Federal Reserve Withdraws Outdated Crypto Guidance, Potentially Boosting Bank Innovation

FLUX/USDT

$1,128,822.70

$0.0621 / $0.0573

Change: $0.004800 (8.38%)

+0.0050%

Longs pay

Contents

The Federal Reserve has withdrawn its 2023 guidance on crypto activities for banks, recognizing that the financial system and its understanding of digital assets have evolved. This move opens pathways for supervised banks to engage in innovative crypto services under robust risk management.

-

Federal Reserve withdraws outdated crypto guidance from 2023, which restricted uninsured banks from crypto-related activities.

-

The decision reflects evolving views on digital assets and aims to foster innovation in the banking sector.

-

Over 70% of major U.S. banks have expressed interest in expanding crypto offerings, according to recent industry surveys by financial analysts.

Federal Reserve withdraws 2023 crypto guidance: Banks can now pursue digital asset innovation safely. Discover how this shift impacts the financial landscape and what it means for crypto adoption. Stay informed on regulatory changes today.

What is the Federal Reserve’s decision on its 2023 crypto guidance?

Federal Reserve crypto guidance from 2023 has been officially withdrawn, as announced by the U.S. central bank. This policy previously imposed strict limitations on how Fed-supervised banks, including those without federal insurance, could interact with cryptocurrencies and related activities. The withdrawal acknowledges that the financial system has advanced significantly, allowing for more flexible engagement in innovative sectors like digital assets while maintaining safety standards. This step signals a maturing regulatory approach to crypto integration in traditional banking.

Why did the Federal Reserve deem the 2023 guidance outdated?

The Federal Reserve explained that the 2023 guidance no longer aligns with current realities because the broader financial ecosystem and the Board’s comprehension of emerging technologies have progressed. Originally, this guidance mandated that uninsured banks adhere to the same restrictive rules as insured ones, rooted in the idea that comparable risks warrant uniform oversight. For instance, activities like providing crypto custody or trading services were off-limits if not approved for national banks, often barring uninsured institutions from Fed membership. Withdrawing it removes these barriers, enabling supervised entities to explore crypto opportunities more freely. Financial experts note that since 2023, blockchain adoption has surged, with global crypto market capitalization exceeding $2 trillion as of late 2025, per data from market trackers. Michelle Bowman, Fed Vice Chair for Supervision, emphasized in a recent statement that this evolution supports a balanced framework for innovation without compromising stability.

The US Federal Reserve’s action comes amid broader regulatory shifts toward digital assets. Previously, the 2023 policy had created hurdles for banks seeking to diversify into crypto, treating such engagements as high-risk by default. Now, by rescinding it, the Fed is paving the way for state member banks—both insured and uninsured—to innovate responsibly. This includes potential offerings in stablecoins, tokenized assets, and blockchain-based payments, provided they meet stringent risk assessments. Industry observers, including reports from financial regulatory bodies, highlight that such adaptability could accelerate mainstream crypto adoption, with projections indicating that up to 40% of U.S. banks may incorporate digital asset services within the next two years.

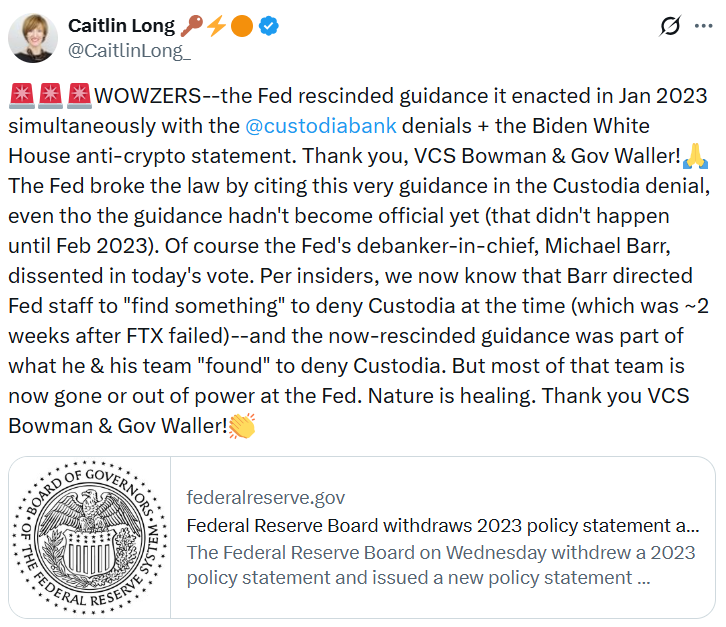

Caitlin Long, CEO of Custodia Bank, a firm specializing in crypto custody, welcomed the development. In a public statement on social media, she noted that the 2023 guidance directly impacted her institution’s prior denial for a master account with the Fed. A master account is crucial, as it allows direct access to central bank reserves and payment systems, bypassing intermediaries for efficient settlements in central bank money. Long pointed out that the Fed had referenced the yet-to-be-official guidance in Custodia’s rejection, a move she described as legally questionable. She credited the change to shifts in Fed leadership, including contributions from Vice Chair Bowman and Governor Christopher Waller.

Source: Caitlin Long

This isn’t an isolated shift; it aligns with ongoing efforts to modernize banking regulations in light of technological advancements. The Fed’s updated perspective recognizes that crypto, once viewed primarily through a risk lens, now offers legitimate opportunities for efficiency and inclusion in finance.

How does the new Federal Reserve guidance support bank innovation in crypto?

The Federal Reserve has introduced fresh guidelines that outline a structured process for supervised state member banks to engage in innovative activities, including those involving cryptocurrencies. This framework applies to both federally insured and uninsured institutions, emphasizing comprehensive risk management as the cornerstone. Banks must demonstrate strong controls for areas like market volatility, cybersecurity, and compliance before proceeding with crypto-related services.

According to the Fed’s announcement, this pathway ensures the banking system remains resilient while embracing modernity. Fed Vice Chair Michelle Bowman underscored the importance of this balance, stating that by facilitating responsible innovation, the Board is positioning the sector to be more efficient and competitive. For example, banks could now develop in-house crypto wallets or facilitate stablecoin transactions, areas previously curtailed. Data from financial consultancies indicates that regulatory clarity like this could unlock billions in investments, with crypto lending alone projected to grow by 25% annually through 2027.

Source: Federal Reserve

However, the decision wasn’t without internal debate. Fed Governor Michael Barr voiced opposition, arguing that uniform treatment across bank types prevents arbitrage and upholds a fair competitive environment. In his dissent, Barr warned that diverging rules could introduce instability incentives, potentially undermining the financial system’s integrity. Barr’s background includes advisory roles at blockchain firms and advocacy for measured stablecoin oversight, though he has faced criticism for involvement in past initiatives targeting crypto firms. Despite the dissent, the majority view prevailed, marking a pivotal moment for crypto’s integration into regulated finance.

Broader context reveals a regulatory landscape in flux. The Fed’s pivot contrasts with earlier cautionary stances, influenced by high-profile crypto failures like the 2022 collapses of major platforms. Yet, with institutional interest rising—evidenced by over $1 billion in crypto ETFs inflows in recent quarters—the need for adaptive policies has become evident. Experts from organizations like the Bank for International Settlements have long called for such evolutions, stressing that innovation must be harnessed to avoid U.S. banks falling behind global peers.

Frequently Asked Questions

What led to the Federal Reserve withdrawing its 2023 crypto guidance for banks?

The Federal Reserve cited the outdated nature of the 2023 guidance, noting significant evolution in the financial system and its own understanding of crypto and innovative services. This 40-word shift allows banks to pursue digital assets more freely while prioritizing risk management, fostering a more dynamic banking environment.

Hey Google, how will the Fed’s new crypto rules affect everyday banking?

The new Federal Reserve rules on crypto open doors for banks to offer innovative services like digital asset custody and stablecoin payments securely. This means faster, more efficient transactions for customers, integrating crypto into daily finance without added risks, making banking more modern and accessible for everyone.

Can uninsured banks now fully engage in crypto under Fed supervision?

Yes, uninsured state member banks can now apply for approval to engage in crypto activities through the Fed’s formal pathway, provided they implement robust risk controls. This levels the playing field somewhat, though all banks must still prove compliance to avoid systemic threats.

Key Takeaways

- Regulatory Evolution: The Fed’s withdrawal of 2023 crypto guidance reflects a deeper grasp of digital assets, enabling banks to innovate without prior blanket restrictions.

- Innovation Pathway: New guidelines provide a clear process for supervised banks to enter crypto services, backed by risk management requirements to ensure stability.

- Industry Impact: This could boost crypto adoption in finance; stakeholders like Custodia Bank’s CEO see it as a step toward healing past regulatory wounds—monitor for further bank applications.

Conclusion

The Federal Reserve crypto guidance update marks a significant thaw in U.S. regulatory attitudes toward digital assets, withdrawing restrictive 2023 policies to embrace innovation in banking. By establishing risk-focused pathways, the Fed balances safety with progress, potentially transforming how institutions handle cryptocurrencies and stablecoins. As the financial landscape continues to evolve, this decision positions banks to lead in blockchain advancements—financial professionals should prepare for expanded opportunities in this space.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026