Institutions Cut Bitcoin and Ethereum ETF Stakes as Solana Sees Steady Inflows

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

Institutional investors are reducing exposure to Bitcoin and Ethereum spot ETFs amid declining stablecoin inflows and macroeconomic pressures, with outflows reaching $1.17 billion last week. Solana ETFs, however, continue to attract inflows, holding $714.8 million in assets after 17 days of accumulation.

-

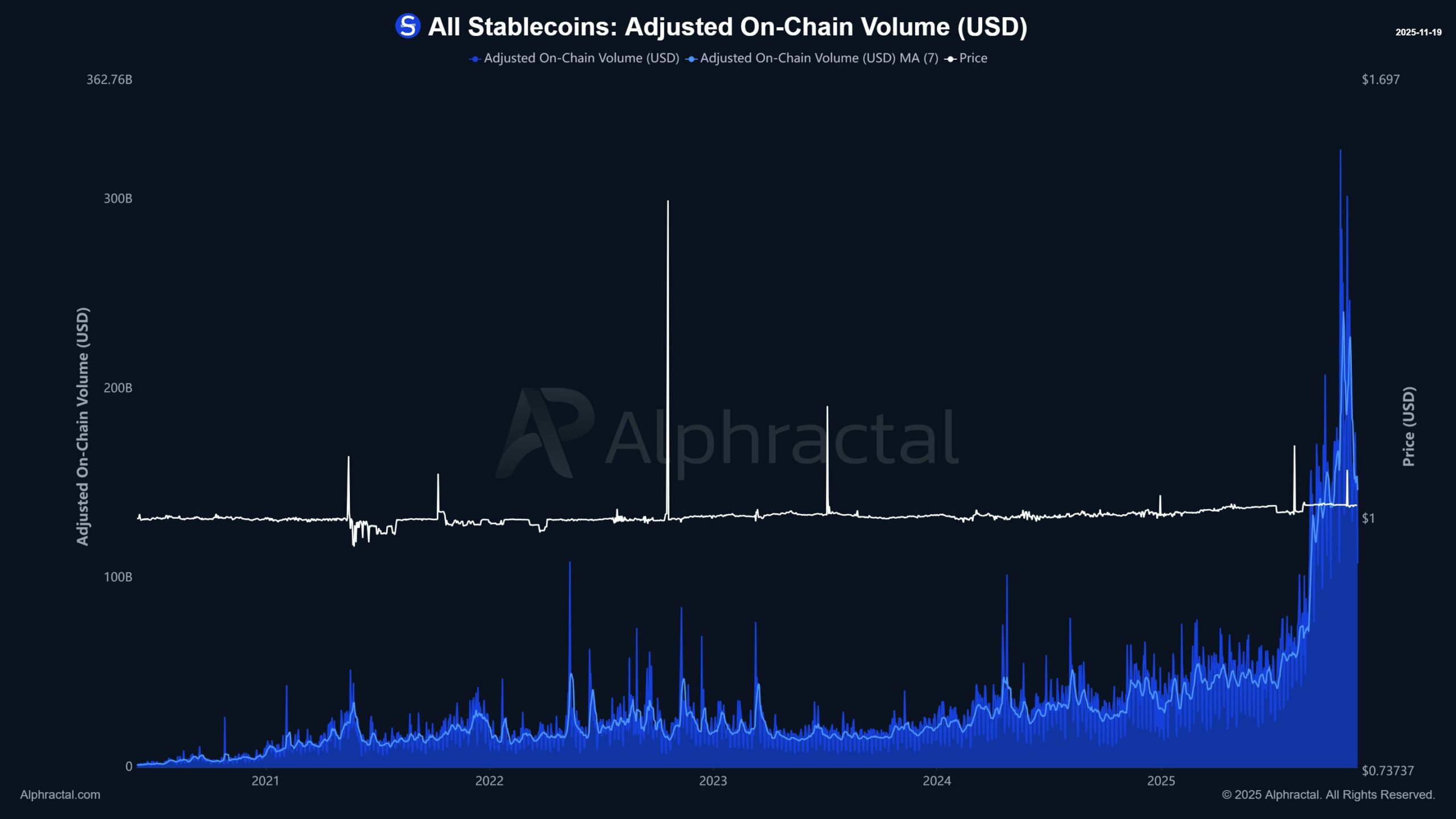

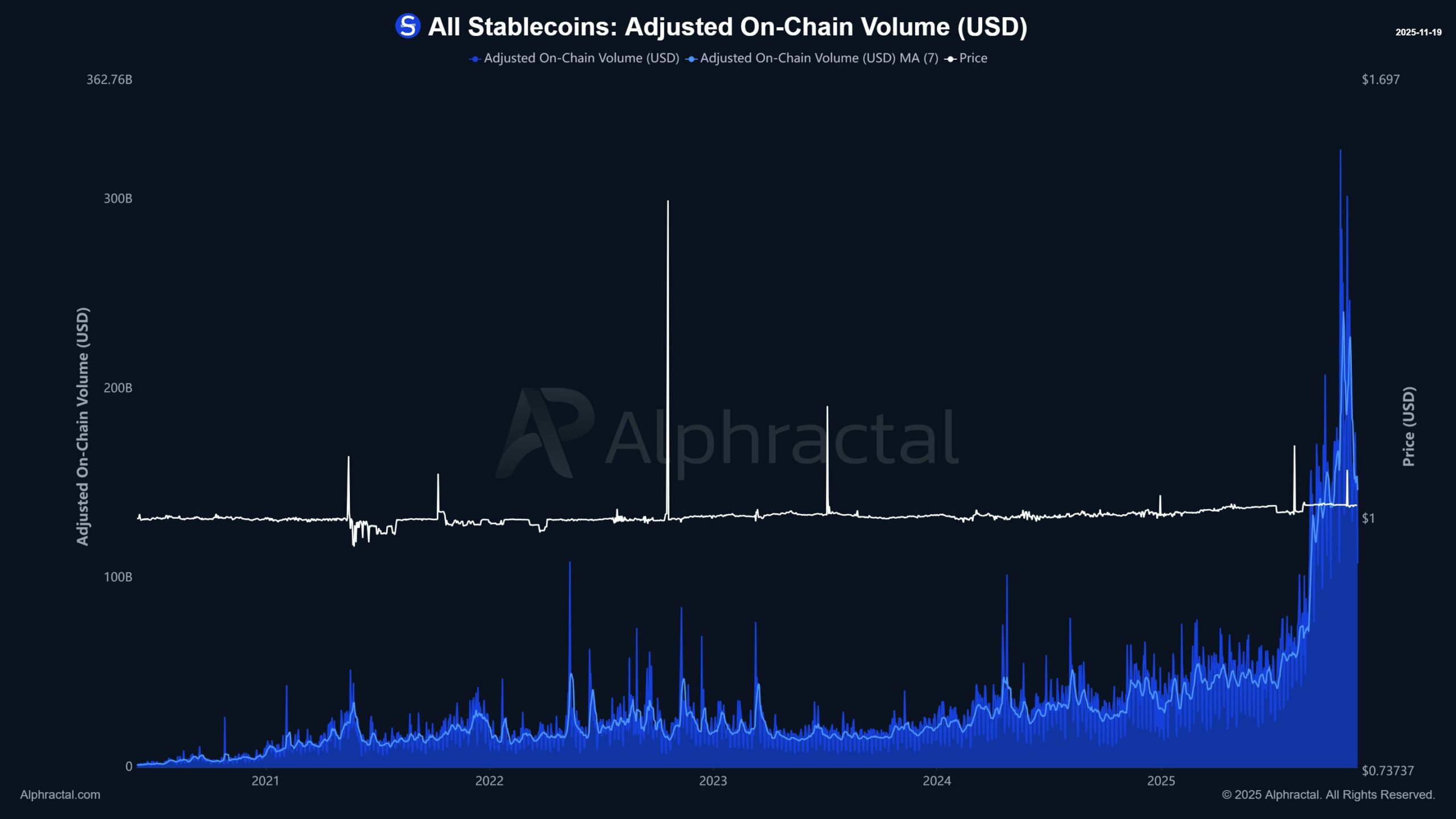

Stablecoin on-chain volume has dropped sharply, signaling reduced institutional activity in volatile crypto assets like Bitcoin and Ethereum.

-

Institutional outflows from Bitcoin and Ethereum ETFs totaled $682.64 million in a single day, reflecting bearish sentiment.

-

Solana spot ETFs have seen consistent inflows for over two weeks, amassing $714.8 million in net assets, positioning it as a preferred alternative.

Discover why institutions are withdrawing from Bitcoin and Ethereum ETFs while favoring Solana. Explore stablecoin trends, outflows, and market insights for informed crypto investment decisions today.

What is causing the institutional pullback from Bitcoin and Ethereum spot ETFs?

Institutional pullback from Bitcoin and Ethereum spot ETFs stems from weakening macroeconomic conditions and diminished expectations for interest rate cuts, leading to heavy outflows. Stablecoin inflows, a key indicator of institutional activity, have declined significantly, with on-chain volumes dropping amid broader market caution. This shift highlights a bearish outlook, as investors close positions worth hundreds of millions daily to mitigate risks in a tightening liquidity environment.

How are stablecoin inflows influencing institutional ETF decisions?

Stablecoin inflows serve as a reliable proxy for institutional interest in cryptocurrencies, and their recent decline points to reduced swapping into high-volatility assets like Bitcoin and Ethereum. According to data from Alphractal, on-chain stablecoin volume has fallen sharply, correlating with ETF outflows exceeding $1.17 billion at the week’s start. This trend underscores how institutions are recalibrating portfolios, prioritizing stability over aggressive exposure.

Bitcoin remains range-bound near $91,000, far from its recent peak above $126,000, while Ethereum faces similar pressures. Expert analysis from Shawn Young, chief analyst at MEXC, attributes this to fading rate cut probabilities, which have dropped from 100% to 33%. He explains that prolonged tight liquidity could dampen risk assets across the board, prompting institutions to unwind positions swiftly.

Over the past day, closures in Bitcoin and Ethereum spot ETFs amounted to $682.64 million, following $508.58 million on November 18. These figures, drawn from market tracking sources, illustrate a bearish consensus among major players, potentially signaling wider market corrections if sustained.

Source: Alphractal

Bitcoin and Ethereum dominate ETF holdings with net values of $117.34 billion and $12.84 billion, respectively, making their outflows particularly influential on market dynamics.

Frequently Asked Questions

Why are institutional investors reducing exposure to Bitcoin and Ethereum ETFs in 2025?

Institutional investors are cutting back on Bitcoin and Ethereum ETFs due to declining stablecoin inflows and shifting macroeconomic factors, including lower odds of interest rate cuts. Outflows hit $1.17 billion early this week, driven by caution over prolonged tight liquidity, as noted by analysts. This reflects a strategic retreat to preserve capital amid market volatility.

What makes Solana ETFs attractive to institutions despite Bitcoin and Ethereum outflows?

Solana ETFs stand out for institutions because they’ve seen 17 straight days of inflows, building $714.8 million in assets, per SoSoValue data. Investors see Solana as undervalued with strong growth potential, offering a diversification play while Bitcoin and Ethereum face headwinds from broader risk aversion.

Key Takeaways

- Declining stablecoin inflows signal caution: On-chain volumes are dropping, leading to reduced activity in Bitcoin and Ethereum ETFs and highlighting institutional risk management.

- Solana emerges as a winner: With $714.8 million in net assets from consistent inflows, Solana ETFs demonstrate selective optimism in the altcoin space.

- Macro factors drive the shift: Fading rate cut expectations and a fear-dominated market, scoring 15 on the Fear and Greed Index, urge investors to rotate capital strategically.

Source: SosoValue

Despite the pullback, selective activity persists. For instance, BitMine recently added 24,827 ETH valued at $72.52 million, boosting its holdings to 3.56 million ETH worth $10.77 billion. This indicates that while broad retreats dominate, targeted accumulations continue in Ethereum for long-term holders.

Source: CoinMarketCap

The market’s fearful state, with the Fear and Greed Index at 15 from CoinMarketCap, amplifies these moves. Total crypto market cap has shed about $1.13 trillion since peaking at $4.27 trillion on October 6, fostering uncertainty and capital concentration in resilient assets like Solana.

Conclusion

The institutional pullback from Bitcoin and Ethereum spot ETFs underscores a cautious response to stablecoin inflow declines and macroeconomic headwinds, with significant outflows reshaping market sentiment. Yet, Solana’s steady ETF inflows highlight opportunities in undervalued assets, as institutions rotate capital strategically. As liquidity conditions evolve, monitoring these trends will be crucial for navigating the crypto landscape—consider diversifying portfolios to capitalize on emerging strengths.

Comments

Other Articles

Vitalik Buterin: The AI Revolution in DAO Management

February 23, 2026 at 02:58 PM UTC

BitMine Boosts Ethereum Stake to 461K ETH, Eyes Network Share Growth

January 1, 2026 at 08:06 PM UTC

Ethereum Inflow to Binance Surges to 24,500 ETH, Hinting at Short-Term Bearish Pressure

January 1, 2026 at 05:00 PM UTC