Fidelity, Canary, and VanEck Poised to Launch Solana ETFs Amid Strong Inflows

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

Solana ETFs from Fidelity, Canary, and VanEck are launching soon, providing U.S. investors with regulated access to SOL amid strong demand. These funds, including staking options, signal growing institutional interest despite recent price dips, with Fidelity’s $FSOL set to debut tomorrow at a 25bps fee.

-

New Solana ETFs from Fidelity and Canary launch tomorrow, intensifying competition and boosting regulated SOL exposure for investors.

-

Staking features in Canary and VanEck ETFs offer yield potential, attracting those seeking rewards without direct crypto management.

-

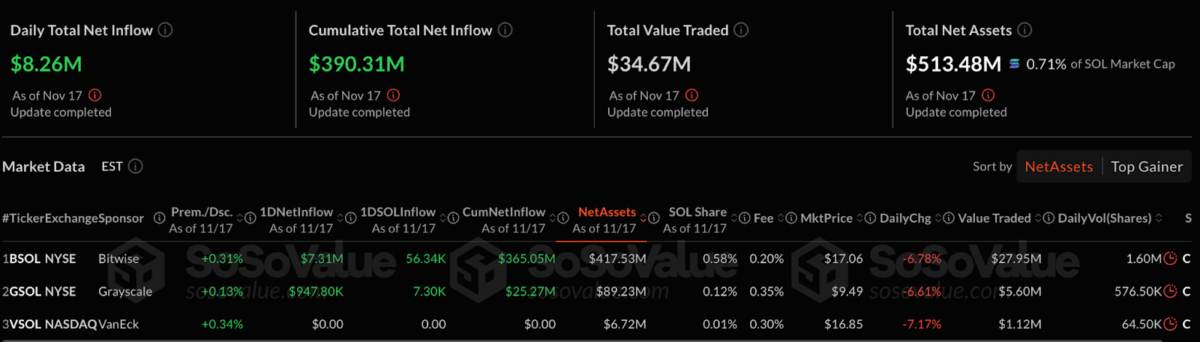

Solana funds saw $8.26 million in inflows on November 17, totaling $390.31 million, representing 0.71% of SOL’s market cap.

Discover how Fidelity, Canary, and VanEck’s new Solana ETFs open regulated doors to SOL investment, with staking yields and strong inflows amid market dips—explore opportunities now.

What are the latest developments in Solana ETFs?

Solana ETFs are advancing rapidly with launches from major players like Fidelity, Canary Funds, and VanEck. Fidelity’s $FSOL ETF is scheduled to debut tomorrow following Nasdaq’s approval, while Canary partners with Marinade Finance for staking management. These developments provide U.S. investors secure, regulated ways to access Solana despite its recent price challenges.

How do staking features enhance Solana ETFs?

Staking-enabled Solana ETFs, such as those from Canary and VanEck, allow investors to earn yields by participating in the Solana network without managing assets directly. Canary’s ETF uses Marinade Finance for staking operations, potentially offering returns based on network validation rewards. VanEck’s fund, with a 0.30% annual fee, collaborates with SOL Strategies for similar functionality. According to Bloomberg ETF analyst Eric Balchunas, these innovations position Solana ETFs as competitive alternatives, with Fidelity’s entry as the largest asset manager in this space. Data from SosoValue shows Solana funds holding $390.31 million in assets, underscoring sustained interest. This structure simplifies crypto investment for institutions and retail participants alike, reducing risks associated with direct staking.

Frequently Asked Questions

What makes Fidelity’s Solana ETF a key launch?

Fidelity’s $FSOL Solana ETF launches tomorrow with a low 25bps fee, making it accessible for broad investor adoption. As the biggest asset manager entering this category—without BlackRock’s involvement—it builds on existing funds like Bitwise’s $BSOL, which has amassed $450 million. This launch highlights Fidelity’s commitment to crypto innovation under regulatory oversight.

Why are investors still buying Solana despite price declines?

Even as Solana trades at $135.81, down 3.25% daily and 27% monthly per CoinMarketCap data, inflows into Solana funds remain robust at $8.26 million on November 17. Investors view these dips as buying opportunities, driven by ETF accessibility and long-term network growth potential, making it a smart move for diversified portfolios.

Key Takeaways

- Intensifying Competition: Fidelity, Canary, and VanEck launches create more options for Solana exposure, with Nasdaq and NYSE approvals paving the way.

- Staking Yields: Partnerships like Marinade Finance and SOL Strategies introduce reward mechanisms, enhancing ETF appeal for yield-seeking investors.

- Strong Inflows: Despite SOL’s slump, $390.31 million in total fund assets signals confidence—consider adding regulated Solana positions now.

Conclusion

The launches of Solana ETFs by Fidelity, Canary, and VanEck mark a pivotal moment for regulated crypto investing, offering staking-integrated options and low fees to capitalize on SOL’s ecosystem. With robust inflows amid market volatility, these funds demonstrate institutional trust in Solana’s future. As competition heats up, investors should monitor these developments for strategic portfolio enhancements in the evolving digital asset landscape.

Fidelity, Canary, and VanEck prepare to launch Solana ETFs, offering investors new regulated ways to gain exposure as SOL demand stays strong.

Key Highlights

- New Solana ETFs from Fidelity and Canary hit the market, signaling rising institutional appetite despite SOL’s recent price slump.

- Strong inflows into Solana funds show investors buying the dip as competition grows among major issuers like Fidelity, Canary, and VanEck.

- Staking-enabled ETFs from Canary and VanEck introduce yield potential, giving U.S. investors fresh regulated avenues to access Solana.

Competition for Solana (SOL) spot exchange-traded funds (ETFs) in the U.S. is set to intensify as Fidelity and Canary Funds prepare launches. According to crypto journalist Eleanor Terrett, Fidelity and Canary will roll out their Solana ETFs in partnership with Marinade Finance at market open tomorrow.

Terrett noted that Marinade Finance will manage staking for Canary’s product. The launches come after Nasdaq cleared the ETFs for listing, marking a crucial regulatory step.

🚨NEW: In addition to @Fidelity, @CanaryFunds will launch their $SOL ETF in partnership with @MarinadeFinance (doing the staking) tomorrow at market open after receiving the green light to list from the @Nasdaq. https://t.co/IAI3TDv6UJ

— Eleanor Terrett (@EleanorTerrett) November 18, 2025

Bloomberg ETF analyst Eric Balchunas confirmed the Fidelity Solana ETF on X, posting, “Fidelity Solana ETF $FSOL is slated to launch TOMORROW. Fee is 25bps. Easily the biggest asset manager in this category with BlackRock sitting out. $BSOL got out first, has $450m, $VSOL launched today, Grayscale is in mix. Game on.” This positions Fidelity as a major player in the Solana ETF competition.

@media only screen and (min-width: 0px) and (min-height: 0px) {

div[id^=”wrapper-sevio-e0d3bc50-0aae-47cc-a8d7-f0c9a0cef941″] {

width: 320px;

height: 100px;

}

}

@media only screen and (min-width: 728px) and (min-height: 0px) {

div[id^=”wrapper-sevio-e0d3bc50-0aae-47cc-a8d7-f0c9a0cef941″] {

width: 728px;

height: 90px;

}

}

Regulatory green light and launch details

Fidelity recently filed its S-1 form on October 30, moving closer to launching the fund. NYSE Arca’s approval followed, signaling readiness for trading under the Securities Act of 1934. Similarly, Nasdaq cleared Canary’s Solana Marinade ETF after receiving its Form 8-A12(b) registration on November 14. The approval confirms that both ETFs can start trading once the Securities and Exchange Commission gives formal notice. Moreover, Nasdaq supports the immediate effectiveness of the filings, allowing trading to begin without delay.

VanEck is also moving forward with its Solana ETF. The fund has a 0.30% annual fee and will work with SOL Strategies to handle staking. This could make VanEck’s ETF stand out by giving investors a chance to earn extra rewards through network participation. As a result, both everyday and institutional investors in the U.S. will have more safe, regulated ways to invest in Solana.

Investor demand and market dynamics

Even with regulatory approvals, Solana’s price is struggling. SOL is trading at $135.81, down 3.25% in a day and 27% over the past month, according to CoinMarketCap. Despite this, investors are still showing strong interest in Solana funds. On November 17, these funds saw $8.26 million in new investments, bringing total inflows since launch to $390.31 million.

US SOL Spot ETF, Source: SosoValue

Bitwise’s BSOL remains the leader, adding $7.31 million in inflows, while Grayscale’s GSOL gained $247,800. VanEck’s VSOL reported no new inflows but holds $6.72 million in net assets. Total trading volume reached $34.67 million, with all Solana ETFs now representing roughly 0.71% of Solana’s market cap. Hence, investors continue adding exposure despite short-term price declines.

The upcoming launches show that crypto ETFs, especially for Solana, are becoming more popular. Investors now have safer, regulated ways to get involved, and steady inflows show strong ongoing interest. With Fidelity, Canary, and VanEck leading the way, these funds could play a big role in shaping how people invest in Solana.

Also Read: BTC Falls Below $90K, ETH Drops Under $3K as Market Fear Deepens

Follow The COINOTAG on Google News to Stay Updated! ![]()

TAGGED:Crypto ETFsSolana (SOL)