Fed's New Margin Proposal Including BNB for Crypto Derivatives

BNB/USDT

$669,473,373.58

$615.60 / $588.64

Change: $26.96 (4.58%)

-0.0013%

Shorts pay

Contents

A new working paper published by the Federal Reserve on Wednesday suggests categorizing cryptocurrencies as a separate asset class in initial margin requirements for “uncleared” derivatives markets. These markets cover over-the-counter transactions and other trades that do not go through a central clearinghouse. This distinction is made because crypto is more volatile than traditional asset classes and does not fit into the Standardized Initial Margin Model (SIMM) risk categories. SIMM covers interest rates, equities, FX, and commodities.

Cover page of the Federal Reserve staff working paper. Source: Federal Reserve Board

The Fed's Crypto Benchmark Index and BNB Impact

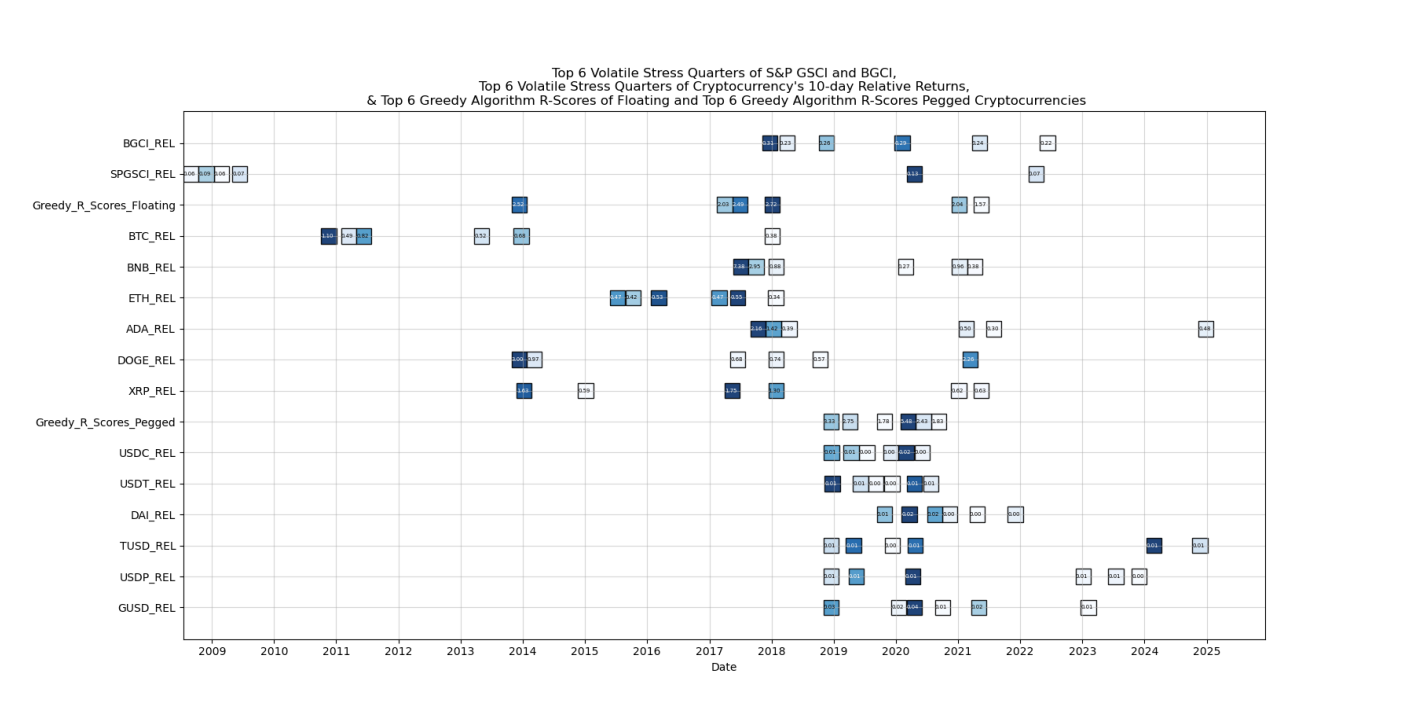

According to authors Anna Amirdjanova, David Lynch, and Anni Zheng, separate risk weights are proposed for “floating” cryptos like Bitcoin (BTC), BNB detailed analysis, Ether (ETH), Cardano (ADA), Dogecoin (DOGE), XRP (XRP), and “pegged” cryptos like stablecoins. An equally weighted benchmark index of six floating cryptos and six pegged stablecoins can be used as a proxy for crypto market volatility.

The crypto benchmark index of six floating cryptocurrencies and six pegged stablecoins used in the paper. Source: Federal Reserve Board

Initial margin requirements are critical as collateral against counterparty default in derivatives markets; due to crypto's high volatility, traders will have to post more collateral. This shows that crypto is being accepted as a maturing asset class. In December, the Fed lifted restrictions limiting banks' crypto interactions.

Critical Support and Resistance Levels for BNB

- Price: $611.80 (+0.19% 24s)

- Supports: S1 $570.30 (Strong, -6.79%), S2 $447.80 (Medium, -26.81%)

- Resistances: R1 $621.44 (Strong, +1.57%), R2 $666.97 (Strong, +9.02%)

- Trend: Downtrend (RSI 24.31, Supertrend Bearish)

Latest news: Binance SAFU fund bought 304M$ BTC, Goldman Sachs holds 1.1B$ BTC, BTC ETFs saw 144.9M$ inflows (Feb 9).

Frequently Asked Questions About BNB and Fed Regulation

How does the Fed's margin proposal affect BNB? Separate risk weights for floating cryptos like BNB could force derivatives traders to post higher collateral, potentially increasing volatility.

Is BNB in a downtrend? Yes, with RSI 24.31 and bearish Supertrend, S1 $570 is critical support.

What do crypto ETF flows say? BTC/ETH inflows support the Fed's maturation signal.

Comments

Other Articles

Oobit Crypto-to-Bank Transfer: 11 Assets Including BNB

February 24, 2026 at 04:34 PM UTC

Bitcoin Rebounds Near $90K, but Analysts Say It’s Not a True Recovery Amid 22% Q4 Drop and Ongoing Market Volatility

December 23, 2025 at 06:30 AM UTC

Franklin Crypto Index ETF Expands Holdings to ADA, LINK, DOGE, SOL, XLM, XRP While Retaining Bitcoin and Ethereum

December 2, 2025 at 04:32 AM UTC