Gnosis Chain Hard Fork Aims to Recover Funds from November Balancer Exploit

GNO/USDT

$404,414.53

$128.38 / $119.48

Change: $8.90 (7.45%)

+0.0053%

Longs pay

Contents

The Gnosis hard fork, executed on Monday, recovered funds from the November Balancer exploit where $116 million in crypto was stolen. Following a soft fork by most validators, this hard fork placed the assets out of the hacker’s control, enabling potential recovery for affected users by Christmas.

-

Gnosis chain operators implemented a hard fork to address the Balancer exploit’s impact on managed contracts.

-

The soft fork in November was adopted by a majority of validators to mitigate immediate risks from the theft.

-

Onchain data confirms the exploit involved over $116 million, with white hat hackers recovering about $28 million initially.

Gnosis hard fork recovers $116M from Balancer exploit: What it means for crypto security. Dive into the details of this pivotal move and its implications for DeFi users today.

What is the Gnosis Hard Fork in Response to the Balancer Exploit?

The Gnosis hard fork was a deliberate network upgrade executed on Monday to recover digital assets stolen in the November Balancer exploit. This action followed a majority of Gnosis validators adopting a soft fork earlier to address vulnerabilities in Balancer-managed contracts on the Gnosis Chain. The hard fork successfully moved the funds out of the hacker’s control, paving the way for their return to rightful owners through a DAO-controlled wallet.

How Did the Balancer Exploit Affect Gnosis Chain Users?

The Balancer exploit, reported on November 3, targeted the decentralized exchange’s automated market maker, resulting in the theft of more than $116 million in digital assets, including staked Ether. Onchain data revealed that the hacker transferred millions to a new wallet, exploiting vulnerabilities isolated to Balancer V2 Composable Stable Pools. Despite 11 audits by four security firms on Balancer’s smart contracts—as documented in public repositories—the breach occurred, highlighting persistent risks in DeFi protocols.

Gnosis Chain, which hosts Balancer-managed contracts, saw indirect impacts as the exploit drained funds from integrated liquidity pools. White hat hackers intervened, recovering approximately $28 million, but the majority remained inaccessible until the Gnosis response. According to Balancer’s official statements, the incident underscored the need for enhanced security measures in cross-chain environments. Expert analysis from blockchain security firms emphasizes that such exploits often stem from complex interactions between protocols, even after rigorous auditing.

Philippe Schommers, head of infrastructure at Gnosis, noted in a December 12 forum post: “There is still a live community discussion around how people will be able to claim back their funds, as well as how contributors involved in the rescue mission may be recognized or compensated. Right now we’re focused on enabling funds to be recovered by Christmas. Once they sit safely in a DAO controlled wallet we will figure out everything else.” This quote reflects the community’s proactive stance in resolving the aftermath.

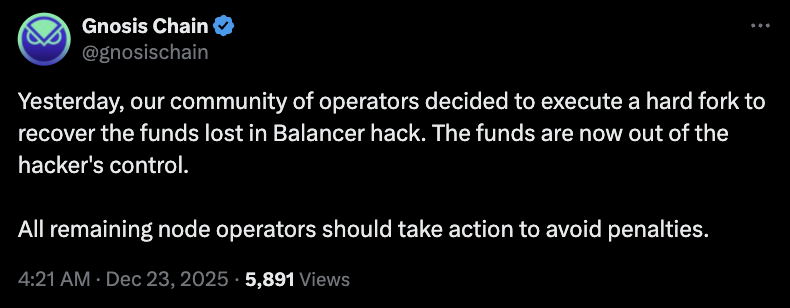

Source: Gnosis Chain

Gnosis announced the hard fork execution in a Tuesday update to node operators, confirming that the funds were now secured. This move builds on the November soft fork, which a majority of validators implemented to stabilize the network without disrupting ongoing operations. The hard fork represents a more definitive step, altering the blockchain’s state to reverse the unauthorized transfers.

In the broader context of cryptocurrency security, the Balancer incident adds to a series of DeFi exploits that have tested the resilience of Ethereum-compatible chains like Gnosis. Data from blockchain analytics platforms shows that 2024 alone saw over $1.5 billion in DeFi hacks, with liquidity providers bearing the brunt. Gnosis’s response demonstrates effective governance, as the chain’s operators coordinated swiftly to prioritize user fund recovery.

Security experts, including those from firms like Trail of Bits and OpenZeppelin—which conducted audits on similar protocols—stress the importance of ongoing monitoring post-audit. While Balancer isolated the vulnerability to specific pools, the event prompted reviews across Gnosis-integrated projects. Community forums are now debating compensation mechanisms, including bounties for white hat rescuers and streamlined claims processes.

Frequently Asked Questions

What Caused the $116 Million Balancer Exploit on Gnosis Chain?

The exploit stemmed from a vulnerability in Balancer V2 Composable Stable Pools, allowing unauthorized drainage of $116 million in assets, primarily staked Ether. Despite 11 audits by four security firms, the issue involved complex contract interactions on Gnosis Chain. Balancer confirmed the breach was contained, but it highlighted risks in DeFi liquidity management.

How Can Users Recover Funds from the Gnosis Hard Fork?

Users affected by the Balancer exploit can expect recovery through a DAO-controlled wallet established post-hard fork. Gnosis is prioritizing claims to enable distributions by Christmas, with community discussions ongoing for verification processes. Monitor official Gnosis channels for claim instructions to ensure secure access to recovered assets.

Key Takeaways

- Gnosis’s hard fork success: Secured $116 million in stolen funds, moving them beyond hacker control for potential user recovery.

- Soft fork’s role: Majority validator adoption in November stabilized the network, setting the stage for the more permanent hard fork solution.

- DeFi security lessons: Even with multiple audits, exploits persist—implement robust monitoring and community governance to mitigate risks.

Conclusion

The Gnosis hard fork marks a significant achievement in addressing the Balancer exploit, recovering substantial funds lost in November and reinforcing trust in the Gnosis Chain’s governance. By integrating community input and expert oversight, this response exemplifies proactive DeFi security measures. As discussions on claims and compensation continue, users should stay informed to benefit from these developments, ensuring a more resilient crypto ecosystem moving forward.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026