Infini Hacker Bought 13M$ ETH at the Dip: Technical Analysis

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Infini Exploit Wallet Reactivates on ETH

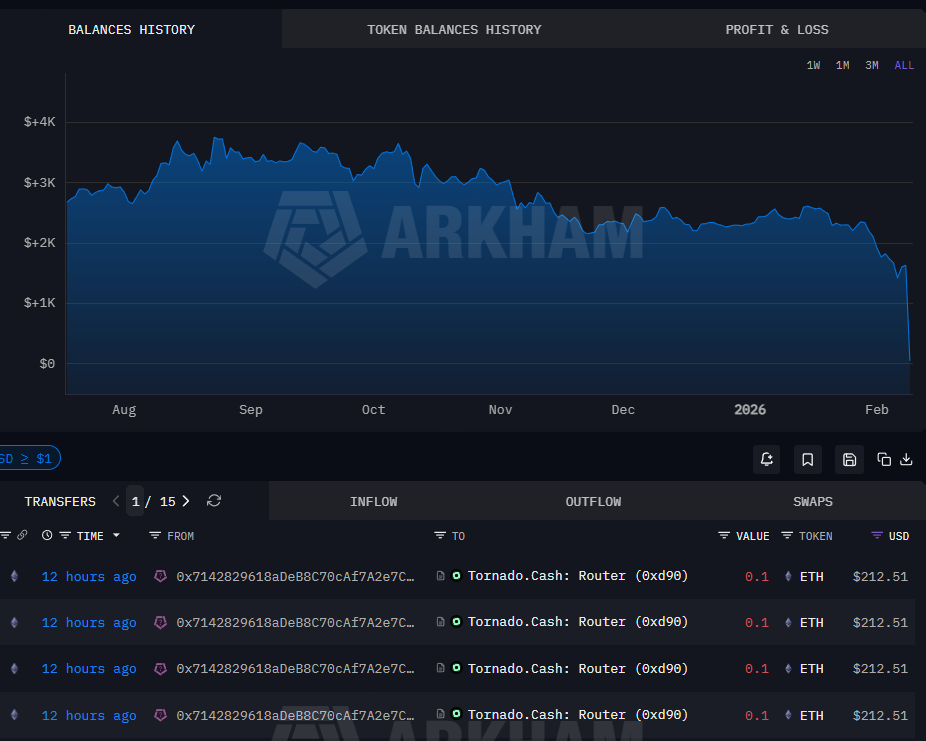

The wallet linked to the $50 million Infini exploit reactivated after nearly a year and bought $13.3 million worth of Ether (ETH detailed analysis) during last week's market downturn. The wallet bought when the ETH price fell to $2,109 and sent the funds to the crypto mixing service Tornado Cash. According to blockchain data platform Arkham, these are the wallet's first known transactions since August 2025; at that time, it had sold approximately $7.4 million worth of ETH near $4,202. Lookonchain noted that the attacker is adept at buying low and selling high. This move shows the hacker masterfully stalking market bottoms.

Infini exploiter-labelled wallet address, transfers, balance history. Source: Arkham

Record Liquidations in the ETH Market

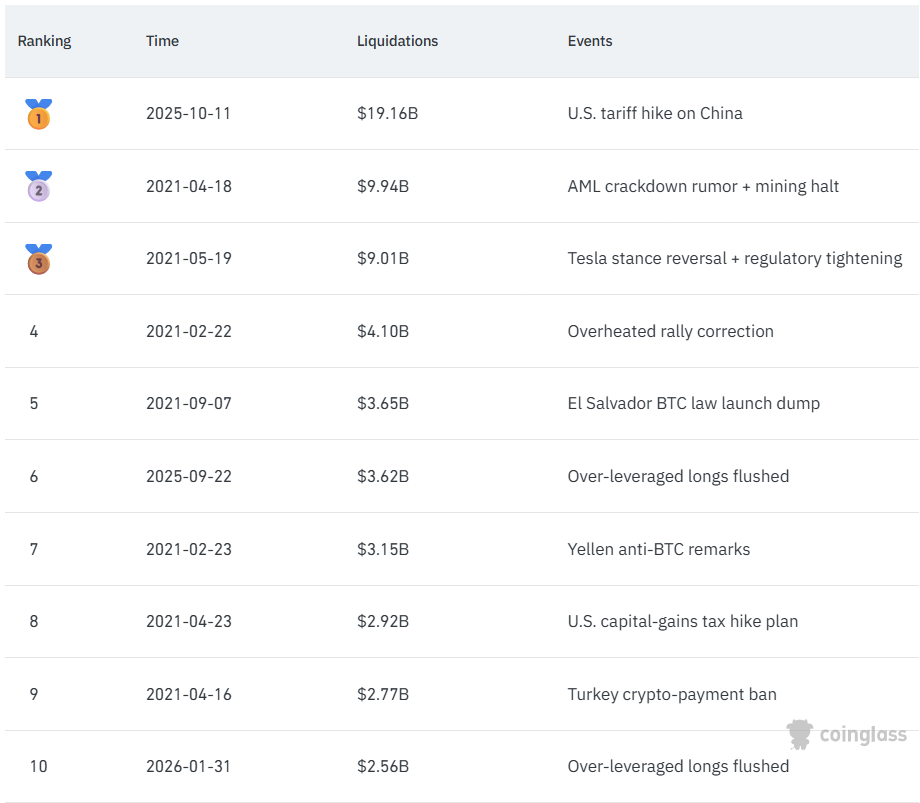

Last week, $2.56 billion in leveraged positions were liquidated in the market; the ETH price dropped to $1,811 on Thursday, its nine-month low. Infini lost $50 million USDC in February 2025 due to suspicion of a rogue developer, and the stolen funds were converted to DAI. A month later, the company sued developer Chen Shanxuan and other suspects in Hong Kong, served notice via onchain message, and offered a 20% bounty. The attacker continues to trade the funds with ETH – the latest purchase turned the chaos in the ETH futures market into an opportunity.

Top 10 liquidations in crypto history. Source: Coinglass

ETH Technical Outlook: Oversold and Supports

ETH is currently at $2,030, showing RSI 30.07 (oversold) with a -4.65% drop in 24 hours. Downtrend dominant, Supertrend bearish, EMA 20: $2,444.

- Supports: S1 $1,994 (strong, -1.74%), S2 $1,748 (-13.91%)

- Resistances: R1 $2,087 (+2.80%), R2 $2,576 (+26.88%)