HYPE Surges 6.7% Amid Market Dip, Potential Adam and Eve Breakout to $50

HYPE/USDT

$568,888,529.70

$29.69 / $26.11

Change: $3.58 (13.71%)

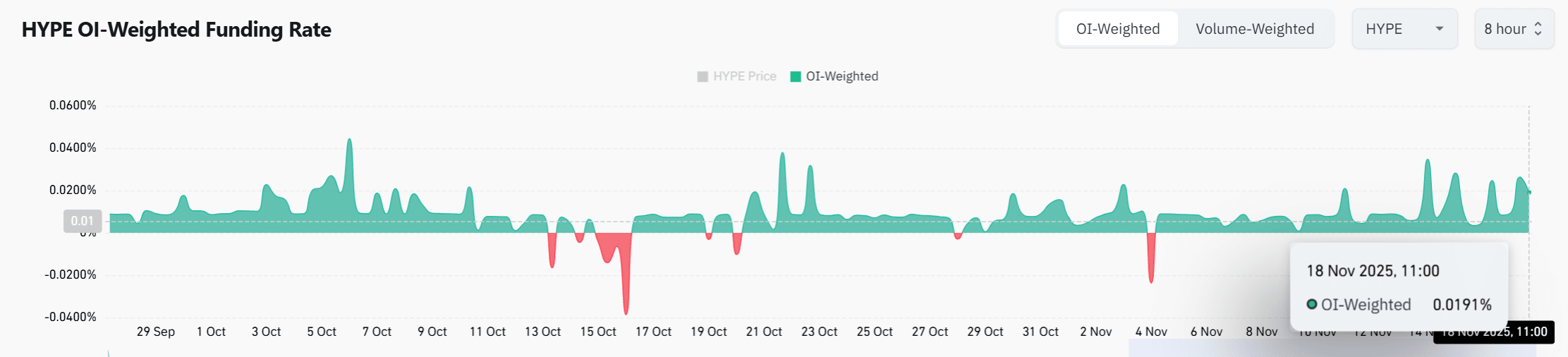

+0.0056%

Longs pay

Contents

Hyperliquid’s HYPE token surged 6.7% to $41.28 amid a broader market decline, driven by increased trading volume, a developing Adam and Eve chart pattern, rising open interest, and bullish trader positioning. This resilience highlights strong demand in derivatives markets despite overall volatility.

-

Trading volume rose 57.58%, indicating heightened investor participation and fresh buying interest in HYPE.

-

The Adam and Eve pattern on the chart suggests potential bullish continuation, with buyers defending key support levels around $38.

-

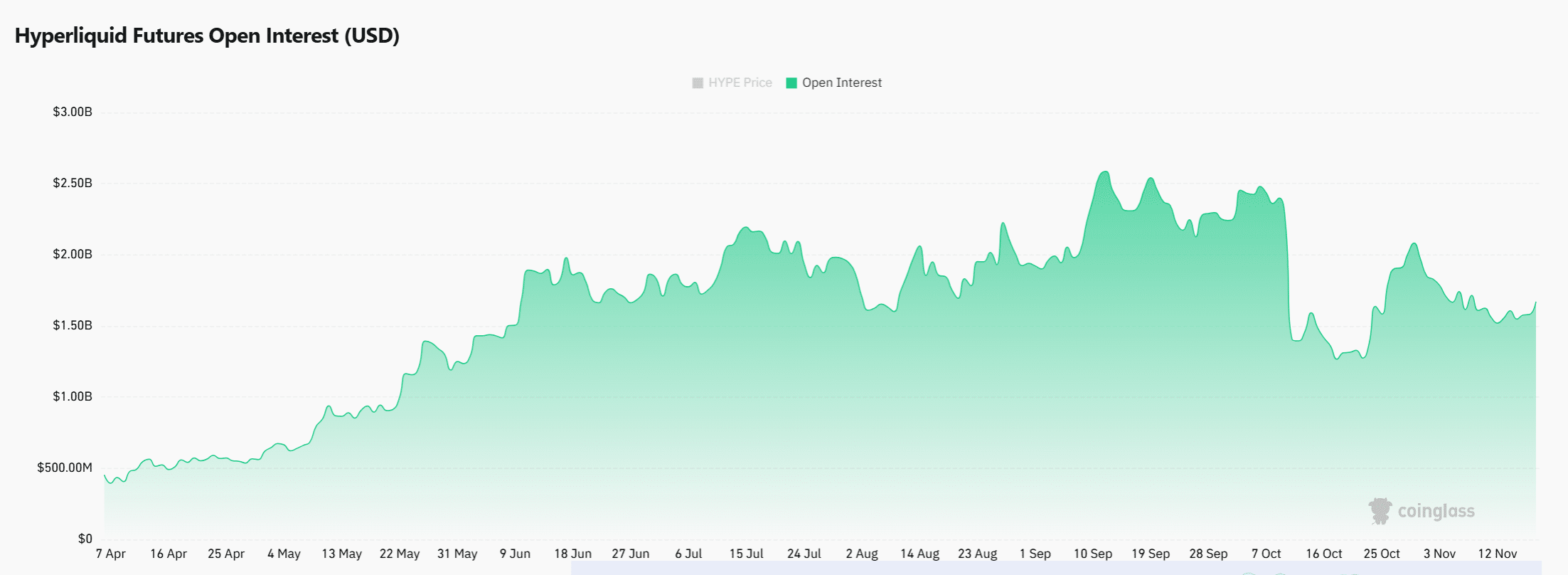

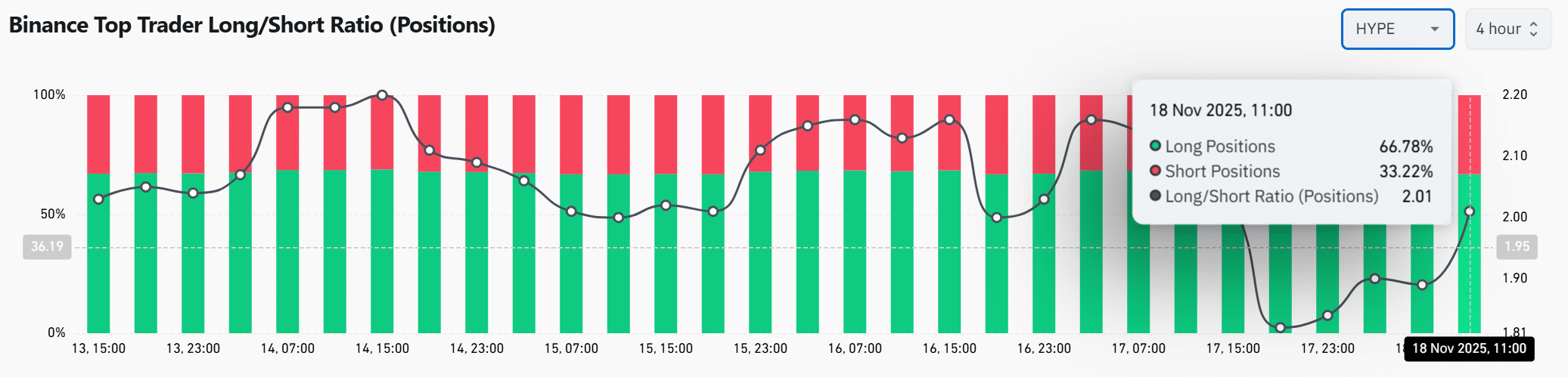

Open interest climbed 10.89% to $1.77 billion, while the long-short ratio reached 2.01, reflecting leveraged optimism among top traders.

Discover why Hyperliquid HYPE surges 6.7% despite crypto market drops. Explore chart patterns, open interest spikes, and trader sentiment for bullish insights. Stay updated on HYPE price action today!

What is driving the Hyperliquid HYPE price surge amid market volatility?

Hyperliquid HYPE price surge is fueled by robust trading activity and positive derivatives metrics, even as the wider cryptocurrency market faces downward pressure. At the time of reporting, HYPE traded at approximately $41.28, marking a 6.7% increase that pushed its market capitalization to $13.9 billion. This performance stands out against the backdrop of declining altcoins, underscoring selective investor interest in HYPE’s ecosystem.

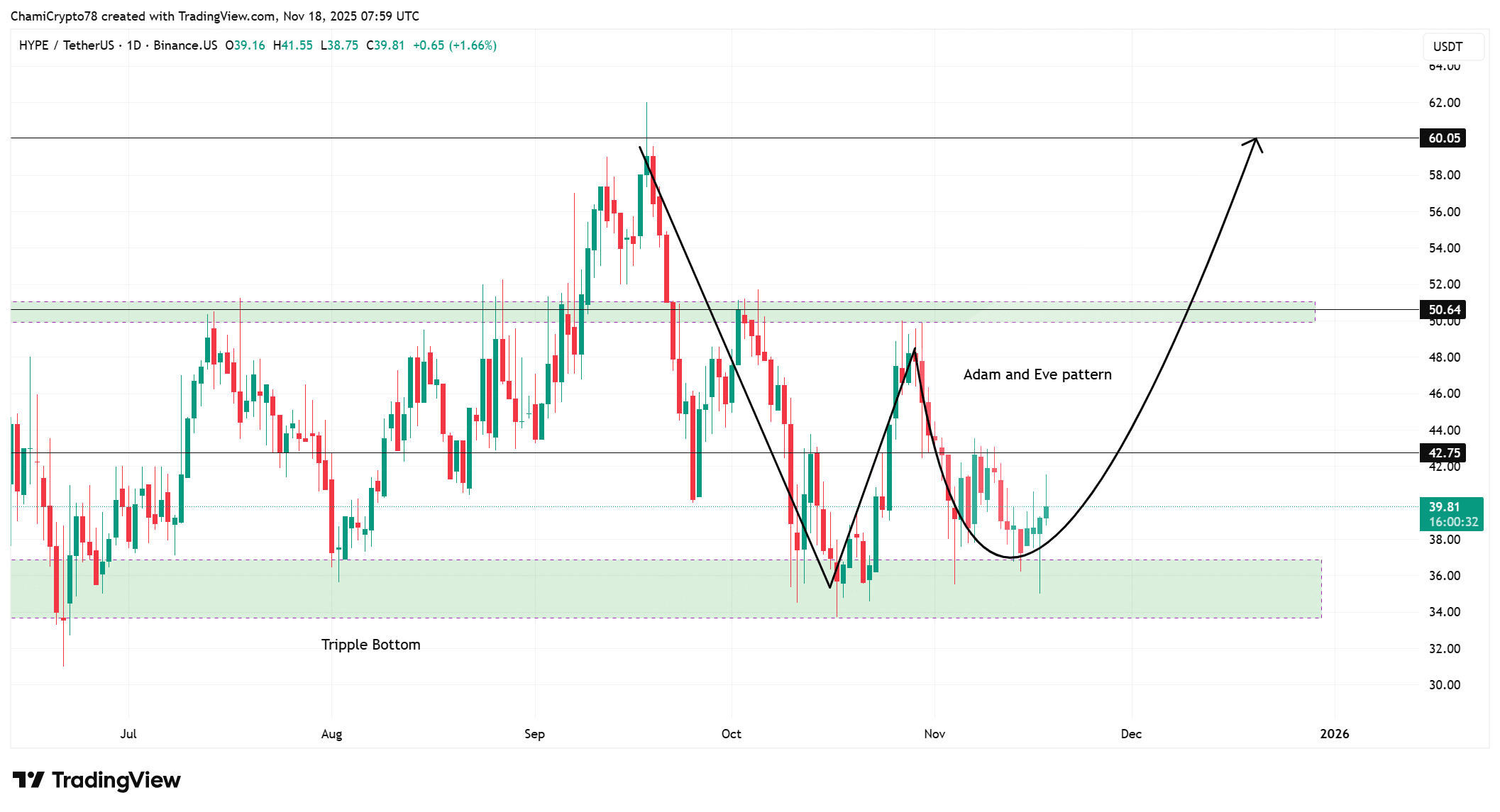

How does the Adam and Eve pattern signal potential for HYPE breakout?

The emerging Adam and Eve structure on HYPE’s price chart indicates building bullish momentum, characterized by a sharp V-shaped recovery in the Adam phase from a triple-bottom support near $38, followed by a rounded base in the Eve phase. This pattern, as observed on platforms like TradingView, reflects growing buyer confidence with aggressive wick rejections on intraday candles. Supporting data from market analysis shows volume expansion aligning with these formations, suggesting HYPE could challenge resistance at $42.75. If sustained, this setup may propel prices toward $50.64 and beyond to $60.05, though a confirmed breakout above key levels is essential to mitigate risks from ongoing market uncertainty. Experts in technical analysis, such as those cited in CoinGlass reports, emphasize that such patterns often precede significant rallies when accompanied by rising open interest.

Source: TradingView

How has open interest in HYPE derivatives markets evolved recently?

Open interest for HYPE has seen a notable 10.89% increase to $1.77 billion, demonstrating heightened speculative activity and trader commitment even as other assets falter. This rise in open interest, tracked via CoinGlass data, coincides with price stabilization near consolidation lows, pointing to expectations of upward movement. The alignment of increasing open interest with volume gains reinforces a narrative of sustained demand, though it also elevates the potential for amplified volatility if sentiment shifts. Market observers note that such metrics often serve as leading indicators for trend continuation in decentralized finance tokens like HYPE.

Source: CoinGlass

What factors are influencing top traders’ shift to long positions in HYPE?

Top traders on platforms like Binance have tilted heavily toward long positions, with 66.78% longs versus 33.22% shorts, resulting in a long-short ratio of 2.01. This positioning, derived from CoinGlass analytics, underscores optimism tied to HYPE’s technical setup and discounted entry points amid the market downturn. The shift benefits from rotational flows away from underperforming assets, allowing experienced traders to build exposure near support zones like $39 and $42.75. However, this imbalance heightens liquidation risks, prompting recommendations for prudent risk management from derivatives market specialists.

Source: CoinGlass

Do positive funding rates indicate strengthening buyer dominance in HYPE?

Funding rates for HYPE remain positive across major derivatives venues, with an open interest-weighted rate of 0.01991%, affirming ongoing long-side pressure that counters prevailing market pessimism. These rates, as reported by CoinGlass, reflect buyers’ willingness to incur costs to hold positions, synchronized with open interest growth and favorable trader ratios. Frequent spikes in funding during recovery phases further bolster the case for momentum, though persistently high levels could invite short-term corrections if overextension occurs. Analysts from trading platforms highlight that positive funding in volatile environments often correlates with resilient price action.

Source: CoinGlass

Frequently Asked Questions

Why is Hyperliquid HYPE outperforming other altcoins in a declining market?

HYPE’s outperformance stems from a 57.58% volume increase and bullish technical indicators like the Adam and Eve pattern, attracting selective inflows. Open interest at $1.77 billion and a 2.01 long-short ratio further support this, as traders position for breakouts above $42.75 amid broader sell-offs.

What should traders watch for in HYPE’s price movement today?

Traders should monitor price acceptance above $42.75 for confirmation of the bullish trend, alongside sustained positive funding rates and open interest growth. These factors could drive HYPE toward $50.64, but watch for volatility spikes that might test support at $38 in response to market-wide pressures.

Key Takeaways

- HYPE’s 6.7% surge defies market trends: Driven by volume expansion and technical patterns, positioning it for potential resistance tests.

- Open interest and trader bias signal strength: With $1.77 billion in OI and 66.78% long positions, conviction builds for upside continuation.

- Monitor key levels for breakout confirmation: Sustained action above $42.75 could target $50-$60, but manage risks from high leverage.

Conclusion

In summary, the Hyperliquid HYPE price surge showcases resilience through aligned metrics like the Adam and Eve pattern, elevated open interest, and positive funding rates, even as the cryptocurrency market grapples with volatility. These elements collectively point to a bullish outlook, provided buyers hold key supports. As HYPE approaches critical resistance, investors are advised to track derivatives data closely for opportunities, potentially setting the stage for further gains in the evolving crypto landscape.