Global Liquidity Surge Hints at Potential Bitcoin Rebound Despite Bearish Trends

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The crypto market has lost over $1.37 trillion in capitalization in 79 days due to outflows, but isolated capital from global liquidity at $147 trillion could signal a potential rebound if financial stress eases.

-

Global liquidity surge: Reached $147 trillion, typically boosting risk assets like Bitcoin.

-

Investors shifting to safe havens: Gold hit $4,420 per ounce, stablecoins grew to $308.88 billion.

-

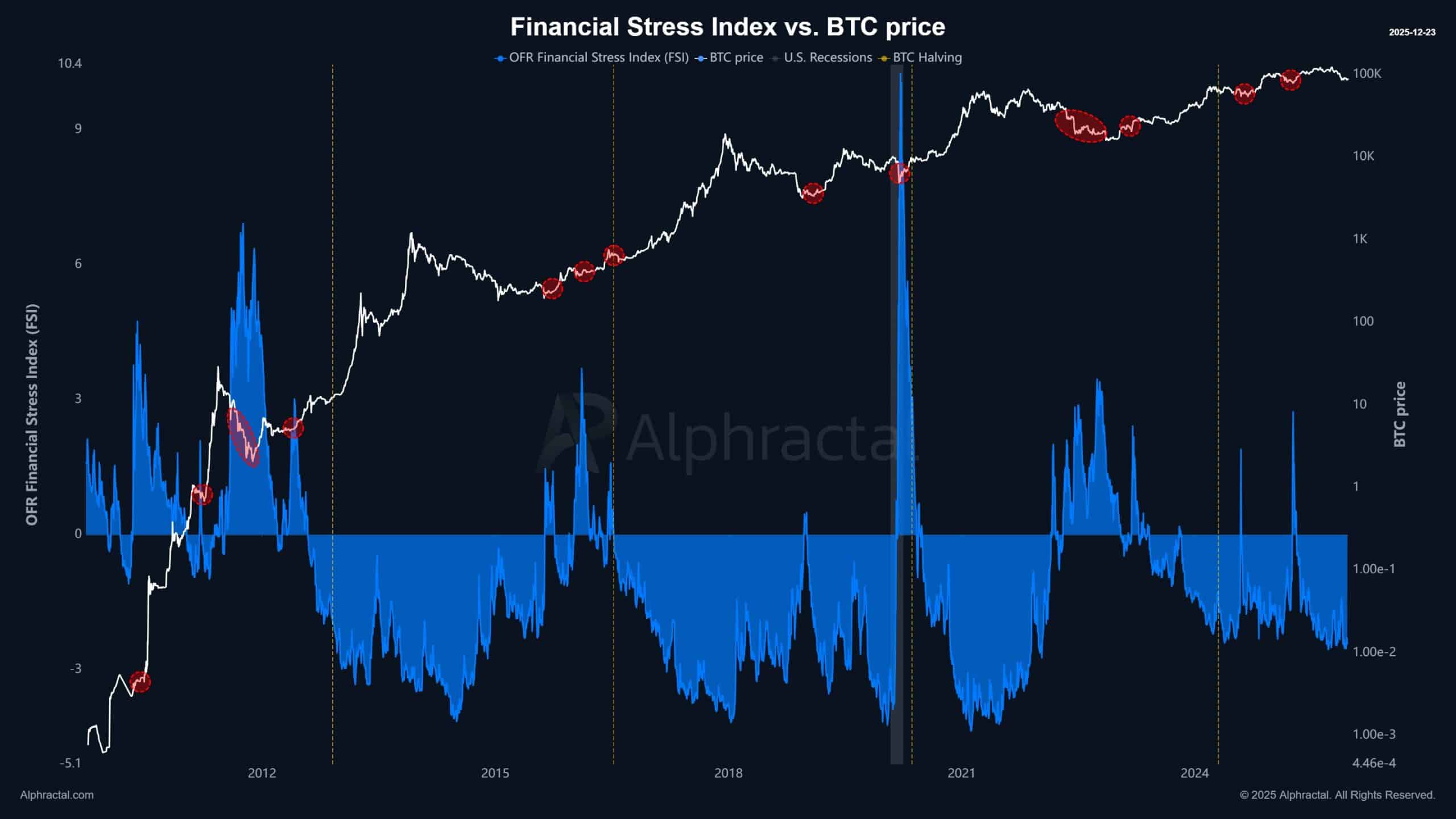

Financial Stress Index negative: Indicates caution for accumulating crypto now, per Alphractal data.

Crypto market faces bearish pressures with $1.37T losses, yet isolated capital hints at rebound potential. Discover liquidity trends and eSLR changes driving recovery—stay informed on Bitcoin’s future today.

What is isolated capital in the crypto market?

Isolated capital in the crypto market refers to substantial liquidity pools, like the current $147 trillion in global money and credit, that remain untapped by high-risk assets such as Bitcoin and other cryptocurrencies despite favorable conditions. This capital, held by investors and institutions, prioritizes stability amid ongoing market outflows. While it has historically fueled rebounds in speculative markets, current caution has kept it sidelined, delaying potential inflows into crypto.

How does global liquidity impact cryptocurrency prices?

Global liquidity, measuring total money and credit available for economic and financial activities, has climbed to $147 trillion, according to data from Alpha Extracts. This excess often flows into risk assets like cryptocurrencies, equities, and commodities during low-stress periods. For instance, Bitcoin has seen price surges correlating with liquidity peaks, as investors seek higher returns. However, in the present environment, with a bearish crypto market erasing $1.37 trillion over 79 days, this liquidity remains isolated. Experts note that stablecoin market caps reaching $308.88 billion—a 2% rise in 30 days—show some capital entering digital assets, but not enough to counter outflows. Gold’s record high of $4,420 per ounce further illustrates the flight to safety. Short sentences highlight the disconnect: liquidity is abundant, yet crypto adoption lags. Supporting statistics from financial analyses indicate that when liquidity thresholds shift positively, Bitcoin could gain up to 20-30% in subsequent months, based on historical patterns.

Source: Alpha Extract

Regulatory shifts also play a role. The recent adjustment to the Enhanced Supplementary Leverage Ratio (eSLR) by federal banking regulators aims to ease capital burdens on large banks. Previously set at 5% for banks and 6% for subsidiaries, the threshold has lowered to around 3%, freeing up billions for potential investment. This could encourage allocations to assets like Bitcoin, as noted in regulatory filings from late 2025. Implementation is ongoing, but the change underscores a supportive framework for liquidity to reach crypto markets.

The crypto market’s bearish phase persists, with sellers dominating and assets like Bitcoin under pressure. Capital preservation drives flows into traditional safe havens. Gold’s ascent to $4,420 per ounce exemplifies this trend, drawing investors away from volatility. Stablecoins, pegged to fiat like the US dollar, have absorbed some inflows, with their total market cap at $308.88 billion. This 2% growth over 30 days indicates measured interest in digital stability amid uncertainty.

Frequently Asked Questions

Can isolated capital lead to a Bitcoin price rebound in 2025?

Isolated capital from $147 trillion global liquidity holds rebound potential for Bitcoin in 2025 if financial stress eases. Historical data from Alpha Extracts shows liquidity surges often precede 20-30% gains in risk assets. Regulatory relief via eSLR changes could channel billions into crypto, but negative Financial Stress Index readings advise caution for now.

What does the Financial Stress Index mean for cryptocurrency investments?

The Financial Stress Index tracks global market tensions, and its current negative tilt suggests avoiding aggressive crypto buys like Bitcoin. When it turns positive, it signals safer entry points for risk assets. Alphractal analyses confirm this correlation, with positive FSI periods historically boosting cryptocurrency performance by reducing systemic fears.

Broader market dynamics add layers to this outlook. Institutional investors, facing heightened volatility, are reallocating to low-risk options. Yet, the sheer volume of available liquidity—now approaching $157 trillion in some estimates—provides a foundation for eventual integration into crypto. Data from financial monitoring services like Alpha Extracts reveal that past cycles saw similar isolations resolved within quarters, leading to market upswings. For cryptocurrencies, this means monitoring indicators like stablecoin growth and banking policy shifts closely.

Source: Alphractal

The eSLR modifications, finalized in late 2025, represent a pivotal development. By reducing capital requirements, banks gain flexibility to engage more actively in markets, including Treasuries and potentially crypto. Financial experts from regulatory bodies emphasize that this adjustment supports overall stability while unlocking resources. In the context of isolated capital, it bridges the gap between abundant liquidity and crypto inflows. Observations from market analysts indicate that similar policy tweaks in prior years led to increased institutional participation in digital assets.

Current sentiment underscores restraint. The Financial Stress Index (FSI), a key gauge of global financial health, remains in negative territory. Alphractal reports link this to underperformance in assets like Bitcoin, advising against accumulation. A shift to positive FSI would alter this dynamic, inviting risk-on behaviors. For now, the bearish crypto market endures, with losses mounting from sustained selling pressure.

Despite these challenges, underlying positives persist. Stablecoin expansion reflects growing comfort with blockchain-based stability. Gold’s performance, while drawing capital away, also signals broader economic resilience that could indirectly benefit crypto. As liquidity evolves, the isolated capital narrative may shift, paving the way for recovery.

Key Takeaways

- Global liquidity at $147 trillion: Offers rebound potential for the crypto market, but remains isolated due to investor caution.

- Stablecoin growth to $308.88 billion: Indicates selective inflows into low-volatility digital assets amid bearish trends.

- Monitor FSI for entry points: Negative readings suggest waiting; positive shifts could signal time to accumulate Bitcoin.

Conclusion

The crypto market’s ongoing bearish phase, marked by $1.37 trillion in losses and isolated capital, highlights the tension between abundant global liquidity and risk aversion. With eSLR changes freeing bank resources and stablecoins gaining traction, a rebound appears feasible once the Financial Stress Index improves. Investors should track these isolated capital in crypto dynamics closely, as they could herald stronger performance for Bitcoin and beyond in the coming months—position yourself for informed decisions today.