Grayscale Views Bitcoin’s 2025 Pullback as Potential Local Bottom, Targets 2026 Highs on Fed, Crypto Bills

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

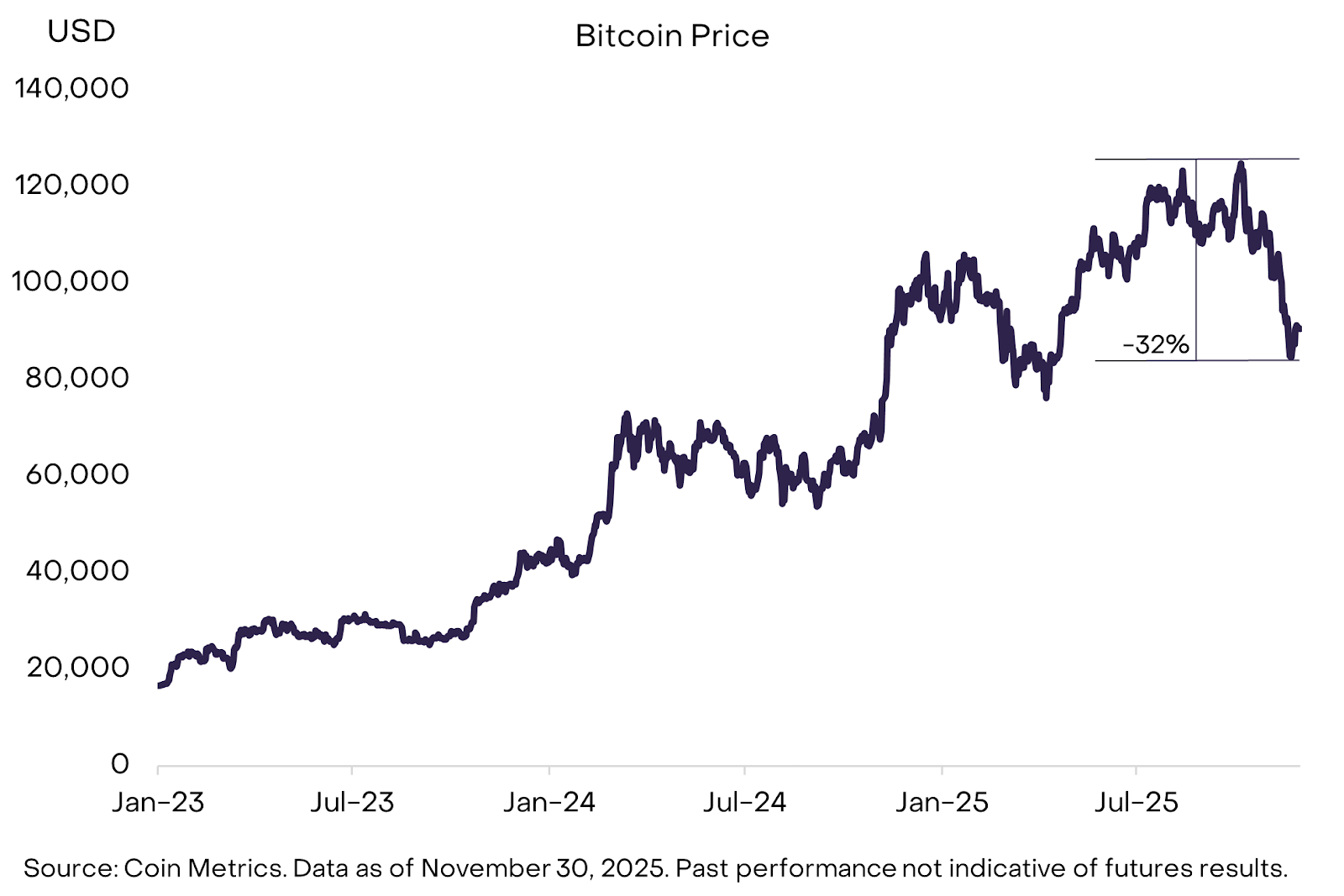

Bitcoin’s 2025 sell-off appears to have reached a local bottom rather than signaling a new cycle peak, according to Grayscale. Key factors like Federal Reserve policy and U.S. crypto legislation could drive new all-time highs in 2026, breaking the traditional four-year halving pattern.

-

Bitcoin’s option skew exceeds 4, indicating extensive downside hedging and a potential local bottom.

-

Despite a 32% decline, market indicators suggest recovery rather than prolonged downturn.

-

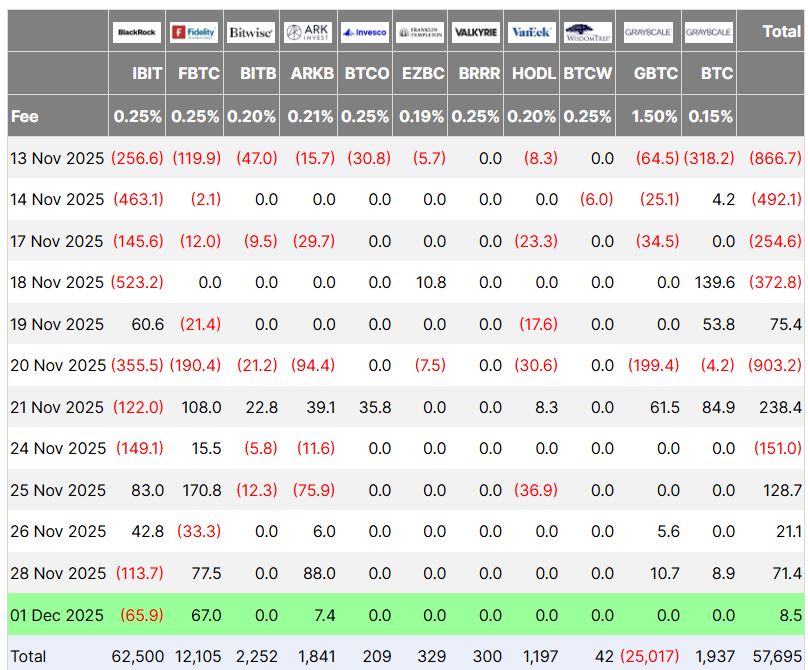

U.S. spot Bitcoin ETFs saw $3.48 billion in outflows in November 2025, but recent inflows signal returning buyer interest, per Farside Investors data.

Bitcoin 2025 sell-off hits local bottom per Grayscale, eyeing 2026 highs amid Fed cuts and crypto bills. Discover catalysts for Bitcoin’s next rally—stay informed on market shifts today.

What is the Outlook for Bitcoin’s 2025 Sell-Off?

Bitcoin’s 2025 sell-off may have already formed a local bottom, positioning the cryptocurrency to challenge the conventional four-year halving cycle and achieve new all-time highs by 2026, as outlined in Grayscale’s latest research report. The firm highlights that while short-term uncertainties persist, elevated hedging activity and shifting market flows point to resilience rather than a cycle peak. This perspective challenges traditional market narratives, emphasizing adaptive investor behavior in response to macroeconomic pressures.

Asset manager Grayscale’s analysis underscores that Bitcoin’s recent 32% pullback does not indicate a prolonged bearish phase. Instead, indicators such as the elevated option skew—now above 4—reveal that investors have hedged extensively against further downside, suggesting the market’s pessimism has peaked locally. This setup aligns with historical drawdowns but shows unique momentum drivers like institutional inflows poised for reversal.

Bitcoin pullback, compared to previous drawdowns. Source: research.grayscale.com

Short-term recovery hinges on key flow reversals, including futures open interest, exchange-traded fund (ETF) inflows, and reduced selling from long-term holders. Without these shifts, Bitcoin risks testing lower support levels, but Grayscale remains optimistic about cycle disruption. The report notes that external catalysts could accelerate upward momentum, drawing from established patterns in crypto market evolution.

How Are U.S. Spot Bitcoin ETFs Influencing the Market?

U.S. spot Bitcoin ETFs, pivotal in fueling 2025’s momentum, exerted significant downward pressure in November with $3.48 billion in net outflows—their second-worst month on record, according to data from Farside Investors. This outflow reflected broader market caution amid economic signals, yet it represents a potential turning point as investor confidence rebuilds. Recent trends show four straight days of inflows, totaling $8.5 million on the latest Monday, indicating a gradual return of buyer appetite post-sell-off.

Bitcoin ETF Flow, in USD, million. Source: Farside Investors

Market positioning frames this as a leverage reset rather than a sentiment collapse, per insights from Nexo analyst Iliya Kalchev. He emphasizes that Bitcoin must reclaim the low $90,000 range to sidestep a drop toward mid-to-low $80,000 support. Such ETF dynamics, supported by regulatory clarity, underscore the growing institutional role in stabilizing and propelling Bitcoin’s trajectory, with historical data showing inflows often precede rallies of 20-50%.

Cathie Wood maintains a bullish stance on Bitcoin, targeting $1.5 million long-term, as discussed in recent financial analyses. This expert perspective aligns with Grayscale’s view, reinforcing the asset’s foundational strength despite temporary volatility. Overall, ETF flows serve as a barometer for broader adoption, with sustained positive inflows likely to catalyze renewed price discovery.

Fed Policy and US Crypto Bill Loom as 2026 Catalysts

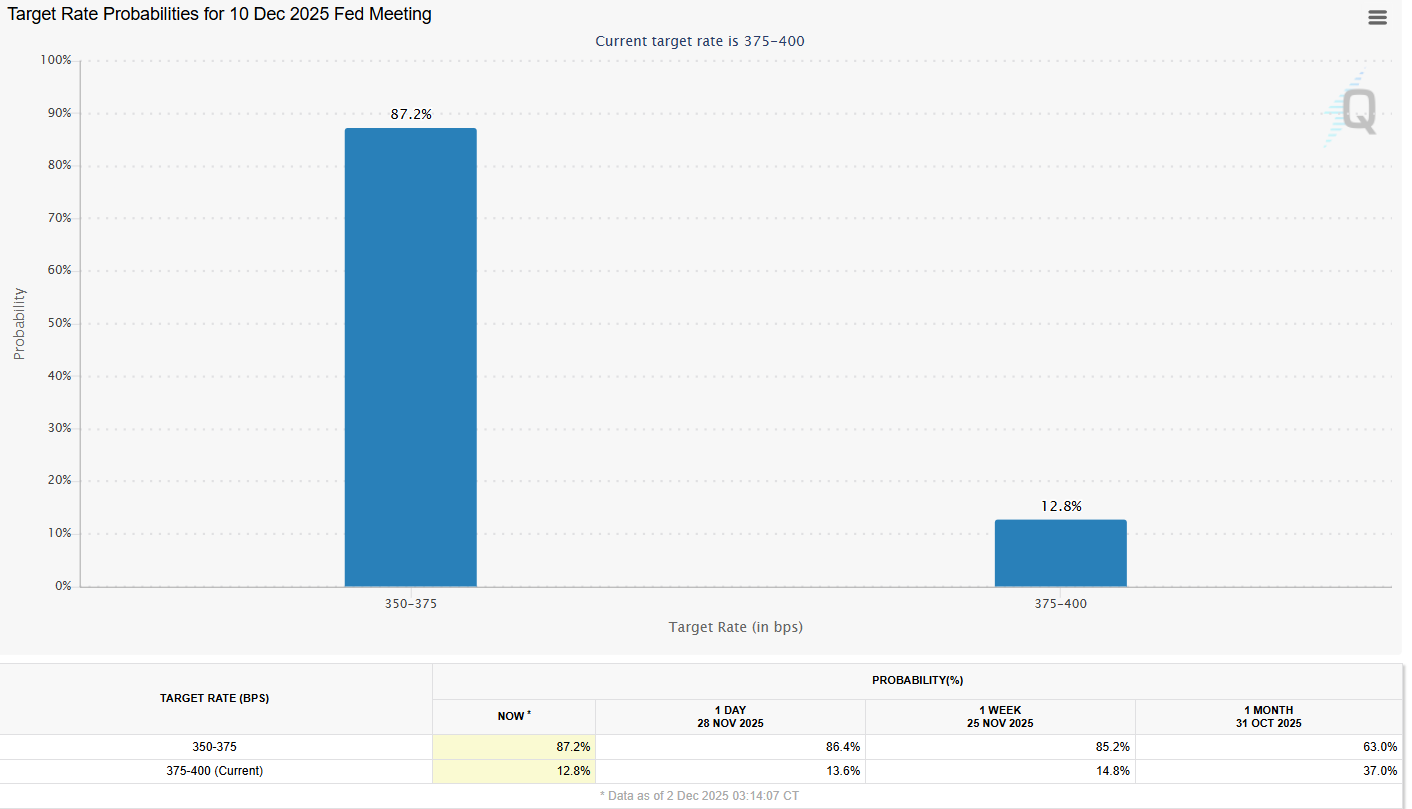

The cryptocurrency market anticipates the U.S. Federal Reserve’s interest rate decision on December 10 as a major swing factor, with Grayscale identifying it as a critical catalyst for 2026 performance. Markets currently price an 87% probability of a 25 basis point cut, a rise from 63% a month prior, based on the CME Group’s FedWatch tool. This anticipated easing could alleviate liquidity constraints, benefiting risk assets like Bitcoin by encouraging capital rotation into high-growth sectors.

Interest rate cut probabilities. Source: CMEgroup.com

Beyond monetary policy, legislative progress on the Digital Asset Market Structure bill holds promise for institutional investment. Grayscale stresses the need for crypto to remain a bipartisan priority, avoiding partisan divides ahead of midterm elections. Initial advancements, such as the CLARITY Act’s passage in the House during July’s “crypto week,” set the stage for broader frameworks under the Responsible Financial Innovation Act in the Senate.

The bill advances through the Republican-led Senate Agriculture and Banking Committees, with Chair Tim Scott targeting readiness for enactment by early 2026. This regulatory evolution could enhance market structure, fostering innovation while mitigating risks—key for attracting trillions in sidelined capital. Experts like those at Nexo highlight that such bills, combined with Fed actions, could propel Bitcoin beyond previous highs, drawing parallels to post-2024 halving surges where policy tailwinds amplified gains by over 100%.

Frequently Asked Questions

What Caused Bitcoin’s 2025 Sell-Off?

Bitcoin’s 2025 sell-off stemmed from macroeconomic pressures, including ETF outflows and leverage unwinding, resulting in a 32% decline from peaks. Grayscale attributes this to a temporary reset rather than structural weakness, with hedging indicators like option skew above 4 signaling investor caution has crested, paving the way for stabilization.

Will Bitcoin Reach New Highs in 2026?

Yes, Bitcoin is poised to potentially set new all-time highs in 2026, driven by Federal Reserve rate cuts and U.S. crypto legislation, according to Grayscale’s analysis. These catalysts could disrupt the four-year halving cycle, with ETF inflows and institutional adoption providing sustained upward momentum for investors seeking long-term growth.

Key Takeaways

- Local Bottom Formation: Bitcoin’s 2025 sell-off likely marks a temporary dip, evidenced by high option skew and reversing ETF flows, setting up for cycle-breaking recovery.

- Policy Catalysts Ahead: Fed’s December rate decision and Digital Asset Market Structure bill progress could unlock institutional capital, boosting Bitcoin toward $100,000+ levels.

- Investor Action: Monitor ETF inflows and holder behavior; accumulating during leverage resets has historically yielded 50-100% returns in subsequent rallies.

Conclusion

In summary, Bitcoin’s 2025 sell-off represents a local bottom per Grayscale’s assessment, with Federal Reserve policy and U.S. crypto bills emerging as pivotal drivers for 2026 gains. As ETF inflows resume and regulatory clarity builds, the stage is set for Bitcoin to surpass traditional cycles and deliver substantial value. Investors should track these developments closely, positioning for a promising year ahead in digital assets.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026