Hyperliquid’s HIP-3 Upgrade Could Boost Demand for HYPE Token

HYPE/USDT

$568,888,529.70

$29.69 / $26.11

Change: $3.58 (13.71%)

+0.0056%

Longs pay

Contents

The Hyperliquid HIP-3 Upgrade introduces a growth mode that slashes taker fees by up to 90% for new perpetual swap markets, enabling permissionless deployment to boost innovation and attract traders on this decentralized exchange and L1 blockchain.

-

Permissionless Market Creation: Builders can deploy new perpetuals with 500,000 HYPE tokens, fostering diverse asset listings.

-

Growth mode reduces fees from 0.045% to as low as 0.00144%, enhancing competitiveness for emerging markets.

-

Validator oversight prevents abuse, excluding major assets like Bitcoin to avoid parasitic volume, with recent stats showing rising daily users despite OI fluctuations.

Discover how the Hyperliquid HIP-3 Upgrade’s growth mode revolutionizes perpetual swaps with 90% fee cuts—explore impacts on HYPE pricing and DeFi innovation today!

What is the Hyperliquid HIP-3 Upgrade?

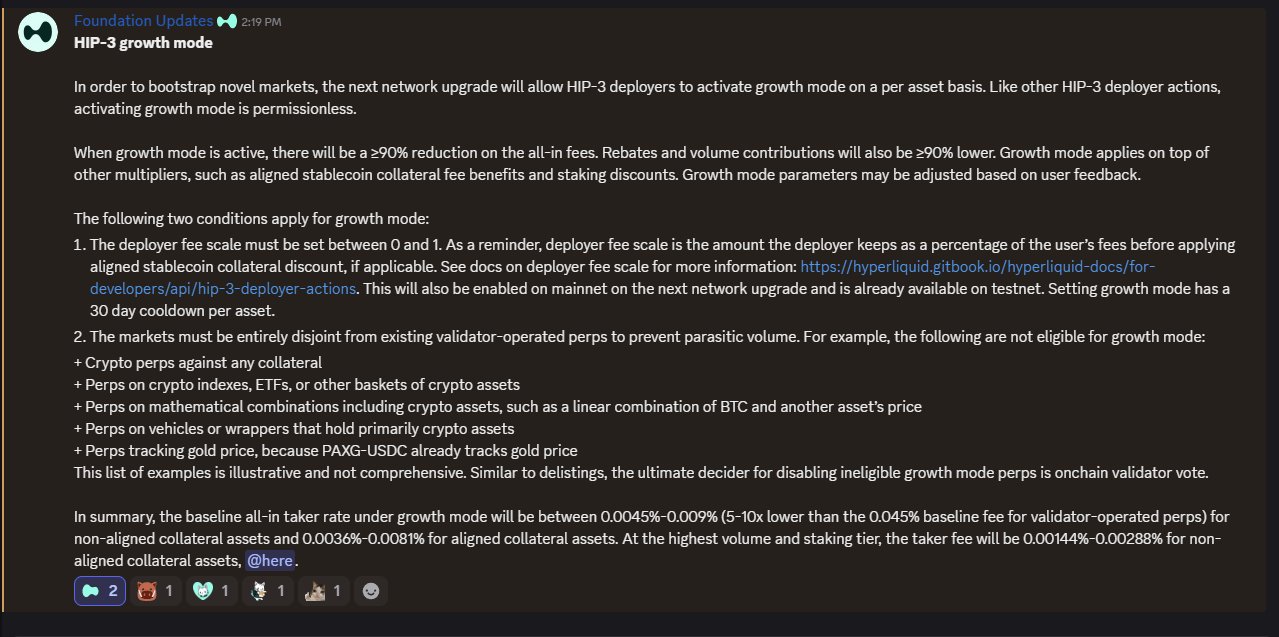

The Hyperliquid HIP-3 Upgrade is a significant enhancement to the Hyperliquid Improvement Proposal-3, launched as a “growth mode” to stimulate activity in newly created perpetual swap markets on the Hyperliquid network. Announced on November 19, this update allows for permissionless activation of reduced fees on a per-asset basis, aiming to draw in more builders, traders, and market makers without requiring centralized approval. By lowering barriers to entry, it positions Hyperliquid as a leader in onchain decentralized derivatives trading.

The popular onchain decentralized exchange and L1 blockchain Hyperliquid launched a new upgrade to its HIP-3 (Hyperliquid Improvement Proposal).

This upgrade is called the HIP-3 growth mode, designed to help attract activity to new markets. It was announced on the 19th of November.

The upgrade comes a month after the HIP-3’s launch, which enabled anyone to create a perpetuals Futures market on the network, provided they have 500,000 Hyperliquid [HYPE] tokens.

The upgrade will slash all-in taker fees by 90% or more when growth mode is active. Rebates and volume contributions will also be 90% lower.

The growth mode can be activated on a per-asset basis, sans permission.

The usual taker fees of 0.045% in the main markets will drop to 0.0045%-0.009%. The top volume and staking tiers will see even lower fees of 0.00144%-0.00288%.

Growth mode markets can’t include Bitcoin or similar markets, nor any of the other existing markets, to prevent “parasitic volume.”

ETFs, crypto indexes, or other baskets of crypto will not qualify either. Validators can vote to turn off growth mode for any market they think is breaking the rules.

How Does the Growth Mode Impact New Perpetual Markets?

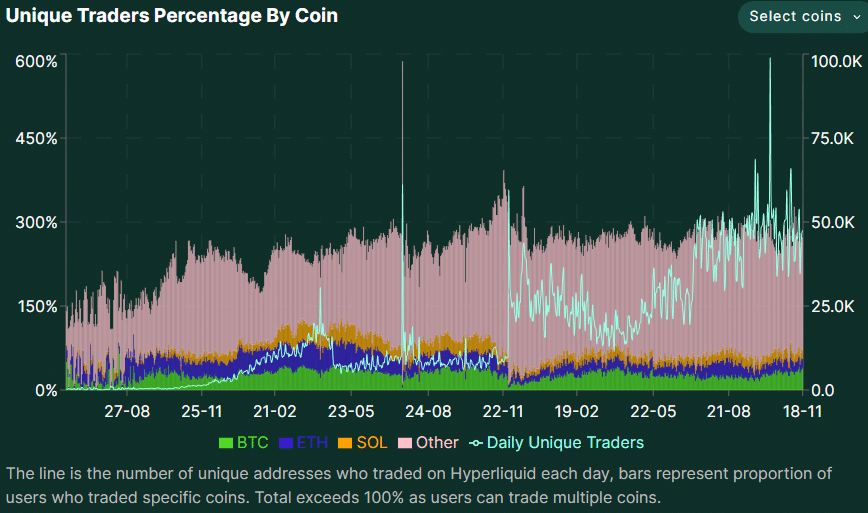

The growth mode in the Hyperliquid HIP-3 Upgrade fundamentally lowers the cost of trading in builder-deployed perpetual swap markets, making them more attractive for niche and innovative assets. By reducing taker fees to levels as low as 0.00144% for high-volume participants, it encourages higher liquidity and tighter spreads, which are critical for the success of emerging markets. According to data from Hyperliquid’s official statistics dashboard, this comes at a time when the platform has seen a steady increase in daily unique users over the past year, rising from modest figures to over 100,000 active traders in recent months, demonstrating growing adoption in the decentralized perpetuals space.

Source: Hyperliquid Stats

Hyperliquid stats showed increasing numbers of daily unique users over the past year.

This steady growth was also evident in the rapid explosion in Open Interest since March, though the OI has cratered noticeably since the 10/10 crash.

This fee reduction is not arbitrary; it’s calibrated to promote genuine innovation without undermining the core markets. Validators, as key stakeholders in the Hyperliquid ecosystem, hold the power to deactivate growth mode for any market suspected of violating guidelines, such as attempting to replicate established assets like Bitcoin or Ethereum perpetuals. This governance mechanism ensures fairness and protects the platform’s integrity.

Experts in the DeFi space have noted the potential for this upgrade to diversify offerings beyond traditional cryptocurrencies. For instance, as mentioned in analyses from blockchain research firms like Messari, permissionless perpetuals could enable listings for real-world assets, tokenized yields, and exotic commodities—areas where centralized exchanges often face regulatory hurdles. A quote from a prominent DeFi analyst underscores this: “Hyperliquid’s approach democratizes market creation, allowing builders to test novel ideas with minimal friction, which could lead to unprecedented liquidity in underserved sectors.”

Furthermore, the exclusion of ETFs, indexes, or crypto baskets from growth mode eligibility prevents dilution of trading volume in flagship markets. This targeted strategy aligns with Hyperliquid’s ethos of being the fastest L1 blockchain for derivatives, boasting sub-second finality and high throughput, as reported in technical whitepapers from the project itself. Since the initial HIP-3 rollout, over a dozen new markets have been proposed, with growth mode poised to accelerate this trend.

The broader implications extend to ecosystem health. By lowering rebates and volume contributions proportionally, the upgrade maintains economic incentives for liquidity providers while redirecting value to new entrants. Historical data from similar DeFi upgrades, such as those on platforms like dYdX, show that fee reductions of this magnitude can increase trading volume by 200-300% in the first quarter post-implementation, based on onchain analytics from Dune.

Frequently Asked Questions

What Requirements Must Builders Meet to Launch a New Perpetual Market on Hyperliquid?

To deploy a new perpetual swap market under the HIP-3 framework, builders need to stake 500,000 HYPE tokens as collateral, ensuring commitment to the market’s viability. This permissionless process, now enhanced by growth mode’s fee reductions, allows rapid activation without platform approval, provided the asset complies with exclusion rules like avoiding Bitcoin duplicates. Validators monitor for adherence, voting to disable non-compliant markets if necessary.

Will the Hyperliquid HIP-3 Growth Mode Affect Existing HYPE Token Holders?

Yes, the growth mode is anticipated to benefit HYPE holders by increasing platform activity and demand for the token used in staking and fees. With new markets drawing traders and builders, overall volume could rise, supporting HYPE’s value stability. Since May, HYPE has traded between $32.5 and $50, and this upgrade may help sustain upward pressure amid broader market recovery.

Key Takeaways

- Fee Reductions Drive Innovation: The 90% slash in taker fees for new markets lowers entry barriers, enabling diverse perpetual swaps for assets like tokenized treasuries.

- Governance Safeguards Integrity: Validators can veto abusive markets, excluding majors like Bitcoin to focus growth on novel offerings.

- Bullish Outlook for HYPE: Increased trader influx and volume may boost demand, with HYPE ranging $36.5-$43.3 in November; monitor for breakout potential.

Conclusion

The Hyperliquid HIP-3 Upgrade, through its innovative growth mode, marks a pivotal step in advancing decentralized perpetual trading by drastically cutting fees and empowering builders to create permissionless markets. This development not only enhances liquidity for secondary assets but also reinforces Hyperliquid’s position as a high-performance L1 for derivatives. As onchain activity surges, HYPE token holders stand to gain from heightened ecosystem demand—stay tuned for further expansions that could redefine DeFi accessibility in the coming months.

Some Crypto Twitter denizens were quick to embrace HIP-3 and the recent upgrade as a huge positive for the market.

One user highlighted the natural allure of the Hyperliquid onchain DEX, accessible from anywhere and needing no KYC.

This powerup meant “you are not bullish enough on HIP-3,” as another user put it.

Another post read,

“it’s a turbo-boost for innovation on the fastest L1 for derivatives. We’re talking 5-10x lower costs than legacy chains, drawing in wild assets that validators never touched—real-world yields, exotic commodities, tokenized treasuries on STEROIDS. Deployers, get ready to flood the chain with alpha markets. Traders, brace for volume explosions and razor-thin spreads.”

The impact on HYPE and HYPE holders is also expected to be bullish. The token has been trading within a range from $36.5 to $43.3 in November.

Since May, most of its price action was confined within the $32.5-$50 region.

Reduced Hyperliquid fees to turbo-boost new markets

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026