Institutions Rush to Crypto Treasury Companies: BMNR Surge

ETH/USDT

$14,005,555,347.39

$2,039.05 / $1,941.66

Change: $97.39 (5.02%)

-0.0019%

Shorts pay

Contents

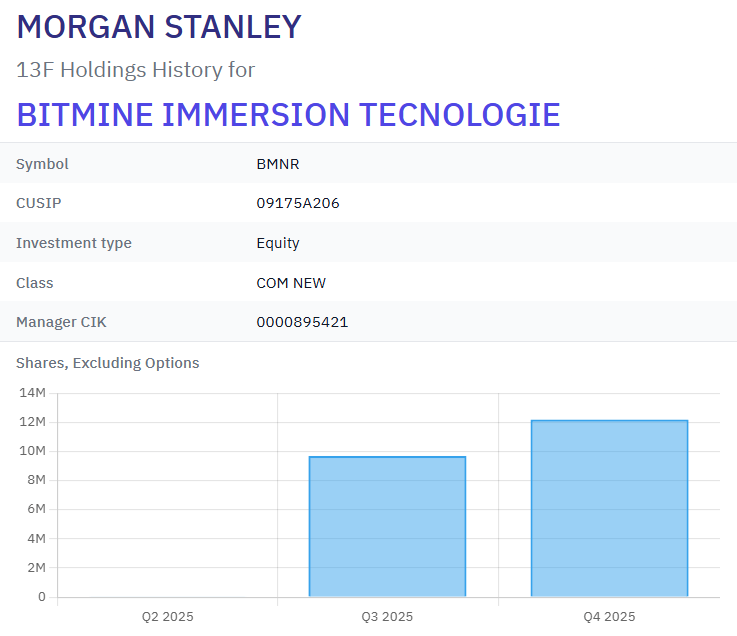

Major institutional investors increased their exposure to crypto treasury companies despite liquidity issues in the bear market. Among the largest shareholders of Bitmine Immersion Technologies (BMNR), Morgan Stanley increased its share position by 26% to 12,1 million shares, ARK Investment by 27% to 9,4 million shares. BlackRock by 166%, Goldman Sachs by 588%, Bank of America by 1,668%. Despite the company's ETH-focused treasury structure, BMNR stock lost 48% value in the fourth quarter of 2025. According to recent news, institutions are accumulating BTC despite predictions that Bitcoin will go to zero.

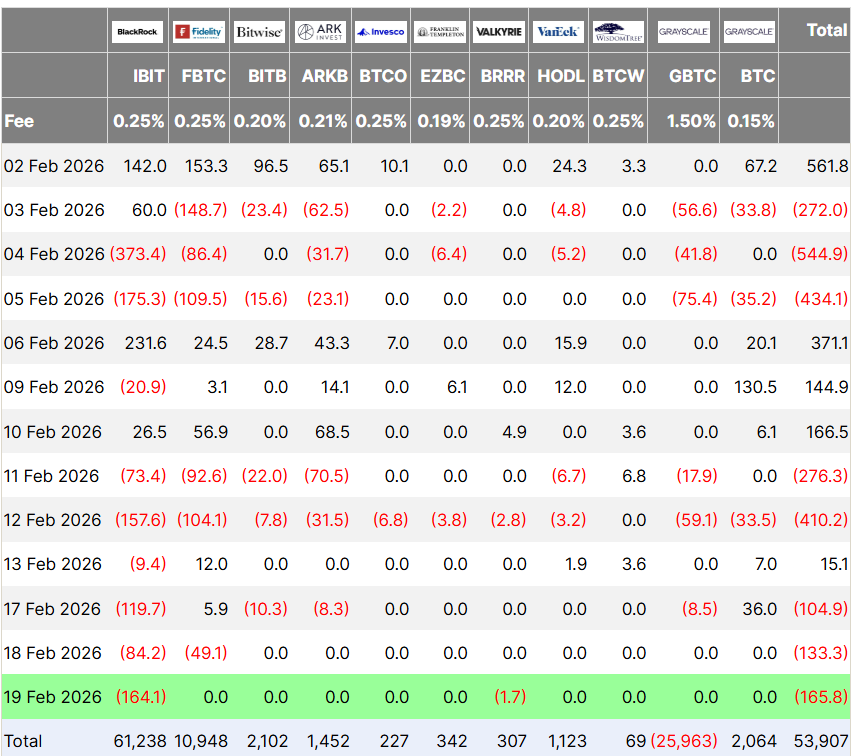

Bitcoin ETF Flow, USD million. Source: Farside Investors

Morgan Stanley BMNR share holdings during 2025, 13F-HR filing. Source: 13f.info

BTC Technical Analysis: Critical Support and Resistance Levels

BTC price at 67.726 USD, in downtrend with +1.15% 24-hour change. RSI 37.08 giving oversold signal. Supertrend bearish, below EMA20 at 71.305 USD.

- Supports: S1 65.072 USD (⭐ Strong, -4.21% distance)

- S2 62.910 USD (⭐ Strong, -7.39% distance)

- Resistances: R1 69.491 USD (⭐ Strong, +2.30% distance)

- R2 71.333 USD (⭐ Strong, +5.01% distance)

For more, check BTC detailed analysis.

Why Are Institutional BTC and ETH Investments Increasing?

While Bitcoin and ETH rose 2.6% weekly, US spot BTC futures ETFs saw 165 million USD outflow. Ether ETFs started with 48 million inflow and closed with 171 million outflow. In DeFi, ZeroLend closed due to liquidity shortage, Parsec due to volatility. DerivaDEX launched Bermuda-licensed DEX, Kraken xStocks reached 25 billion USD volume. In the top 100, Kite +38%, Stable +30%. According to BIP-360, BTC quantum security will take 7 years.

Frequently Asked Questions About BTC

Why is BTC in downtrend? Although RSI is oversold, ETF outflows and macro pressures are effective. Institutions continue accumulating.

Why did BMNR stock fall? Despite ETH-focused treasury, Q4 48% loss, liquidity issues played a role.

How much BTC are institutions accumulating? Giants like Morgan Stanley are increasing positions, despite zero price fears.