Figure Technology Eyes Second IPO for Solana-Based Blockchain Equity

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

Figure Technology is pursuing a second IPO to issue blockchain-native equity on Solana, allowing seamless onchain trading and integration with DeFi protocols. This initiative bypasses traditional exchanges, enabling investors to borrow against or lend the tokenized shares directly in the Solana ecosystem.

-

Figure’s filing with the SEC targets native equity issuance on Solana for expanded DeFi applications.

-

Tokenized equity will trade via Figure’s decentralized alternative trading system, independent of Nasdaq or brokers like Robinhood.

-

Solana’s RWA market share has grown significantly in 2025, with tokenized US Treasuries highlighting its high-performance edge, per RedStone research.

Discover Figure’s innovative second IPO on Solana for blockchain-native equity. Unlock DeFi potential beyond stocks—explore tokenized assets today for future-proof investing. (142 characters)

What is Figure’s Second IPO on Solana?

Figure’s second IPO on Solana involves issuing equity tokens directly on the blockchain, marking a shift from traditional markets to decentralized finance. The company, known for its blockchain-based lending and tokenized assets, filed with the U.S. Securities and Exchange Commission (SEC) to launch this native equity product. This allows investors to engage with shares in a fully onchain environment, fostering new DeFi opportunities like collateralized lending.

Figure Technology, a leader in blockchain financial services, builds on its recent Nasdaq debut with this ambitious step. By leveraging Solana’s infrastructure, the firm aims to create a more accessible and efficient equity model.

How Does Blockchain-Native Equity on Solana Enhance DeFi Use Cases?

Blockchain-native equity on Solana revolutionizes asset management by embedding shares directly into smart contracts, enabling instant settlement and interoperability with DeFi platforms. Investors can use these tokens as collateral for loans or yield farming without intermediaries, reducing costs and settlement times to seconds. According to Figure executive chairman Mike Cagney, speaking at the Solana Breakpoint conference, this approach “expands beyond traditional stock markets” by allowing native issuance and trading onchain.

Cagney emphasized that the equity would operate through Figure’s alternative trading system, functioning as a decentralized exchange. This setup avoids reliance on platforms like Nasdaq, the New York Stock Exchange, or brokers such as Robinhood and Goldman Sachs. Instead, it prioritizes Solana’s high throughput for scalable, low-cost transactions.

Source: Solana

Furthermore, Figure plans to extend this model to other companies, facilitating native Solana equity issuance. Cagney stated, “One of the focus points that we have is not only bringing that equity over to the Solana ecosystem but allowing for native Solana equity issuance as well.” This could democratize access to capital markets, particularly for fintech innovators seeking blockchain integration.

Supporting data from industry analysts underscores Solana’s suitability for such innovations. The network processes over 2,000 transactions per second with sub-second finality, making it ideal for high-volume asset tokenization. As tokenized assets grow, projected to reach $10 trillion by 2030 according to Boston Consulting Group, Solana’s efficiency positions it as a key player.

Frequently Asked Questions

What Makes Figure’s Solana Equity Different from Traditional IPOs?

Figure’s Solana equity differs by issuing shares natively on the blockchain, enabling decentralized trading and DeFi interactions without centralized exchanges. This 40-50 word setup allows direct onchain use, such as lending tokens for yield, while complying with SEC regulations for tokenized securities.

Why Choose Solana for Tokenized Equity Issuance?

Solana stands out for tokenized equity due to its exceptional speed, low fees, and robust ecosystem for real-world assets. With fast transaction finality and support for complex smart contracts, it naturally integrates with DeFi protocols, making it a go-to choice for innovative financial products as voiced by experts like Bitwise CIO Matt Hougan.

Tokenization on Solana is Gaining Momentum

Solana has solidified its role as a premier blockchain for tokenized assets, with activity metrics showing steady expansion in the real-world asset (RWA) sector throughout 2025. While Ethereum remains a leader in overall tokenization volume, Solana’s advantages in speed and cost are drawing institutional interest, particularly for stablecoins and securities.

Matt Hougan, chief investment officer at Bitwise, predicts Solana will emerge as the financial industry’s preferred network for these applications. He notes that as Wall Street assesses tokenized assets’ viability, factors like high throughput and quick finality—where Solana excels—will drive adoption over slower competitors.

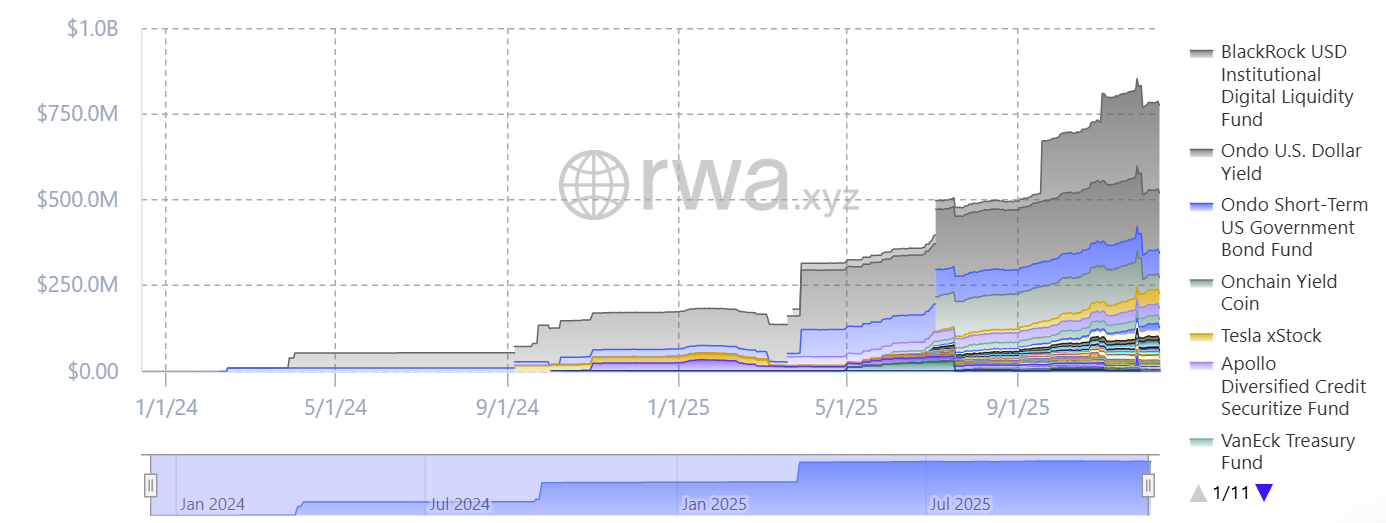

Research from RedStone positions Solana as a “high-performance challenger” in RWAs, especially in tokenized U.S. Treasury markets. The platform’s RWA metrics, excluding stablecoins, reflect robust growth, with market share increasing by over 25% year-over-year. This momentum aligns with broader trends, where tokenized assets are bridging traditional finance and blockchain.

Solana’s RWA metrics, excluding stablecoins. Source: RWA.xyz

Figure’s initiative contributes to this trend by pioneering equity tokenization, potentially setting a precedent for corporate adoption. Industry observers, including those from Deloitte, highlight how such moves could streamline capital raising, with onchain equity offering 24/7 liquidity and global accessibility. As more firms explore Solana, the ecosystem’s total value locked in RWAs is expected to surpass $5 billion by year-end, per Chainalysis reports.

Key Takeaways

- Decentralized Equity Trading: Figure’s Solana IPO enables onchain issuance, bypassing traditional brokers for faster, cost-effective access to shares.

- DeFi Integration Boost: Token holders can leverage equity in protocols for lending or borrowing, expanding utility beyond mere ownership, as per Cagney’s vision.

- Solana’s RWA Growth: With rising metrics in tokenized assets, Solana is poised to capture more market share—consider exploring DeFi opportunities on the network today.

Conclusion

Figure’s second IPO on Solana represents a pivotal advancement in blockchain-native equity, integrating tokenized assets with DeFi for enhanced liquidity and innovation. As Solana’s RWA ecosystem flourishes, driven by high-performance features and expert endorsements, this move signals a transformative era for financial services. Investors and companies alike should monitor these developments, preparing to capitalize on the onchain equity revolution ahead.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026