Grayscale Positions Chainlink as Potential Anchor for Blockchain Tokenization

LINK/USDT

$260,016,843.55

$8.76 / $8.21

Change: $0.5500 (6.70%)

+0.0007%

Longs pay

Contents

Chainlink serves as the essential middleware for blockchain adoption, enabling secure data integration and cross-chain interactions that bridge cryptocurrencies with traditional finance, according to Grayscale’s latest analysis.

-

Chainlink acts as modular middleware connecting on-chain applications to off-chain data and ensuring enterprise compliance.

-

Its tools facilitate tokenization of real-world assets, driving efficiency in financial markets.

-

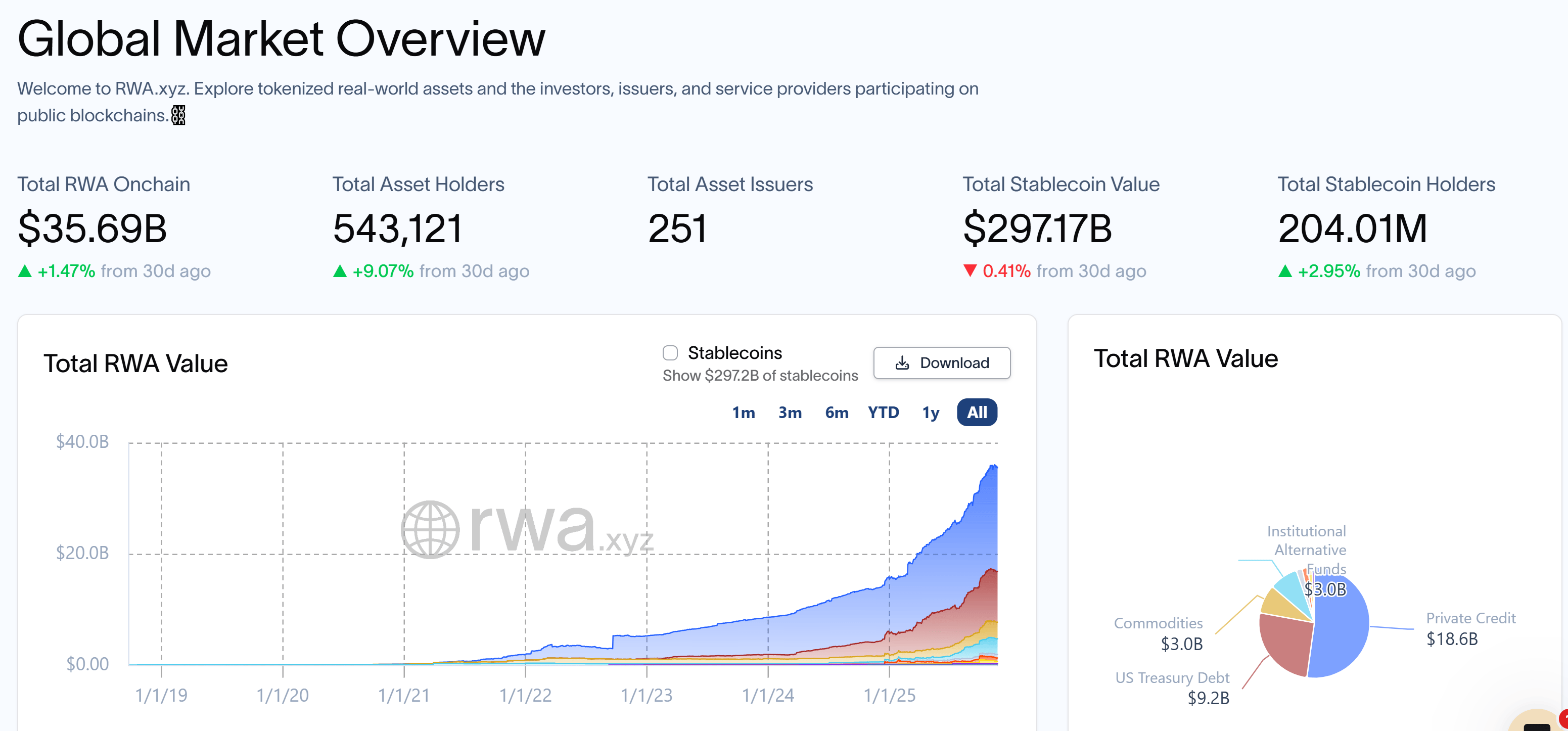

Tokenized asset market has surged from $5 billion to over $35.6 billion since early 2023, per RWA.xyz data.

Discover how Chainlink anchors blockchain adoption per Grayscale’s insights. Explore its role in tokenization and cross-chain settlements. Stay informed on crypto infrastructure trends today.

What is Chainlink’s Role in the Next Phase of Blockchain Adoption?

Chainlink is positioned by Grayscale as the critical connective tissue linking cryptocurrencies to traditional finance through its advanced middleware capabilities. This infrastructure allows on-chain applications to securely access off-chain data, interact across multiple blockchains, and meet rigorous enterprise compliance standards. As blockchain adoption accelerates, Chainlink’s tools are becoming indispensable for enabling real-world asset tokenization and seamless cross-chain operations.

How Does Chainlink Facilitate Tokenization in Finance?

Chainlink’s oracle network provides verifiable data feeds essential for tokenizing assets like securities and real estate, transforming them into programmable blockchain-based tokens. Grayscale highlights that nearly all financial assets currently rely on off-chain ledgers, but tokenization unlocks blockchain’s efficiency gains. The firm notes partnerships with entities such as S&P Global and FTSE Russell to support this transition. For instance, the tokenized asset market expanded from $5 billion to more than $35.6 billion between early 2023 and now, according to data from RWA.xyz. This growth underscores Chainlink’s potential to orchestrate large-scale tokenization, reducing intermediaries and enhancing transparency in global finance. Experts emphasize that reliable oracles are vital to prevent manipulation, ensuring tokenized assets reflect accurate real-world values. Chainlink’s proof-of-reserve mechanisms and decentralized architecture further bolster trust, making it a preferred choice for institutional adoption.

Total RWA onchain. Source: RWA.xyz

Grayscale Investments has also filed for a US IPO, signaling broader interest in crypto asset management. Additionally, Emory University increased its stake in Grayscale’s Bitcoin ETF to $52 million, reflecting institutional confidence in the sector.

Chainlink, JPMorgan, Ondo Complete First Crosschain DvP Settlement

In June 2025, Chainlink collaborated with JPMorgan’s Kinexys network and Ondo Finance to achieve a pioneering crosschain delivery-versus-payment (DvP) settlement. This pilot integrated a permissioned bank payment system with a public blockchain testnet, demonstrating practical interoperability. By leveraging Chainlink’s Runtime Environment (CRE) as the coordination layer, the transaction exchanged Ondo’s tokenized US Treasurys fund, OUSG, for fiat payment while keeping assets on their native chains. This milestone highlights Chainlink’s ability to bridge traditional and decentralized finance without compromising security or efficiency.

The settlement process involved real-time data verification and automated execution, minimizing settlement times from days to near-instantaneous. Participants noted that such integrations could revolutionize global payments, potentially reducing costs by up to 50% for cross-border transactions, based on industry benchmarks. Chainlink’s cross-chain interoperability protocol (CCIP) played a key role, enabling secure message passing between disparate blockchains. This development aligns with Grayscale’s view of Chainlink as foundational infrastructure, supporting the shift toward tokenized real-world assets (RWAs). As more institutions explore RWAs, Chainlink’s ecosystem—now spanning over 2,000 integrations—positions it to capture significant value in this evolving market. Analysts point out that successful pilots like this one could accelerate regulatory clarity, fostering wider adoption among banks and asset managers.

Frequently Asked Questions

What Makes Chainlink the Largest Non-Layer 1 Crypto Asset by Market Cap?

Chainlink’s expansive middleware suite provides exposure to multiple blockchain ecosystems, unlike single-chain assets, driving its market dominance excluding stablecoins. Grayscale reports that its tools for data oracles, cross-chain communication, and compliance have fueled organic growth, with LINK’s market cap reflecting investor confidence in its utility across DeFi, RWAs, and enterprise applications.

How Will Chainlink Impact Traditional Finance Integration?

Chainlink bridges the gap by supplying secure, tamper-proof data to smart contracts, enabling traditional assets to operate on blockchains seamlessly. As heard in voice searches, it’s like the internet’s backbone for crypto—connecting banks and blockchains for faster, cheaper transactions while maintaining high security standards for global finance.

Key Takeaways

- Essential Middleware: Chainlink functions as modular infrastructure, linking on-chain and off-chain worlds to support blockchain’s real-world applications.

- Tokenization Leadership: Partnerships with major indices like S&P Global position Chainlink to lead the $35.6 billion RWA market surge.

- Innovation in Settlements: The JPMorgan and Ondo pilot showcases crosschain DvP, paving the way for efficient institutional crypto adoption.

Conclusion

Grayscale’s analysis underscores Chainlink‘s pivotal role in blockchain adoption and tokenization, transforming it into the connective tissue for finance’s digital future. With proven capabilities in crosschain settlements and data integrity, Chainlink is set to drive efficiency and innovation. Investors and institutions should monitor these developments closely, as they signal a maturing crypto landscape ripe for broader integration.

Comments

Other Articles

Chainlink Price May Stay Range-Bound Near $12 Amid Fading Whale Demand

January 1, 2026 at 07:14 PM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

UK Lowest in G7 Investments for 2025 Amid Expert Warnings on Frameworks

December 30, 2025 at 04:43 PM UTC