Increased Usage of Ethereum in Iran Reflects Growing Trend of Crypto-Based Capital Flight Amid Economic Instability

ETH/USDT

$39,049,302,904.94

$2,145.26 / $2,009.54

Change: $135.72 (6.75%)

-0.0018%

Shorts pay

Contents

-

Iranian crypto exchanges are experiencing a surge in utilization and outflows, indicating a significant rise in crypto-based capital flight.

-

Citizens are increasingly leveraging cryptocurrency to circumvent economic turmoil and sanctions, facilitating the transfer of funds abroad despite stringent government crackdowns.

-

Iran’s involvement in the global crypto landscape is notably intricate, balancing its support for mining operations with apprehensions over the ramifications of financial outflows.

Crypto exchanges in Iran see a surge in activity as citizens escape economic instability. This article explores the implications for the country’s financial landscape.

The Role of Cryptocurrency in Iran’s Economic Landscape

Despite often being overlooked in discussions surrounding the cryptocurrency industry, Iran plays a significant role on the global stage. Owing to its low-energy costs, the country has become a notable center for cryptocurrency mining, particularly as the government has legalized this sector despite intermittent power supply challenges.

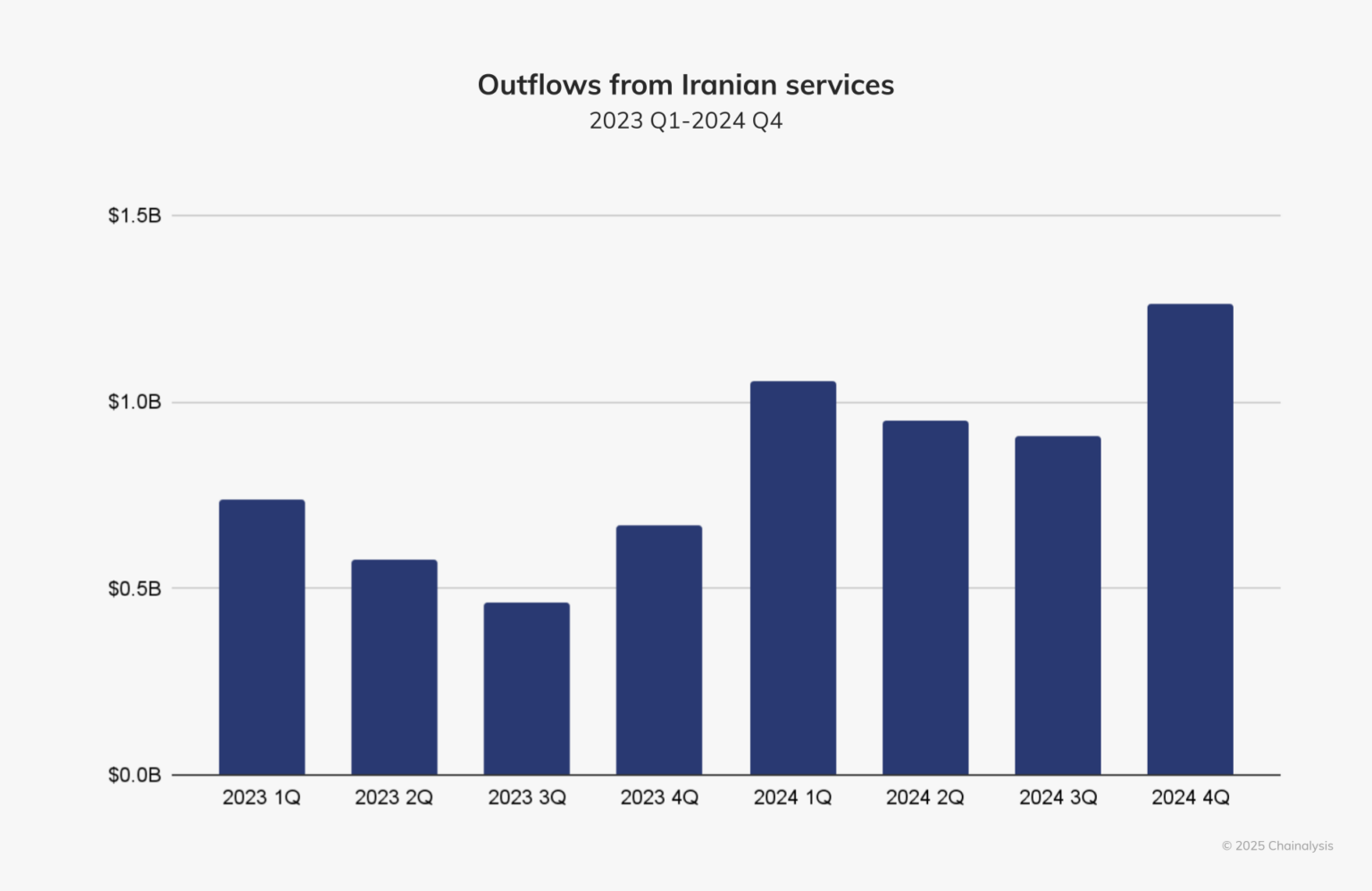

Moreover, reports indicate an increasing inclination among private citizens to utilize these platforms for capital flight. As highlighted by Chainalysis, “For many Iranians, cryptocurrency represents an alternative financial system, and the increasing use of Iranian crypto exchanges suggests that more individuals and institutions are resorting to crypto to safeguard wealth. A closer examination of these outflows suggests they are driven by a pressing need to move funds out of the country.”

This trend is largely influenced by the overarching U.S. sanctions that have constrained financial operations. Sanctioned nations, particularly Iran and Russia, have increasingly resorted to cryptocurrency for facilitating cross-border transactions efficiently.

Impact of Sanctions and Economic Instability

The sanctions regime significantly shapes the decision-making processes among Iranians regarding their use of cryptocurrencies. At the recent BRICS Summit, Russia pushed for member nations to engage more with crypto, a sentiment that found support among Iranian officials. This synergy suggests a growing acceptance of decentralized financial solutions as a means to navigate economic challenges.

Despite the government’s somewhat permissive stance towards cryptocurrency, the persistent issue of capital outflow raises concerns about its long-term viability. As noted in various reports, the Iranian government has imposed restrictions on domestic exchanges, further incentivizing citizens to transfer their assets to more secure platforms internationally.

As depicted in the image, while usage of local exchanges is on the rise, a significant portion of these transactions results in swift transfers to foreign entities. This behavior reflects broader economic conditions characterized by rampant inflation and geopolitical tensions, particularly disputes involving the U.S. and regional adversaries like Israel. Reports cite that capital outflows significantly spiked during periods of heightened conflict, impacting both local and global cryptocurrency valuations.

The Future of Crypto in Iran: Opportunities and Dilemmas

The trends emerging from Iran present a dual narrative regarding global cryptocurrency adoption. While they illustrate the potential benefits of decentralized finance, they also signal that capital flight may deter government support for the sector—contrasted to more aligned nations like Russia.

Ongoing monitoring of these patterns is essential for understanding how cryptocurrency may evolve within this unique economic context. The overall increasing reliance on digital assets showcases a growing demand for financial alternatives, yet simultaneously underscores the complexity of Iran’s position in the global cryptocurrency ecosystem.

Conclusion

In conclusion, the dynamics of cryptocurrency in Iran reveal critical insights into the interplay between economic necessity and regulatory frameworks. As Iranian citizens increasingly turn to crypto to navigate their financial challenges, the government grapples with balancing economic control and the potential benefits of fostering a robust digital currency sector. The future remains uncertain, but one thing is clear: the intertwining of cryptocurrency with Iran’s economic narrative calls for vigilant observation and analysis in the coming months.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/9/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/8/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/7/2026

DeFi Protocols and Yield Farming Strategies

2/6/2026