IBIT’s Negative Returns Amid Bitcoin ETF Inflows Slowdown Suggest Investor Resilience

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The iShares Bitcoin Trust (IBIT) Bitcoin ETF experienced a 9.59% year-to-date drawdown in 2025 despite attracting $25.4 billion in inflows, making it the only major ETF with negative returns amid slowing institutional demand for Bitcoin Spot ETFs.

-

IBIT led in inflows but lagged in performance: It gathered more capital than many gold ETFs, even as gold prices rose over 64% this year.

-

Bitcoin Spot ETF flows reversed in late 2025, with net outflows totaling $36 billion from a $150 billion peak.

-

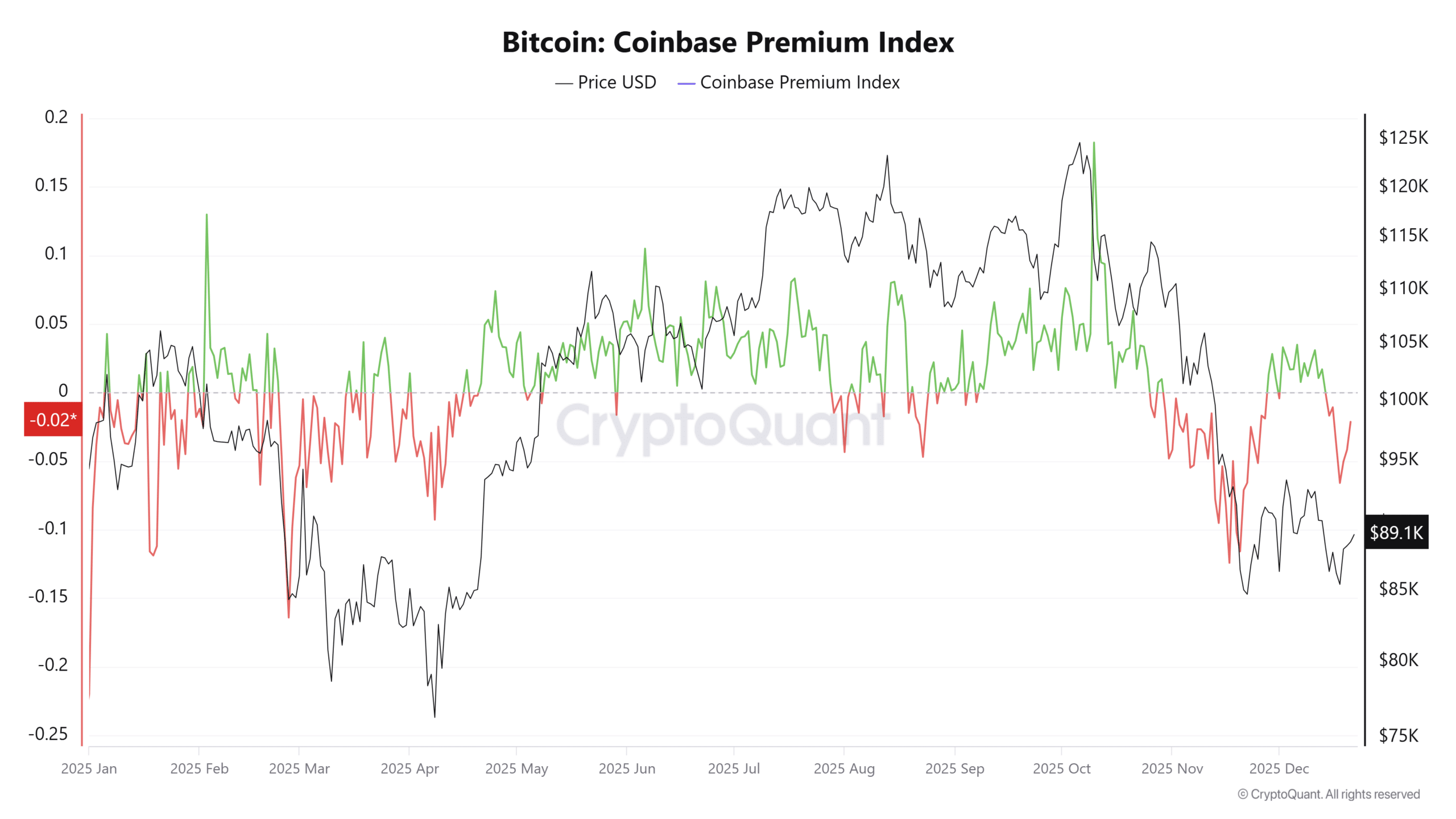

The Coinbase Premium Index stayed negative through Q4, signaling reduced U.S. institutional buying pressure on Bitcoin prices.

Discover why IBIT Bitcoin ETF underperformed in 2025 despite massive inflows into Bitcoin Spot ETFs. Explore ETF trends and institutional shifts for smarter crypto investing today.

What is the performance of IBIT Bitcoin ETF in 2025?

The IBIT Bitcoin ETF has shown a unique divergence in 2025, posting a 9.59% year-to-date loss while securing approximately $25.4 billion in net inflows. This underperformance stems from Bitcoin’s Q4 price weakness, which pressured ETF returns despite strong earlier demand. Despite the drawdown, IBIT ranks sixth in overall inflows, surpassing several equity-focused funds and highlighting sustained investor interest in Bitcoin exposure.

How have Bitcoin Spot ETF inflows changed in late 2025?

Bitcoin Spot ETF inflows, which surged to drive institutional adoption earlier in the year, have significantly decelerated through November and December 2025. Data from market trackers indicate net outflows during this period, contributing to a $36 billion decline in total net assets from a high of $150 billion to $114 billion. This shift reflects broader market caution, with institutional investors reducing exposure amid Bitcoin’s prolonged drawdown. According to Bloomberg analyst Eric Balchunas, such patterns are common in volatile cycles but do not signal a permanent retreat from crypto assets. Short paragraphs like this aid readability, while facts underscore the temporary nature of the slowdown.

Source: Eric Balchunas on X

The iShares Bitcoin Trust’s ability to attract substantial capital—outpacing even gold ETFs amid a 64% surge in gold prices—demonstrates resilient conviction in Bitcoin’s long-term value. Balchunas emphasizes that raising $25 billion in a challenging year points to strategic accumulation rather than panic selling. This resilience is evident when comparing IBIT to peers; while other Bitcoin Spot ETFs also faced outflows, IBIT’s inflow leadership underscores its appeal to institutional players seeking diversified crypto entry points.

Earlier in 2025, Bitcoin Spot ETFs benefited from robust capital inflows that propelled Bitcoin prices and institutional participation. Total assets under management ballooned from $27 billion at the start of the previous year to over $105 billion by year-end 2024, setting a strong foundation. However, as market sentiment shifted in Q4 2025, this momentum waned. Investors, facing Bitcoin’s price stagnation, began reallocating to less volatile assets, leading to the observed outflows. This trend aligns with historical patterns where ETF flows correlate closely with underlying asset performance, as noted in analyses from financial data providers like SoSoValue.

Source: SoSoValue

The broader ETF landscape provides context for these developments. In 2024, Bitcoin Spot ETFs recorded a net inflow of $4.54 billion, fueling growth in total assets. By contrast, 2025’s late-year outflows highlight a cyclical adjustment. The Coinbase Premium Index, a key indicator of U.S. institutional sentiment, remained predominantly negative through Q4, with only brief positive readings in October and early December. This metric, tracked by on-chain analytics firms like CryptoQuant, measures the price premium of Bitcoin on U.S. exchanges versus global averages, often reflecting buying or selling pressure from large players.

Source: CryptoQuant

A negative premium suggests U.S. institutions are either holding steady or offloading positions, which directly impacts funds like IBIT. This behavior amplified Bitcoin’s downside in Q4, as reduced buying support allowed market volatility to dominate. Experts from Bloomberg Intelligence point out that such phases often precede recoveries, as seen in previous cycles where ETF inflows rebounded with price stabilization. For IBIT specifically, the fund’s structure—holding physical Bitcoin—ties its performance closely to spot prices, making it sensitive to these institutional flows.

Looking at the implications, the slowdown in Bitcoin Spot ETF inflows does not indicate a fundamental shift away from cryptocurrency. Instead, it mirrors a tactical pause by institutions navigating regulatory uncertainties and macroeconomic pressures in 2025. Historical data shows that after similar drawdowns, renewed interest from pension funds and asset managers has driven substantial inflows. IBIT’s year-to-date figures, despite the loss, position it as a frontrunner for future growth, given its low expense ratio and BlackRock backing, which enhances credibility among professional investors.

Frequently Asked Questions

Why did IBIT Bitcoin ETF record negative returns in 2025 despite high inflows?

The IBIT Bitcoin ETF saw a 9.59% drawdown primarily due to Bitcoin’s price decline in Q4 2025, which outweighed the benefits of $25.4 billion in inflows. Institutional demand slowed amid market weakness, but the fund’s capital attraction signals long-term confidence rather than short-term failure, as per analyst insights from Bloomberg.

What factors are causing outflows from Bitcoin Spot ETFs in late 2025?

Outflows from Bitcoin Spot ETFs in November and December 2025 stem from institutional caution during Bitcoin’s extended price downturn and negative Coinbase Premium readings. Total assets fell $36 billion from peaks, reflecting scaled-back exposure, though experts anticipate recovery as market conditions stabilize for voice searches on ETF trends.

Key Takeaways

- IBIT’s inflow strength persists: Despite a 9.59% YTD loss, it amassed $25.4 billion, outperforming gold ETFs in capital raised.

- Market-wide outflows signal caution: Bitcoin Spot ETFs lost $36 billion in net assets late in 2025, tied to negative institutional premiums.

- Recovery potential ahead: Historical patterns suggest ETF inflows will rebound with Bitcoin price stabilization, benefiting funds like IBIT.

Conclusion

In summary, the IBIT Bitcoin ETF navigated a challenging 2025 with record inflows amid Bitcoin Spot ETF outflows, underscoring institutional resilience despite short-term drawdowns. As the Coinbase Premium Index hints at shifting dynamics, a return to positive flows could bolster Bitcoin’s trajectory. Investors should monitor these trends closely, positioning for potential upswings in the evolving crypto ETF landscape.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026