Gemini Launches US-Wide Prediction Markets, Including Bitcoin Price Bets, After CFTC Nod

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Gemini has launched its prediction markets nationwide across all 50 US states after receiving CFTC approval, allowing users to trade on real-world events through yes/no questions with instant execution and full transparency.

-

Gemini Predictions enables trading on events like Bitcoin prices via affiliate Gemini Titan.

-

The platform integrates into Gemini’s super app, combining crypto trading, staking, and tokenized assets.

-

Over 80% of US crypto users now access prediction markets amid a surge in industry adoption post-2025 regulatory shifts.

Gemini prediction markets launch in US: Trade events with crypto securely after CFTC nod. Explore yes/no bets on Bitcoin, stocks—join the super app revolution now! (148 characters)

What Are Gemini Prediction Markets?

Gemini prediction markets represent a new feature from the cryptocurrency exchange, enabling users to wager on the outcomes of real-world events using digital assets. Launched nationwide in the United States following approval from the Commodity Futures Trading Commission, these markets allow for binary yes/no trading with near-instant execution. This addition positions Gemini as a comprehensive platform for crypto enthusiasts seeking diverse financial tools beyond traditional trading.

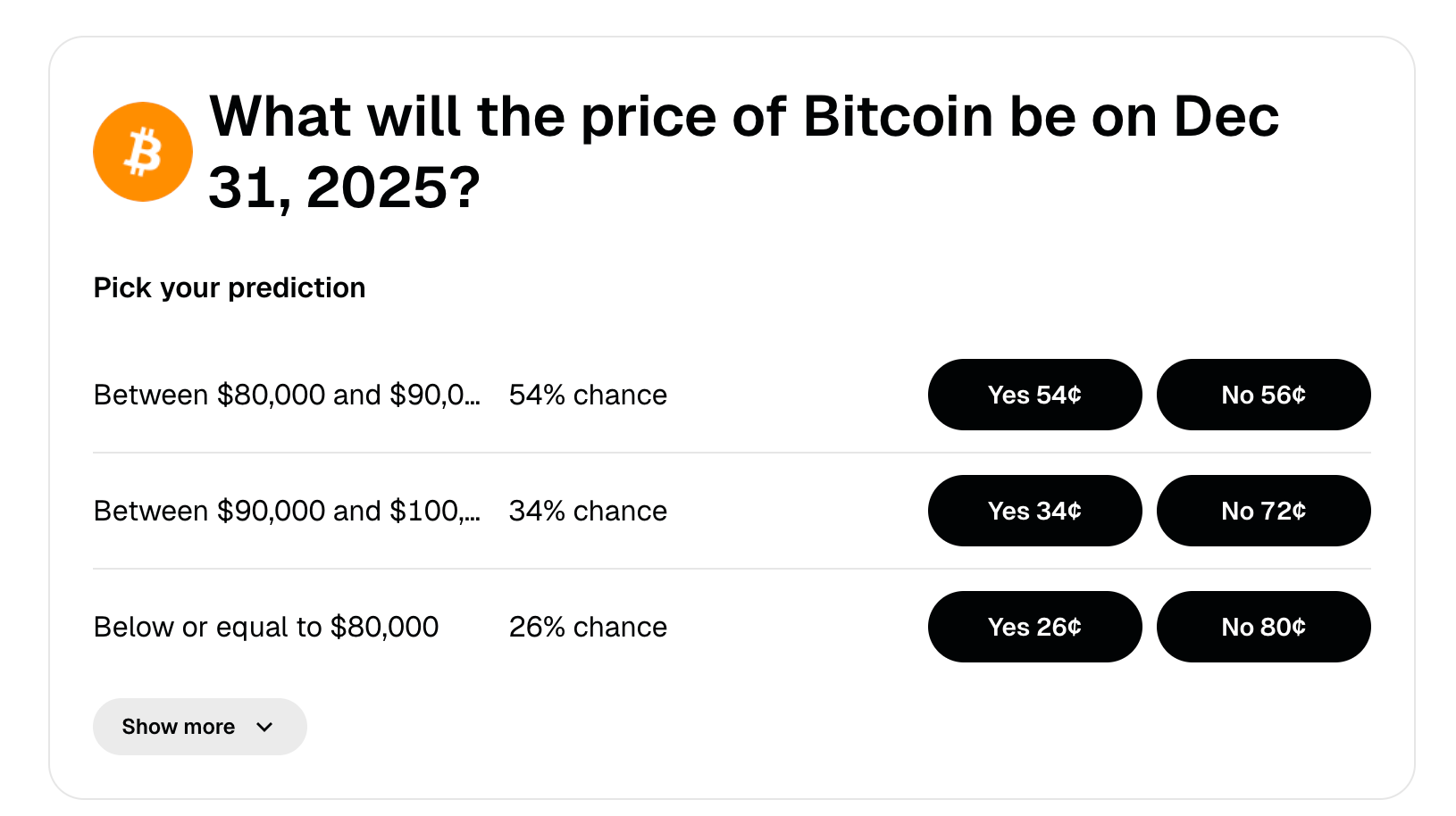

Gemini Prediction’s market on the price of Bitcoin on Dec. 31. Source: Gemini

How Do Gemini’s Everything Apps Fit Into the Crypto Trend?

Gemini’s expansion into prediction markets underscores a broader movement in the cryptocurrency sector toward creating all-encompassing “everything apps” that bundle multiple services. Users can now seamlessly trade cryptocurrencies, stake assets for rewards, purchase tokenized versions of traditional stocks, and engage in event-based betting—all within one interface. According to industry analysts, this integration could boost user retention by up to 40%, as reported in recent financial reviews from sources like the CFTC’s market oversight reports. The platform’s transparency ensures every trade is verifiable on the blockchain, reducing risks associated with centralized systems. Experts, including regulatory consultants familiar with CFTC guidelines, note that such innovations align with evolving US policies aimed at fostering controlled innovation in digital finance. Short sentences highlight key benefits: instant settlements minimize latency, while diversified offerings attract both novice and experienced traders. This step by Gemini, founded by the Winklevoss twins, builds on their established reputation for compliance-focused crypto solutions, drawing from over a decade of exchange operations.

The cryptocurrency landscape has seen a rapid evolution, with prediction markets gaining traction as tools for hedging and speculation. Gemini’s launch via its affiliate, Gemini Titan, which secured a designated contract market license last week, exemplifies this shift. Previously limited by regulatory hurdles, these markets now operate legally across the country, providing users with opportunities to predict outcomes on topics ranging from economic indicators to cryptocurrency price milestones. Data from similar platforms indicates average daily volumes exceeding $50 million in early adopters, suggesting strong market demand. Financial experts emphasize the importance of such regulated environments, quoting a CFTC spokesperson who stated, “Licensed markets promote fair competition and protect consumers from undue risks.” Gemini’s approach ensures users maintain control over their assets, integrating prediction trading without requiring separate accounts or transfers.

Beyond core trading, Gemini Predictions enhances the user experience by offering educational resources on event probabilities and risk management. This feature set is particularly appealing in a sector where volatility remains a constant challenge. As crypto firms compete to offer multifaceted services, Gemini’s nationwide rollout sets a benchmark for accessibility and reliability. Stakeholders in the industry, from venture capitalists to everyday investors, view this as a pivotal moment for mainstream adoption of advanced financial instruments in the digital age.

Frequently Asked Questions

What Is the Regulatory Status of Gemini Prediction Markets in the US?

Gemini Prediction Markets operate under a designated contract market license issued by the Commodity Futures Trading Commission to Gemini Titan, enabling legal nationwide access in all 50 states. This approval ensures compliance with federal oversight, focusing on transparent trading and consumer protection without the need for state-by-state variations.

Can Users Trade Bitcoin Price Predictions on Gemini’s Platform?

Yes, Gemini Predictions allows trading on Bitcoin prices and other real-world events through simple yes/no questions, designed for quick and easy participation. This feature integrates smoothly with your existing Gemini account, providing real-time updates that work well for voice searches on mobile devices or assistants.

Key Takeaways

- Regulatory Milestone: Gemini Titan’s CFTC license clears the path for secure, nationwide prediction markets, emphasizing compliance in crypto innovations.

- Super App Expansion: The launch adds event trading to crypto, staking, and tokenized stocks, creating a unified platform for diverse financial activities.

- Industry Momentum: Join the trend by exploring Gemini Predictions to hedge risks on events like Bitcoin milestones—start with small trades for informed insights.

Source: Polymarket

The push toward integrated crypto platforms continues to reshape user engagement, with Gemini prediction markets leading the charge in the US market. As regulatory frameworks mature, these tools offer practical ways to navigate uncertainties in both traditional and digital finance. Investors are encouraged to review platform features and consult financial advisors to leverage opportunities responsibly, looking ahead to further innovations in 2025 and beyond.

Conclusion

In summary, Gemini prediction markets mark a significant advancement in accessible crypto trading, bolstered by CFTC approval and integrated into a robust everything app ecosystem. This development, alongside secondary features like tokenized assets, reflects the sector’s commitment to comprehensive, user-centric solutions. As the industry progresses, staying informed on such platforms will empower users to make strategic decisions in an ever-evolving financial landscape—consider integrating these tools into your portfolio today for enhanced diversification and real-time event insights.