Hyperliquid Shows Market Dominance Despite Majority of Traders Facing Profitability Challenges

HYPE/USDT

$808,968,749.09

$32.53 / $30.51

Change: $2.02 (6.62%)

+0.0041%

Longs pay

Contents

-

Hyperliquid, a leading decentralized perpetual futures exchange, reveals that only 14% of its traders are profitable, highlighting significant challenges in leveraged crypto trading.

-

A small elite group of traders has amassed over $10 million in profits, often leveraging substantial capital, while the majority face consistent daily losses averaging $5,600.

-

Despite these profitability disparities, Hyperliquid commands over 60% of the DeFi perpetual futures market, with a robust $188 billion in monthly trading volume.

Explore Hyperliquid’s trader profitability dynamics, market dominance, and the impact of leveraged trading on user outcomes in the decentralized finance space.

Analyzing Trader Profitability on Hyperliquid: A Closer Look at Market Realities

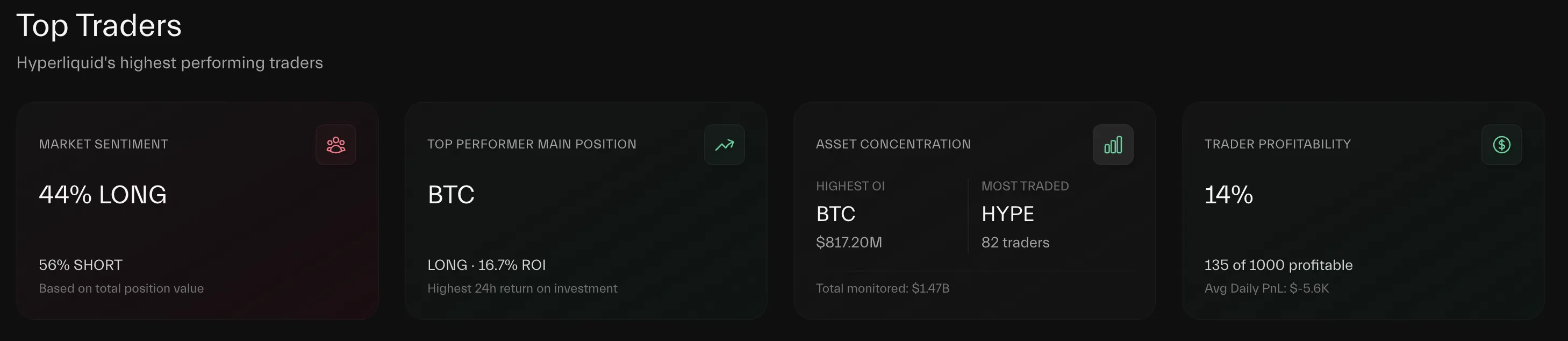

Recent data from Hyperdash underscores a stark reality for traders on Hyperliquid: only 135 out of 1,000 sampled traders have achieved profitability. This translates to a mere 14% success rate, with the average trader incurring a daily loss of approximately $5,600. Such figures reflect the inherent risks associated with leveraged perpetual futures trading, where amplified exposure can lead to significant financial setbacks for the majority of participants.

This trend is emblematic of the broader challenges faced by retail traders in high-leverage environments, where market volatility and rapid price movements often erode gains. The data suggests that while the platform offers lucrative opportunities, the majority of users must navigate a steep learning curve and risk management hurdles to achieve consistent profitability.

Top Earners and Capital Concentration: Insights from Industry Analysts

Crypto analyst DeFi Mochi, commenting on X (formerly Twitter), highlighted that only 170 traders on Hyperliquid have surpassed $10 million in profits, with 1,589 traders exceeding $1 million. These figures encompass both trading profits and rewards from platform airdrops. However, Mochi noted that many of these top earners exhibit a return on investment (ROI) below 200%, indicating that their success is often predicated on substantial initial capital rather than extraordinary trading skill alone.

This observation is supported by community commentary, with some users attributing large gains to favorable airdrops rather than pure market trading. Such capital concentration raises important questions about the accessibility and sustainability of profit distribution on decentralized trading platforms like Hyperliquid.

Hyperliquid Trader Profitability. Source: Hyperdash

Market Dominance and Trading Volume: Hyperliquid’s Position in DeFi Perpetual Futures

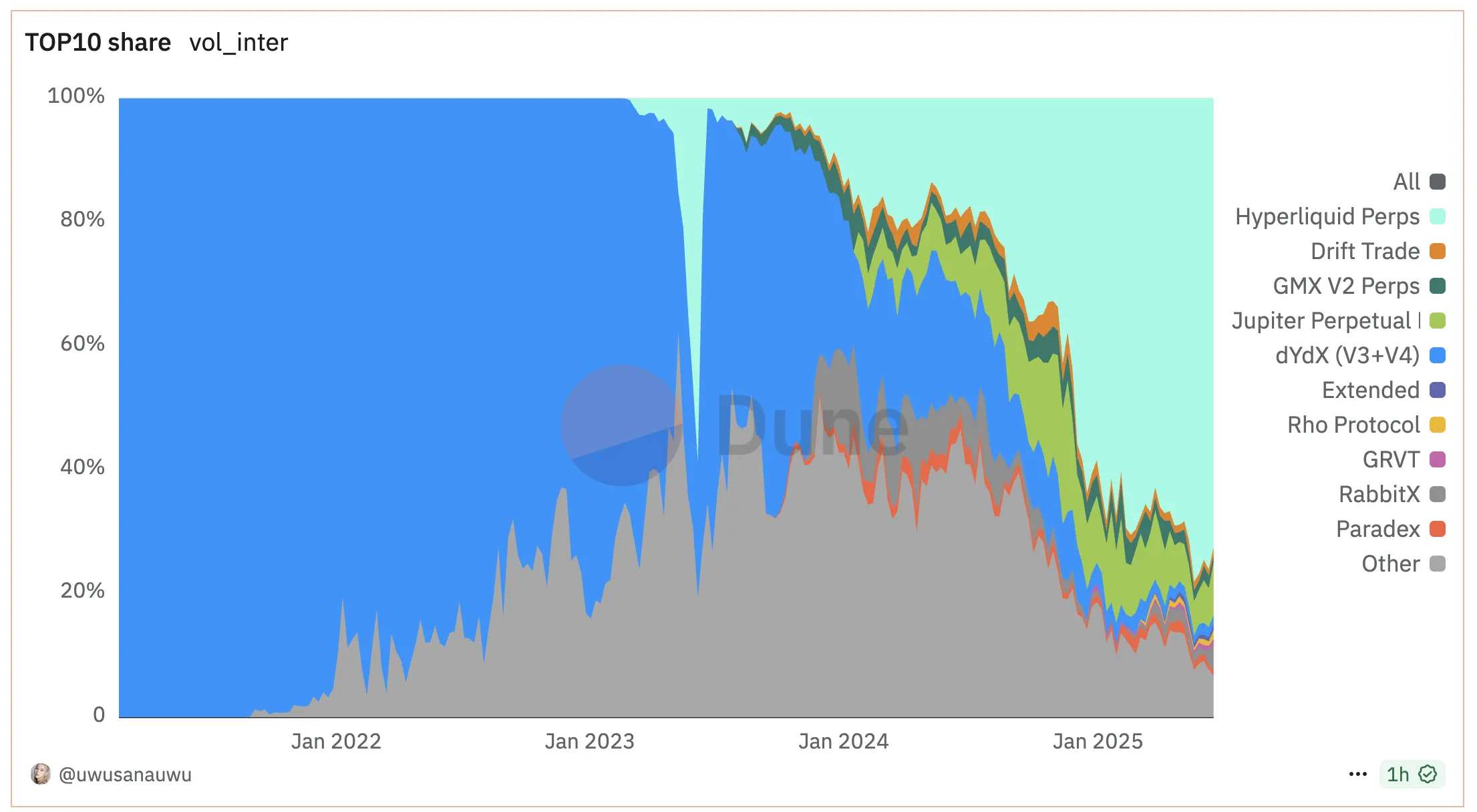

Despite the uneven profitability landscape, Hyperliquid maintains a commanding presence in the decentralized finance sector. According to recent reports from COINOTAG and data aggregated by Dune Analytics, Hyperliquid controls over 60% of the perpetual futures market share. This dominance is attributed to its hybrid decentralization model, which has successfully attracted investor capital and fostered user trust.

The platform’s user base exceeds 499,000, with an impressive $188 billion in trading volume processed over the past 30 days. This activity has generated $37.61 million in fees, underscoring Hyperliquid’s significant role in facilitating high-frequency, high-value trades within the DeFi ecosystem.

Hyperliquid Perps Market Share. Source: Dune

Implications for Traders and the DeFi Ecosystem

The disparity in trader profitability on Hyperliquid highlights the complex dynamics of decentralized leveraged trading. While the platform offers substantial opportunities, the data suggests that success is heavily skewed towards well-capitalized traders who can absorb risks and leverage positions effectively. For retail traders, this environment demands rigorous risk management strategies and a deep understanding of market mechanics.

Moreover, Hyperliquid’s market leadership and robust trading volumes indicate a strong demand for decentralized perpetual futures, signaling continued growth potential for the platform and the broader DeFi sector. Investors and traders alike should monitor evolving trends and platform developments to navigate this competitive landscape effectively.

Conclusion

In summary, Hyperliquid exemplifies both the opportunities and challenges inherent in decentralized leveraged trading. While only a small fraction of traders achieve profitability, the platform’s market dominance and substantial trading volumes reflect its critical role in the DeFi ecosystem. Moving forward, traders must balance ambition with caution, leveraging insights and capital prudently to succeed in this high-stakes environment.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/8/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/7/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/6/2026

DeFi Protocols and Yield Farming Strategies

2/5/2026