Growing Greed Among Bitcoin Investors May Extend Market Top Timeline

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

-

Recent trends indicate a surge in investor greed, potentially delaying Bitcoin’s market peak by several months.

-

Despite a record 98% of Bitcoin holders making profits, several metrics suggest the king coin may be entering overvalued territory.

-

“Historical patterns show that when long-term holders exhibit increased greed, it typically takes 8-11 months for BTC to reach a market top,” noted crypto analyst Ali Martinez.

This article explores the growing investor greed in Bitcoin and its implications for future price movements, providing critical insights for crypto enthusiasts.

Bitcoin’s Bullish Momentum and Rising Greed

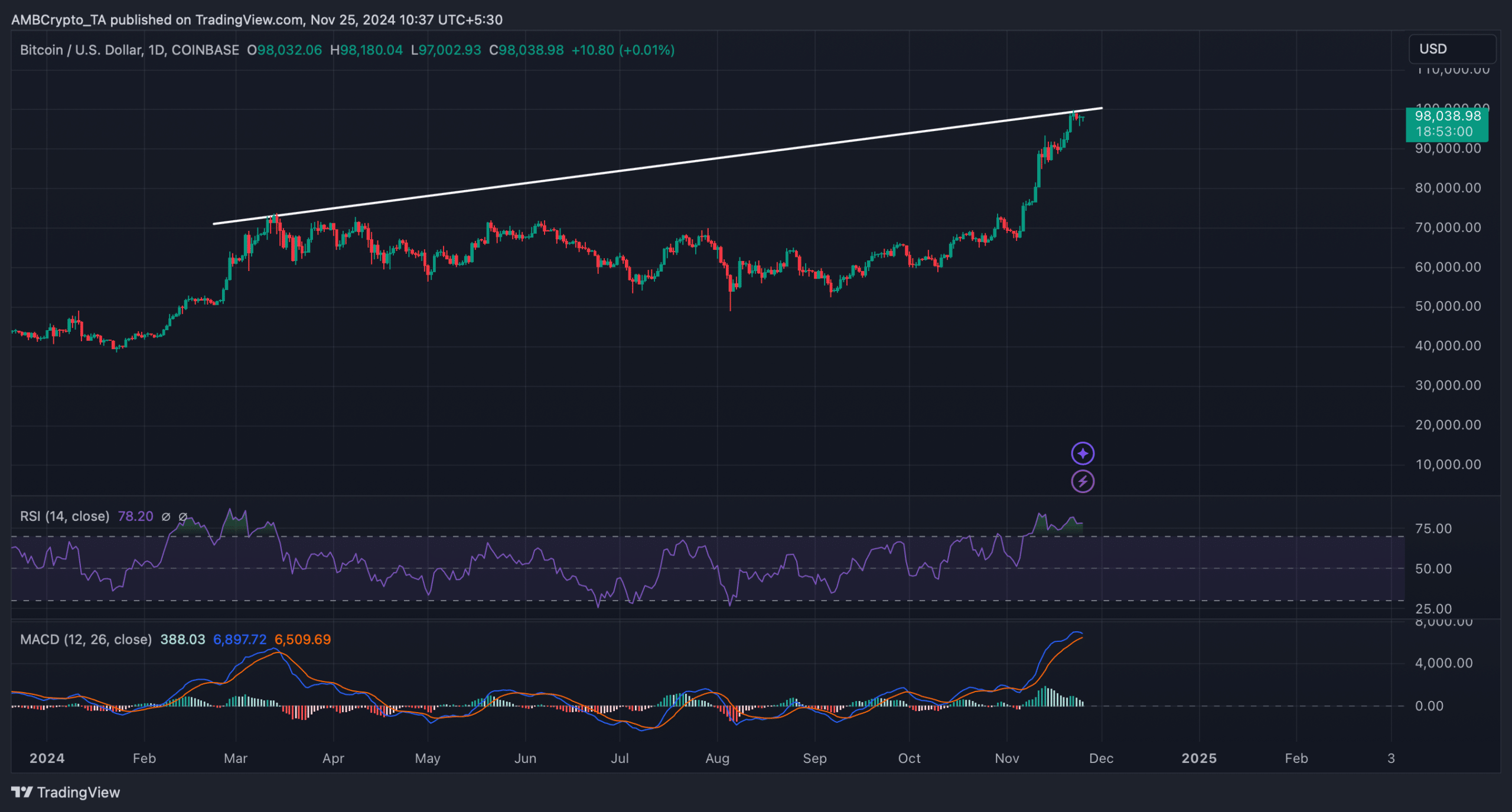

In an impressive display of strength, Bitcoin (BTC) surged by 8% last week, successfully flipping its previous resistance of $96k into a new support level. This momentum has many analysts optimistic about the potential for BTC to exceed the symmetrically significant $100k mark, reflecting heightened investor enthusiasm.

As of now, a striking 53.24 million BTC addresses are currently in profit, which constitutes over 98% of all Bitcoin wallets. This data paints a picture of widespread profitability among investors, suggesting a robust bullish environment.

As BTC has begun consolidating, trading around $97.7k at the time of writing, there are emerging signals of caution. According to Ali Martinez, recent data suggests that increased greed among long-term Bitcoin holders could imply a prolonged wait for BTC to achieve its next market top—forecasted around mid-2025.

Analyzing Key Metrics for Future Price Movements

To further understand the potential impact of rising investor greed, data from Glassnode reveals critical metrics about Bitcoin’s NVT ratio, which is currently suggestive of an overvaluation. This indicates a possible price correction in the near future as BTC continues to face resistance.

Despite this, optimistic sentiment prevails within the market, demonstrated by Bitcoin’s accumulation trend score, which sits impressively at over 0.9. A score nearing 1 indicates significant buying pressure, contributing to ongoing price increases. Hence, the potential for BTC to withstand the implications of growing market greed remains plausible.

Moreover, Bitcoin’s Open Interest (OI) continues to reflect high trading activity, which typically correlates with sustained price trends. However, key resistance levels are being tested on Bitcoin’s daily chart, which poses a challenge for further upward movements.

The MACD indicator suggests a potential bearish crossover on the horizon, and the Relative Strength Index (RSI) currently resides in the overbought zone, which may trigger a sell-off and restrict Bitcoin from surpassing existing resistance shortly.

Conclusion

In summary, the current environment around Bitcoin illustrates a dichotomy of rising investor greed against a backdrop of potential market corrections. With a sizeable percentage of holders in profit and growing accumulation trends, the short-term outlook remains cautiously optimistic. However, vigilance is advised as critical resistance levels and various technical indicators suggest that a consolidation phase may emerge. Investors should remain informed and prepared for potential fluctuations in BTC’s price movement.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC