Fartcoin Nears Key Resistance After 12 Percent Surge on Bullish Momentum

FARTCOIN/USDT

$152,795,006.73

$0.1621 / $0.1468

Change: $0.0153 (10.42%)

+0.0031%

Longs pay

Contents

Fartcoin experienced a 12% price surge, reaching approximately $0.305, driven by increased trading volume, improved liquidity, and sustained buyer interest amid broader market volatility. This rebound highlights renewed speculative activity in meme coins like Fartcoin.

-

Increased trading volume to $192.7 million supports the Fartcoin surge.

-

Enhanced liquidity draws traders to Fartcoin’s short-term momentum.

-

Bullish derivatives metrics, including a 17% rise in open interest to $209.37 million, bolster breakout potential.

Discover why Fartcoin surged 12% to $0.305 amid rising volume and buyer dominance. Explore key metrics signaling a potential breakout in this volatile meme coin market—stay informed on crypto trends today.

What caused Fartcoin’s recent 12% price surge?

Fartcoin saw a notable 12% increase in its price over the past 24 hours, pushing it to around $0.305 and elevating its market capitalization above $305 million. This movement was primarily fueled by heightened trading activity, with daily volume reaching $192.7 million, and stronger liquidity as investors shifted toward assets demonstrating short-term resilience. Consistent buyer pressure has countered recent softness, reflecting growing confidence in Fartcoin’s potential amid ongoing market fluctuations.

How do derivatives metrics indicate Fartcoin’s breakout potential?

Derivatives data reveals a robust setup for Fartcoin, with taker buy cumulative volume delta (CVD) showing dominant buyer control over the last 90 days. This metric indicates aggressive absorption of sell orders during dips, particularly around the mid-range price levels, as traders capitalize on momentum. Open interest expanded by nearly 17% to $209.37 million, signaling increased speculative commitment and leverage, while the long/short ratio tilted to 56.36% longs, aligning with bullish MACD signals. According to data from CryptoQuant, this confluence of factors strengthens the case for a push toward the $0.34956 resistance, though sustained volume is crucial to avoid reversals. Market analysts note that such alignments often precede significant moves in volatile assets like Fartcoin, with historical patterns supporting up to 20-30% follow-through gains post-breakout if resistance holds.

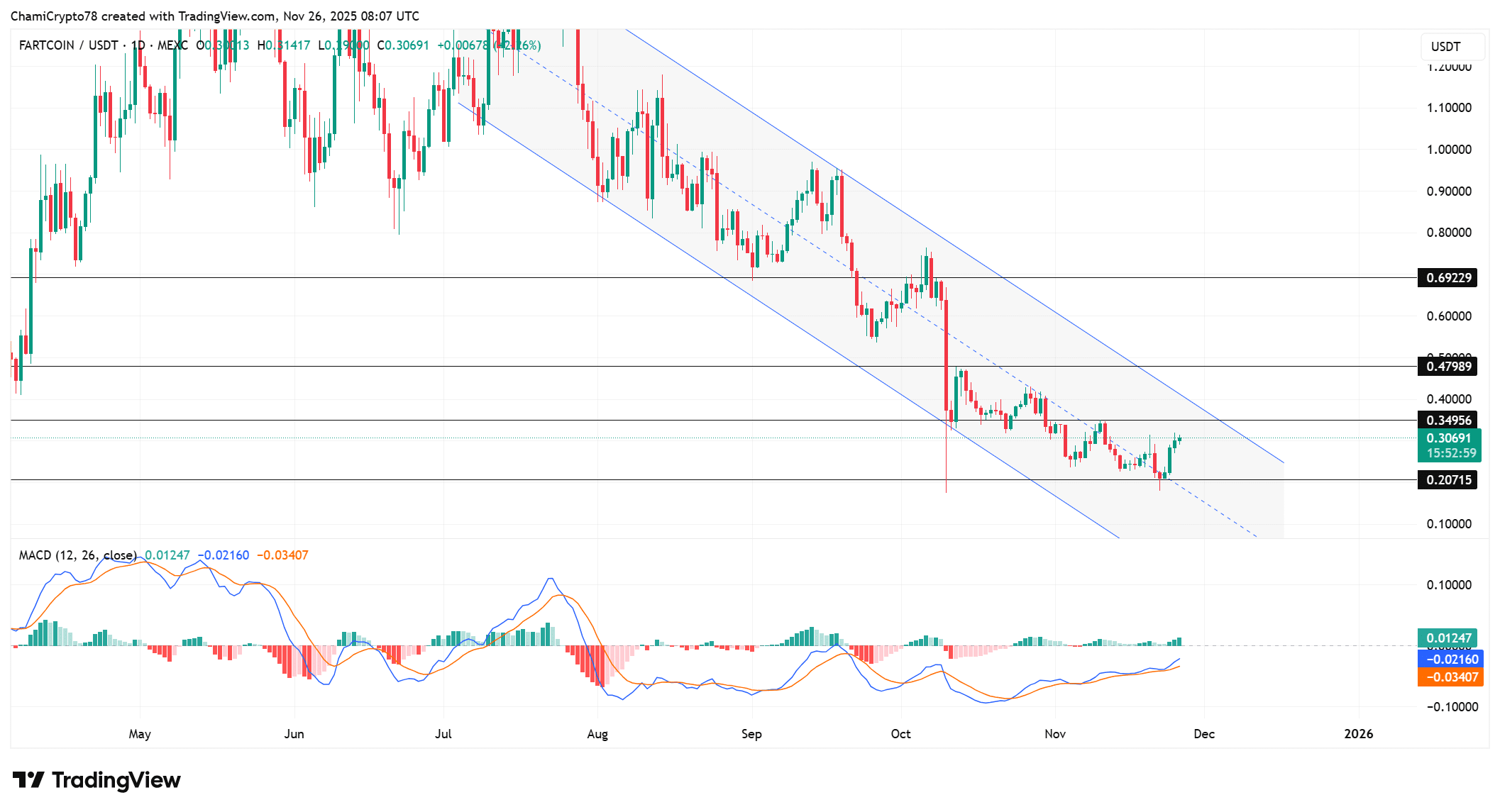

Source: TradingView

Fartcoin’s price action has captured attention in the cryptocurrency space, particularly as meme coins regain traction following broader market recoveries. After experiencing weeks of subdued performance, the token’s swift rebound underscores the influence of sentiment-driven trading. Liquidity enhancements have played a pivotal role, allowing for smoother order execution and attracting more participants to both spot and futures markets. This shift comes at a time when overall crypto volatility remains high, with Fartcoin responding sensitively to changes in derivatives sentiment.

Fartcoin approaches a critical breakout zone

Fartcoin is now testing a pivotal resistance area as buyers solidify their hold on the mid-range price structure. The token rebounded decisively from the $0.20715 support level, demonstrating resilient demand with each correction met by fresh buying. Technical indicators, such as the MACD, display persistent bullish divergence through expanding green histogram bars, confirming upward momentum.

The upcoming challenge lies at the $0.34956 level, a historically significant barrier that has prompted volatile reactions in prior encounters. Successfully surpassing this could catalyze a momentum shift, potentially leading to new highs. Conversely, a failure to break through might encourage sellers to reassert control, pulling prices back toward recent lows.

Source: CryptoQuant

Buyer dominance remains firm on CVD

The taker buy CVD for Fartcoin has exhibited unwavering buyer supremacy throughout the 90-day period, highlighting robust demand that counters every selling effort. During price retracements to the mid-range, this metric shows buyers stepping in aggressively to maintain upward pressure.

This sustained CVD positivity correlates with a surge in speculative interest, as market participants focus on tokens displaying clear momentum. It bolsters the token’s short-term framework and aids in efforts to recapture equilibrium points on the chart. Nonetheless, achieving consistent CVD vigor near key resistance is essential; any lapse in buying intensity could invite amplified short interest from cautious traders.

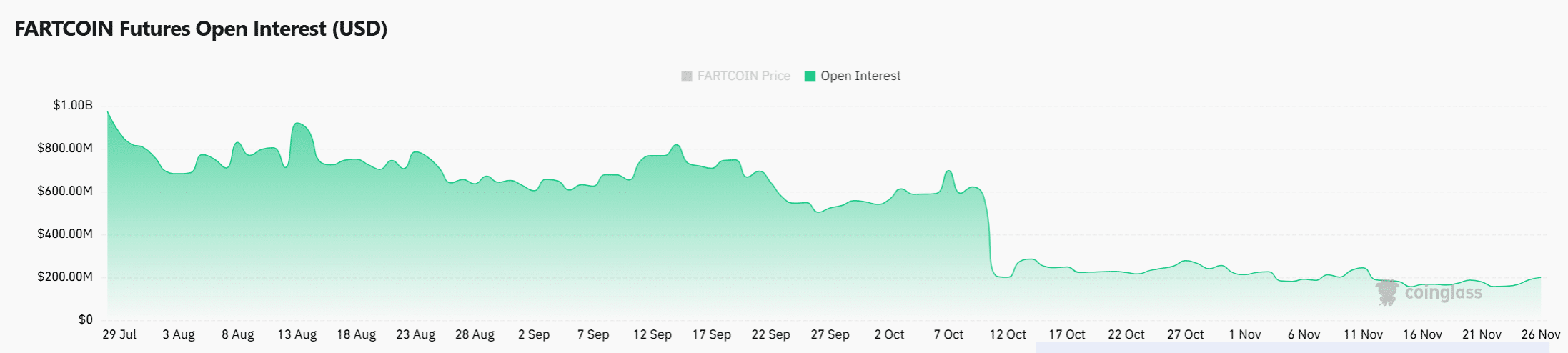

Open Interest rises with stronger conviction

Open interest in Fartcoin futures has surged by almost 17%, attaining $209.37 million, which points to heightened trader engagement and leveraged bets on the ongoing recovery. This growth synchronizes with positive CVD trends, forming a powerful alignment in the derivatives landscape.

Futures participants are safeguarding their stakes more vigorously amid the leverage buildup, paving the way for amplified price swings. Such dynamics suggest anticipation of a substantial response at the $0.34956 threshold. That said, the elevated leverage also amplifies vulnerability to downside if rejection occurs at this level.

Source: CoinGlass

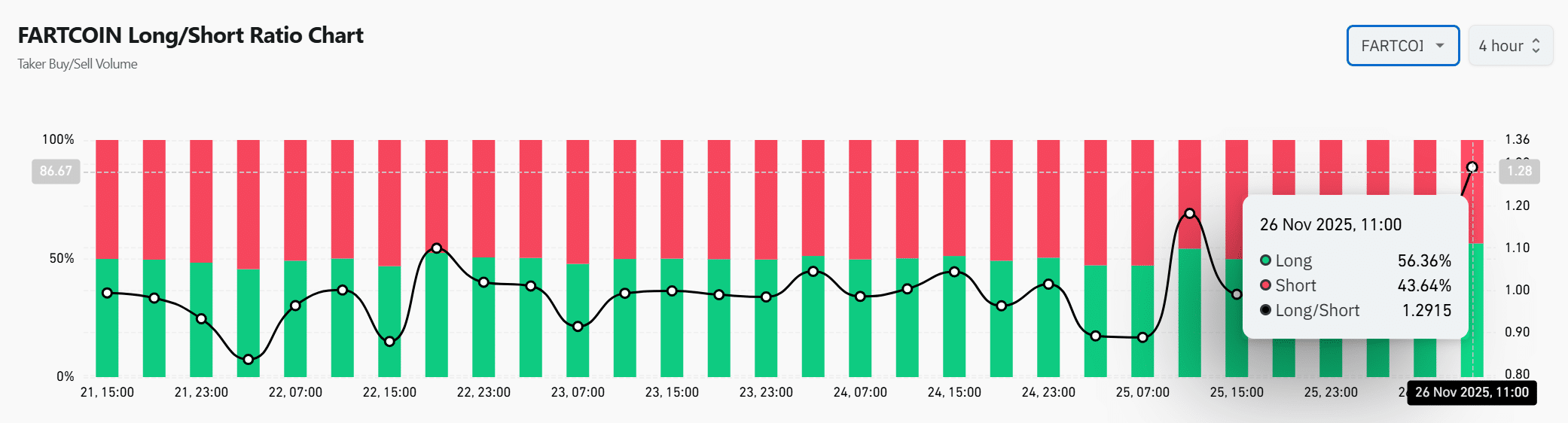

Long traders regain clear market control

Long positions now dominate with a long/short ratio of 56.36% compared to 43.64% shorts, a development that gained traction on November 26. This shift illustrates traders’ preference for upside continuation over defensive strategies.

The ratio’s improvement dovetails with favorable MACD readings and solid CVD performance, establishing a multi-indicator bullish consensus. It further underscores the intent to test the $0.34956 barrier. Still, excessive optimism at resistance levels carries the risk of liquidation squeezes if momentum wanes; ongoing long superiority is vital for breakout validation.

Source: CoinGlass

In summary, Fartcoin stands at a crossroads, where strengthening derivatives indicators converge with recovering spot market demand. The synergy of superior CVD, growing open interest, and pronounced long bias paves the way for a legitimate challenge to higher levels. Should buyers decisively overcome the $0.34956 resistance, Fartcoin may initiate a sustained uptrend. Failure to do so, however, could swiftly reignite bearish forces in this high-volatility environment.

Frequently Asked Questions

What is driving the current Fartcoin price surge and breakout potential?

The Fartcoin price surge stems from a 12% gain to $0.305, backed by $192.7 million in trading volume and improved liquidity. Breakout potential is supported by bullish CVD dominance, 17% open interest growth, and a 56% long/short ratio, positioning it to test $0.34956 resistance effectively.

Is Fartcoin a good investment right now given its recent surge?

Fartcoin’s recent 12% surge to $0.305 reflects strong buyer interest and derivatives momentum, making it appealing for short-term traders. However, its meme coin nature involves high volatility risks, so consider market conditions and personal risk tolerance before investing.

Key Takeaways

- Fartcoin’s 12% surge explained: Heightened volume at $192.7 million, better liquidity, and steady buyer influx drove the rebound from recent lows.

- Breakout factors for Fartcoin: Positive CVD flow, 17% open interest rise to $209.37 million, and 56% long dominance create a solid setup against $0.34956 resistance.

- Risk considerations: Monitor leverage and momentum; a rejection could lead to quick pullbacks, while a break may signal new highs.

Conclusion

Fartcoin’s impressive 12% surge and approach to the $0.34956 resistance underscore its sensitivity to derivatives strength and buyer conviction in the meme coin sector. With metrics like CVD dominance and rising open interest pointing to potential upside, the token embodies the crypto market’s speculative edge. As volatility persists, investors should track these indicators closely for opportunities, positioning themselves ahead of possible trend shifts in Fartcoin’s trajectory.