Fidelity Analyst Sees Potential Bitcoin Dip to $65K-$75K in 2026 Cycle

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin’s 2026 outlook points to a potential off year, with prices possibly retreating to $65,000-$75,000 amid its historical four-year halving cycle. Analysts from Fidelity Investments highlight slowed momentum and weak demand as key factors influencing this trajectory, urging investors to monitor global policy shifts.

-

Bitcoin trades below its 2025 opening level of $93,576, signaling persistent sluggishness into the new year.

-

Market activity shows more internal wallet reshuffling than true accumulation, limiting price upside.

-

Regulatory caution and macroeconomic uncertainties, including rate cuts and bond yield rises, contribute to investor hesitancy, per data from Glassnode and Fidelity.

Discover the Bitcoin 2026 outlook: Expert predictions suggest a market winter ahead. Stay informed on crypto trends and prepare your strategy with this in-depth analysis.

What is the Bitcoin 2026 Outlook?

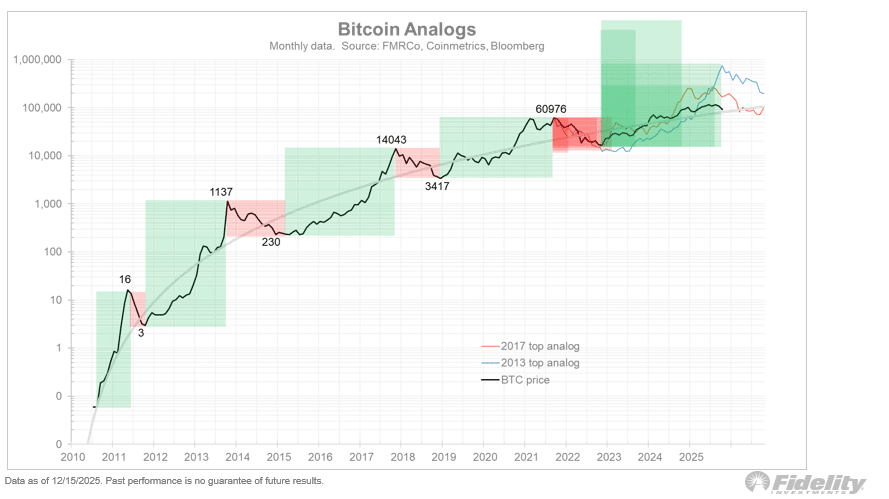

Bitcoin 2026 outlook suggests a challenging period ahead, potentially marking an “off year” for the asset as it follows its established four-year halving cycle. Analysts at Fidelity Investments, a leading global asset manager, indicate that after a prolonged rally phase lasting about 145 months post-halving, Bitcoin could see a retreat to support levels between $65,000 and $75,000. This projection aligns with historical patterns where peak prices, such as the all-time high of $126,000 reached in October 2025, precede broader market corrections.

The four-year halving cycle reduces miners’ rewards, typically sparking rallies that eventually give way to declines. Fidelity’s Director of Global Macro, Jurrien Timmer, emphasized that Bitcoin’s current positioning fits this framework perfectly in both price and timing. As the cryptocurrency remains range-bound below its 2025 opening price of approximately $93,576, overall market momentum has notably slowed, raising concerns about extended underperformance.

Source: Fidelity

Why Is Bitcoin Demand Remaining Weak?

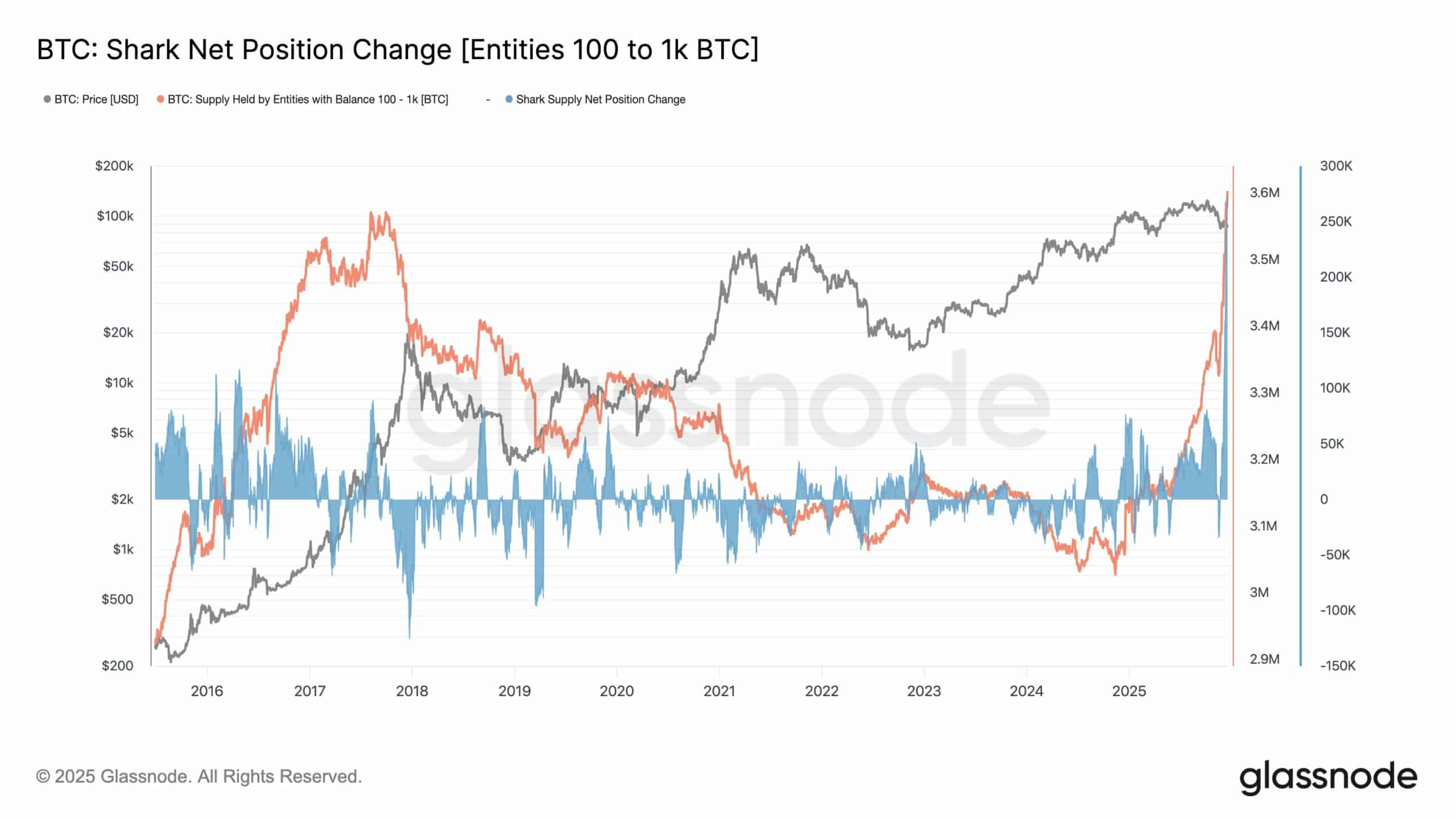

Bitcoin demand has shown minimal signs of sustained growth, with the market exhibiting more reshuffling of holdings than fresh accumulation. On-chain analytics from Glassnode reveal that recent reports of “shark” wallets—those holding 100 to 1,000 BTC—increasing by 270,000 BTC were misleading. Instead, this movement resulted from internal transfers by large entities with over 100,000 BTC, aimed at custody management or risk mitigation rather than net buying.

A senior analyst at Glassnode clarified: “Wallet reshuffling occurs when large entities split or merge balances across addresses to manage custody, risk, or accounting, shifting coins between cohort size brackets without changing true ownership.” While approximately 300,000 BTC shifted from large holders, the net effect was a reduction of about 30,000 BTC in shark wallets, indicating sales rather than accumulation. This lack of genuine demand has kept Bitcoin’s price confined between $85,000 and $93,000, underscoring a broader hesitancy among investors as 2025 concludes.

Supporting data from CoinGlass highlights the role of institutional players. Fidelity’s FBTC ETF, the second-largest Bitcoin ETF in the U.S. with $16.73 billion in holdings, saw a net inflow of 179 BTC—worth around $15.7 million—this week, trailing far behind BlackRock’s IBIT at $65.57 billion. Despite this bullish inflow, the overall market sentiment remains cautious, influenced by these redistribution dynamics.

Source: Glassnode

Regulatory and macroeconomic factors further dampen demand. In the U.S., dovish signals from Federal Open Market Committee rate cuts have been offset by capital outflows tied to rising Japanese bond yields. European markets mirror this uncertainty, leading to a wait-and-see stance among investors. Ray Youssef, CEO of the crypto super app NoOnes, noted in an email statement: “Divergent signals from major sovereign banks, uneven global policy coordination, and mixed guidance on 2026 rate and liquidity pathways have prompted capital to adopt a wait-and-see approach as the year ends.”

Additionally, Jerome de Tychey, President of Ethereum France, observed that growing institutional involvement via ETFs is aligning crypto more closely with traditional markets. He stated: “With ETFs and institutional participation growing, crypto-specific corrections are less probable, but correlation with global markets will increase.” This convergence may erode Bitcoin’s role as a standalone inflation hedge, though it bolsters long-term blockchain adoption.

Frequently Asked Questions

What Factors Are Driving Bitcoin’s Potential Decline in 2026?

The Bitcoin 2026 outlook is shaped by its four-year halving cycle, which historically leads to rallies followed by corrections. Fidelity Investments’ analysis points to a possible retreat to $65,000-$75,000, influenced by slowed momentum and lack of new demand. Global policy divergences and investor caution amid rate cuts and bond yield pressures exacerbate this risk, based on on-chain data from Glassnode.

Is Bitcoin’s Market Showing Signs of True Accumulation?

No, current Bitcoin market activity primarily involves internal wallet reshuffles by large holders rather than genuine buying. Glassnode reports indicate that apparent increases in mid-tier “shark” wallets stemmed from transfers, resulting in a net sell-off of about 30,000 BTC. This explains the asset’s range-bound trading between $85,000 and $93,000 as 2025 ends.

Key Takeaways

- Halving Cycle Influence: Bitcoin’s 2026 outlook aligns with historical patterns, potentially ushering in an off year with prices dipping to $65,000-$75,000, as per Fidelity’s Jurrien Timmer.

- Weak Demand Dynamics: On-chain metrics from Glassnode show reshuffling, not accumulation, with net sales contributing to stagnant prices below $93,576.

- Regulatory Impacts: Dovish U.S. policies and global uncertainties, including Japanese yield rises, are fostering investor caution; monitor ETF flows for early signals of recovery.

Conclusion

The Bitcoin 2026 outlook underscores a period of potential consolidation, driven by the asset’s four-year halving cycle and subdued demand as revealed by Glassnode analytics. With institutional ETFs like Fidelity’s FBTC holding significant positions yet showing mixed flows, and expert insights from figures like Ray Youssef and Jerome de Tychey highlighting increased market correlations, investors should prepare for heightened volatility tied to traditional finance. As blockchain adoption advances, staying attuned to these developments will be crucial for navigating the evolving landscape ahead.