HYPE Whale Adds $4.1M Long Position Amid Potential Rebound Near $32 Support

HYPE/USDT

$568,888,529.70

$29.69 / $26.11

Change: $3.58 (13.71%)

+0.0056%

Longs pay

Contents

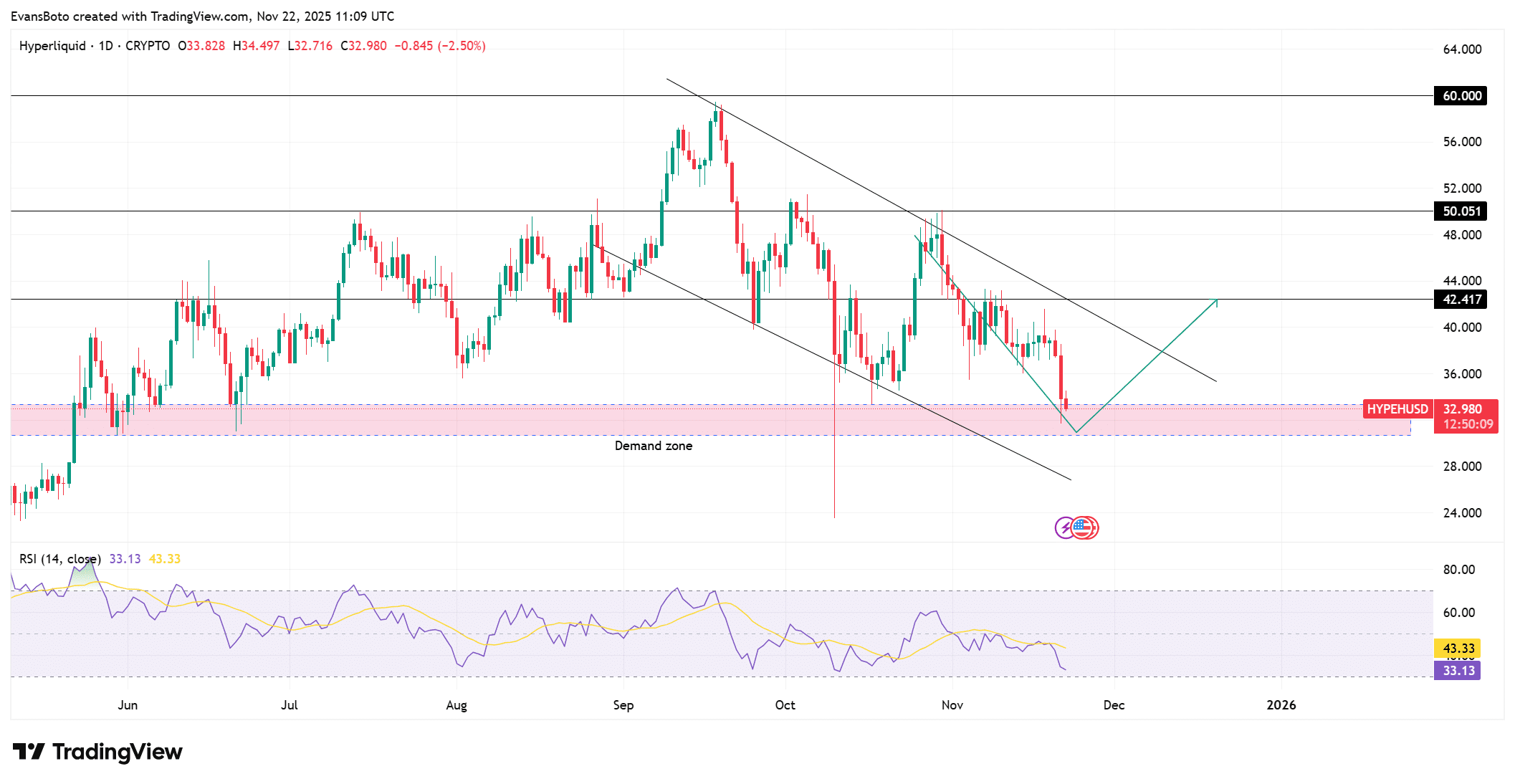

A major whale has added a $4.1 million long position in Hyperliquid’s HYPE token at 5x leverage, signaling strong conviction despite a shift from $2.4 million in unrealized profits to a $1.5 million loss. This move occurs as HYPE approaches a key $30–$33 demand zone, potentially boosting buyer momentum amid rising volatility.

-

Whale Activity Impact: The $4.1M long addition highlights aggressive accumulation near historical support levels, drawing trader attention.

-

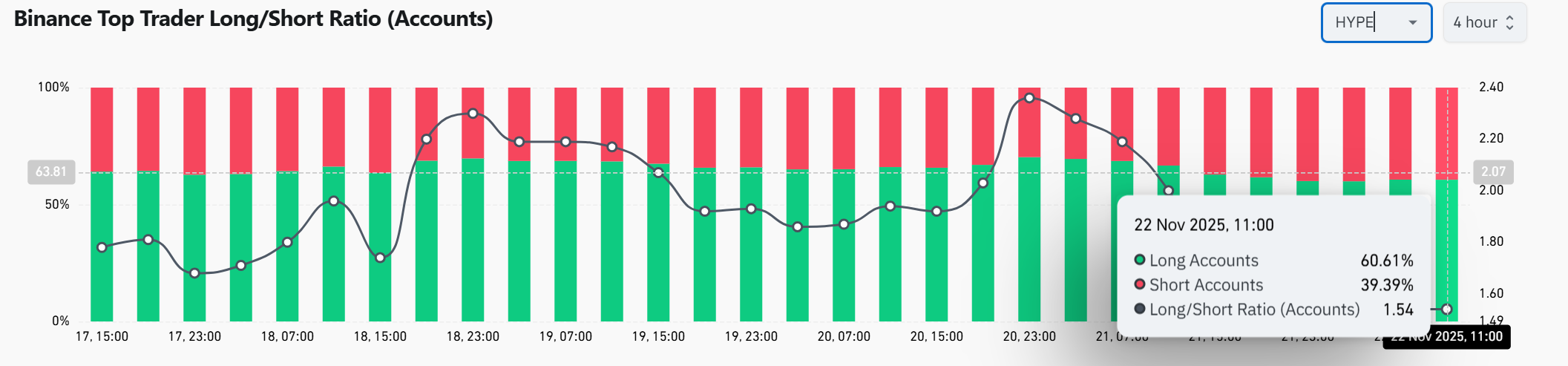

Market Sentiment: Long positions dominate at 60.61%, reflecting buyer confidence even in a descending channel structure.

-

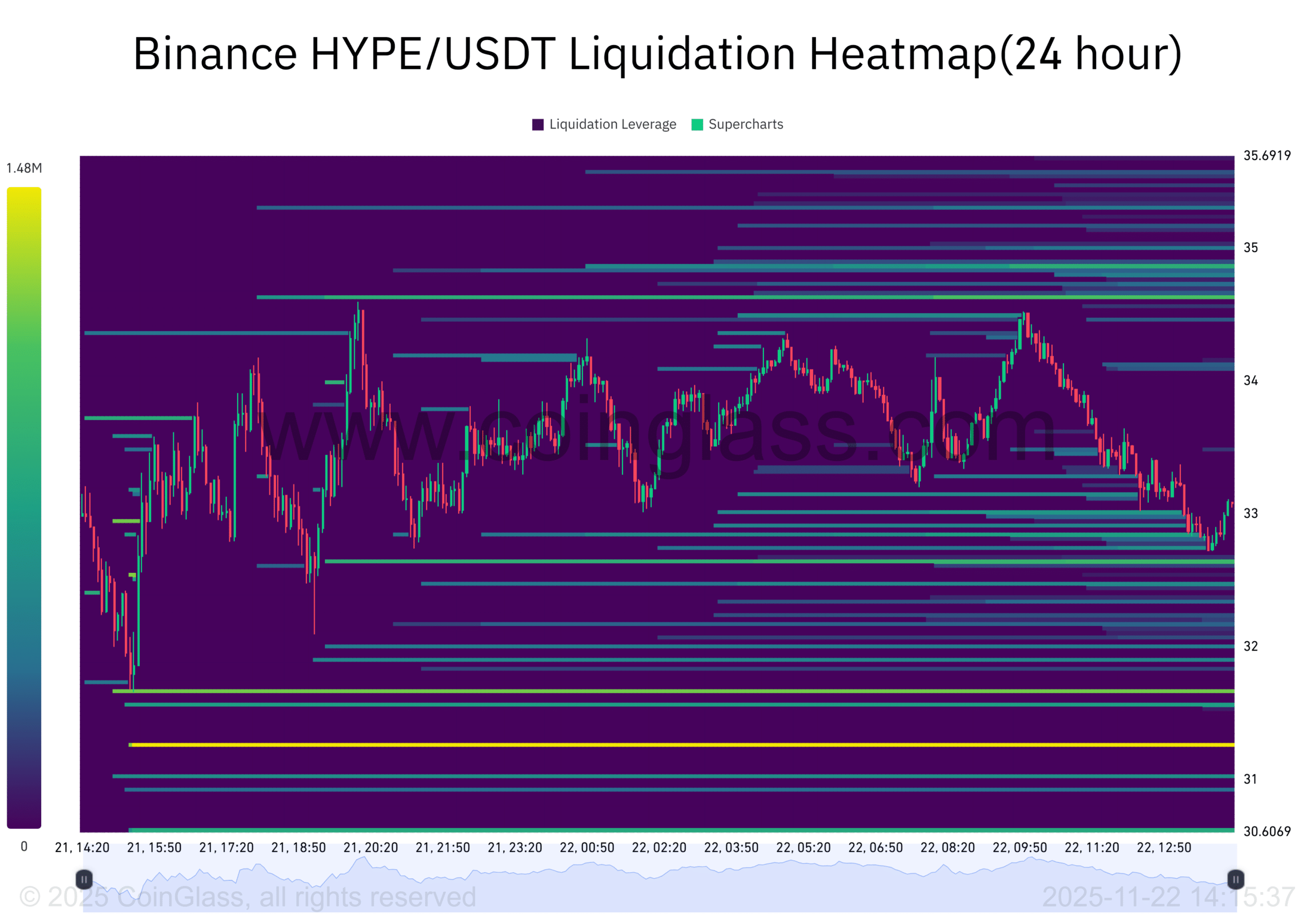

Open Interest Surge: A 3.46% rise to $1.58 billion indicates heightened speculation, with liquidation risks below $32 potentially triggering reversals, per CoinGlass data.

Discover how a whale’s $4.1M long in Hyperliquid HYPE influences price action near $32 support. Analyze volatility, long-short ratios, and rebound potential for informed trading decisions.

What is the impact of the whale’s $4.1M long position on Hyperliquid HYPE?

Hyperliquid HYPE whale long position demonstrates significant market conviction as a major trader expands exposure by $4.1 million at 5x leverage, even after unrealized profits turned into a $1.5 million loss. This bold step occurs while HYPE hovers near the $32 mark, testing a historically responsive demand area between $30 and $33. Such whale activity often influences retail traders, potentially stabilizing prices and encouraging accumulation in high-volatility environments.

Whales typically target zones with proven reaction history, and this expansion aligns with HYPE’s current position inside a descending channel. Data from on-chain analytics reveals that similar moves have preceded volatility spikes, where buyers defend key floors to challenge overhead resistance. As HYPE trades in this critical range, the whale’s commitment could catalyze a shift, though sellers maintain control over rebounds for now.

How does HYPE’s long-short ratio and open interest reflect trader sentiment?

The long-short ratio stands at 1.54, with 60.61% of accounts holding long positions compared to 39.39% shorts, according to Binance trader data. This imbalance underscores robust buyer resolve amid price weakness, potentially amplifying volatility if a sudden reversal occurs. Open interest has climbed 3.46% to $1.58 billion, signaling increased participation and leveraged bets near the $30–$33 demand zone, as reported by CoinGlass.

Experts from market analysis platforms like CoinGlass note that rising open interest during declines heightens liquidation pressures but also sets the stage for sharp reactions. For instance, long dominance can lead to short squeezes if price breaks above $42.41, the channel resistance level. Short sentences highlight the setup: Buyer conviction grows. Volatility builds. A sweep of lower liquidity could ignite a rebound, while failure at support exposes deeper targets. Supporting statistics show HYPE’s RSI at 33, indicating oversold conditions ripe for intervention.

Frequently Asked Questions

What does the whale’s $4.1M addition mean for Hyperliquid HYPE price direction?

The whale’s expansion of a 5x long position to $4.1 million reflects high conviction in HYPE’s potential, despite a $1.5 million unrealized loss. It bolsters buyer confidence near the $30–$33 support, where historical rebounds have occurred, but the descending channel caps upside until a clean break above $42.41 materializes.

Could increasing volatility in HYPE lead to a price rebound from current levels?

Yes, with HYPE trading near $32 and volatility rising, the combination of whale accumulation and long-heavy positioning creates rebound potential. Liquidation pockets below this level could trigger a sharp bounce if buyers defend aggressively, though sellers’ control in the channel suggests monitoring for a structural shift first.

Key Takeaways

- Whale Expansion Signals Strength: The $4.1M long addition at 5x leverage shows conviction, potentially stabilizing HYPE near $32 support amid turning unrealized profits to losses.

- Long Dominance Builds Pressure: A 60.61% long ratio on Binance indicates buyer resolve, which could force short squeezes if momentum builds from the demand zone.

- Volatility and OI Rise Demand Caution: Open interest at $1.58B and liquidation risks below $32 highlight opportunities for reversals but warn of downside sweeps without structural confirmation.

Conclusion

In summary, the Hyperliquid HYPE whale long position of $4.1 million, alongside long-short imbalances and surging open interest, positions HYPE at a pivotal juncture near the $30–$33 demand floor. Data from sources like CoinGlass and TradingView illustrate how this convergence could foster buyer momentum if support holds, potentially targeting $42.41 resistance. As volatility intensifies, traders should stay vigilant for signs of reversal, ensuring strategies align with emerging market structures for optimal outcomes.

Buyers Look for a Breakout Path

HYPE currently navigates a vital $30–$33 demand region that has ignited recoveries in prior months, including July and September. The Relative Strength Index (RSI) hovers around 33, pointing to oversold territory and drawing potential buyer inflows. Yet, the overarching descending channel continues to limit upside, with multiple failed breakout attempts underscoring seller dominance.

Market participants eye a decisive move beyond $42.41 to validate a structural change favoring bulls. The convergence of the channel’s lower boundary with this demand area heightens the prospects for pronounced price responses. Earlier interactions here saw modest buyer defenses, but sustained momentum remains essential to avert retreats toward lower liquidity zones. Consequently, observers focus on whether renewed buying power emerges to challenge the prevailing downtrend.

Source: TradingView

HYPE Long Traders Hold Their Ground

Insights from Binance’s leading trader metrics indicate that long accounts comprise 60.61%, dwarfing shorts at 39.39%. This skew reveals steadfast buyer belief, persisting despite evident price softness. Nonetheless, heavy long exposure risks magnifying swings during abrupt market turns, aligning closely with the whale’s amplified stake.

The 1.54 long-short ratio reinforces a bullish undercurrent, which gains traction from the whale’s proactive scaling. Long prevalence heightens the chance of seller squeezes on unexpected upticks. As HYPE lingers at a robust demand base, the actions of these positioned traders become central to directional cues. Long holders anticipate building resilience from this level, with overall path hinging on sustained aggressive buyer postures.

Source: CoinGlass

Open Interest Climbs as Speculators Load Up

Open interest has advanced 3.46% to reach $1.58 billion, evidencing amplified engagement around the prevailing price range. During downturns, such growth often escalates liquidation threats, yet it also underscores committed speculation. HYPE’s proximity to the demand zone amplifies the impact of these leveraged commitments on price dynamics.

OI upticks coinciding with whale builds typically denote firm directional convictions. Surveillance centers on fluctuations near $32 as positions accumulate. Near structural bases, escalating open interest implies expectations of upward pushes. A surpass of $42.41 might accelerate short coverings, whereas further declines could engage lower liquidity reserves, per CoinGlass observations.

Source: CoinGlass

Could a Sweep Trigger a Rebound?

Liquidation heatmaps reveal concentrated clusters under $32 and around $31, elevating the risk of wicks but also offering robust bounce points upon liquidity grabs. HYPE’s prior touch of low-liquidity areas hints at deliberate targeting by sizable players. The descending channel overlays several such shelves, tightening the trading bandwidth.

Buyer protections within this reactive zone frequently spark upward moves. Evaluations now center on price engagements with these liquidity groupings ahead of shifts. A rapid dip into inferior bands might provoke a vigorous uplift should buyers respond forcefully. Market analysts from platforms like CoinGlass emphasize how these dynamics often precede significant reversals in volatile assets like HYPE.

Source: CoinGlass

Overall, HYPE occupies a decisive nexus where whale builds, long biases, and foundational levels intersect. The ecosystem scrutinizes if this setup propels a recovery to $42.41 or cedes ground in the $30–$33 band. Firm defense here could lay groundwork for resurgence, but lapses unveil extended liquidity pursuits. Thus, ensuing developments clarify if the whale’s initiative heralds a market inflection.