Hyperliquid HYPE Unstake Signals Potential Price Dip Ahead of November Token Unlock

HYPE/USDT

$568,888,529.70

$29.69 / $26.11

Change: $3.58 (13.71%)

+0.0056%

Longs pay

Contents

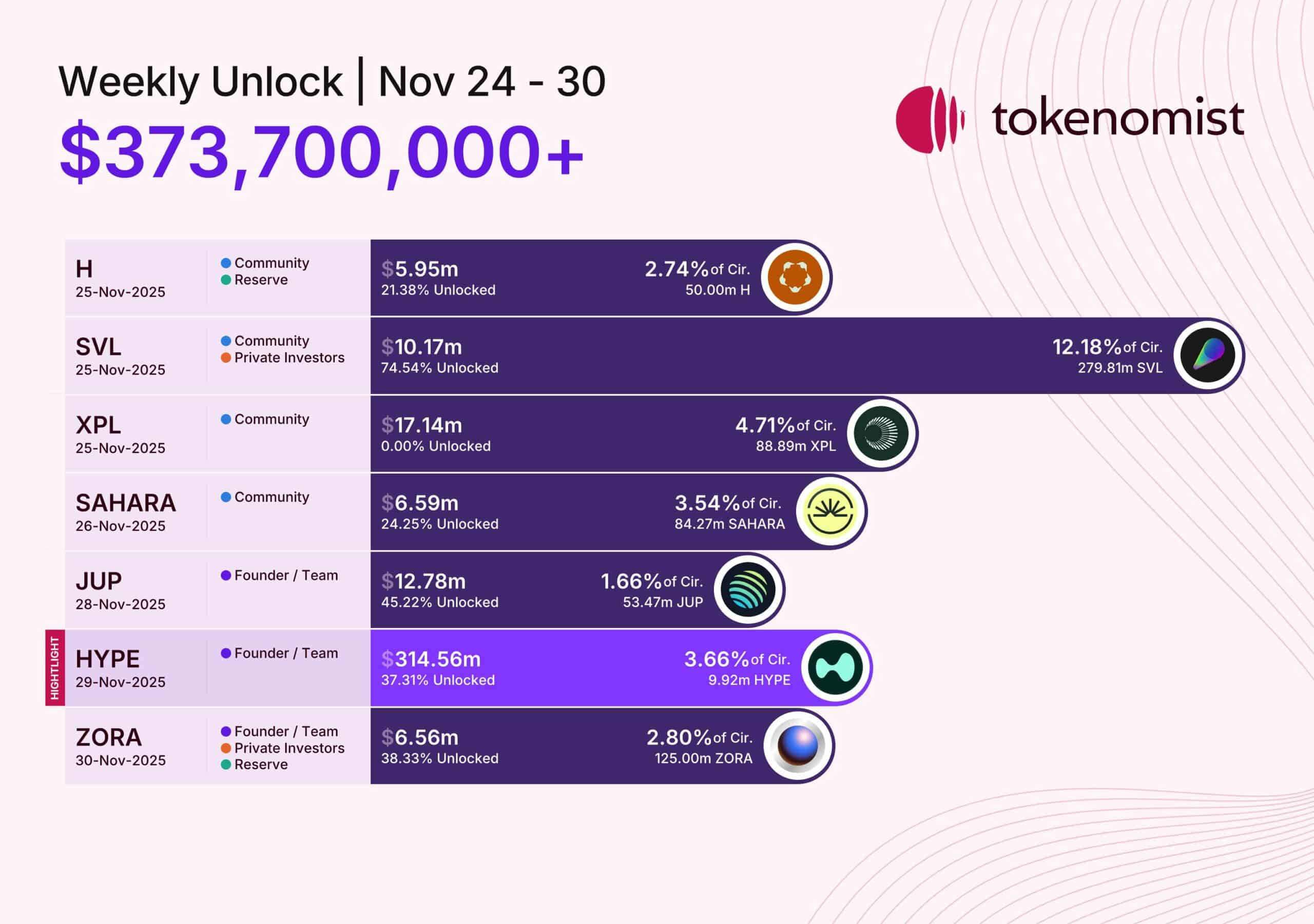

The Hyperliquid team has unstaked approximately 10 million HYPE tokens, valued at $316 million, in preparation for the upcoming token unlock on November 29. This move involves releasing tokens to support the founders and team, potentially impacting market dynamics amid mixed trader expectations of a price dip or rebound.

-

Unstaking event: Hyperliquid’s team unstaked 10M HYPE tokens worth $316M ahead of the November 29 unlock.

-

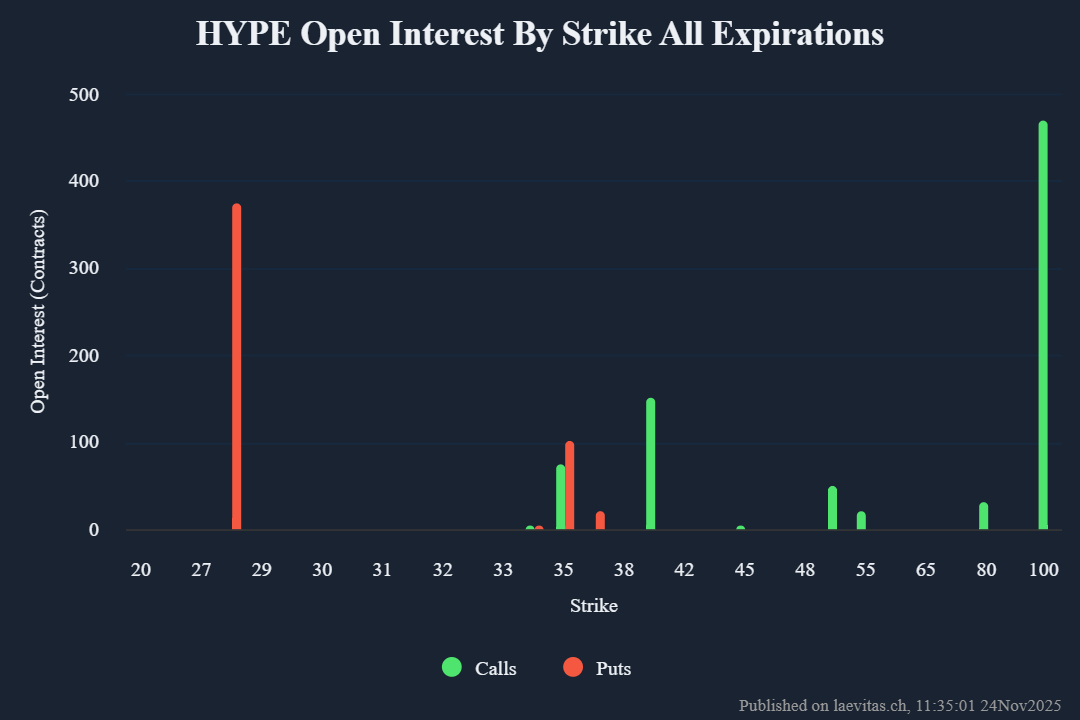

Market positioning shows HYPE trading at $31.4, with options data indicating heavy put activity at $28, suggesting downside protection.

-

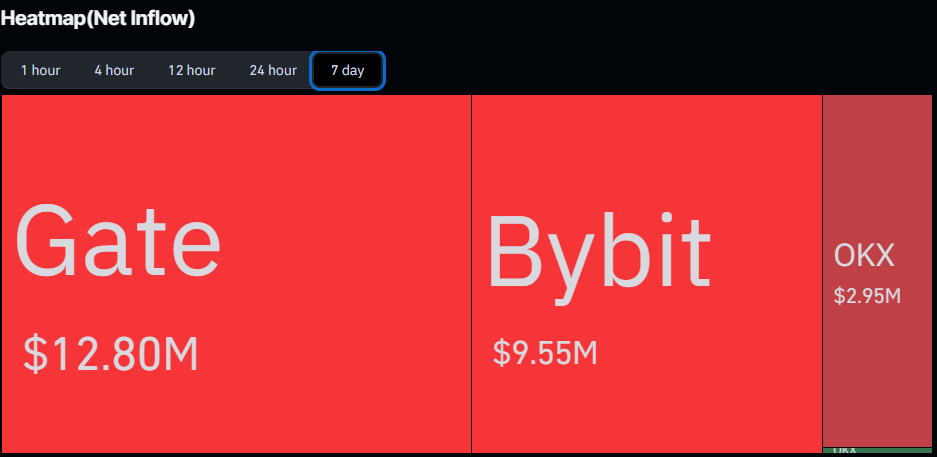

Accumulation trends reveal net outflows from exchanges over the past week, signaling bullish self-custody moves despite the unlock overhang of over $400 million in the next 24 months.

Discover how Hyperliquid’s HYPE token unlock on November 29 could affect prices, with $316M unstaked by the team. Stay informed on market expectations and trading strategies in this detailed analysis.

What is the Hyperliquid HYPE Token Unlock?

Hyperliquid HYPE token unlock refers to the scheduled release of locked tokens from the project’s vesting schedule, specifically set for November 29. In this instance, about 3.6% of the circulating supply, or 10 million HYPE tokens, will be made available to the founders and team. This event follows the team’s recent unstaking of $316 million worth of HYPE, as reported by on-chain data analysts, aiming to prepare for the distribution while navigating potential market volatility.

How Will the HYPE Token Unlock Impact Market Sentiment?

The Hyperliquid HYPE token unlock is poised to introduce additional supply into the market, which could exert downward pressure on the price if selling occurs. Tokenomist data indicates that this unlock represents a significant portion of the project’s allocation for core contributors, with monthly unlocks continuing over the next 24 months potentially adding over $400 million in supply overhang, according to crypto investor Arthur Hayes. He emphasized that even with ongoing buybacks, this influx might outweigh current token value, leading to heightened caution among investors. Historically, similar unlocks in successful projects like Hyperliquid have sparked fear, uncertainty, and doubt (FUD), but on-chain metrics show varied trader responses.

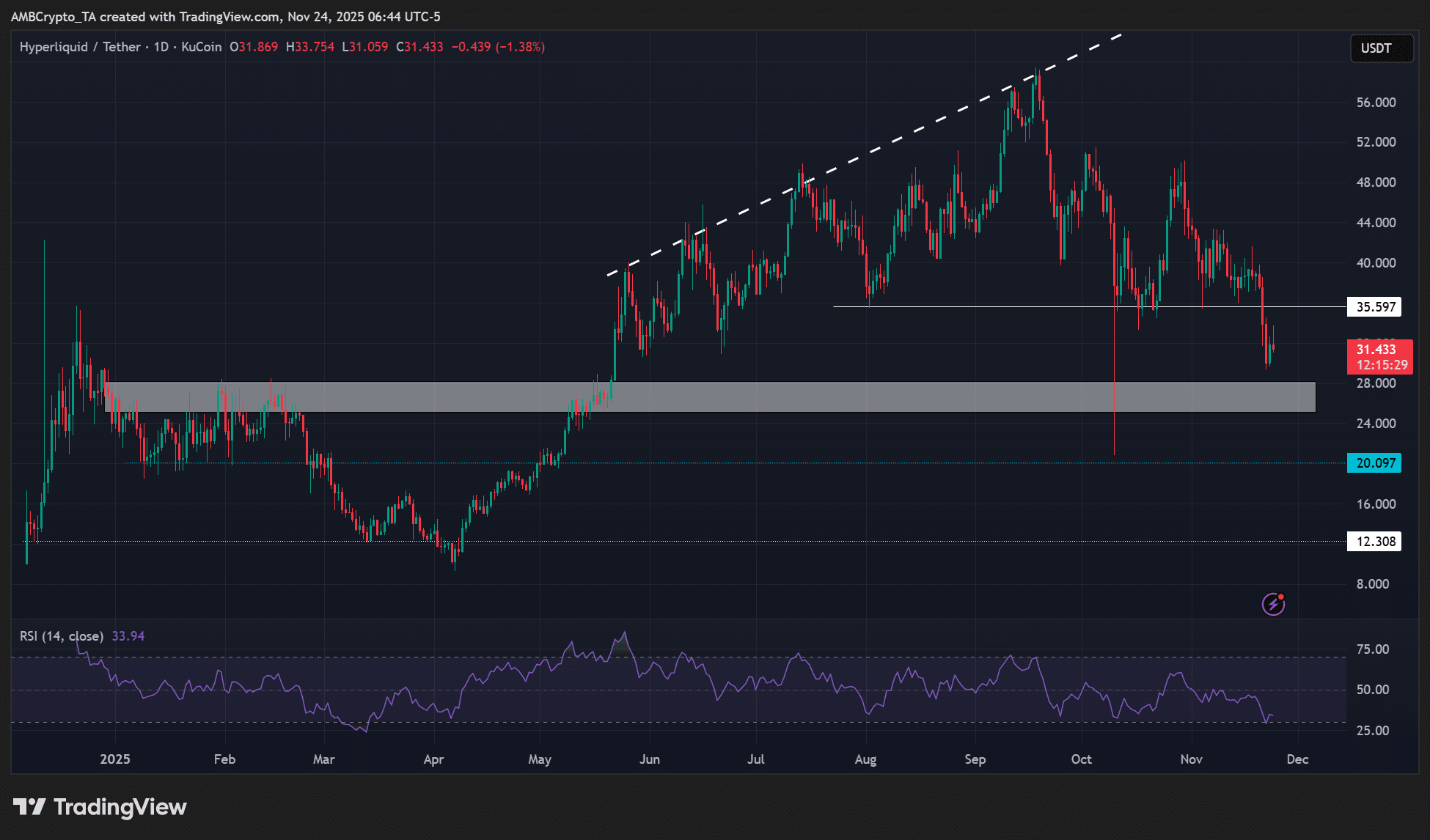

A pseudonymous analyst, Avseenko, observed that most market participants were either farming HYPE through its decentralized finance (DeFi) ecosystem or engaging in short positions. However, spot market bidding remained weak, suggesting limited immediate support. Options data from Laevitas further highlights this tension, with the highest volume of put options concentrated at the $28 strike price, indicating large players are hedging against a potential 10% dip from the current $31.4 level. Conversely, price charts on TradingView reveal $28 as a prior breakout zone during HYPE’s early-year recovery, potentially serving as strong support for a rebound toward $30, as projected by some analysts.

Despite these concerns, recent accumulation patterns offer a counterbalance. CoinGlass reports net outflows of HYPE from exchanges over the past seven days, implying investors are moving tokens to self-custody—a bullish indicator of long-term confidence. Analyst Teng Yang reinforced this view, stating, “In my opinion, the team will sell tokens, but the impact probably won’t be as steep as people fear—for example, through over-the-counter deals or a slow drip. It’s more diamond-handed compared to a typical venture capital unlock.” This suggests the unlock may not trigger the severe sell-off some anticipate, given Hyperliquid’s proven track record in the derivatives trading space.

Overall, the event underscores the importance of monitoring vesting schedules in layer-1 blockchain projects like Hyperliquid, which has gained traction for its high-performance perpetual futures platform. As of now, HYPE remains down 47% from its all-time high of $59.4, but sustained ecosystem growth could mitigate unlock-related pressures.

Source: Tokenomist

In the broader context, Hyperliquid’s tokenomics are designed to align incentives between the team and community, with unlocks spaced to support ongoing development. This approach, common in established protocols, helps fund innovations in areas like on-chain order books and low-latency trading. Investors should note that while short-term volatility is likely, Hyperliquid’s total value locked (TVL) in its DeFi ecosystem continues to grow, providing a foundation for resilience.

Frequently Asked Questions

What Triggers the Hyperliquid HYPE Token Unlock Schedule?

The Hyperliquid HYPE token unlock schedule is predefined in the project’s smart contracts, releasing vested tokens to the team and founders on specific dates like November 29. This batch involves 10 million tokens, or 3.6% of circulation, to fund operations and rewards, as detailed by Tokenomist trackers, ensuring transparency and gradual supply introduction over 24 months.

Will the HYPE Token Unlock Cause a Price Drop?

The upcoming Hyperliquid HYPE token unlock on November 29 may lead to short-term selling pressure from the released 10 million tokens, but market data shows mixed signals. Options positioning protects against a drop below $28, while exchange outflows indicate accumulation. Analysts like Teng Yang suggest minimal severe impact through controlled sales, potentially stabilizing at support levels for a possible rebound.

Key Takeaways

- Unstaking Preparation: The Hyperliquid team unstaked $316 million in HYPE tokens to facilitate the November 29 unlock of 10 million tokens for founders and team support.

- Market Expectations: Traders anticipate a potential 10% dip to $28 based on options data, though accumulation trends and historical support suggest a rebound to $30 is possible.

- Long-Term Outlook: With monthly unlocks over 24 months creating a $400 million overhang, investors should monitor buybacks and ecosystem growth for sustained HYPE value.

Source: Laevitas

Source: HYPE/USDT, TradingView

Source: CoinGlass

Conclusion

The Hyperliquid HYPE token unlock on November 29 marks a pivotal moment, with the team’s unstaking of $316 million in tokens highlighting strategic preparation amid ongoing monthly releases. While market sentiment around HYPE price impact remains mixed—balancing downside hedges at $28 with bullish accumulation—Hyperliquid’s robust DeFi ecosystem positions it for recovery. As the project continues to innovate in perpetual trading, investors are advised to track on-chain flows and vesting updates closely, potentially capitalizing on post-unlock opportunities in the evolving crypto landscape.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026