Fitch Ratings Flags Potential Rating Risks for US Banks with Significant Crypto Exposure

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Fitch Ratings has warned that significant cryptocurrency exposure could lead to negative reassessments of US banks’ ratings due to risks like volatility and compliance issues, despite opportunities in fees and efficiency.

-

Key risks include reputational damage and operational challenges from crypto volatility.

-

Crypto integrations offer banks new revenue through stablecoin issuance and blockchain efficiency.

-

Over 50% of major US banks are involved in crypto, heightening potential systemic impacts per Fitch data.

Discover Fitch Ratings’ warnings on crypto risks for US banks, including volatility and stablecoin threats. Learn how this affects major institutions and what banks must address for safer adoption. Stay informed on crypto banking trends today.

What are the crypto risks for US banks according to Fitch Ratings?

Fitch Ratings crypto risks for US banks encompass reputational, liquidity, operational, and compliance challenges stemming from significant cryptocurrency exposure. While blockchain technologies can enhance customer service and payment efficiency, Fitch emphasizes that volatility in crypto values and pseudonymity of owners pose substantial hurdles. Banks must mitigate these to avoid negative rating revisions that could increase borrowing costs and erode investor confidence.

How do stablecoins impact the financial system per Fitch analysis?

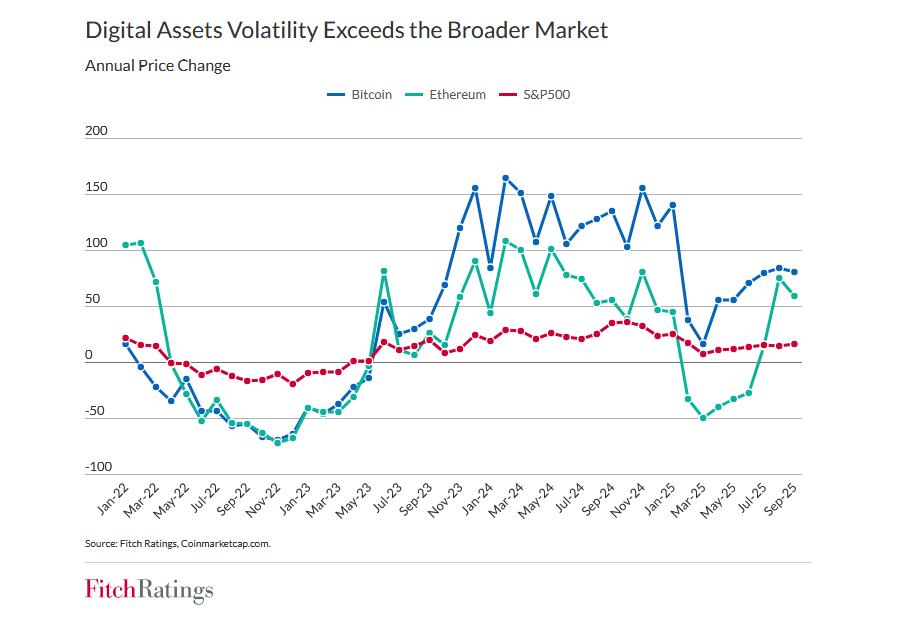

Fitch Ratings highlights that the rapid growth of stablecoins could introduce systemic risks if their adoption scales to influence broader markets like the Treasury sector. For instance, high penetration of USD-linked stablecoins might weaken monetary transmission mechanisms, creating opacity in transactions similar to unofficial dollarization. According to Fitch’s report, banks involved in stablecoin issuance face amplified liquidity pressures during market stress, as evidenced by historical crypto price swings that exceeded those of traditional assets like the S&P 500 by factors of up to 10 times in volatility. Expert analysts at Fitch note, “Financial system risks could also increase if adoption of stablecoins expands, particularly if it reaches a level sufficient to influence the Treasury market.” This underscores the need for robust safeguards, including enhanced regulatory oversight, to protect institutional stability. Moody’s, another leading agency, echoes these concerns in its September analysis, warning that widespread stablecoin use could undermine the US dollar’s legitimacy by shifting pricing and settlement outside traditional channels. Banks like JPMorgan Chase and Citigroup, which have piloted blockchain-based stablecoin projects, must balance innovation with risk management to prevent cascading effects on the economy. Data from recent market reports show stablecoin market capitalization surpassing $150 billion in 2025, amplifying these potential vulnerabilities. Fitch advises that without adequate protections against loss or theft of digital assets, banks’ franchise benefits remain unrealized amid ongoing regulatory evolution in the US.

Bitcoin and Ether volatility vs S&P 500. Source: Fitch Ratings

International credit rating agency Fitch Ratings has issued a cautionary report on the implications of cryptocurrency for US banks. As one of the Big Three agencies alongside Moody’s and S&P Global Ratings, Fitch’s assessments carry substantial influence on financial perceptions and investment decisions.

The report outlines that while crypto offers banks opportunities to generate new revenue streams through fees, yields, and operational efficiencies, it also introduces risks that could prompt rating downgrades. Stablecoin issuance, deposit tokenization, and blockchain adoption can improve customer services like faster payments and smart contracts, leveraging the technology’s inherent speed.

However, Fitch stresses that concentrated digital asset exposures may lead to negative reassessments of business models or risk profiles. Challenges include the inherent volatility of cryptocurrency values, the pseudonymity of digital asset owners, and vulnerabilities to loss or theft, all of which banks must address to fully capitalize on these innovations.

Regulatory progress in the US is fostering a more secure environment for cryptocurrency, yet persistent hurdles remain. Fitch’s analysis draws on extensive market data, showing how crypto’s price fluctuations—often far more extreme than those in equities—can strain bank liquidity during downturns.

Major institutions such as JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo have deepened their involvement in the crypto sector, exploring blockchain for internal efficiencies and client offerings. A potential downgrade from Fitch could result in diminished investor trust, elevated borrowing expenses, and obstacles to expansion for these banks.

Beyond individual institutions, Fitch points to broader systemic concerns, particularly from stablecoins. Their explosive growth, with market volumes now in the hundreds of billions, risks spilling over into core financial infrastructure if unchecked.

Moody’s recent report from late September reinforces this, stating that high adoption of USD-linked stablecoins could erode monetary policy effectiveness. “This creates cryptoization pressures analogous to unofficial dollarization, but with greater opacity and less regulatory visibility,” Moody’s analysts observed.

In the context of traditional finance’s evolving relationship with crypto, sentiment has improved, with Bitcoin traders eyeing resistance levels around $93,000. Yet, these advancements do not negate the foundational risks Fitch identifies.

Crypto projects continue to navigate tensions between privacy features and anti-money laundering requirements, a dilemma that indirectly affects banks’ compliance burdens when partnering with such entities.

Frequently Asked Questions

What specific crypto exposures are prompting Fitch’s warnings for US banks?

Fitch Ratings focuses on banks with significant holdings in cryptocurrencies, stablecoin operations, or blockchain integrations. These exposures heighten risks from market volatility and regulatory scrutiny, potentially leading to rating changes that impact capital access and operational costs for institutions like JPMorgan and Citigroup.

Why might stablecoin growth threaten the US financial system according to rating agencies?

Rating agencies like Fitch and Moody’s explain that as stablecoins grow, they could disrupt Treasury markets and monetary transmission by enabling off-chain settlements. This opacity increases systemic vulnerabilities, similar to dollarization risks, urging banks to strengthen safeguards against liquidity shocks in voice-activated financial queries.

Key Takeaways

- Crypto Opportunities vs. Risks: Banks can boost efficiency with blockchain but face volatility-driven rating downgrades if exposures are unmanaged.

- Stablecoin Systemic Impact: Rapid adoption may influence Treasury stability, amplifying liquidity and compliance challenges across the sector.

- Regulatory Imperative: US banks should prioritize protections against theft and pseudonymity to realize franchise benefits without eroding investor confidence.

Conclusion

In summary, Fitch Ratings crypto risks for US banks highlight the dual-edged nature of digital assets, offering revenue potential through stablecoins and blockchain while posing reputational and operational threats from volatility. As agencies like Moody’s concur on stablecoin systemic dangers, banks must navigate these carefully amid regulatory advancements. Looking ahead, proactive risk management will be key for institutions to thrive in this evolving landscape—explore more insights on en.coinotag.com to stay ahead of crypto-finance trends.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026