Flow Exploit Drains $3.9M, FLOW Drops 46% to New Low with Recovery in Question

RUNE/USDT

$11,817,699.87

$0.4010 / $0.3740

Change: $0.0270 (7.22%)

-0.0166%

Shorts pay

Contents

The Flow blockchain hack on December 27, 2025, exploited a vulnerability in its execution layer, resulting in $3.9 million stolen. The Flow Foundation halted network exits, flagged attacker wallets, and secured user funds while exchanges suspended FLOW deposits.

-

2025 crypto hacks exceeded $2.7 billion, per TRM Labs data.

-

North Korean-linked exploits rose 51% to $2.02 billion, according to Chainalysis.

-

FLOW token price plunged 46% to an all-time low of $0.097 before partial rebound.

Flow blockchain hack: $3.9M exploited, FLOW crashes 46% to $0.097. Network response safeguards users amid surging 2025 crypto thefts. Explore causes, market impact, and recovery signs now!

What is the Flow blockchain hack?

The Flow blockchain hack occurred on December 27, 2025, when attackers exploited a vulnerability in Flow’s execution layer, siphoning $3.9 million from the network. The Flow Foundation quickly identified the breach, halted all exit paths to prevent further losses, and coordinated with Circle, Tether, and exchanges to flag and freeze the attacker’s wallet. User balances remained fully intact throughout the incident.

As crypto adoption has grown mainstream, security risks have escalated dramatically. TRM Labs data shows over $2.7 billion in crypto exploited in 2025 alone, while Chainalysis reports a 51% surge in North Korea-linked hacks, from $1.4 billion to $2.02 billion. The Flow incident underscores the persistent threats facing even established blockchains.

How did the Flow blockchain hack impact the FLOW price?

Forensic analysis revealed the stolen funds routed through bridges like Celer, Debridge, Relay, and Stargate, then laundered via Thorchain and Chainflip. This prompted immediate market panic: holders dumped aggressively, driving FLOW price down 46% from $0.17 to a record low of $0.097, before a slight rebound to $0.117 at press time—a 32.54% daily drop. Market capitalization shrank from $284 million to $164 million due to massive outflows.

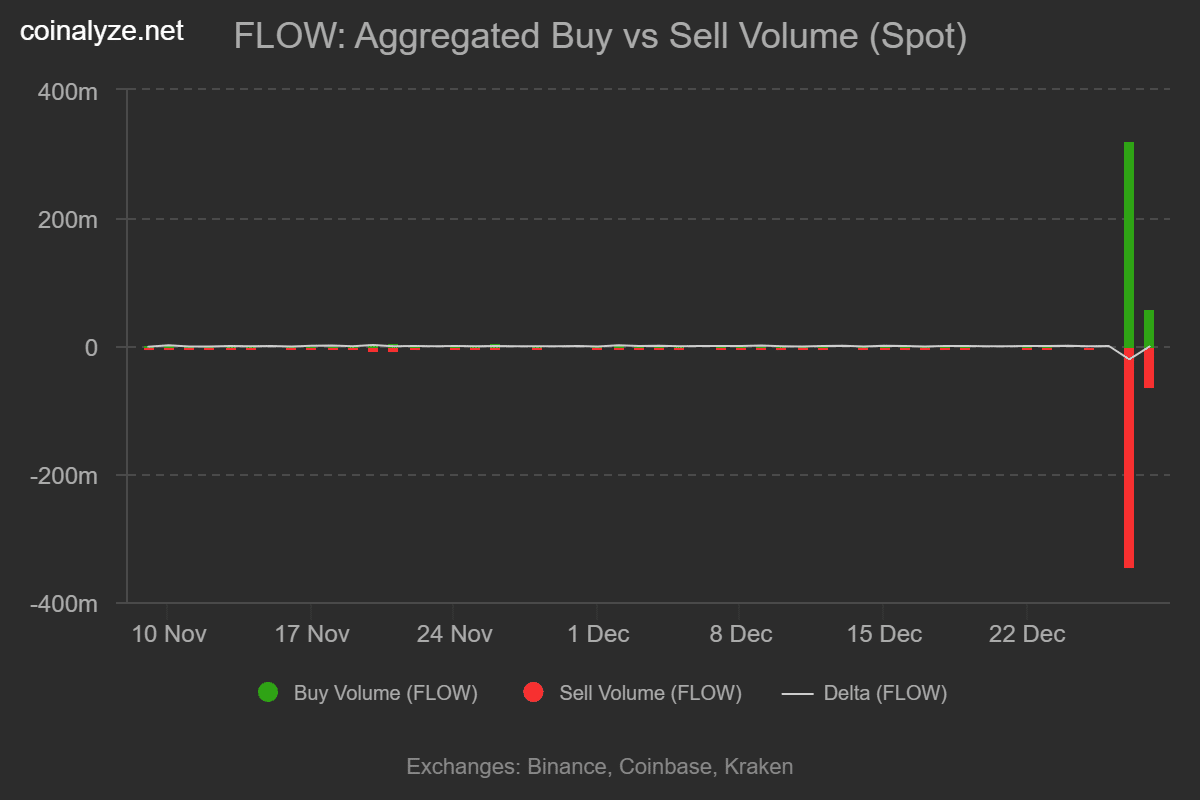

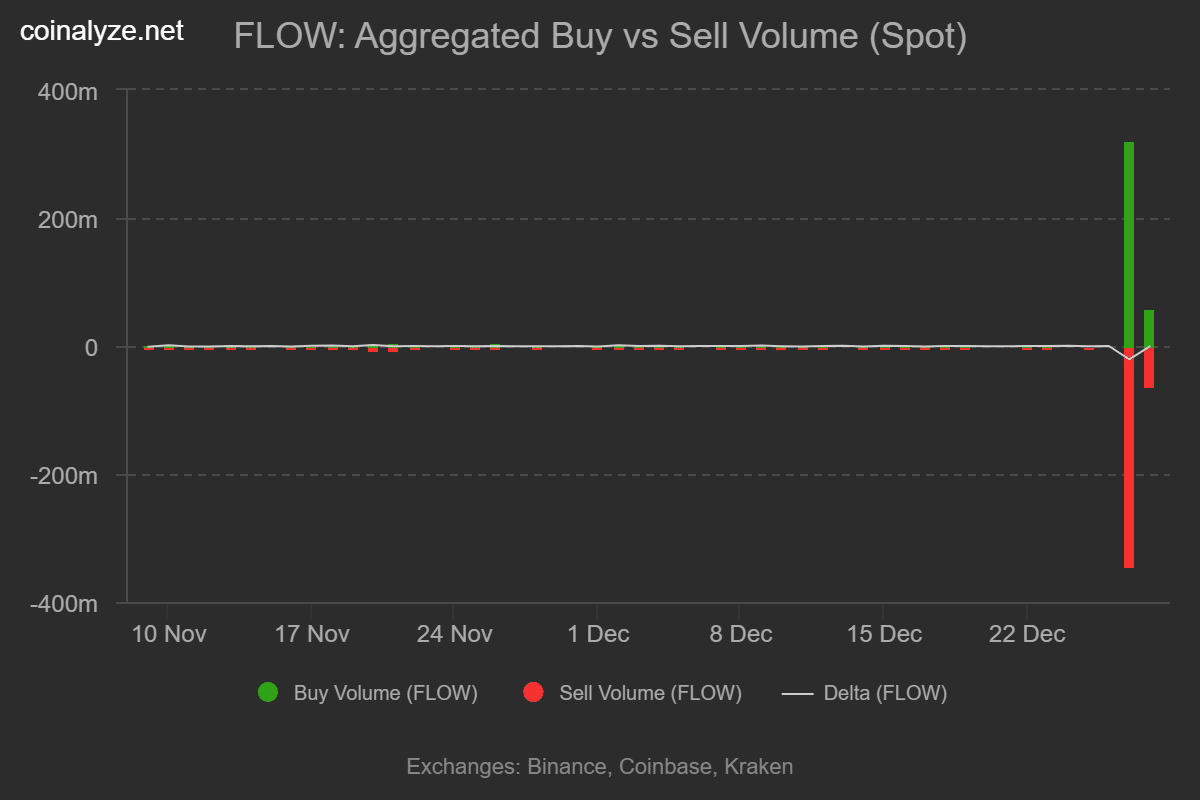

Coinalyze data highlights seller dominance on platforms like Binance, Kraken, and Coinbase, with $405 million in sell volume versus $382 million in buy volume, yielding a 23 million sell bull delta.

Source: Coinalyze

Exchanges Upbit and Bithumb suspended FLOW deposits and withdrawals to mitigate risks. Technical indicators confirmed bearish momentum: the Directional Movement Index (DMI) fell to 5, signaling strong downside pressure.

Source: TradingView

The Relative Strength Index (RSI) declined from 29 to 19, entering deep oversold territory. This combination points to potential further declines toward $0.10 support if panic selling continues, though bargain hunters could spark recovery to $0.17 pre-hack levels.

Flow, known for scalable architecture supporting NFTs and gaming, now faces scrutiny on execution layer security. The swift response minimized damage, aligning with industry best practices amid rising sophisticated attacks.

Frequently Asked Questions

What caused the $3.9 million Flow blockchain hack in 2025?

An attacker targeted a vulnerability in Flow’s execution layer on December 27, 2025, extracting $3.9 million. Funds moved via bridges including Celer and Debridge, then laundered through Thorchain. The Flow Foundation halted exits and flagged wallets, ensuring no user funds were lost.

Will the FLOW token price recover after the blockchain hack?

Yes, partial recovery occurred from $0.097 to $0.117 after the initial 46% drop. Oversold RSI at 19 and DMI at 5 suggest downside risks persist, but discount buying could push it back toward $0.17 if market confidence returns.

Key Takeaways

- Execution layer exploit: Attacker stole $3.9M from Flow on December 27, 2025, but user funds stayed safe.

- Price volatility: FLOW fell 46% to $0.097 amid panic selling, with $405M sell volume dominating.

- Path forward: Monitor RSI and DMI for recovery signals; strengthen blockchain security to prevent repeats.

Conclusion

The Flow blockchain hack highlights 2025’s escalating crypto security challenges, with $2.7 billion stolen industry-wide per TRM Labs. Despite the $3.9 million loss and sharp FLOW price decline, rapid network halts and asset freezes protected users. As investigations continue, enhanced protocols could bolster resilience—investors should track technical indicators for rebound opportunities.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/27/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/26/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/25/2026

DeFi Protocols and Yield Farming Strategies

2/24/2026