Fidelity Suggests Potential Bitcoin Market Bottom Amid Capitulation and Macro Risks

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin’s market bottom may be forming near $90,000 as short-term holder capitulation and extreme fear sentiment align with historical reversal signals, according to Fidelity Digital Assets analysis. This 20-30% drawdown within the bull market suggests a healthy reset before potential higher prices.

-

Short-term holder capitulation: Metrics like the MVRV ratio indicate extreme selling pressure similar to past local bottoms in this bull cycle.

-

Market sentiment at extreme fear levels of 10 has historically preceded rebounds in Bitcoin’s price.

-

Macro factors, including uncertain Federal Reserve rate decisions, could delay a strong reversal despite on-chain positives, with rate pause odds at 66%.

Discover Bitcoin market bottom signals from Fidelity experts amid $90k consolidation. Explore STH capitulation and sentiment insights for informed crypto strategies today.

What Signals a Bitcoin Market Bottom According to Fidelity?

Bitcoin market bottom indicators point to a potential stabilization above $90,000, driven by short-term holder (STH) capitulation and historically low sentiment levels. Fidelity Digital Assets’ Chris Kuiper highlights that the current drawdown mirrors past corrections within bull markets, where the MVRV ratio tests short-term holders before upward momentum resumes. This setup suggests a healthy reset rather than a cycle end.

How Does Short-Term Holder Capitulation Influence Bitcoin’s Price Floor?

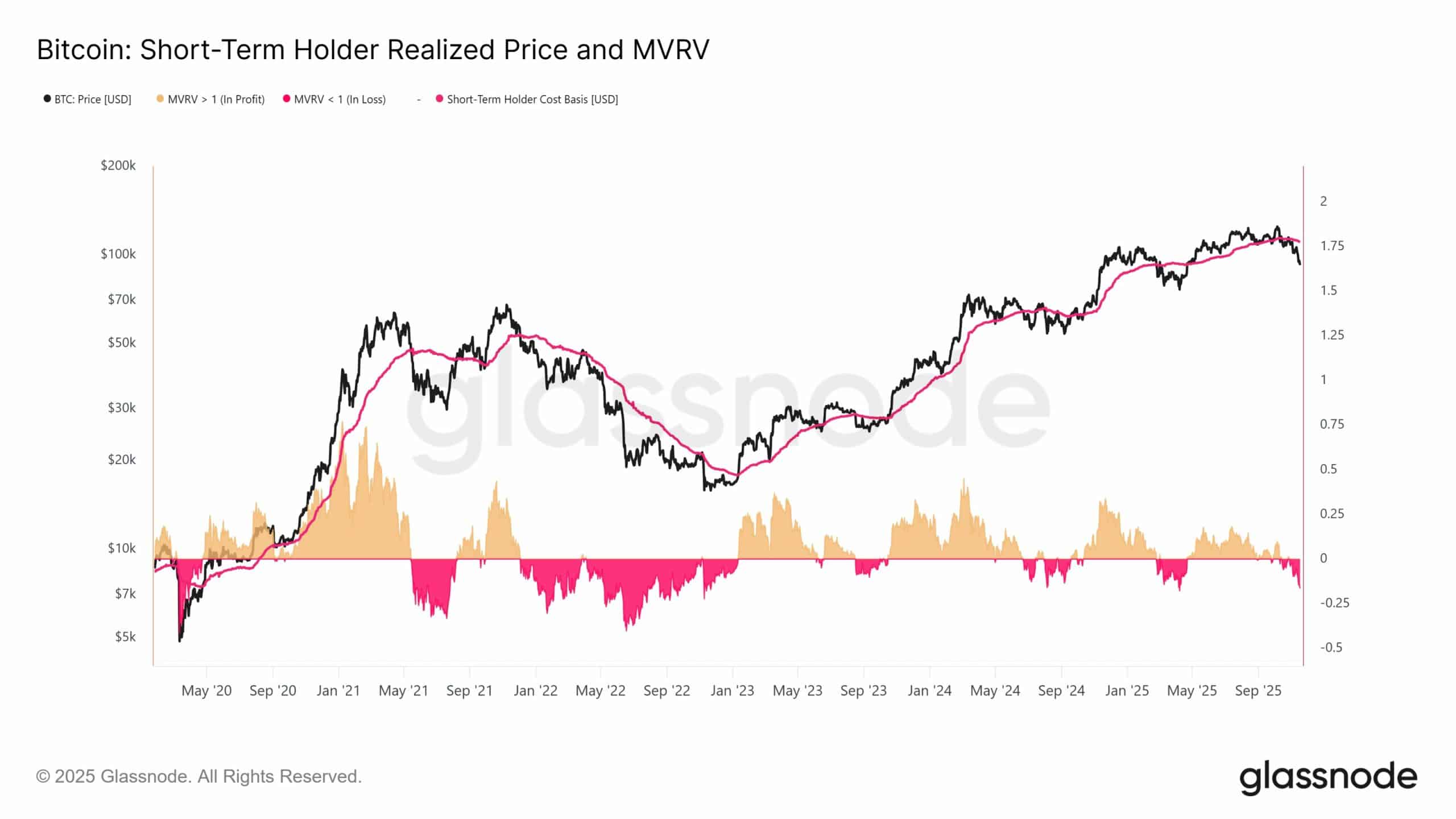

Short-term holder capitulation occurs when recent Bitcoin buyers sell at a loss, flooding the market with supply and pushing prices lower. In the current scenario, the MVRV ratio—a metric comparing market value to realized value—has dipped into negative territory, signaling extreme undervaluation. According to data from Glassnode, this level echoes previous local bottoms during the ongoing bull run, where STHs capitulated before prices reversed. Kuiper notes that such events typically reset market dynamics, allowing long-term holders to accumulate at discounted prices. For instance, similar MVRV valleys in prior drawdowns led to 20-50% rebounds within weeks, underscoring the metric’s predictive power in bull market corrections.

Source: Glassnode

Swissblock analysts have corroborated this view, using the same MVRV data to project market stabilization. The negative readings reflect widespread STH selling, but they also mark capitulation points where selling exhausts itself. Kuiper emphasized, “If this indeed is a regular 20-30% drawdown within the current bull market, then the MVRV ratio is showing a similar valley as before, testing the mettle of short-term holders before resetting to move higher.” This alignment of on-chain metrics provides a data-driven foundation for viewing the current levels as a potential floor.

Complementing the capitulation signals, Bitcoin’s market sentiment has reached an extreme fear level of 10 on the Fear & Greed Index. Historically, readings below 20 have preceded price reversals, as panic selling gives way to bargain hunting. Kuiper added, “These data tips may assess probabilities in favor of this being a regular and healthy drawdown.” Such sentiment extremes, combined with on-chain exhaustion, bolster the case for a Bitcoin market bottom forming soon.

Frequently Asked Questions

What Role Do Macroeconomic Factors Play in Bitcoin’s Potential Rebound?

Macroeconomic uncertainty, particularly around Federal Reserve rate decisions, can hinder Bitcoin’s rebound despite positive on-chain signals. The cancellation of the October Jobs report leaves the Fed with incomplete data for its December meeting, raising the odds of a rate pause to 66% from earlier cut expectations. This shift could pressure risk assets like Bitcoin, delaying recovery until clearer policy signals emerge in the coming weeks.

Is the Current Bitcoin Drawdown Indicative of a Bull Market Continuation?

Yes, the ongoing 20-30% pullback aligns with typical bull market corrections, not a cycle top, based on historical patterns. Analysts like those at Fidelity observe that support levels and sentiment lows often lead to renewed upside. A reclaim of the 50-week Exponential Moving Average would confirm continuation, potentially driving Bitcoin toward new highs in the near term.

Source: BTC/USD, TradingView

While optimism builds from on-chain data, counterarguments highlight risks. Fundstrat’s Tom Lee, echoing Kuiper, stated, “This is the reality in crypto. Near the bottom, but as my friend Eric S says, bottoms are ‘ugly’.” Past drawdowns often rebounded at the 50-week EMA, but the current price action has breached this support, introducing caution. Analyst Benjamin Cowen warned, “One sign of a cycle being over is when you get to ‘Extreme Fear’ and no bounces occur. I would argue that the signs of the top being in continue to mount.” Cowen suggests a bullish flip only if Bitcoin reclaims the 50-week EMA soon, emphasizing the need for price confirmation.

The macroeconomic landscape adds further complexity. Expectations for Federal Reserve rate cuts have waned due to data disruptions. The September Jobs report proceeds as planned on November 20, but the October survey’s absence leaves policymakers with limited insights. Markets have adjusted accordingly: the probability of a 25 basis point cut fell to 33%, while a pause rose to 66%, per the CME FedWatch Tool.

Source: CME FedWatch Tool

This repricing reflects heightened uncertainty, potentially keeping Bitcoin’s volatility elevated. Without a strong catalyst like confirmed rate relief, the market remains susceptible to further downside, even as on-chain indicators hint at exhaustion. Fidelity’s analysis underscores the interplay between micro-level on-chain health and broader economic pressures in shaping Bitcoin’s trajectory.

Broader context reveals Bitcoin’s resilience in this bull cycle. Since early 2024, the asset has navigated multiple 20-30% corrections, each followed by higher lows and progressive all-time highs. The current consolidation above $90,000 positions it well for accumulation, provided external shocks are contained. Institutional interest, evidenced by steady ETF inflows and corporate balance sheet additions, further supports a floor narrative. However, retail sentiment’s extreme fear could prolong sideways action until positive news breaks the impasse.

Looking at comparable historical events, the 2021 bull run saw similar STH capitulation during mid-cycle dips, leading to 100%+ gains post-reversal. Fidelity’s metrics align with this pattern, suggesting the Bitcoin market bottom is likely a temporary shakeout. Yet, vigilant monitoring of the 50-week EMA and Fed developments remains essential for traders navigating this phase.

Key Takeaways

- STH Capitulation as Bottom Signal: The MVRV ratio’s negative territory mirrors past bull market lows, indicating selling exhaustion and a potential price floor.

- Extreme Fear Sentiment: Levels at 10 on the Fear & Greed Index have historically triggered reversals, supporting Fidelity’s healthy drawdown assessment.

- Macro Risks Ahead: Fed rate pause probabilities at 66% underscore uncertainty; monitor the 50-week EMA for rebound confirmation.

Conclusion

In summary, Fidelity’s analysis of Bitcoin market bottom signals through STH capitulation, MVRV ratios, and extreme fear sentiment paints a picture of a routine bull market correction nearing its end above $90,000. While on-chain data favors stabilization, macroeconomic hurdles like Fed policy opacity introduce fragility. Investors should stay informed on key supports and economic releases, positioning for the next upward leg as historical patterns suggest sustained growth ahead.