN once broader risk appetite returns. He stated, “I think FARTCOIN will be one of the best performers once we get back into risk on mode.” This perspective aligns with observed derivatives trends but emphasizes the need for wider market recovery.

Source: Arkham

In the memecoin ecosystem, FARTCOIN’s performance stands out amid a generally subdued market. While many tokens continue to decline after a month-long downturn, this breakout offers a glimpse of selective recovery. Historical data from similar channel breaks in 2025 altcoin cycles shows that follow-through depends on sustained volume and avoidance of liquidity traps.

Key Takeaways

- Breakout Confirmation: FARTCOIN’s price exceeded the multi-month descending channel with RSI above neutral, backed by $673 million in futures volume.

- Exchange Momentum: Open interest at $224 million and positive funding rates on Bybit, Binance, and OKX signal bullish derivatives activity.

- Liquidity Risks: Clusters at $0.26 and $0.24, holding over $2 million, could pull prices lower and hinder sustained appreciation.

Source: CoinGlass

Conclusion

FARTCOIN’s breakout from its multi-month range marks a pivotal moment in the memecoin landscape, driven by robust exchange activity and technical confirmations as of late 2025. While liquidity clusters present near-term hurdles, the alignment of volume, open interest, and expert commentary like that from Unipcs suggests potential for continued upside if market conditions improve. Traders should monitor these levels closely for opportunities in the evolving crypto environment.