Hong Kong SFC Licenses Victory Fintech: 12th Platform

BTC/USDT

$25,688,978,986.00

$71,632.08 / $68,176.47

Change: $3,455.61 (5.07%)

-0.0000%

Shorts pay

Contents

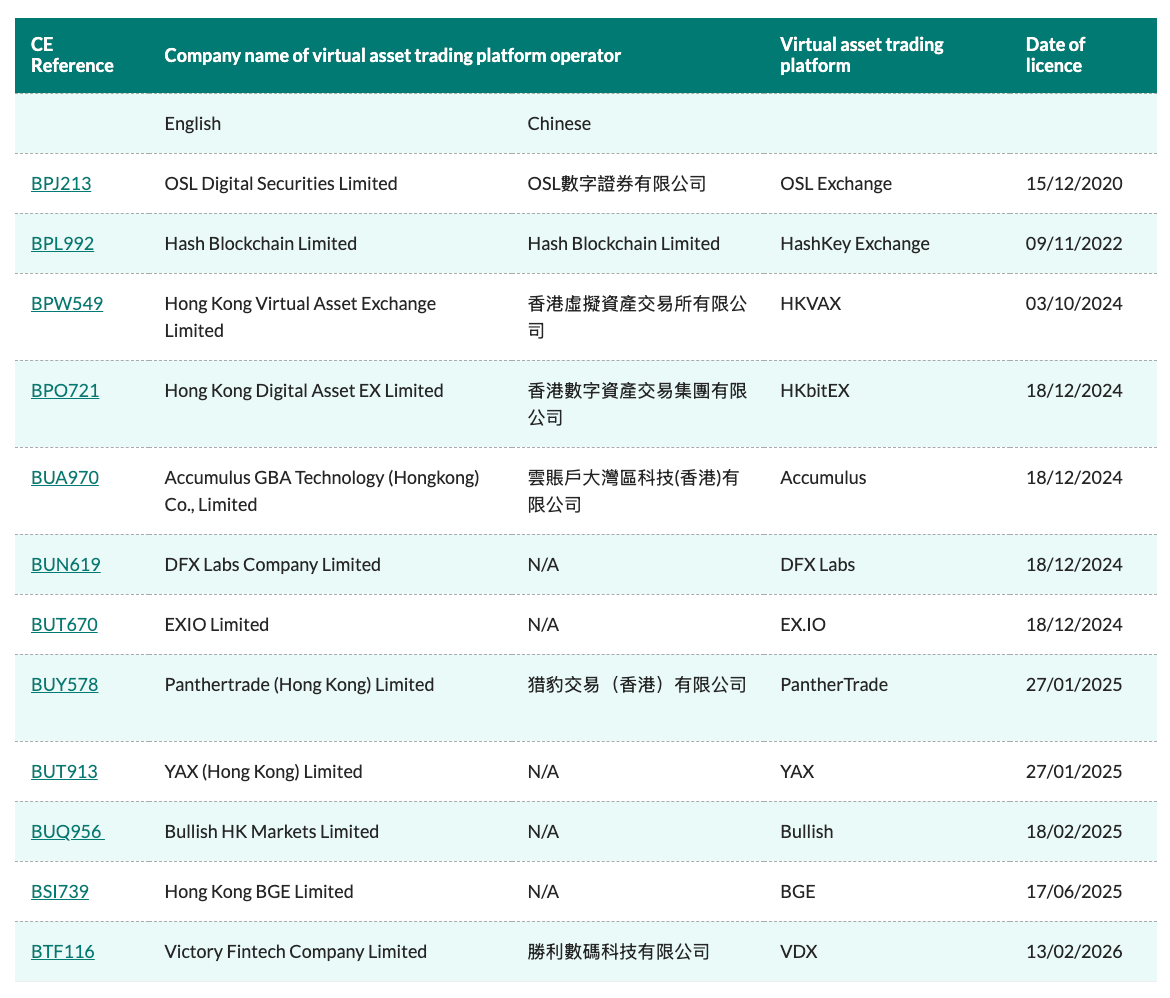

The Hong Kong Securities and Futures Commission (SFC) added Victory Fintech Company Limited to the list of licensed crypto trading platforms in its announcement on Friday. The list on the SFC's website now includes 12 crypto and blockchain entities. The addition of Victory Fintech is the first crypto trading platform approved by the SFC since June 2025.

Hong Kong is known as a strict jurisdiction for crypto companies and has been criminalizing unlicensed virtual asset trading platforms since June 2024. While many exchanges halted their operations, OKX and Bybit withdrew their license applications.

Hong Kong SFC Victory Fintech License Details

Victory Fintech's license is a significant step for platforms meeting the SFC's strict criteria. This addition strengthens Hong Kong's efforts to build a secure ecosystem for institutional investors. Licensed platforms offer trading of major assets like BTC and ETH under strict supervision. For BTC detailed analysis, SFC standards play a critical role in preventing market manipulation.

BTC and ETH Margin Financing Permission: New Opportunities

Shortly before the addition of Victory Fintech, the SFC granted licensed intermediaries permission to offer virtual asset margin financing accepting Bitcoin (BTC) and Ether (ETH) as collateral. It also outlined a framework for perpetual contract trading for professional investors. This development could increase BTC futures volume. BTC, giving an oversold signal with RSI 35.11, may find support from this regulation.

No Hong Kong Stablecoin Issuers: Regulatory Gap

There are no licensed stablecoin issuers at the Hong Kong Monetary Authority. This situation increases dependence on offshore stablecoins like Tether, and the SFC is expected to accelerate stablecoin regulations. There is potential for opportunities in ETH-based stablecoins.

BTC Technical Analysis: Support and Resistance Levels

The BTC price is currently at $68,115.30, with a 24-hour change of -0.42%. Although the downtrend continues, the weekly candlestick chart has turned positive, rising 8% from the lowest point. The table below shows the critical levels:

| Level | Price | Score | Distance |

|---|---|---|---|

| S1 Support | $65,534 | 76/100 ⭐ | -3.71% |

| S2 Support | $60,000 | 67/100 ⭐ | -11.85% |

| R1 Resistance | $71,268 | 71/100 ⭐ | +4.71% |

| R2 Resistance | $83,835 | 58/100 | +23.17% |

Supertrend bearish, above EMA 20 $73,222. RSI oversold, strong recovery signal.

Metaplanet Bitcoin Loss and Market Connection

Metaplanet announced a net loss of 619 million dollars in Bitcoin valuation but reached 35.102 BTC in assets. This corporate accumulation supports BTC along with positive developments like Hong Kong regulations. ALT coins will also be affected by BTC movements.

Impact of Hong Kong Regulations on BTC Investors

Hong Kong's license could accelerate institutional entry in Asia. Perpetuals and margin for professional investors provide advantages in managing volatility. Even though BTC is in a downtrend, SFC news could test the R1 $71k resistance.