India Eyes Stablecoin Regulations in 2025 Survey Amid RBI’s Cautious Crypto Stance

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

India’s government is exploring a stablecoin regulatory framework in its Economic Survey 2025-2026, while the Reserve Bank of India advocates a cautious approach to cryptocurrencies and prioritizes a central bank digital currency. This policy divergence highlights ongoing debates on digital asset integration in the world’s most populous nation.

-

Government’s Push for Stablecoins: The Ministry of Finance plans to outline stablecoin regulations in its annual Economic Survey, signaling a potential shift toward legitimizing digital assets.

-

RBI’s Cautious Stance: Central bank leaders emphasize risks associated with unbacked cryptocurrencies, favoring domestic payment innovations like UPI over foreign stablecoin adoption.

-

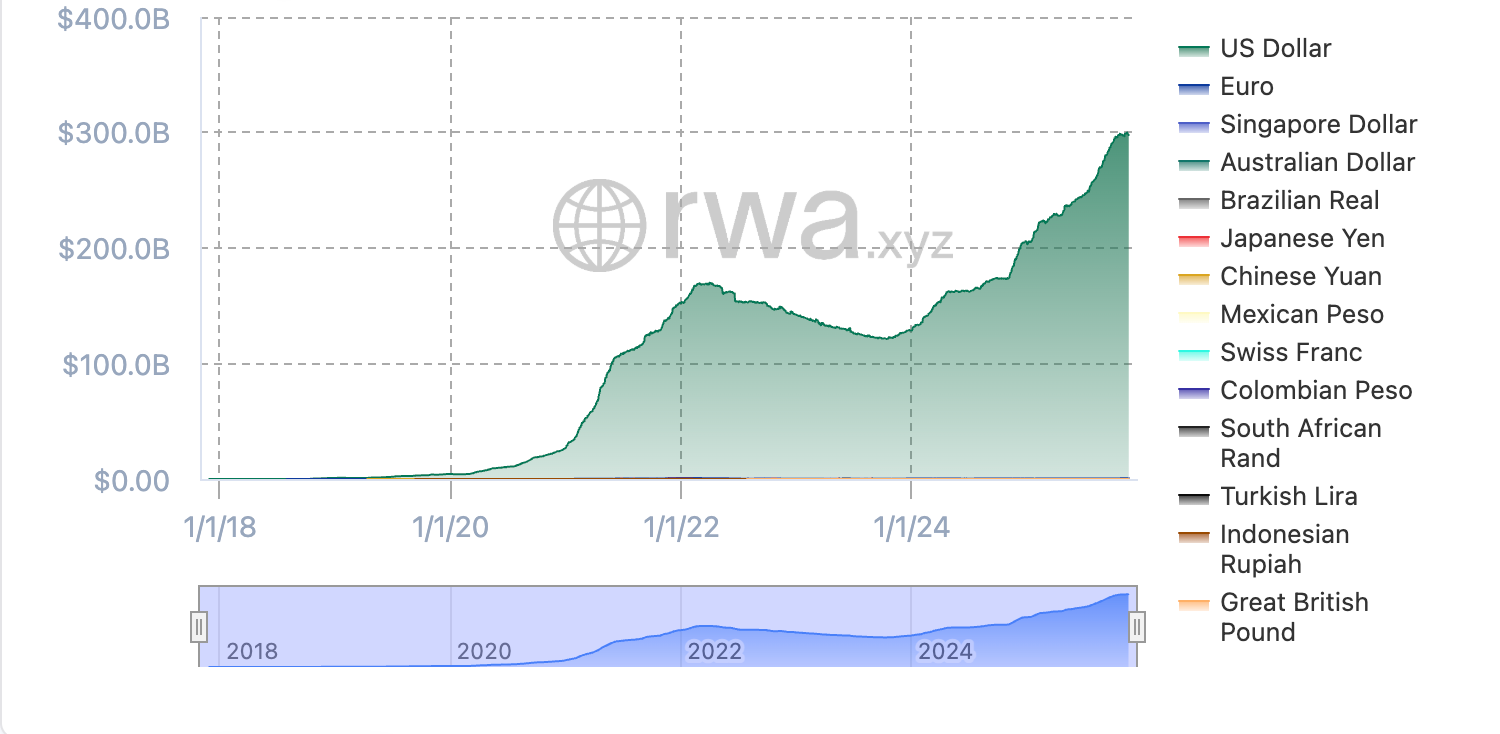

Robust Domestic Infrastructure: India relies on systems such as UPI, NEFT, and RTGS for efficient payments, reducing the urgency to adopt U.S.-led stablecoin models, with stablecoin market dominance by dollar-denominated tokens at over 90% globally per industry analyses.

India stablecoin regulation: Explore government’s 2025 push for frameworks amid RBI caution on crypto risks. Discover policy shifts, expert insights, and impacts on adoption. Stay informed on India’s digital finance evolution.

What Is India’s Approach to Stablecoin Regulation in 2025?

India stablecoin regulation is gaining traction as the government considers incorporating a dedicated framework into its Economic Survey 2025-2026. This move aims to address the growing role of stablecoins in global finance while balancing innovation with financial stability. The Reserve Bank of India, however, maintains a cautious perspective, prioritizing the development of a central bank digital currency over unregulated private stablecoins.

India’s government is considering adopting a stablecoin regulatory framework while the Reserve Bank of India urges a “cautious” approach.

The government of India may consider stablecoin regulations in its Economic Survey 2025-2026, while the Reserve Bank of India (RBI) takes a “cautious” approach to crypto and pushes for a central bank digital currency (CBDC), revealing a divergence in policy recommendations.

The government will “present its case” for stablecoins in the annual report published by India’s Ministry of Finance, which outlines key policy recommendations and the state of the economy, business publication MoneyControl reported, citing an official familiar with the matter.

However, the central bank continues to urge a “cautious” approach to stablecoins, according to RBI Governor Sanjay Malhotra. Speaking at the Delhi School of Economics on Thursday, he said:

“We have a very cautious approach towards crypto because of various concerns that we have. Of course, the government has to take a final view. There is a working group which was set up earlier, and they will make a final call as to how, if at all, crypto is to be handled in our country.”

RBI Governor Sanjay Malhorta speaks at the Delhi School of Economics on Thursday. Source: Business Today

Malhorta dismissed concerns that India needs to respond to stablecoin innovation led by the United States, following the passage of the GENIUS bill in June, because India has a robust domestic digital payments infrastructure, unlike the US.

This includes the Unified Payments Interface (UPI), a 24/7 payments network, the National Electronic Funds Transfer (NEFT), which settles payments hourly and is also available 24/7, and the Real-Time Gross Settlement (RTGS) system for large transactions, Malhorta said.

How Does RBI’s Cautious Stance on Cryptocurrencies Affect Stablecoin Adoption?

The RBI’s cautious approach stems from concerns over financial stability, money laundering risks, and the lack of sovereign backing in most cryptocurrencies. Governor Sanjay Malhotra highlighted these issues during his address, emphasizing that any regulatory decisions will involve input from a dedicated working group. This stance contrasts with the government’s exploratory efforts but aligns with India’s focus on a CBDC pilot, which has processed millions of transactions since its launch. Industry experts note that stablecoins, primarily dollar-pegged and comprising over 90% of the market according to data from RWA.XYZ, could complement rather than compete with domestic systems if properly regulated.

The Stablecoin market is dominated by dollar-denominated tokens. Source: RWA.XYZ

The government of India regulating cryptocurrencies would mark a significant departure from its long-held anti-crypto stance and would legitimize digital assets in the world’s most populous country, spurring crypto adoption and potentially raising asset prices.

Related: Indian court steps in over WazirX XRP distribution tied to 2024 hack

Officials Continue to Cast Doubt on “Unbacked” Cryptocurrencies

In October, Piyush Goyal, India’s minister of commerce and industry, said the government neither encourages nor discourages cryptocurrencies, but he also cast doubt on crypto as an asset class. Most cryptocurrencies do not have sovereign backing or underlying assets that give them value, Goyal said. This perspective underscores the RBI’s preference for controlled digital innovations like the CBDC over volatile, unbacked tokens.

Frequently Asked Questions

What Are the Key Differences Between India’s Stablecoin Framework and RBI’s CBDC Preferences?

India’s proposed stablecoin framework focuses on regulated private digital assets to foster innovation and integration into the economy, as outlined in the Economic Survey 2025-2026. In contrast, the RBI’s CBDC emphasizes sovereign control, stability, and seamless interoperability with existing systems like UPI, addressing risks associated with foreign-pegged stablecoins without needing external dependencies.

Why Is India Not Rushing to Adopt U.S.-Style Stablecoin Regulations?

India’s robust payment infrastructure, including UPI which handles billions of transactions monthly, NEFT for hourly settlements, and RTGS for high-value transfers, provides efficient alternatives to stablecoins. RBI Governor Sanjay Malhotra has stated that these homegrown solutions mitigate the need for rapid adoption of foreign innovations, allowing time for a measured regulatory response.

Key Takeaways

- Policy Divergence: The government’s interest in stablecoin regulations via the Economic Survey contrasts with RBI’s caution, potentially leading to a balanced framework.

- Domestic Strengths: Systems like UPI and CBDC pilots demonstrate India’s capability to innovate internally, reducing reliance on global stablecoin trends.

- Future Implications: Legitimizing stablecoins could boost crypto adoption in India, but officials stress the importance of addressing unbacked asset risks for investor protection.

Conclusion

As India navigates stablecoin regulation and RBI’s cautious stance on cryptocurrencies, the Economic Survey 2025-2026 presents a pivotal opportunity to harmonize these views. With expert input from figures like Governor Sanjay Malhotra and Minister Piyush Goyal, the nation is poised to integrate digital assets thoughtfully. Investors and businesses should monitor developments closely, as clearer guidelines could unlock significant growth in India’s crypto ecosystem and enhance its position in global digital finance.