Hedera (HBAR) Faces Key Support Test Near $0.153 Amid Bearish Momentum and Oversold Conditions

HBAR/USDT

$124,525,960.52

$0.09608 / $0.08831

Change: $0.007770 (8.80%)

-0.0126%

Shorts pay

Contents

-

Hedera (HBAR) has experienced a significant downturn, dropping 9% in 24 hours and 25% over the past month, signaling a critical phase for the cryptocurrency.

-

Technical indicators such as BBTrend and RSI reveal weakening momentum and oversold conditions, suggesting a potential for either a rebound or further decline.

-

According to COINOTAG analysis, maintaining the $0.153 support level is crucial for HBAR to avoid a deeper breakdown toward $0.124, with resistance levels at $0.168, $0.175, and $0.183 posing key hurdles ahead.

Hedera (HBAR) faces bearish pressure with key technical indicators signaling oversold conditions; critical support at $0.153 will determine its next move amid volatile market trends.

HBAR Struggles to Regain Momentum Amid Bearish Indicators

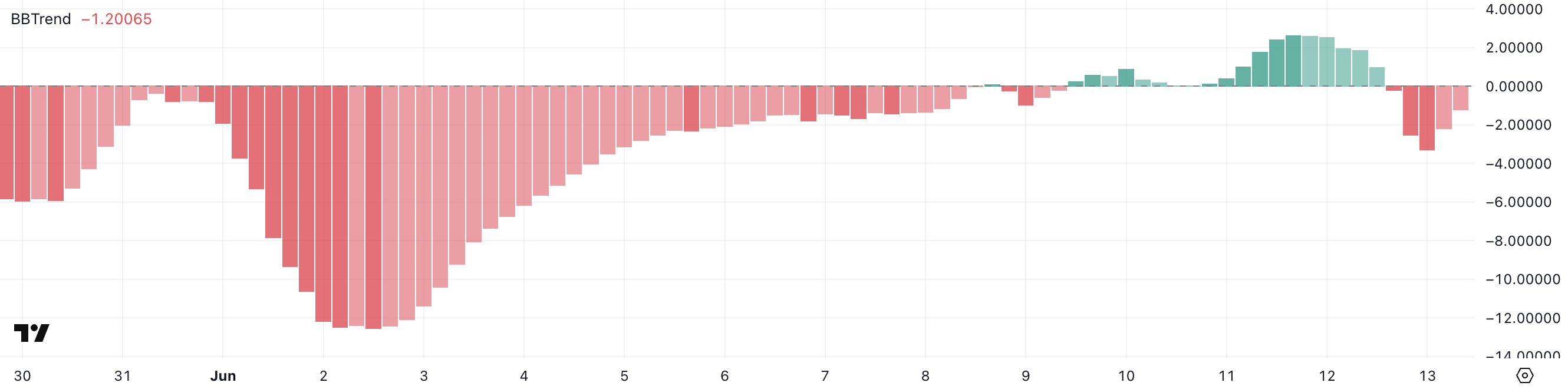

Hedera’s recent price action highlights a struggle to sustain bullish momentum as the BBTrend indicator currently stands at -1.2, a recovery from earlier lows but still indicative of bearish pressure. This suggests that the token is transitioning from a brief rally phase into a consolidation period, where market participants remain cautious. The modest bounce from deeper negative BBTrend levels points to some underlying buyer interest; however, the overall trend remains fragile. Investors should monitor this closely, as a sustained move above neutral BBTrend values could signal renewed buying strength.

The BBTrend, which measures price momentum relative to Bollinger Bands, is a valuable tool for assessing directional strength. Values below -1, as seen with HBAR, typically indicate bearish conditions, but the current reading near -1.2 suggests that selling pressure may be easing. A shift toward positive territory would be a key indicator for traders looking for signs of recovery.

RSI Plunge Signals Oversold Conditions, Opening Door for Possible Rebound

The Relative Strength Index (RSI) for HBAR has plunged to 22.29 from a neutral 61.99 just days ago, marking a sharp increase in selling pressure. This deep oversold condition often precedes a corrective bounce as market participants reassess value levels. While the aggressive sell-off reflects heightened market anxiety, it also creates a potential entry point for buyers anticipating a rebound. Monitoring the RSI alongside price action near critical support levels will be essential for gauging the likelihood of a recovery.

RSI readings below 30 are generally interpreted as oversold, signaling that the asset may be undervalued in the short term. For HBAR, this presents a tactical opportunity if the $0.153 support level holds firm, potentially limiting downside risk and setting the stage for a rebound.

Critical Support at $0.153: Key to Avoiding Further Declines

Hedera’s price currently hovers just above a pivotal support level at $0.153, which has historically acted as a floor during previous retracements. A failure to maintain this support could trigger a further decline toward the next significant support zone near $0.124. Compounding bearish sentiment, recent EMA lines have formed a death cross, a technical pattern often associated with sustained downward momentum.

Despite the bearish signals, a turnaround remains possible if buyers regain control and push HBAR above immediate resistance levels at $0.168. Surpassing this threshold could pave the way for tests of higher resistance points at $0.175 and $0.183, contingent on increased trading volume and market confidence. These zones have historically served as critical inflection points, requiring strong momentum to break decisively.

Conclusion

Hedera (HBAR) is navigating a challenging period marked by significant price declines and bearish technical indicators. The cryptocurrency’s ability to hold the $0.153 support level will be crucial in determining whether it can stabilize or face further losses toward $0.124. While oversold conditions indicated by the RSI suggest a potential rebound, traders should remain vigilant for confirmation signals. Monitoring resistance levels at $0.168, $0.175, and $0.183 will provide insight into the strength of any recovery. Overall, HBAR’s near-term trajectory hinges on market reaction around these key technical thresholds.