Hyperliquid Whale Increases Ether Long Position to $44.5M Amid Rally Signals

HYPE/USDT

$568,888,529.70

$29.69 / $26.11

Change: $3.58 (13.71%)

+0.0056%

Longs pay

Contents

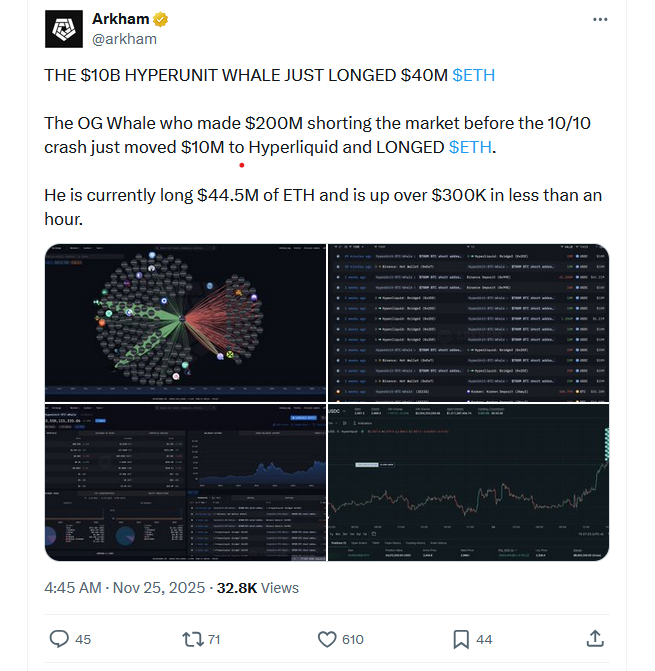

The Hyperliquid OG Whale, famous for a $200 million profit during the October 2025 market crash, has boosted its Ether long position by $10 million, reaching $44.5 million total amid signs of an Ethereum price rally.

-

Hyperliquid Whale’s Move: The unidentified trader added $10 million to its existing Ether longs on a decentralized exchange platform.

-

This positions the whale to potentially profit from Ethereum’s recovery, with ETH up 2% in the last 24 hours to $2,900.

-

Blockchain data from Arkham Intelligence shows the whale is already up over $300,000 in under an hour on this position.

Discover how the Hyperliquid whale’s $10 million Ether long addition signals bullish Ethereum momentum. Explore market insights and potential rally drivers—stay informed on crypto trends today.

What is the Hyperliquid OG Whale’s Latest Ether Position Strategy?

The Hyperliquid OG Whale’s Ether position involves a strategic increase in long bets on Ethereum, bringing the total exposure to $44.5 million after adding $10 million on Monday. This move follows the whale’s renowned success in shorting the market during the October 2025 crash, where it netted nearly $200 million. Blockchain analytics from Arkham Intelligence confirm the position is already yielding gains, with over $300,000 in profits realized in less than an hour, highlighting the trader’s timing amid broader crypto market recovery signals.

The whale, often referred to as the “$10B HyperUnit Whale,” operates on the Hyperliquid decentralized exchange and remains unidentified, listed by Arkham Intelligence as an unverified custom entity tied to a specific wallet address. This latest bullish stance on Ether contrasts with previous profitable shorts, suggesting confidence in Ethereum’s upward trajectory despite recent volatility. As the crypto market shows signs of stabilization, such large-scale positions from influential traders like this one could influence sentiment and price action in the coming days.

How Does This Ether Long Position Impact Ethereum’s Market Outlook?

The addition to the Hyperliquid whale’s Ether long position underscores growing optimism in the Ethereum ecosystem, potentially amplifying a rally if market conditions align. According to data from CoinGecko, Ethereum’s price has risen 2% over the past 24 hours, trading around $2,900 as of the latest updates. This uptick occurs alongside a broader surge in the cryptocurrency market, where analysts point to stabilizing futures data as evidence of a possible bottom formation.

Arkham Intelligence’s monitoring reveals the whale’s wallet activity, including the recent $10 million infusion that pushed the total long exposure to $44.5 million. “He is currently long $44.5M of ETH and is up over $300K in less than an hour,” the firm stated in a post on X on Monday. Such rapid gains early in the position suggest the trader is leveraging momentum from Ethereum’s recent dip to a four-month low, now hinting at a rebound toward $3,200 based on futures indicators.

Industry experts emphasize that while individual whale actions do not dictate market direction, they often serve as leading signals. For instance, changes in open interest and funding rates in Ether futures markets indicate reduced bearish pressure, supporting the potential for upward movement. Ethereum’s network fundamentals, including ongoing developments like the Fusaka fork, further bolster this outlook by enhancing scalability through innovations such as PeerDAS, which simplifies data availability for validators and users alike.

Historically, this whale has demonstrated expertise in timing trades, profiting from the October 10, 2025, market crash through well-executed shorts that capitalized on widespread sell-offs. The shift to longs now positions it to benefit from any sustained rally, particularly as institutional interest in Ethereum grows. However, market analysts caution that volatility remains high, with macroeconomic factors like interest rate policies influencing crypto prices. Data from blockchain platforms shows no direct correlation to external events yet, but the whale’s move aligns with on-chain metrics showing increased accumulation by large holders.

To provide deeper context, consider Ethereum’s performance metrics: trading volume has spiked 15% in the last week, per CoinGecko reports, while the ETH/BTC ratio stabilizes, suggesting relative strength against Bitcoin. Expert commentary from figures in the space, such as former executives in crypto exchanges, highlights the whale’s pattern of high-conviction trades. Garret Jin, ex-CEO of the now-defunct BitForex exchange, has publicly denied ownership of the wallet but acknowledged indirect connections uncovered by blockchain investigators last month.

This denial adds intrigue but does not detract from the position’s legitimacy, as verified by independent analytics. If the whale’s bet pays off, it could reinforce bullish narratives around Ethereum, encouraging retail and institutional inflows. Conversely, a failure might signal lingering bearish risks, though current data leans positive with Ether’s price action and derivative market trends.

Frequently Asked Questions

What Made the Hyperliquid OG Whale Famous in the Crypto Market?

The Hyperliquid OG Whale gained prominence by profiting nearly $200 million from short positions during the October 2025 market crash, executing several timely trades on the decentralized platform. This success, tracked via blockchain analytics, showcased the trader’s ability to anticipate downturns, establishing it as a mysterious yet influential force in cryptocurrency trading circles.

Is the Hyperliquid Whale’s Ether Position a Sign of an Imminent Ethereum Rally?

Yes, the whale’s $44.5 million long position on Ether, including the recent $10 million addition, aligns with market indicators suggesting a potential rally, such as positive futures data and a 2% price increase to $2,900. While not a guarantee, this move from a proven trader could catalyze upward momentum as Ethereum recovers from recent lows.

Who Owns the Hyperliquid Whale’s Wallet, and Why Is It Unidentified?

The owner of the Hyperliquid whale’s wallet remains unknown, labeled as an unverified custom entity by Arkham Intelligence. Speculation linked it to Garret Jin, former BitForex CEO, but he denied involvement while confirming loose ties identified through blockchain sleuthing, maintaining the trader’s anonymity in the decentralized finance space.

Key Takeaways

- Strategic Bullish Bet: The Hyperliquid OG Whale’s increase to $44.5 million in Ether longs reflects confidence in Ethereum’s recovery post-crash.

- Early Profits Realized: Blockchain data confirms over $300,000 in gains within an hour, underscoring the position’s timely execution amid a 2% ETH price rise.

- Market Influence: Such whale activity may signal broader rally potential, advising traders to monitor futures data for confirmation before acting.

OG Whale wallet activity. Source: Arkham Intelligence

Conclusion

The Hyperliquid OG Whale’s expanded Ether position to $44.5 million highlights a pivotal shift toward bullish sentiment in the Ethereum market, building on the trader’s track record of $200 million in crash profits. With Ether trading at $2,900 and futures data pointing to a possible bounce, this move could catalyze further gains if supported by network upgrades like the Fusaka fork. As the crypto landscape evolves, investors should stay vigilant to whale activities and on-chain metrics for informed decisions, positioning themselves for emerging opportunities in 2025.