From ETH Mining Origins, CoreWeave Pursues $2B Raise for AI Infrastructure Expansion

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

CoreWeave is raising $2 billion through a convertible senior note offering due in 2031 to expand its AI infrastructure, following a failed acquisition attempt of Core Scientific for additional power capacity. Proceeds will support general corporate needs and capped-call transactions to minimize shareholder dilution.

-

Funding Details: $2 billion private offering with an option for $300 million more, settling in cash, shares, or a combination.

-

Strategic Pivot: Originally founded for Ethereum mining, CoreWeave shifted to AI-focused cloud computing in 2019.

-

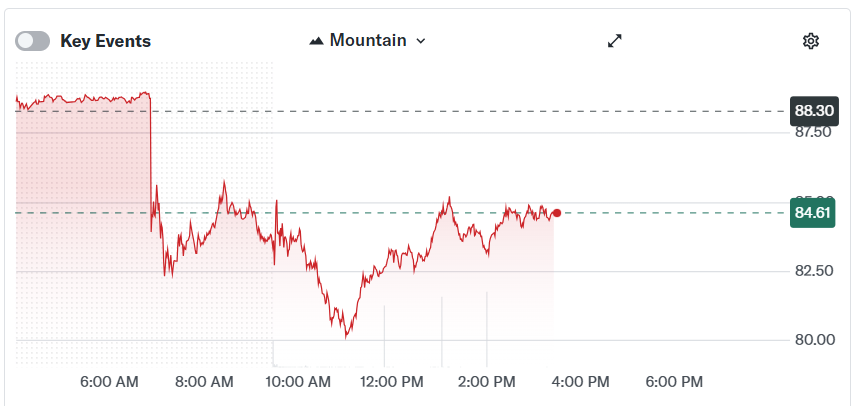

Market Reaction: Shares dropped as much as 9.2% on the announcement, reflecting investor concerns over dilution risks, per market data.

Discover how CoreWeave’s $2 billion convertible note offering fuels AI growth amid crypto roots. Explore the failed Core Scientific bid and implications for infrastructure scaling. Stay informed on key developments.

What is CoreWeave’s $2 Billion Convertible Note Offering?

CoreWeave’s $2 billion convertible note offering involves issuing private convertible senior notes maturing in 2031 to fund its expanding AI infrastructure operations. The proceeds will be used for general corporate purposes, including potential expansions of its data center network, and for entering capped-call transactions designed to reduce dilution if the notes convert to equity. Announced on Monday, this move provides financial flexibility while addressing shareholder protection through hedging mechanisms.

How Does CoreWeave’s Failed Core Scientific Acquisition Impact Its Strategy?

CoreWeave’s year-long pursuit of Core Scientific, culminating in a rejected $9 billion bid, highlighted its need for substantial power capacity to support AI workloads. The acquisition targeted 1.3 gigawatts across Core Scientific’s sites, which could have bolstered CoreWeave’s GPU-intensive computing capabilities without returning to crypto mining. As reported by sources like Cointelegraph, the deal’s failure in late 2024 stemmed from shareholder rejection amid rising stock prices, forcing CoreWeave to seek alternative funding avenues like the current note offering. This event underscores the competitive landscape for energy resources in AI infrastructure, where data centers demand reliable, high-capacity power. Industry experts note that such pursuits demonstrate CoreWeave’s proactive approach to scaling, even as it distances itself from its mining origins. With over 33 operational facilities as of 2025, the company continues to prioritize AI over cryptocurrency activities.

CoreWeave stock reacted negatively to the private note offering, falling as much as 9.2% on Monday. Source: Yahoo Finance

CoreWeave, ticker CRWV, experienced immediate market pressure following the announcement. The stock’s decline of up to 9.2% illustrates investor sensitivity to financing structures that could lead to equity dilution, a common concern in high-growth tech sectors. Despite this, the capped-call transactions aim to mitigate such effects by raising the effective conversion price, offering a buffer for existing shareholders.

Founded in 2017 as Atlantic Crypto, the company initially leveraged GPUs for Ethereum mining. As cryptocurrency markets cooled, CoreWeave pivoted in 2019 toward cloud services and high-performance computing, eventually channeling its resources into AI applications. This evolution has positioned it as a key player in the AI infrastructure space, operating a specialized network of data centers optimized for machine learning and data processing tasks.

The latest fundraising does not specify allocations for new site developments, but given CoreWeave’s growth trajectory, it could enhance its existing 33-plus facilities. This comes at a time when AI demand surges, driving similar moves in the sector, such as TeraWulf’s $500 million raise, betting on AI as an extension of Bitcoin-era infrastructure.

Frequently Asked Questions

What triggered CoreWeave’s pursuit of Core Scientific?

CoreWeave sought Core Scientific to gain access to 1.3 gigawatts of power capacity for its AI and cloud computing needs, starting with an initial offer in June 2024 that was rejected. The effort lasted over a year but ended when shareholders voted down the $9 billion proposal due to escalating share prices.

How will the convertible notes be settled if converted?

The notes can be settled in cash, shares of CoreWeave stock, or a combination at the company’s discretion, providing operational flexibility while the capped-call hedges protect against excessive dilution for current investors.

Key Takeaways

- Strategic Funding Boost: The $2 billion offering, with a $300 million option, equips CoreWeave to scale AI infrastructure amid rising computational demands.

- Dilution Safeguards: Capped-call transactions raise the conversion price, balancing growth financing with shareholder interests in a volatile market.

- Power Capacity Focus: The failed Core Scientific bid reveals ongoing challenges in securing energy for AI, pushing reliance on alternative capital sources.

Conclusion

CoreWeave’s $2 billion convertible note offering marks a pivotal step in fortifying its AI infrastructure amid the evolving landscape once rooted in cryptocurrency mining. By addressing power needs through diversified funding rather than acquisitions like the thwarted Core Scientific deal, the company demonstrates resilience and foresight. As AI workloads proliferate, investors should monitor how these resources propel CoreWeave’s network expansion, potentially setting benchmarks for the sector’s intersection with crypto heritage.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026