Grayscale Dogecoin ETF Could Launch as Soon as Monday

DOGE/USDT

$1,057,188,359.57

$0.09377 / $0.08771

Change: $0.006060 (6.91%)

-0.0065%

Shorts pay

Contents

The VanEck Solana ETF launched on Monday, marking the third U.S. fund offering Solana staking yields amid a surge in crypto ETFs. With over $380 million in inflows for similar funds and more launches expected, including Fidelity’s on Tuesday and potentially Grayscale’s Dogecoin ETF next week, investors gain easier access to altcoins.

-

VanEck Solana ETF (VSOL) debut: Offers staking rewards with a waived 0.3% fee until February 17 or $1 billion in assets.

-

Bitwise and Grayscale Solana ETFs launched late October, attracting significant inflows from institutional investors seeking yield.

-

Upcoming Dogecoin ETF from Grayscale could launch November 24, following SEC filing amendments that streamline approvals.

Discover the VanEck Solana ETF launch and wave of crypto ETFs in 2025, including staking yields and Dogecoin potential. Stay ahead with expert insights on altcoin funds driving market access. Read now for investment updates!

What is the Impact of the VanEck Solana ETF Launch on Crypto Investors?

The VanEck Solana ETF represents a significant milestone for cryptocurrency investors, providing regulated exposure to Solana (SOL) through staking yields without the need for direct wallet management. Launched on Monday, this fund joins Bitwise and Grayscale’s offerings, which debuted late October and have collectively drawn over $380 million in inflows. By waiving its 0.3% management fee until February 17 or until reaching $1 billion in assets, VanEck aims to attract a broad investor base amid the evolving regulatory landscape.

The Securities and Exchange Commission (SEC) updated its listing standards in September, expediting ETF approvals by removing the need for individual fund assessments. This change has accelerated the influx of altcoin-tied products, enhancing liquidity and mainstream adoption for assets like Solana, known for its high-speed blockchain capabilities.

How Do Solana Staking Yields Work in These ETFs?

Solana staking involves locking SOL tokens on the blockchain to validate transactions and secure the network, earning rewards typically ranging from 5% to 8% annually, according to data from Solana’s official network metrics. In ETFs like VanEck’s VSOL, Bitwise, and Grayscale, these yields are generated passively for investors, with the funds handling the technical aspects of staking through custodians.

Bloomberg ETF analyst Eric Balchunas noted that such structures appeal to institutional players wary of self-custody risks. “These ETFs democratize access to Solana’s ecosystem, blending traditional finance with blockchain efficiency,” Balchunas stated in recent commentary. Supporting statistics show Solana’s total value locked (TVL) exceeding $5 billion as of late 2024, underscoring the asset’s growing utility in decentralized finance (DeFi). Short sentences highlight the benefits: Reduced volatility exposure via diversified holdings; Compliance with U.S. regulations; Potential for compounding returns through reinvested yields.

The competitive fee environment—Bitwise and Grayscale charge 0.25%—further pressures innovation, as Fidelity’s Solana ETF (FSOL) is slated for Tuesday’s launch. Balchunas described Fidelity as “easily the biggest asset manager in this category,” especially with BlackRock absent from Solana products so far.

Dogecoin ETF Could Launch as Soon as Monday

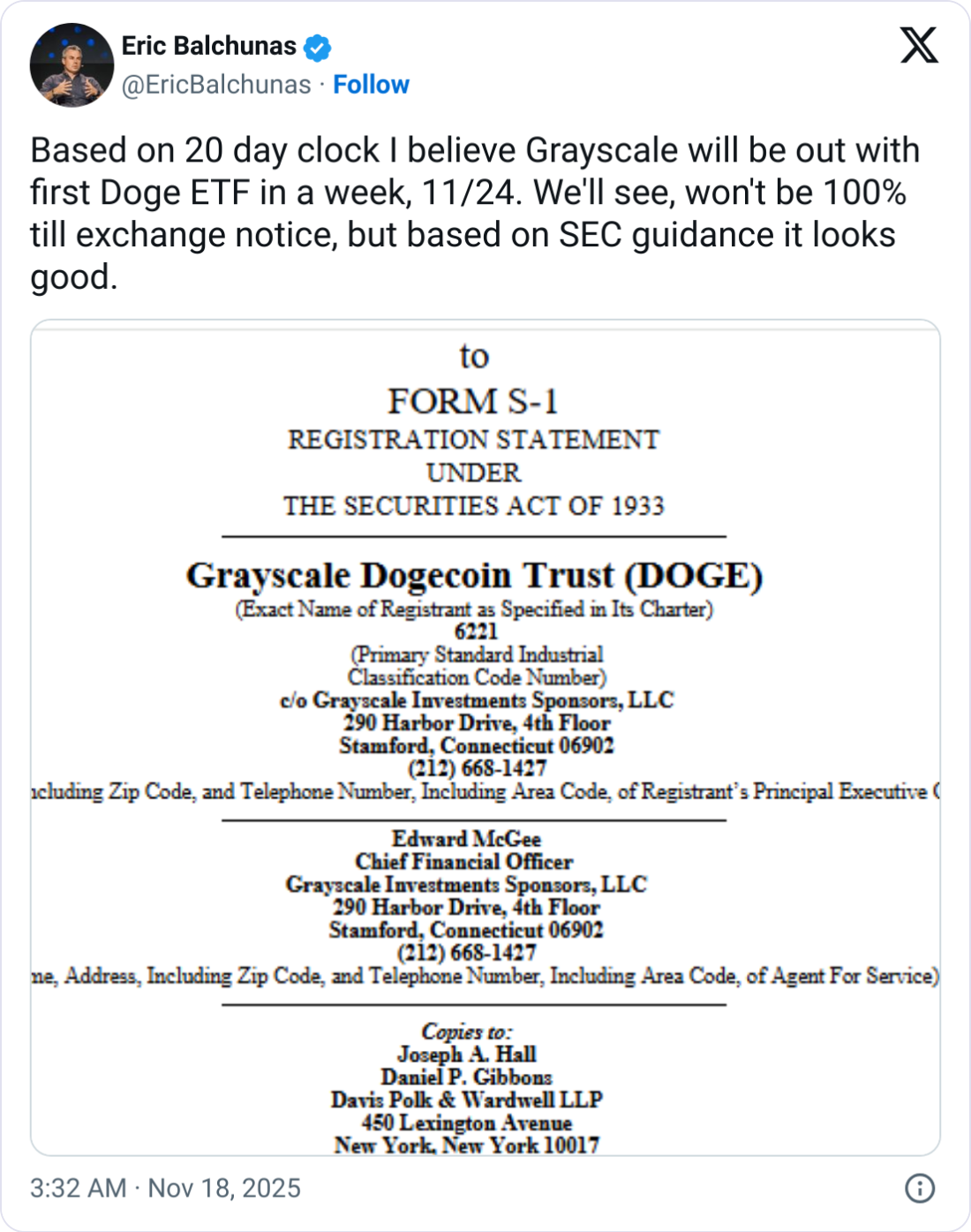

Building on the Solana momentum, a Dogecoin ETF from Grayscale may debut on November 24, following an amended regulatory filing that initiates a 20-day window for launch absent SEC objection. This would convert Grayscale’s existing Dogecoin Trust into a spot ETF tradable on the New York Stock Exchange, pending exchange confirmation.

Balchunas expressed optimism, stating, “We’ll see, won’t be 100% till exchange notice, but based on SEC guidance, it looks good.” If approved, it would mark the first U.S. Dogecoin ETF directly holding the memecoin, differing from earlier products like REX Shares and Osprey Funds’ mid-September launch. That fund, registered under the Investment Company Act of 1940, routes holdings through an offshore subsidiary, limiting direct exposure.

Source: Eric Balchunas

XRP traders hope fresh wave of ETF launches will restore the bull trend.

Bitwise’s spot Dogecoin ETF filing amendment on November 6 similarly triggers a 20-day launch period, potentially going live late next week unless intervened by regulators. Dogecoin, originally a joke cryptocurrency, has evolved with a market cap over $20 billion, driven by community support and endorsements from figures like Elon Musk. Expert analysis from Bloomberg indicates memecoin ETFs could tap into retail enthusiasm, though volatility remains a key risk factor.

The broader crypto ETF landscape reflects maturing infrastructure. Since Bitcoin and Ethereum spot ETFs launched in 2024, altcoin variants have proliferated, with Solana’s proof-of-stake model offering unique yield advantages over Ethereum’s. Grayscale’s potential entry underscores the shift toward diversified portfolios, as institutional inflows reached $50 billion across crypto funds this year, per CoinShares reports.

Regulatory tailwinds continue: The SEC’s streamlined process has cut approval times from months to weeks, fostering competition. VanEck’s fee waiver strategy mirrors tactics used in Bitcoin ETFs, where temporary incentives boosted early adoption. For Solana, this could propel SOL’s price, which traded around $150 recently, toward new highs if ETF demand sustains.

Frequently Asked Questions

What Makes the VanEck Solana ETF Different from Bitcoin ETFs?

The VanEck Solana ETF stands out by incorporating staking yields, allowing investors to earn rewards from SOL locked on the blockchain—up to 8% annually—unlike Bitcoin ETFs focused solely on price exposure. It launched with a competitive fee structure, waived until hitting key milestones, making it accessible for those eyeing altcoin growth without direct custody hassles. This blend of yield and regulation appeals to yield-seeking portfolios.

Will a Dogecoin ETF Launch Boost Its Price Like Ethereum’s Did?

A Dogecoin ETF launch could increase liquidity and attract institutional capital, similar to Ethereum’s 20% price surge post-ETF approval in 2024, but outcomes depend on market conditions. Grayscale’s filing positions it for direct holdings, potentially stabilizing DOGE’s volatile memecoin status. Investors should monitor SEC responses, as past approvals have historically driven short-term rallies through enhanced accessibility.

Key Takeaways

- Accelerated ETF Approvals: SEC’s September changes have flooded the market with Solana and Dogecoin funds, simplifying investor access to altcoins.

- Staking Yields Advantage: VSOL and peers offer 5-8% rewards, drawing $380 million in inflows and competing via low or waived fees.

- Memecoin Milestone: Grayscale’s Dogecoin ETF could launch November 24, marking a first for direct U.S. holdings and signaling broader adoption.

Conclusion

The launch of the VanEck Solana ETF and anticipation around Dogecoin ETF filings highlight the rapid evolution of crypto ETFs in 2025, driven by regulatory efficiencies and investor demand for yield-generating assets. With staking features and competitive structures, these funds bridge traditional finance and blockchain innovation, as noted by analysts like Eric Balchunas from Bloomberg. As more products like Fidelity’s FSOL enter the fray, the sector promises expanded opportunities—investors are encouraged to evaluate risks and consult advisors for tailored strategies moving forward.