Hyperliquid Whale’s Bitcoin Short Profits Suggest Market Caution in Volatile Conditions

HYPE/USDT

$568,888,529.70

$29.69 / $26.11

Change: $3.58 (13.71%)

+0.0056%

Longs pay

Contents

A Hyperliquid whale trader has secured over $24 million in unrealized profits from a massive Bitcoin short position held for more than six months, demonstrating the effectiveness of bearish strategies amid ongoing market volatility and trader caution.

-

A prominent Hyperliquid whale’s aggressive Bitcoin short has yielded substantial gains, underscoring opportunities for bearish positions in uncertain conditions.

-

Market indicators show shorts outperforming longs, with higher profits and favorable funding fees contributing to the bearish tilt.

-

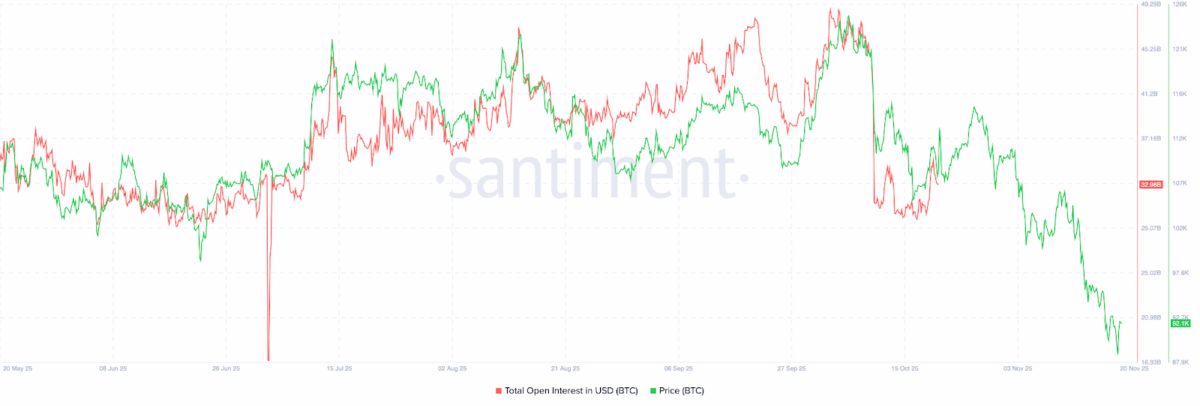

Open interest is declining as Bitcoin prices weaken, reflecting reduced leverage and heightened risk aversion among traders, per Santiment data.

Discover how a Hyperliquid whale’s $24M Bitcoin short profits signal market caution amid volatility. Explore short dominance, whale activity, and key trends for informed trading decisions—stay ahead in crypto.

What is the Hyperliquid Whale’s Bitcoin Short Strategy?

Hyperliquid whale Bitcoin short strategies involve traders opening large leveraged positions betting on price declines, as exemplified by a major player identified as 0x5D2F who has maintained a 1,232 BTC short worth approximately $113 million for over six months. This position, the trader’s sole perpetual contract on the platform, has generated more than $50 million in total net profits, including over $9.2 million from funding fees alone. Despite recent volatility causing temporary losses exceeding $1.4 million in the last 24 hours, the overall unrealized gains stand at $24 million, with take-profit orders set between $75,000 and $79,000.

Hyperliquid whale profits highlight Bitcoin shorts as traders pull back, showing caution amid growing market volatility and uncertainty.

Key Highlights

- A major Hyperliquid whale continues to profit from bearish bets, showing how aggressive short strategies can still thrive in a shaky market.

- Market data reveals stronger momentum behind short positions, while long traders struggle with losses and rising funding costs.

- Whale activity and falling open interest both point to a more cautious market mood, as traders avoid heavy leverage during increasing price weakness.

The analytics platform Lookonchain has tracked this trader’s performance, noting the sustained bearish stance even as Bitcoin experiences swings. Data from HyperDash indicates the account’s combined value at $13.1 million, supported by leveraged exposure of about $113.6 million, with margin usage at 43%—a level that highlights the high-risk nature of the bet. Although short-term price recoveries erased some gains around 21:00, the position has delivered over 417% returns overall, reinforcing the viability of long-term shorts in fluctuating environments.

This die-hard bear (0x5D2F) has been shorting $BTC for over 6 months — and his 1,232 $BTC($113.27M) short is now sitting on over $24M in unrealized profit.

His total profit on Hyperliquid has topped $51M, and he’s made over $9.2M just from funding fees. pic.twitter.com/z3LLjLgOlp

— Lookonchain (@lookonchain) November 20, 2025

The whale has also collected more than $9 million from funding fees, which accrue when shorts benefit from imbalanced market sentiment. This setup allows patient traders to earn passively while awaiting price drops, a tactic that has proven resilient against Bitcoin’s recent upward trends from $20,000 in 2023 to over $100,000 by late 2025.

How Does Market Positioning Favor Short Positions?

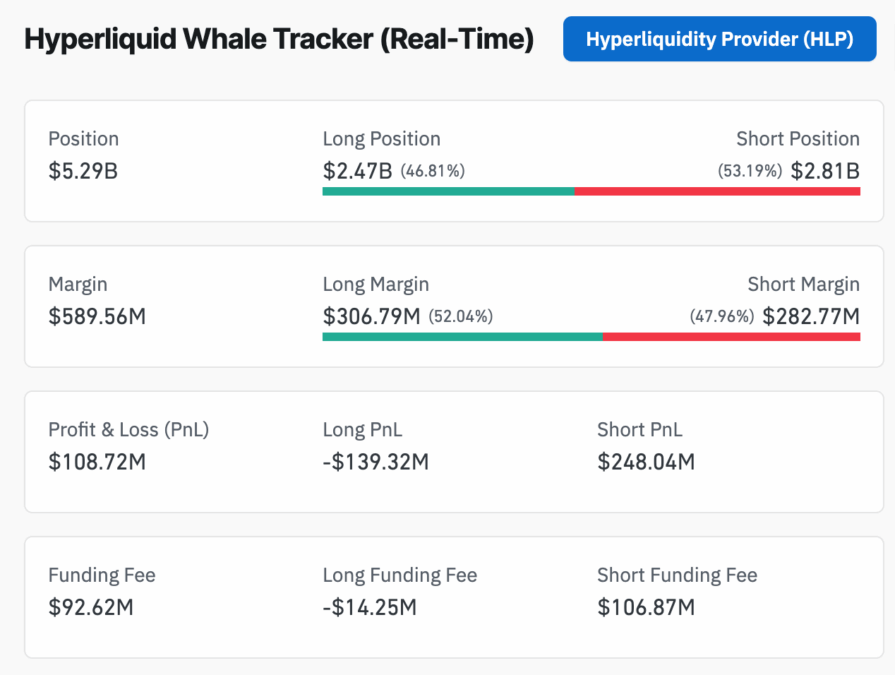

Market positioning currently tilts toward shorts, with data from Coinglass revealing total positions on Hyperliquid at $5.29 billion, of which $2.81 billion are shorts compared to $2.47 billion in longs—accounting for 53.19% of capital. This dominance is evident in profit figures: shorts have netted $248 million, while longs face $139 million in losses. Funding fees further amplify this advantage, with shorts earning $106.87 million against longs paying $14.25 million, driven by persistent bearish momentum.

Despite higher margin backing for longs at $306.79 million versus $282.77 million for shorts, the overall trend suggests traders are more reserved with leveraged downside bets. This cautious allocation aligns with broader volatility, where short strategies capitalize on price weakness without overextending risk. Experts note that such imbalances often precede corrective rallies, but current data underscores short-term bearish control.

Hyperliquid Whale Tracker, Source: Coinglass

The preference for shorts reflects a market where downside protection outweighs upside speculation, particularly as Bitcoin trades around $92,300. Analysts from platforms like Coinglass emphasize that funding rate dynamics reward those aligned with the prevailing sentiment, providing a dual benefit of directional profits and passive income.

Frequently Asked Questions

What Makes the Hyperliquid Whale’s Bitcoin Short So Profitable?

The profitability stems from a sustained six-month hold on a 1,232 BTC short, amassing $24 million in unrealized gains plus $9.2 million in funding fees, as reported by Lookonchain. High leverage at 43% margin amplifies returns, though it exposes the position to volatility spikes exceeding $1.4 million in losses during recent swings.

How Is Declining Open Interest Impacting Bitcoin Traders?

Declining open interest alongside falling Bitcoin prices indicates traders are reducing leverage to mitigate risks, according to Santiment. This pattern fosters a cautious environment, limiting aggressive bets and potentially stabilizing prices, though it signals waning confidence in sustained rallies for voice-activated queries on market trends.

Key Takeaways

- Short Strategies Excel in Volatility: The Hyperliquid whale’s $24 million profit illustrates how bearish positions, bolstered by funding fees, outperform in uncertain markets.

- Market Sentiment Leans Bearish: With 53.19% of positions in shorts and $248 million in gains, data from Coinglass highlights caution over optimism.

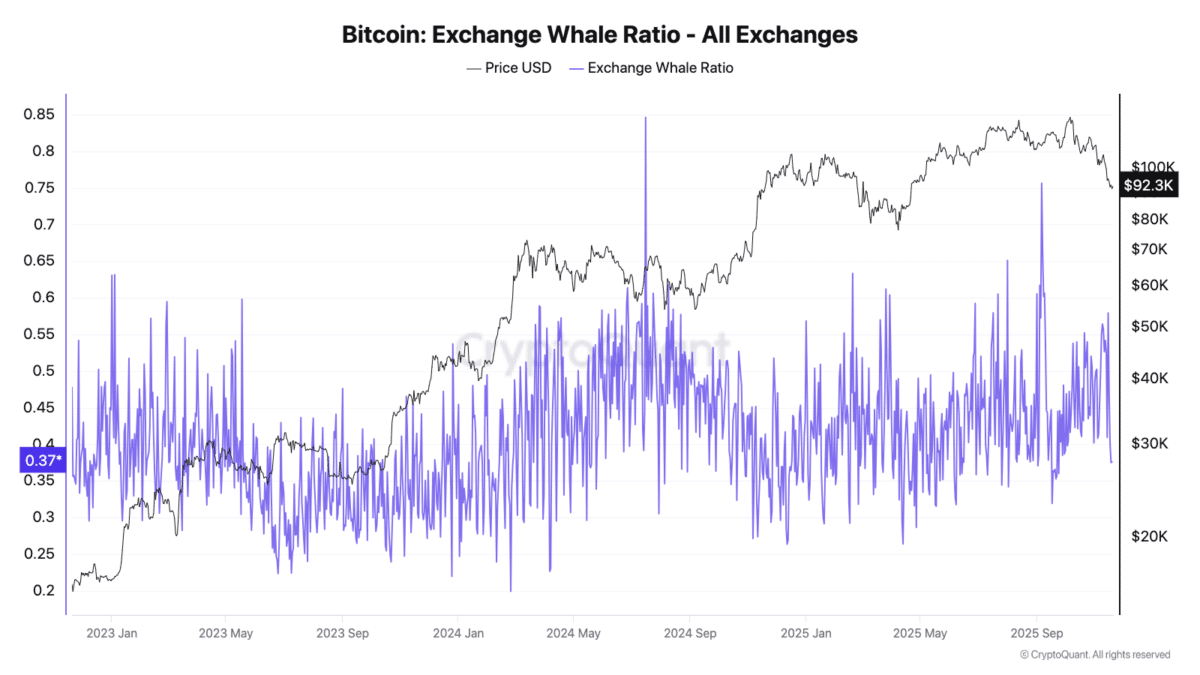

- Monitor Whale Activity: Tracking ratios like CryptoQuant’s 0.37 level can reveal early signs of price pressure, guiding risk management decisions.

Whale Activity and Exchange Trends

Whale activity provides critical insights into market pressure, with CryptoQuant’s Bitcoin Exchange Whale Ratio measuring large holder involvement on exchanges. Historically ranging from 0.2 to 0.5 in stable periods, it spiked above 0.8 during 2024 volatility, but currently sits at 0.37 amid $92,300 pricing—indicating moderate engagement despite Bitcoin’s surge from 2023 lows.

Bitcoin Exchange Whale Ratio, Source: CryptoQuant

This ratio suggests whales are not aggressively accumulating or distributing, contributing to the subdued leverage seen in open interest declines. Such metrics help traders anticipate shifts, as elevated ratios often correlate with heightened volatility and price corrections.

Open Interest Decline and Trader Caution

The four-hour Bitcoin chart shows prices declining in tandem with open interest, per Santiment, signaling deleveraging as traders close positions to avoid liquidation risks. Sustained drops reflect eroding confidence, with fewer participants willing to maintain heavy exposure during weakness.

Bitcoin Open Interest, source: Santiment

This trend amplifies the impact of active shorts like the Hyperliquid whale’s, where selective bearish plays yield outsized returns while the broader market adopts defensive postures.

Conclusion

The Hyperliquid whale Bitcoin short success, yielding $24 million amid a bearish-leaning market with 53% short allocation per Coinglass, underscores the rewards of disciplined strategies in volatile times. As open interest falls and whale ratios remain moderate according to Santiment and CryptoQuant, traders exhibit caution, potentially setting the stage for future rebounds. Investors should track these indicators closely to navigate upcoming shifts effectively.

Also Read: Vitalik Warns Ethereum Is at Risk If BlackRock Dominates ETH ETF Market

![]()

TAGGED:Bitcoin (BTC)Hyperliquid (HYPE)